List of Contents

Polyurethane (PU) Resin MarketSize and Forecast 2025 to 2034

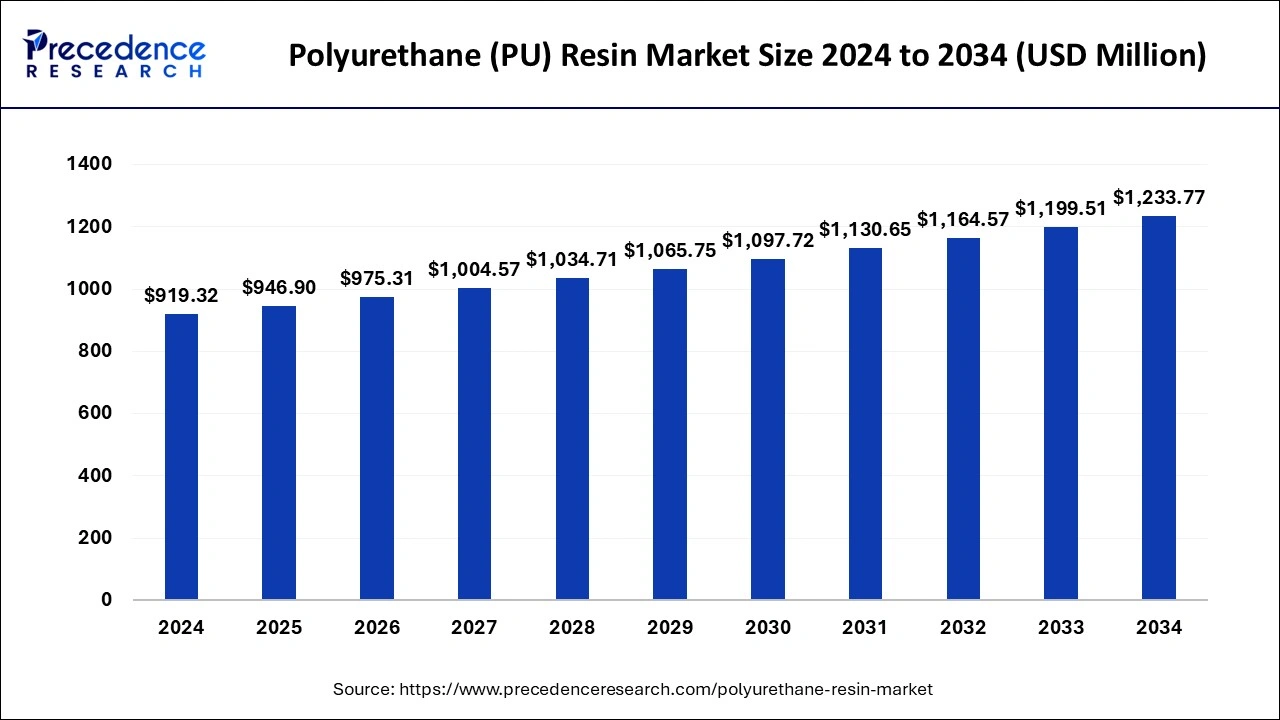

The global polyurethane (PU) resin market size accounted for USD 919.32 million in 2024 and is expected to exceed around USD 1,233.77 million by 2034, growing at a CAGR of 2.99% from 2025 to 2034.

Polyurethane (PU) Resin Market Key Takeaways

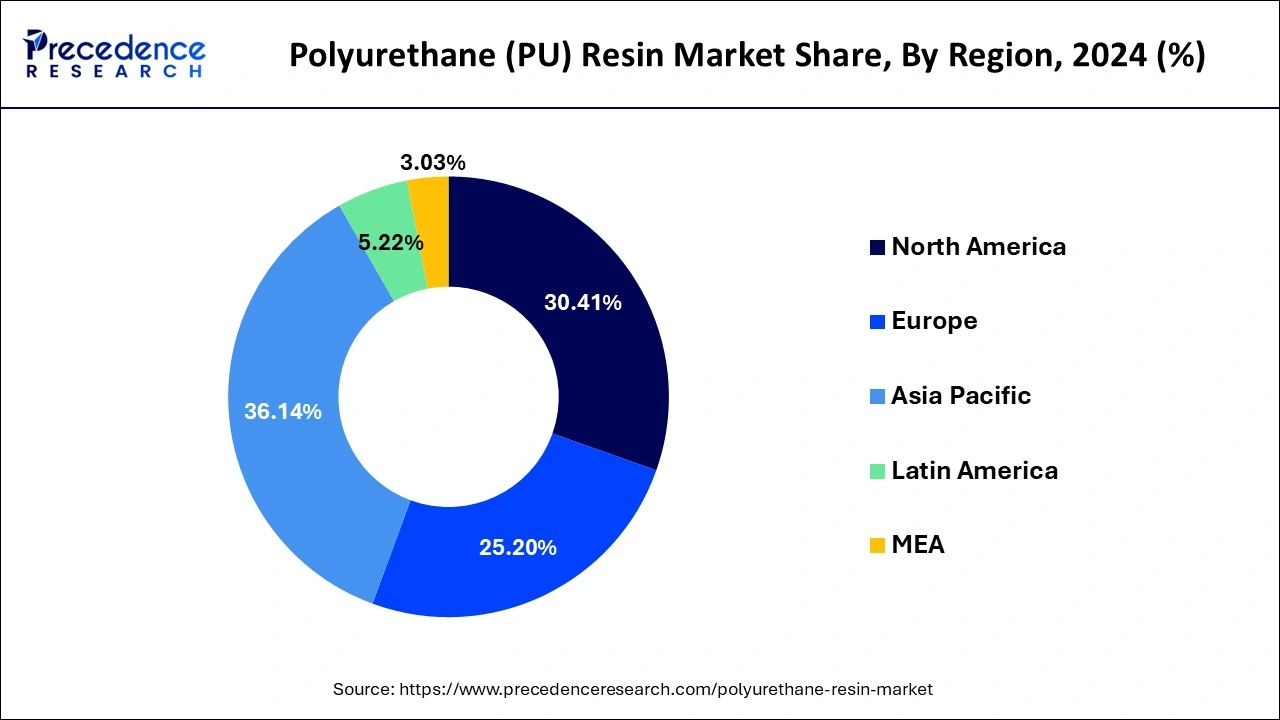

- Asia Pacific led the global market with the highest market share of 36.14% in 2024.

- By resin type, the water-based resin segment is expected to have the largest revenue share from 2025 to 2034.

- By resin type, the solvent-based resins market is predicted to experience continuous revenue growth from 2025 to 2034.

- By applications, the construction segment is projected to record for a sizable portion of the market.

- By applications, the paints and coatings segment is expected to experience continuous revenue growth.

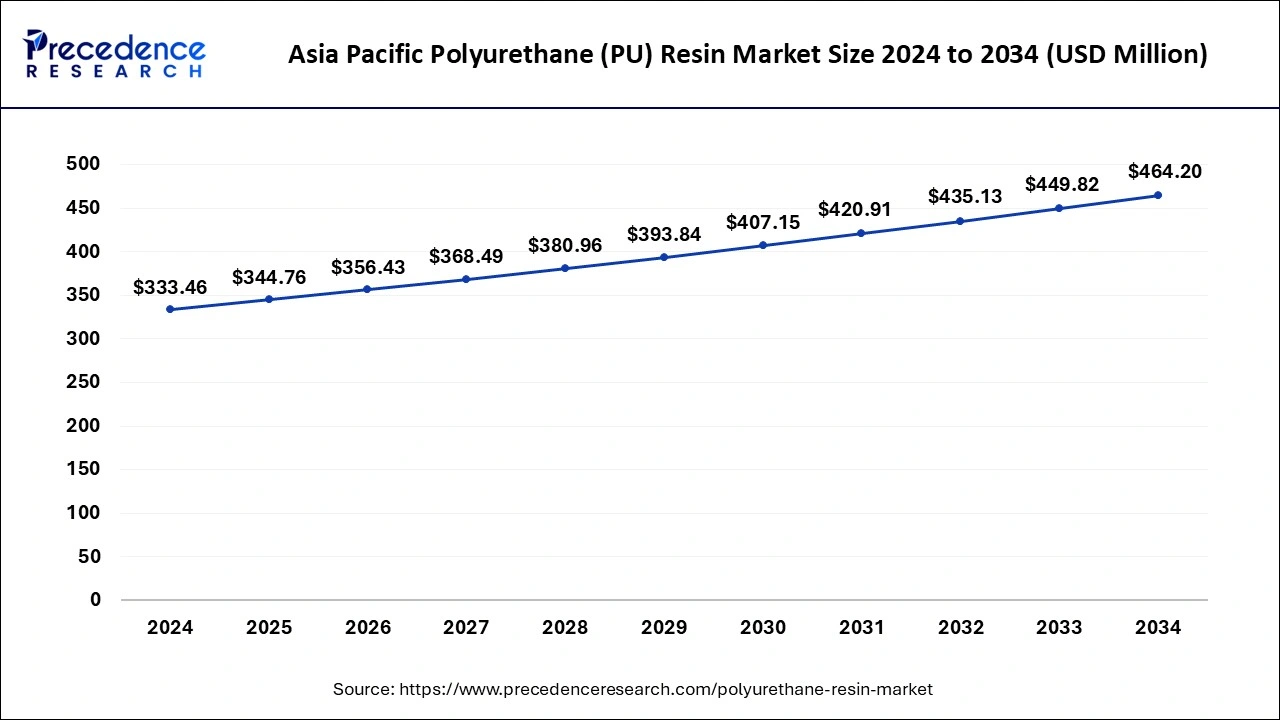

Asia Pacific Polyurethane (PU) Resin Market Size and Growth 2025 to 2034

The Asia Pacific polyurethane (PU) resin market size was exhibited at USD 333.46 million in 2024 and is projected to be worth around USD 1,233.77 million by 2034, growing at a CAGR of 2.99% from 2025 to 2034.

According to regional research, during the forecast period, the Asia Pacific market is anticipated to account for the biggest revenue share in the global market. The use of water-based resins is rising due to their sustainability and eco-friendliness, which makes them non-toxic to the environment and boosts the growth of the polyurethane resin market. Market revenue growth is anticipated to be fueled by rising demand for polyurethane adhesives in the region's nations for the production of fabric and shoes.

The use of such resins is expanding because to the rising need for residential and commercial building rehabilitation and construction, which is anticipated to fuel the Asia Pacific polyurethane resin market's revenue growth.

Over the course of the projected period, the North American market is anticipated to maintain a constant revenue CAGR.The region's rapidly expanding construction industry has raised the use of these resins for construction purposes, which is anticipated to fuel market revenue growth. Another factor that has increased demand for polyurethane resins and is anticipated to fuel the expansion of the polyurethane resin market is the rising demand for non-woven hygiene products in North America.

The demand for lightweight, manoeuvrable, and durable coatings applicators is also anticipated to fuel the expansion of the North American polyurethane resin market. Another factor anticipated to fuel the expansion of the polyurethane resin market's revenue is the rising demand for polyurethane for the laminating and coating of furniture and wooden flooring for aesthetic appearance.

During the course of the forecast period, the European market is anticipated to grow steadily in terms of revenue. The electronic sector's explosive growth is propelling the market's revenue growth. The need for these resins has expanded as a result of their widespread use in sealing, insulating, and compressing circuit boards for electronic items, which is fueling the expansion of the polyurethane resin market's revenue.

Growing demand for polyurethane resins in the pharmaceutical sector for the manufacture of electronic monitors, hospital bedding foams, and other applications is anticipated to fuel market revenue growth.

Market Overview

Polyurethane resins are copolymers that are made when an alcohol named polyol reacts with an isocyanate when proper additives and catalysts are introduced. Factors that are anticipated to support market revenue growth during the projected period include rising acceptance of these resins for building applications and rising usage of these resins for insulating, compressing, and sealing circuit boards of electronic devices.

Due to its ability to produce high-gloss coatings, polyurethane resin is frequently employed in automotive and industrial applications. Because of their advantage of not losing thickness when cured, these resins are more in demand for commercial projects, which is anticipated to fuel the expansion of the polyurethane resin market.

Another reason that is anticipated to promote polyurethane resin adoption is the rising demand for these products for coating applications in architectural and furniture products. In the near future, this is anticipated to fuel market revenue growth. It is anticipated that the long shelf life, quick drying, and simplicity of disposal of these resins would lead to an increase in demand for them in a variety of industrial operations.

The use of polyurethane resins in the production of thermosets and elastomers has increased demand for the substance in industrial and commercial settings, which is boosting the sector's revenue growth. These resins are easy to mix and process, have better flow characteristics, and may be employed in a wide range of industrial applications.

The market's increase in revenue will be driven by this aspect. Its application is ubiquitous and pervasive throughout a wide range of industries because polyurethane resins can be produced by reacting with a number of diisocyanates and polyols. The increasing usage of these resins by manufacturers of electronic devices to fix the parts and cables as well as to secure, insulate, and protect the device's components is one of the additional aspects projected to fuel market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 949.90 Million |

| Market Size in 2024 | USD 919.32 Million |

| Market Size by 2034 | USD 1,233.77 Million |

| Growth Rate from 2025 to 2034 | CAGR of 2.99% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin Type and Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for cut and tear resistance resins a key revenue growth driving factor

The structural similarities between diisocyanates and polyols allow for a wide range of applications and can be tailored for manufacturers. Polyurethane's characteristics might range from soft induction coating to incredibly durable building materials. By modifying the raw components as well as adding other nanomaterials and additives, the material can be improved to create polyurethanes suitable for practically any purpose.

Due to this, market revenue growth is anticipated to pick up in the near future. Also, it offers cut and tear resistance when utilized in applications that have raised its demand and are anticipated to propel global revenue growth.

Demand for these resins is also rising as a result of an increase in small art and craft e-commerce companies providing a variety of gifts and home décor items, which is anticipated to fuel market revenue development. Due of these resins' adhesive qualities, they are frequently employed to repair commonplace items. These resins, for instance, can be used to fix ceramics and glass that have cracks or breaks.

These objects can be strengthened and maintained with polyurethane resins to increase their longevity. The demand for polyurethane resin in the textile sector is also anticipated to rise due to the growing use of polyurethane for coatings that are applied to just one side of base fabrics. These resins have a high resistance to moisture, heat, and light and are highly strong. Plastics made of polyurethane resin are also appropriate for use in high-traffic commercial wrapping applications. This is another element that is anticipated to fuel market revenue growth between 2024 and 2033.

Moreover, the wear resistance, hydrolysis resistance, flame retardancy, light fastness, and cleanability that these chemical additives can enhance are some other aspects that are anticipated to accelerate market growth in the near future.

Restraint

Concerns regarding health complications related to polyurethane resins is a key factor restraining revenue growth

The widespread use of polyurethane in products like beds, insulation for buildings, shoes, and paint has led to an expansion in its use in a variety of products. When inhaled, the toxic fumes that are released by this resin may cause a number of health issues. Overexposure to polyurethane can cause a variety of health issues, including allergic responses, skin rashes, breathing difficulties, unconsciousness, and even blindness. Also, to prevent health issues, the area must be immediately cleaned and thoroughly washed if polyurethane foam comes into contact with the eyes or skin. Such issues are predicted to impede market expansion.

Moreover, these products give up undetectable fumes and scents. Physical issues are brought on by petroleum-based chemicals and flame-retardant fumes; this is especially uncomfortable when it comes to beds and artwork. Long-term patient exposure to this smell can make them sick. Polyurethane finish users who also work with wood are exposed to smokey vapors. These and other elements may prevent the market from growing in terms of revenue.

Opportunity

Rising demand for polyurethane resins in the healthcare industry

The need for polyurethane resins is growing in the healthcare sector due to its biocompatibility, adaptability, and simplicity of manufacturing, polyurethane resins are frequently employed in the healthcare sector. For use in medical applications including catheters, wound dressings, and drug administration systems, polyurethane resins can be designed to be soft, flexible, and elastic.

For implantable medical devices like heart valves, pacemaker parts, and joint replacements, polyurethane resins can also be made hard and robust. The healthcare industry's market for polyurethane resin is expanding as a result of the rising demand for medical services and equipment, particularly in emerging economies.

COVID-19 Impact

Due to the abrupt closure of national and international borders, the COVID-19 outbreak has further altered operational efficiency and interrupted value chains, resulting in loss of revenue and harm. The raw material supply has been adversely affected by the disruptive value chain, which is having an effect on the expansion of the polyurethane market. Yet, the demand for polyurethane is anticipated to increase internationally as economies has restarted their activities.

Resin Type Insights

The global polyurethane resin market has been divided into solvent-based resin, water-based resins, and other resin types depending on resin type. During the course of the forecast period, the water-based resin segment is anticipated to have a greater revenue share in the global polyurethane resin market. Water-based resin is acting as a better substitute for solvent-based resins as a result of evolving environmental laws like the Clean Air Act and technological improvements, which is fueling the segment's expansion.

Water-based resins come in a variety of harnesses and solids contents, making them flexible and environmentally beneficial coating solutions. Its easy formulation into a protective coating for a variety of substrates is made possible by their nil to low volatile organic content. Water-based resins are increasingly used in a variety of applications due to their adaptability and several exceptional qualities, including low-temperature flexibility, impact resistance, and resistance to abrasion. These elements are anticipated to boost demand for water-based polyurethane resins and propel the segment's revenue growth.

Over the projected period, the solvent-based resins market is anticipated to experience consistent revenue growth. Due of their superior performance and durability, solvent-based polyurethane resins are increasingly being used, which is anticipated to help the segment's revenue expand. Solvent-based resins are also capable of producing highly glossy effects and have a longer shelf life, both of which have enhanced their demand in a variety of coatings applications and are anticipated to fuel the segment's expansion.

Application Insights

The global polyurethane resin market has been divided into five categories based on application: construction, transportation, pharmaceuticals, paints & coatings, and others. During the course of the forecast, the construction segment is anticipated to account for a sizable portion of the market. The demand for building materials that are lightweight, robust and durable, simple to install, flexible, and of excellent quality is anticipated to increase. By lowering energy loss, polyurethane resins make it possible to save natural resources, aiding in environmental protection.

Due to its excellent strength-to-weight ratio, flexibility, durability, and insulating qualities, it is frequently employed in construction. These are some additional elements that are anticipated to fuel segment expansion. Also, throughout the course of the projection period, the segment's revenue growth is anticipated to be fueled by the low cost of these resins and the rising utilization for coatings on furniture and floors.

Over the projection period, the paints and coatings segment is anticipated to experience consistent revenue growth. For a variety of uses in paints and coatings, polyurethane resins are employed as single-component and two-component coatings. They are mostly utilised for long-lasting, high-gloss coatings in industrial, flooring, and wood coating applications, as well as PU resins that are employed to modify alkyd resins, which are utilised in coatings, enamels, and varnishes.

Moldable thermoset resins are made using PU resin. Because to this, its use in paints and coatings has expanded, which fuels the segment's expansion. The most typical uses for the segment's products are architectural and interior coatings, special purpose coatings, product finishing primers, and automobile finishes.

Polyurethane (PU) Resin Market Companies

- Covestro AG

- The Dow Chemical Company

- Huntsman Corporation

- BASF SE

- Eastman Chemical Company

- Mitsui Chemical, Inc.

- DuPont de Nemours, Inc.

- Alchemie, Ltd.

- Shanghai Dongda Polyurethane Co., Ltd.

- Perstorp Holdings AB

Recent Developments

- On March 19, 2022, Mitsui Chemicals, Inc. and FullStem Co. Ltd. announced the beginning of a collaboration to jointly create high-performance nonwovens for use in extensive, dense stem cell cultures. The high-density, large-scale stem cell culture apparatus known as AchievaCS was created by FullStem and uses nonwovens as a substrate to allow for large-scale stem cell growth.

- The goal of the partnership between the two companies is to jointly develop the next-generation platform technology for large-scale stem cell culture, which will ultimately advance the field of regenerative medicine. This will be accomplished by utilizing the expertise that Mitsui Chemicals has developed in the development of polymeric materials and nonwovens and combining it with FullStem's technology and equipment for large-scale stem cell culture, high density.

Segments Covered in the Report

By Resin Type

- Solvent-Based Resin

- Water-Based Resins

- Others

By Applications

- Construction

- Transportation

- Pharmaceuticals

- Paints & Coatings

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client