July 2024

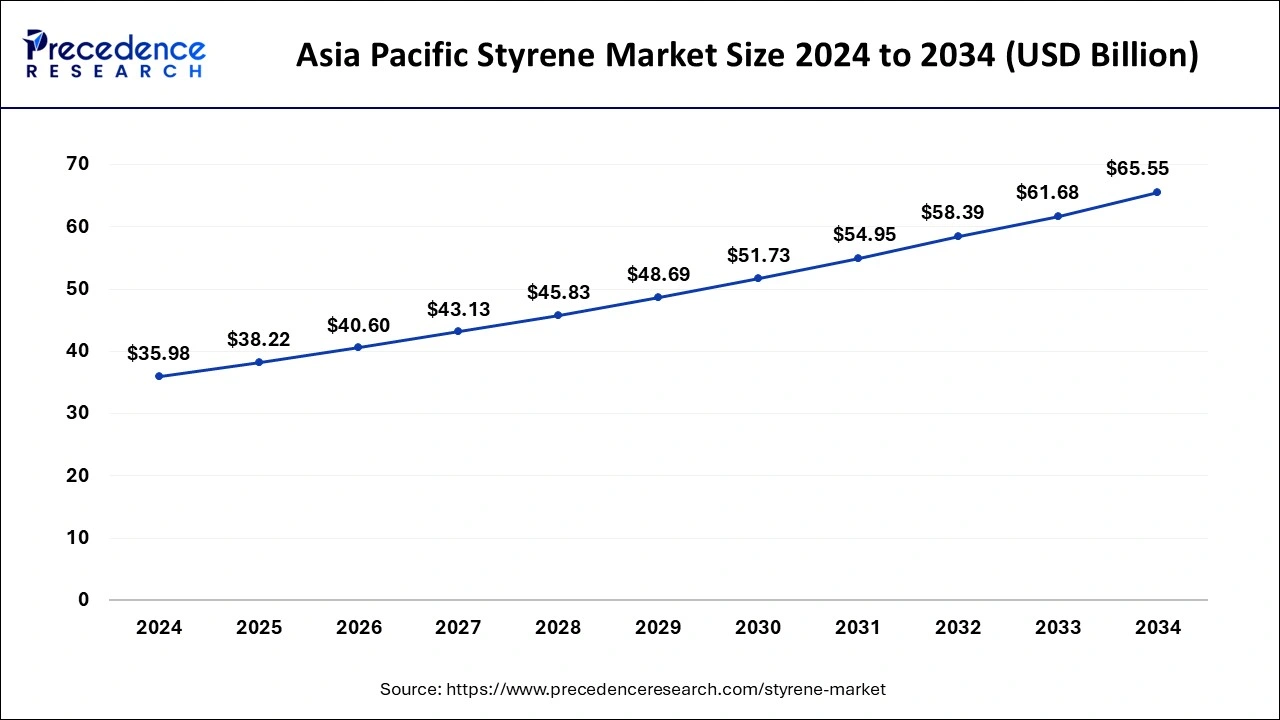

The global styrene market size is calculated at USD 63.70 billion in 2025 and is forecasted to reach around USD 108.35 billion by 2034, accelerating at a CAGR of 6.09% from 2025 to 2034. The Asia Pacific styrene market size surpassed USD 38.22 billion in 2025 and is expanding at a CAGR of 6.18% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global styrene market size was estimated at USD 59.96 billion in 2024 and is anticipated to reach around USD 108.35 billion by 2034, expanding at a CAGR of 6.09% from 2025 to 2034. The introduction of innovative technologies with sustainable applications for styrene use, rising demand for styrene-based products owing to its vast applications in several industries and the growing awareness towards recycling plastic waste with support and initiatives from various industries as well as governments across the globe is driving the growth of the styrene market.

The integration of AI in styrene applications is helping in optimizing production processes by analysing real-time data from manufacturing equipment's, in predictive maintenance and for maximizing efficiency, product quality and yield by adjusting product parameters while minimizing wastage. Furthermore, AI can assist in resource management, development of new applications for styrene polymers based on performance characteristics and designing of new products through advanced data analysis thereby streamlining the processes for styrene manufacturing.

The Asia Pacific styrene market size was evaluated at USD 35.98 billion in 2024 and is predicted to be worth around USD 65.55 billion by 2034, rising at a CAGR of 6.18% from 2025 to 2034.

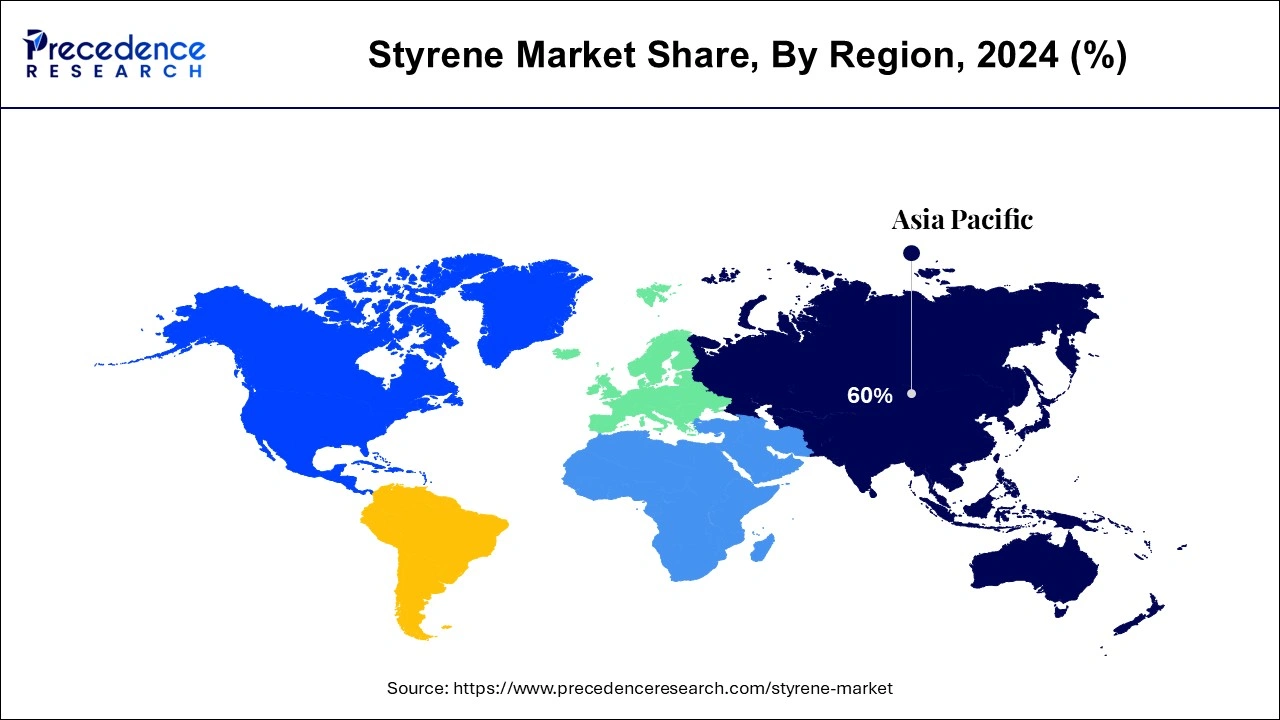

Asia Pacific led the styrene market and generated the highest market share of 60% in 2024., followed by North America and Europe. This expansion can be attributed to an increase in the use of packaging throughout the region. The growth is also attributed to the rise of the disposable culture. Furthermore, demand in significant application categories such as buildings, construction, and the automobile industry is increasing. According to a recent analysis, the styrene market inventory in China grew beginning in January 2023. Also, China is amongst the key packaging industry around the globe. Moreover, styrene is in high demand due to the rising demand for synthetic and processed rubber in Asia-Pacific.

Following the Asia-Pacific market, the North American market will likely expand during the forecast period due to increased demand in the region's automotive and packaging industries. This demand is seen because styrene, as a monomer, is used in various other industrial sectors as a product. For example, the expanded polystyrene market is growing significantly in North America, particularly in the United States, due to increased expenditures on research and development and implementation in the construction industry.

Styrene, an industrial chemical is used widely for many applications such as packaging, construction, electronics, automotive, paints and in medical field. The versatility in polymerization, convenient processing, resistance against aging and abrasion, low temperature properties, ozone resistance and the potential to be moulded into lightweight, rigid and transparent plastic products with sublime thermal and electrical insulating properties makes it a highly a valuable and ideal material for different applications.

The increasing demand for high performance and eco-friendly styrene based-products in various industrial applications, development of advanced polymerization techniques, rising focus on creating recyclable products for mitigating plastics waste, ongoing research and innovations on producing bio-based styrene and incorporation of nanomaterials for enhancing the properties of styrene-based polymers is boosting the growth of the styrene market.

Furthermore, the high demand for polystyrene which is a flexible material used in production of various appliances (ovens, microwaves, freezers), packaging applications and other products is driving the styrene market growth. Additionally, the rising focus on creating recyclable polystyrene and initiatives taken by global organizations for recycling plastic waste are developing opportunities for manufacturers for adopting sustainable methods in styrene production. For instance, in October 2024, the data summary provided by the Global EPS Sustainability Alliance (GESA) confirms that 72 countries committed for varying levels of recycling expanded polystyrene (EPS) Transport Packaging in 2023 have achieved recycling rates above 30%.

| Report Coverage | Details |

| Market Size in 2025 | USD 63.70 Billion |

| Market Size by 2034 | USD 108.35 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.09% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The increased popularity of recycled styrene

Polystyrene manufacturing and use worldwide are increasing annually due to various applications and a wide range of services across multiple industries. The discharge of this polystyrene into the environment has prompted environmentalists and researchers to demand the recycling of polystyrene to lessen the high burden of plastics in the environment. Furthermore, recycled polystyrene can be employed in insulating plates, light switches, and foam packaging. There is overall increased popularity in recycling styrene.

For instance, the French “Climate and Resilience” law sanctioned for banning styrenic polymers and copolymers by 2025. However, in September 2024 the prohibition was postponed to 2030. The extension was in accordance with the European Union’s packaging and packaging waste directive (PPWR) which allows manufacturers for developing recycling channels meeting recyclability standards which will effective in by recyclable packaging in 2030 and will be implemented on an industrial scale by 2035. Also until then, the compliant styrenic packaging materials will not face prohibition.

Increase in health concerns

Styrene consumption is hazardous to human health. Little amounts are discovered in urban air when people consume food packaged in polystyrene, use laser printers, and breathe cigarette smoke. Moreover, the use of styrene can have adverse effects on health. Styrene consumption can harm the respiratory and central nervous systems, causing fatigue, depression, nausea, and narcosis. Furthermore, styrene is poisonous to animals, and animal studies reveal that they are more susceptible to styrene and experience more damage.

The International Agency for Research on Cancer (IARC) has declared that styrene is a potential carcinogen that can cause cancer with prolonged exposure.

Increase in the end user

The styrene market has various uses across all industries. Even so, styrene is most commonly used in huge industries like automotive, construction, and packaging. It is a suitable replacement because it is light in weight and cost-effective, especially in food packaging. The automobile sector and new future automotive parts are currently popular, and such elements are commonly used in making auto parts. Furthermore, the preference for simple alternatives to complex components is becoming a trend in nearly every industry segment.

The tyre market, for example, is massive, and the use of styrene as rubber in the tyre makes the market opportunistic. The heat tolerance property of styrene is fundamental in the construction business and is used as a practical implementation substitute. Furthermore, the use of styrene and its derivatives in the electronics sector is increasing as there is an overall increase in demand for electronics.

For instance, in October 2024, Ineos Styrolution, a German-based materials maker declared the permanent shutdown of its styrene monomer production site in Ontario, Canada due to regulatory concerns regarding benzene emissions and operational challenges.

The styrene market is projected to grow because of rising demand for its packaging applications. The surge in demand for packaged foods is primarily attributed to the food industry. Because of its chemical stability, resistance to bacteria, and superior heat insulation, expanded polystyrene is usually employed, not just in the food packaging business but also in the use of consumer electronics as a result of rapid urbanization, technological developments, and value pricing rates.

Furthermore, several companies are now exploring better recycling technologies for polystyrene to reduce health risks and the use of polystyrene in food contact. For example, the styrene company INEOS Styrolution announced today the release of mechanically recycled polystyrene in EMEA. This includes the development of a new Styrolution PS ECO 440 with the help of TOMRA's high-quality NIR sorting technology, which delivers pure polystyrene.

The automotive industry has witnessed a growth in the number of uses for acrylonitrile butadiene styrene. Dashboards, centre console, seats, bumpers, interior trim, and lighting all use acrylonitrile butadiene styrene. Moreover, the healthcare industry is expected to increase because of its outstanding characteristics, such as performance qualities and adaptability. Acrylonitrile butadiene styrene manufactures medical devices and items such as masks, ventilator valves, gloves, shoes, and patient gowns.

Packaging is an essential factor in practically every industry. It is significant since it concerns consumer product safety. The kind of container used determines the product's safety. Plastic packaging is widely used in various industries nowadays because of its high durability, superior features, high-quality material, and low cost. The applications are widespread in many sectors, although it is high in the packaging industry.

Because of the significant demand from the plastic packaging industry, the styrene market is rapidly growing. Styrene is used in the plastic packaging industry for various food packaging, such as glasses, plates, disposable containers, and insulation. In addition, the plastic packaging business employs styrene in the pharmaceutical and medical industries to make medical devices and packaging.

Automobile Industry is the largest market and is anticipated to increase in the future years due to demand in electric demand for new features in autos and a growing market for premium vehicles. Styrene is widely used in the manufacture of tyres. It is widely used because to its durability, quality, and low cost. The styrene sector is growing because to increased demand for automobile body parts, vehicle rubber tyres, and energy-efficient building insulation. Furthermore, the use of styrene in automotive creates tensions in raw material availability and cost, allowing for shifting demand patterns in the tyre business and technical advancements in the ever-changing automotive space.

Styrene-based products help decrease greenhouse gas emissions by providing energy-efficient insulation in architecture and construction, as well as improved fuel efficiency through the strength and weight-reduction of automobile components. Expanded polystyrene has shown to be a viable alternative material. Because expanded polystyrene is recyclable and inexpensive, it is commonly employed in the construction industry.

By Product Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

October 2024

December 2023

September 2024