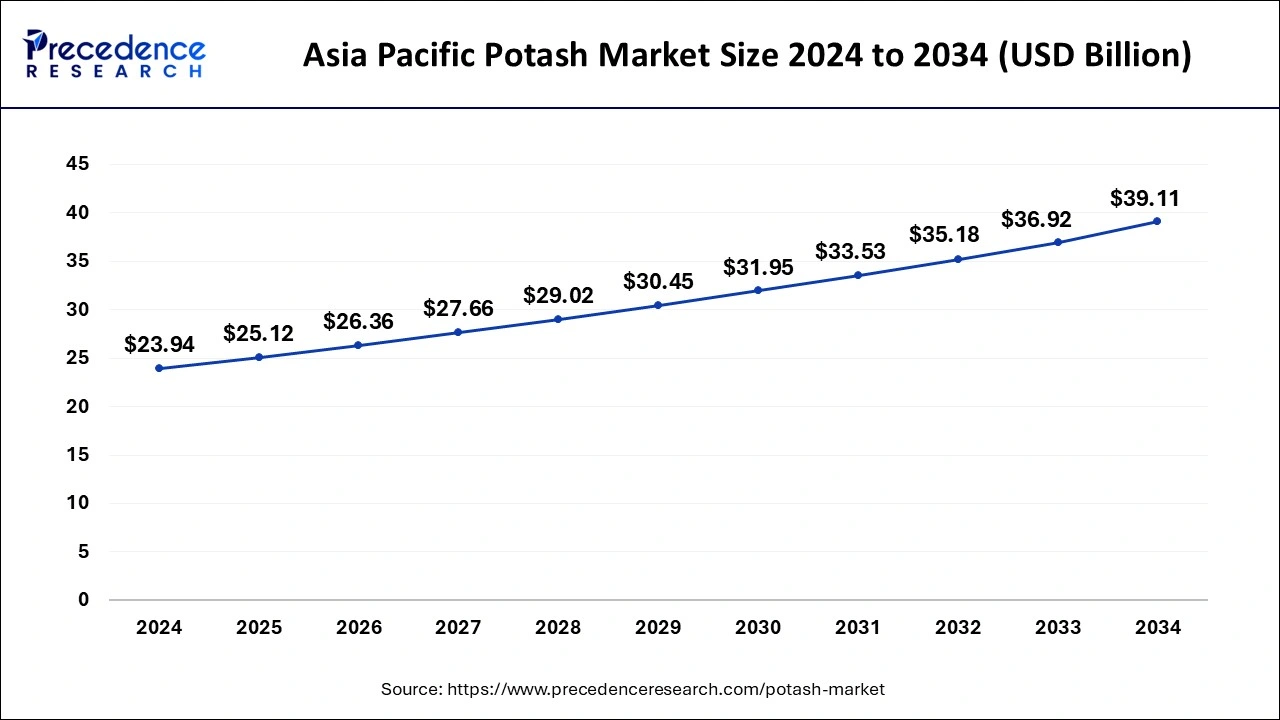

The global potash market size is accounted at USD 66.11 billion in 2025 and is forecasted to hit around USD 101.57 billion by 2034, representing a CAGR of 4.89% from 2025 to 2034. The Asia Pacific market size was estimated at USD 23.94 billion in 2024 and is expanding at a CAGR of 5.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global potash market size accounted for USD 63.00 billion in 2024 and is predicted to increase from USD 66.11 billion in 2025 to approximately USD 101.57 billion by 2034, expanding at a CAGR of 4.89% from 2025 to 2034. Potash is a crucial ingredient for agricultural growth and vital to agriculture everywhere. The need for food increases along with the world's population, leading to a demand for potash as fertilizer.

The Asia Pacific potash market size was exhibited at USD 23.94 billion in 2024 and is projected to be worth around USD 39.11 billion by 2034, growing at a CAGR of 5.03% from 2025 to 2034.

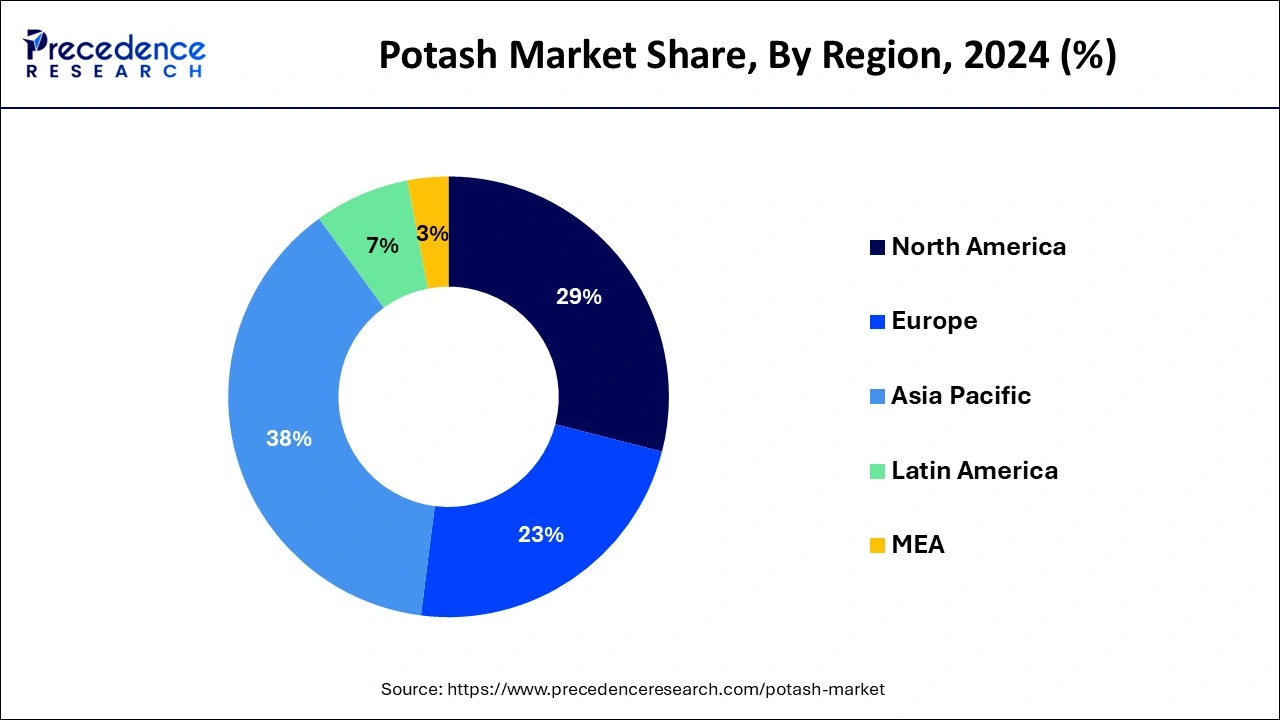

Asia Pacific held the largest share of the potash market in 2024 and is expected to expand further in the upcoming years. A sizable fraction of the world's population resides in Asia Pacific, where demand for food is rising due to increased urbanization and population expansion. To meet this need, agricultural production must rise, and potash is a necessary component. To increase agricultural output and guarantee food security, governments in a number of Asia Pacific nations are putting policies and initiatives into action. Subsidies or other rewards are frequently part of these programs, encouraging farmers to use fertilizers like potash. In the Asia Pacific area, environmental preservation and sustainable agriculture are receiving more attention. The market for potash-based fertilizers is further fueled by the perception that they are more environmentally benign than some other fertilizers.

North America is expected to grow rapidly in the global potash market during the forecast period. Given that North America is one of the world's main producers and consumers of potash, the market for the mineral is substantial. A vital component of fertilizers, potash is essential for maintaining agricultural output, particularly in areas like sections of North America where soils are poor in nutrients.

Being one of the biggest producers and exporters of potash worldwide, Canada holds a significant market share in the North American potash market. Specifically in Saskatchewan, there are some of the biggest potash mines in the world run by businesses like Nutrien and Mosaic.

The United States has a sizable agricultural industry, which contributes to the country's high demand for the potash market. To meet its agricultural demands, the United States imports a significant amount of potash in addition to producing some of it domestically.

One important area of the global fertilizer market is the potash market. A crucial nutrient for plant growth, potash is mostly utilized in agriculture to raise crop quality and yield. It has potassium in a form that is soluble in water, which is necessary for a number of physiological functions in plants, including the management of water, photosynthesis, and enzyme activity. The agricultural industry is the main driver of potash consumption.

The agricultural sector is under growing pressure to increase productivity in order to fulfill the growing demand for food as the world's population continues to rise. Potash is a necessary ingredient when making fertilizer blends to increase crop yields and soil fertility. The demand for potash is significantly influenced by emerging economies such as China, India, and Brazil, which have sizable agricultural industries.

The main source of potash is underground mines, where quantities of potassium salts are mined using traditional techniques. The countries that produce the most potash are China, Belarus, Russia, and Canada. Potash reserves are abundant in Saskatchewan and other parts of Canada, which are known for their superior quality. Potash is traded internationally, with major exporting nations providing supplies to worldwide markets. Among the top exporters of potash are Canada and Russia, with sizable amounts going to Europe, Latin America, and Asia. The potash market has a number of difficulties, including competition from alternative nutrient sources and environmental issues related to fertilizer use and mining. However, there are also chances for innovation in market expansion in areas with increasing demand for agricultural products, sustainable mining methods, and product development.

| Report Coverage | Details |

| Market Size in 2025 | USD 66.11 Billion |

| Market Size in 2024 | USD 63.00 Billion |

| Market Size by 2034 | USD 101.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.89% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Consolidation in the industry

The potash market consolidation is a prevalent trend fueled by a number of variables, such as market demand, economies of scale, and strategic positioning. Potash is necessary for agricultural productivity since it is a vital component in the creation of fertilizer. Consolidation initiatives may be influenced by changes in pricing dynamics and potash demand fluctuations. Businesses can better control market volatility and sustain steady revenue by purchasing rivals or forging alliances.

Through consolidation, businesses can improve their negotiating power with suppliers and customers, diversify their product offerings, and solidify their positions in the potash market. Access to complementary resources or knowledge can also be facilitated through strategic mergers and acquisitions. Government policies and regulations may have an impact on the dynamics of industry consolidation and structure. Depending on the regulatory environment, antitrust laws, and trade obstacles may help or impede consolidation initiatives.

Currency fluctuations

The potash market, which is greatly impacted by the dynamics of global trade, can be greatly impacted by changes in currency values. A crucial fertilizer for agriculture, potash increases crop yields, especially for crops that need a lot of potassium, such as soybeans, corn, and wheat. The cost of production for producers of potash can be impacted by fluctuations in currency values.

A depreciation of the home currency, for instance, can raise production costs for a firm importing machinery or raw materials worth foreign currencies, which could result in higher potash prices. In anticipation of currency fluctuations, investors may modify their holdings, which may have an indirect impact on potash prices and market dynamics. Interest rates, inflation rates, and geopolitical developments are examples of larger macroeconomic variables that frequently influence currency movements.

Investment in infrastructure and research

For crops like corn, wheat, and soybeans, potash is an essential ingredient for plant growth. Putting money into the potash market helps to increase agricultural production and food security by providing farmers with a steady supply of this vital nutrient. Technological developments in potash mining, extraction, and distribution can boost productivity and lessen their negative effects on the environment. By guaranteeing that farmers receive potash on time, infrastructure investments in the form of distribution networks, storage facilities, and transportation can increase market competitiveness. Price volatility and bottlenecks in the supply chain can both be lessened by doing this. Potash is a product that is traded internationally, and a nation's standing in the international market can be improved by infrastructure investments. Enhanced infrastructure makes exports easier and enables nations to take advantage of opportunities for international trade.

The potassium chloride segment held the largest share of the potash market in 2024 and is expected to maintain its dominance during the forecast period. Potash, a general word for fertilizers containing potassium, is commonly known as potassium chloride (KCl). Because it contains potassium, a mineral that is vital to plant growth, potash is an important part of agricultural activities. Potassium chloride is one of the most traded items in the market. Usually, it is applied directly as fertilizer or utilized as a raw material to make other fertilizers that contain potassium. Because it is less expensive than other potassium fertilizers like potassium sulfate and has a reasonably high potassium content, potassium chloride is preferred. Suppliers and producers of potassium chloride frequently compete with one another on the basis of things like product quality, cost, supply chain dependability, and environmental sustainability.

The potassium sulphate segment is expected at the fastest rate during the forecast period. In the agricultural industry, potassium sulfate—also known as sulfate of potash or SOP—is a widely used fertilizer. It is prized for having a high potassium and sulfur content, both of which are advantageous for some soils and crops. Potassium sulfate faces competition in the market from potassium fertilizers such as potassium magnesium sulfate (langbeinite) and potassium chloride (MOP). Sulfur is also supplied by potassium sulfate, which is necessary for plant growth in addition to potassium. Applications of potassium sulfate are beneficial for sulfur-deficient soils. For crops like fruits and vegetables, where quality is important, potassium sulfate is frequently chosen. It is superior to potassium chloride in that it can improve flavor, color, and shelf life in some crops.

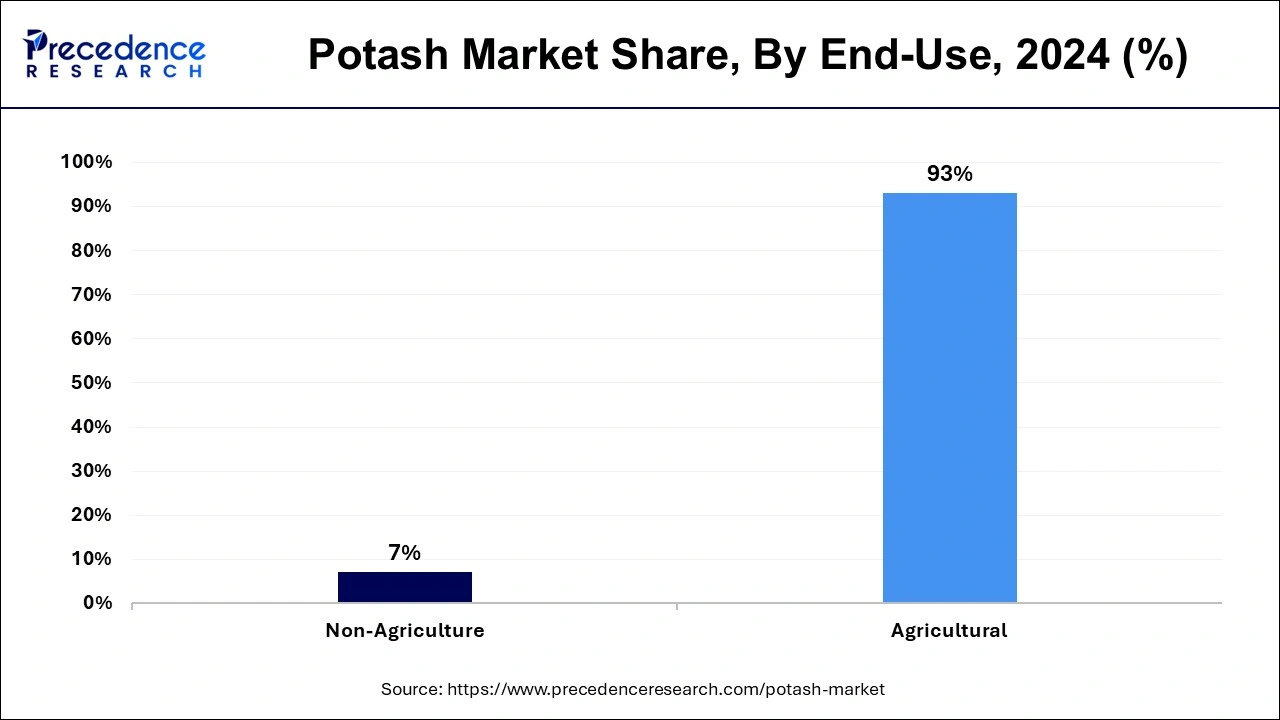

The agriculture segment dominated the potash market in 2024. A key ingredient in agriculture, potash is mostly applied as fertilizer to increase crop yields and quality. It has a lot of potassium, which is one of the key elements needed for plant growth. Potash is essential to the agriculture industry in order to preserve soil fertility and guarantee ideal plant nutrition. Potash aids in restoring the soil's potassium levels, which can gradually decline as a result of ongoing crop cultivation. Sufficient potassium levels in the soil are necessary to maximize agricultural yields, maintain soil fertility, and ensure proper nutrient uptake by plants. Changes in the price of potash can have an effect on input costs and farmer profitability, which can then have an impact on crop selection and agricultural practices.

The non-agriculture segment is expected to grow rapidly during the forecast period. Potash is used in many industrial processes, including those that make ceramics, glass, soaps, and water softeners. In the chemical industry, potassium carbonate (K2CO3), potassium hydroxide (KOH), and other potassium-based compounds are produced using potash. Potash is useful in metallurgical operations, especially for recycling aluminum and making certain metals like titanium. Pharmaceuticals use potassium compounds generated from potash for a variety of uses, including addressing potassium deficits. Specifically in the manufacturing of baked goods and beverages, potash is utilized as a food ingredient. In the water treatment process, potash is used to remove pollutants and soften hard water.

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client