February 2025

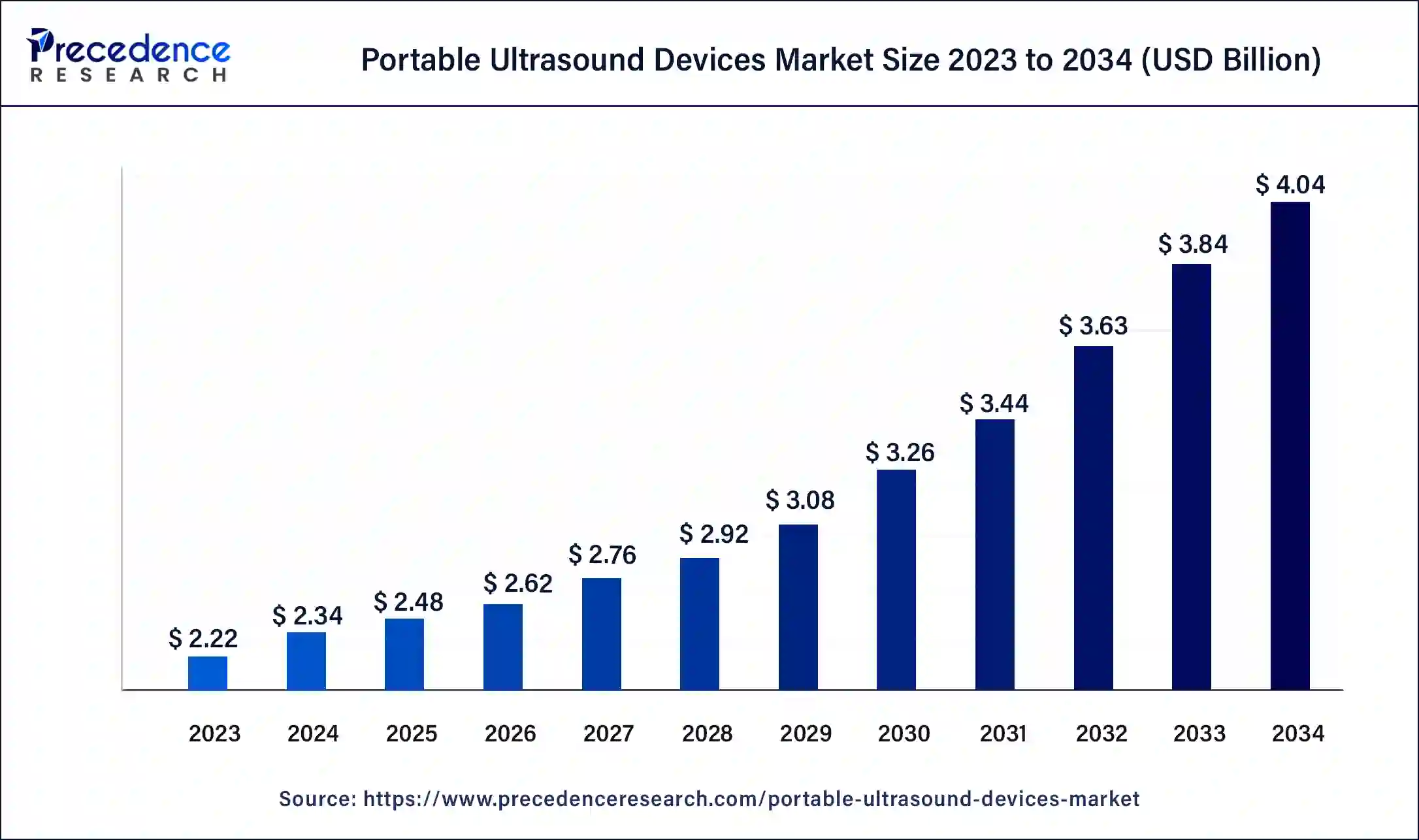

The global portable ultrasound devices market size was USD 2.22 billion in 2023, estimated at USD 2.34 billion in 2024 and is anticipated to reach around USD 4.04 billion by 2034, expanding at a CAGR of 5.60% from 2024 to 2034.

The global portable ultrasound devices market size accounted for USD 2.34 billion in 2024 and is predicted to reach around USD 4.04 billion by 2034, growing at a CAGR of 5.60% from 2024 to 2034. The growing number of medical laboratories and diagnostic centers across the world is driving the growth of the portable ultrasound devices market.

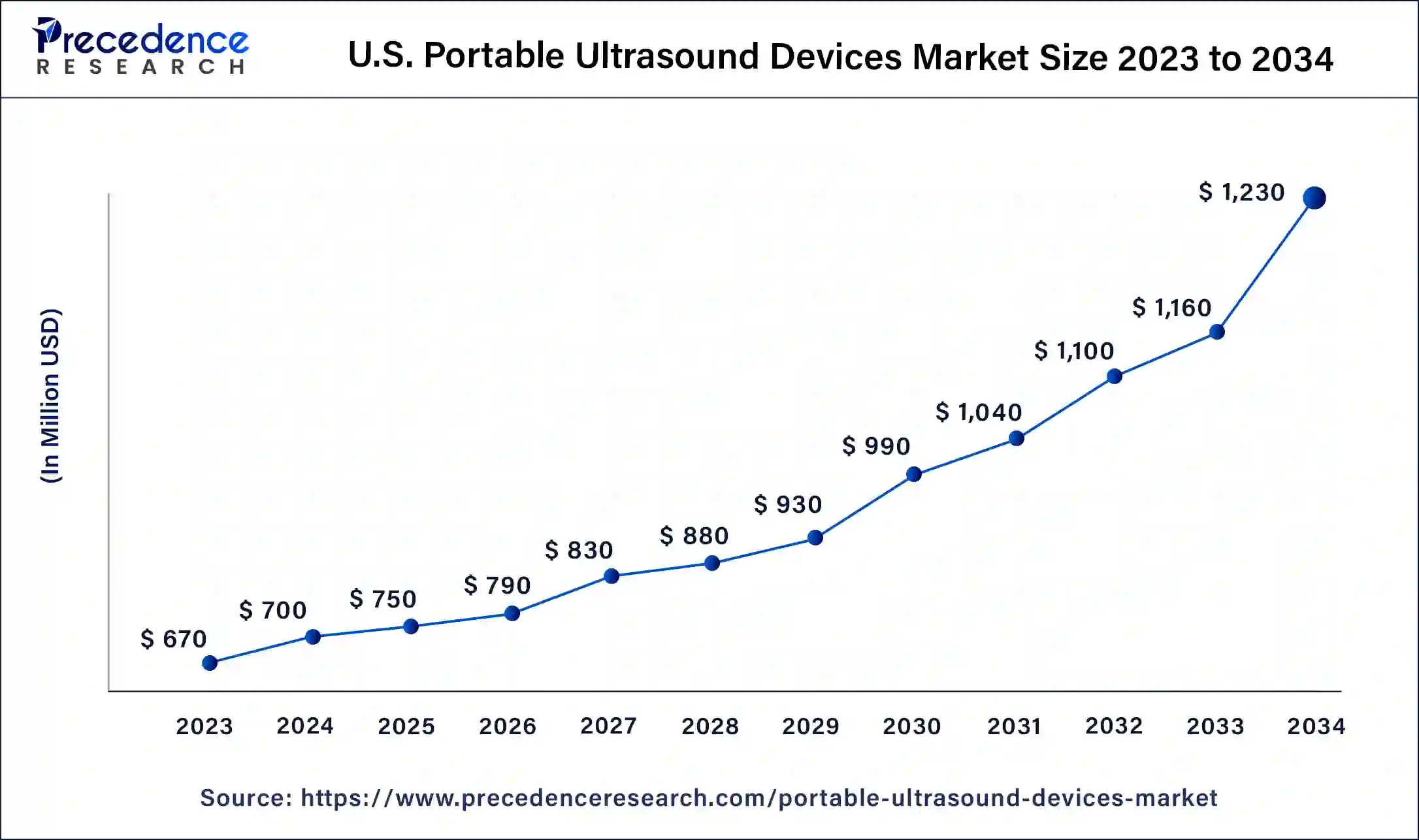

The U.S. portable ultrasound devices market size was estimated at USD 670 million in 2023 and is expected to be worth around USD 1,230 million by 2034 with a CAGR of 5.80% from 2024 to 2034.

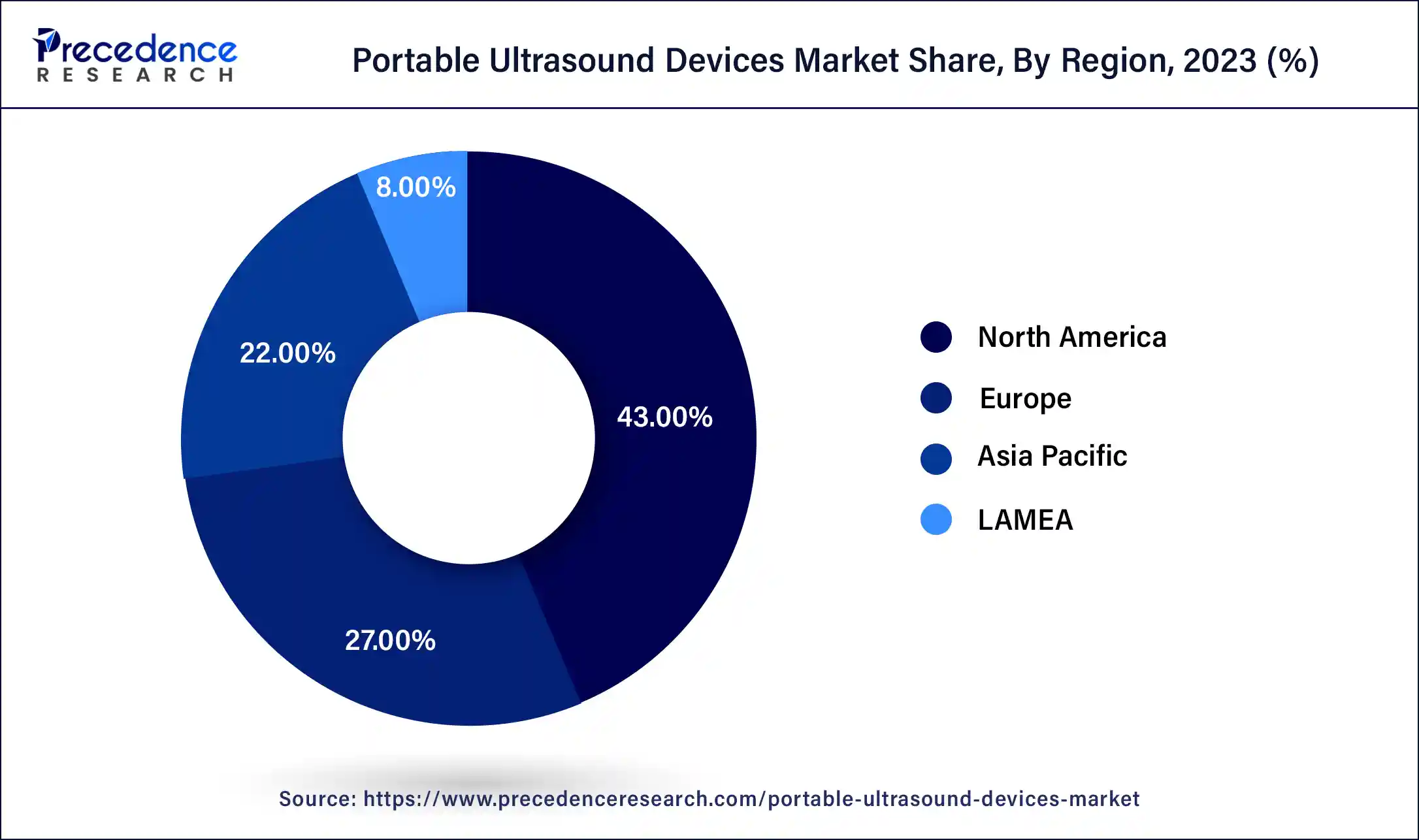

North America dominated the market in 2023. The growth of this region is mainly driven by scientific and medical advancements. Moreover, the rise in the number of hospitals and ambulatory centers in countries such as the U.S., Canada, and others increases the demand for portable ultrasound systems for treating emergency patients.

Also, an increase in investment from the government and private sectors to strengthen the healthcare sector also drives market growth. This new youth mental health fund will help to care for mentally affected patients and ensure a healthy future for youths in Canada. Furthermore, the presence of market players such as GE Healthcare, Acuson, MediView XR, New Frontier Mobile Diagnostics, and some others has also boosted the growth of the portable ultrasound devices market in this region.

Asia-Pacific is estimated to grow at the fastest rate during the forecast period. The growth of this region is mainly driven by the rising development of healthcare infrastructure along with rapid advancements in technologies. Also, the growth of the portable ultrasound devices market can be attributed to the growing number of target diseases, such as cancer, cardiovascular diseases, and others, along with the rise in the number of accident cases. According to a study by Asia Pacific Cohort Studies Collaboration (APCSC), there is an estimated increase of 60% in CVD patients in Asian countries. Also, it is estimated that the total number of hypertension patients in India and China is likely to increase to more than 500 million by the year 2025. Thus, such diseases require early detection and treatment to be cured, which is likely to increase the demand for portable ultrasound devices, thereby driving market growth. Also, the presence of market players such as Mindray, Hitachi, Alpinion Medical Systems, Toshiba, Sonoscape, and some others is further aiding the market growth in this region.

Portable ultrasound devices can be moved from one location to another for ultrasound images. These devices work on the principle of sound waves to provide risk-free imaging tests of body parts. They are smaller and more affordable than conventional ultrasound systems. These portable devices minimize wait time, increase throughput, and improve the patient's experience. These ultrasound systems have several applications, including urology, obstetrics/gynecology, cardiovascular, gastric, musculoskeletal, and others.

The portable ultrasound devices industry has experienced drastic growth in the present time. The growing developments in technologies such as AI, blockchain, AR, VR, and others are significant for the growth of the portable ultrasound devices market.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.22 Billion |

| Market Size in 2024 | USD 2.34 Billion |

| Market Size by 2034 | USD 3.83 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.60% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, Technology, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A growing number of accident cases

There is a significant rise in road accident cases due to careless driving and over-speeding. According to the World Health Organization (WHO), around 1.19 million people around the world die due to road traffic accidents every year, and about 20-50 million people suffer from non-fatal injuries due to accidents. Also, according to the Ministry of Road Transport and Highway in India, the total number of road accidental deaths was 1,68,491 in the year 2022. The rise in the number of accident cases increases the number of emergency surgeries associated with it. Thus, the growing number of emergency surgeries has increased the demand for portable ultrasound devices, thereby driving the portable ultrasound devices market growth.

Transition towards Minimally Invasive Surgery (MIS)

There is an increased prevalence of chronic diseases such as Arthritis, Cancer, Chronic Obstructive Pulmonary Disease (COPD), and others that increase the demand for surgical procedures to cure. According to WHO, the number of new cancer patients reached 20 million, along with 9.7 million cancer-related deaths in the year 2022. Nowadays, people have started preferring minimally invasive surgery over open surgical procedures due to several benefits such as fast recovery, fewer complications, short hospital stays, and some others. Thus, the rising transition towards MIS increases the demand for portable ultrasound devices, thereby driving the growth of the portable ultrasound devices market.

Approval-related issues and lack of sonographers

In the present scenario, the healthcare sector has experienced several challenges due to governmental interventions. The governments of countries such as China, Japan, Canada, and others have adopted various strict regulations regarding the approval of medicines and medical devices. Some of these medicines and medical devices do not get approval from the government due to high risk, negative effects, and environmental factors. Thus, the lack of approval for medical devices such as ultrasound systems is expected to restrain the growth of the portable ultrasound devices market. Also, there is a huge scarcity of medical workers and laboratory professionals due to factors such as increasing workloads, low wages, and other factors. Thus, the lack of skilled sonographers required to operate ultrasound systems is also restraining market growth.

AI-embedded ultrasound devices to shape the future

With the advancements in medical sciences, the manufacturers of medical devices have integrated modern technologies to get accurate results. In recent times, open surgeries have been replaced by robotic surgeries to get optimum results after the completion of surgical procedures. Integrating AI in ultrasound systems can help get high-quality images of body parts and examine them efficiently.

The handheld segment dominated the portable ultrasound devices market in 2023. The growth of this segment is driven by a rise in chronic diseases and the growing adoption of portable systems in diagnosis. Moreover, the increasing awareness about veterinary care and remote treatment has further driven the growth of the handheld ultrasound system, thereby driving the market.

Also, these ultrasound systems are more affordable than traditional ones, increasing their demand in hospitals and diagnostic centers. This, in turn, boosts the growth of the portable ultrasound market. Furthermore, several companies such as MinXray, GE Healthcare, Philips, and others are adopting strategies such as partnerships, joint ventures, acquisitions, product launches, and others to maintain their dominance in the industry.

The obstetrics/gynecology segment dominated the market in 2023. This segment is generally driven by the rise in the number of child delivery surgeries worldwide. Moreover, growing cases of uterine infections, along with hysterectomies, ovarian cyst removal, and others, have increased the demand for portable ultrasound devices. Also, the growing application of laparoscopy in gynecologic surgeries has increased the demand for portable ultrasound systems, boosting the market growth. Moreover, the rise in government initiatives regarding child care and women's health has been further driven by the growth of the portable ultrasound devices market.

The cardiovascular segment is estimated to be the fastest-growing segment during the forecast period. In recent times, cardiovascular diseases have been the most prevalent diseases suffered by most people across the world. Cardiovascular disease is the most common disease and number one cause of death across the world. The rise in cardiovascular diseases increases the number of surgeries associated with it. These surgeries require several medical devices, including portable ultrasound devices, which drive the growth of the portable ultrasound devices market.

The Doppler ultrasound segment dominated the market in 2023. This segment is mainly driven by the rising application of Doppler ultrasound for detecting blood vessels and the heart and its use in diagnosing vascular parts. There are different kinds of Doppler ultrasound systems, such as color, spectral, duplex, power, and transcranial Doppler. Also, companies such as Eagleview and Sonoscape are launching new Doppler ultrasound systems to strengthen their market outreach.

The 3D and 4D ultrasound segment is expected to grow at the fastest CAGR during the forecast period. The growing application of 3D and 4D ultrasound systems in detecting birth defects of a baby, along with the rise in the number of gynecology surgeries worldwide. The companies that manufacture 3D and 4D ultrasound include Vision MediTech, Infinity Medical Systems, Om Surgical Company, Apex Medical Systems, Digitech Medicare, Gemini Medical Networks Private Limited, and others. Also, the integration of AR and VR technologies with 3D/4D ultrasound systems for examining pathology and fetal anatomy has further increased the demand for 3D/4D ultrasound systems, which drives the growth of the portable ultrasound devices market.

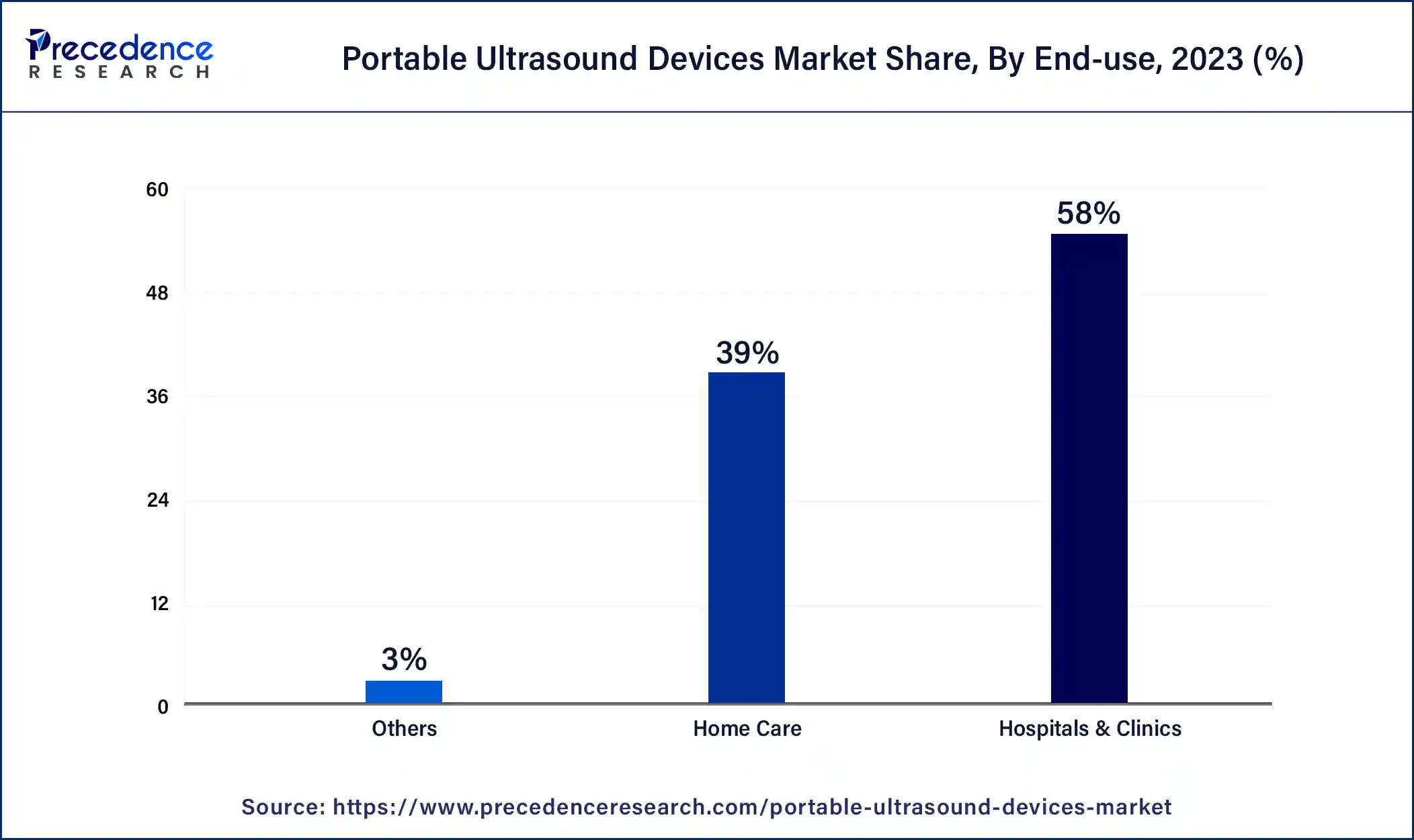

The hospitals & clinics segment held the largest market share in 2023. The growth of this segment is mainly driven by the growing use of ultrasound devices in hospital’s OPD and in-patient departments. Furthermore, the increasing investment from public and private entities for the development of medical devices is also expected to foster the growth of the market. Additionally, growing awareness regarding regular healthcare checkups and the rising number of accident cases globally has increased the demand for portable ultrasound devices in hospitals and clinics, thereby driving the portable ultrasound devices market growth.

The homecare segment is estimated to grow at the fastest CAGR during the forecast period. This segment is mainly driven by the growing technological advancements in medical sciences along with the rising awareness regarding remote patient monitoring. There is a constant rise in the geriatric population suffering from several diseases. These people cannot move out of their stay to visit clinics and hospitals, which increases the demand for handheld ultrasound devices, thereby boosting the growth of the portable ultrasound devices market.

Segments Covered in the Report

By Type

By Application

By Technology

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

December 2024

November 2024