Soybean Market (By Nature: Genetically Modified Organisms (GMO), Non-genetically Modified Organism (N-GMO); By End-use: Food and Beverages, Soybean Food Products, Fermented Soya Food, Non-fermented, Soybean Oils, Animal Feed) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

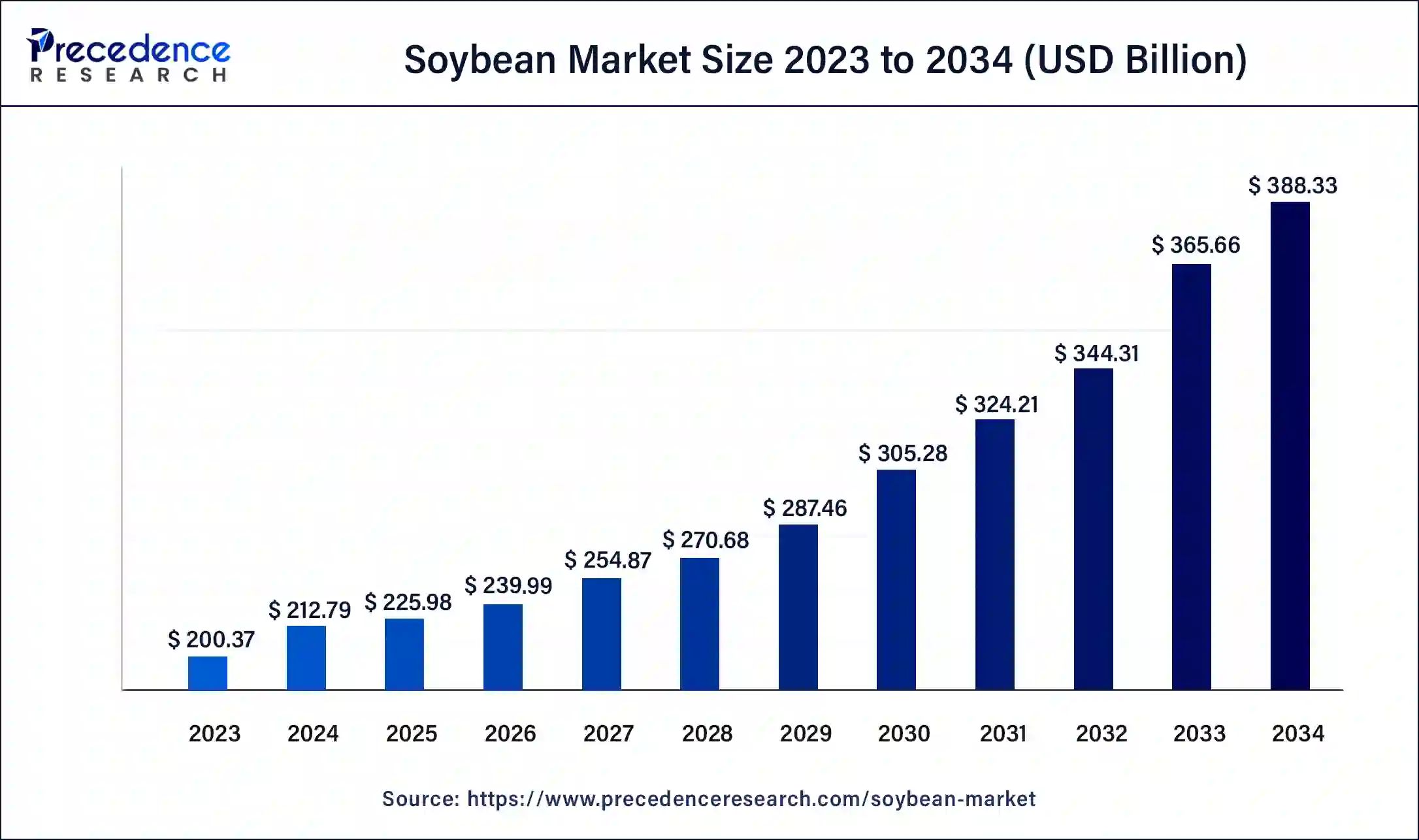

The global soybean market size was USD 200.37 billion in 2023, accounted for USD 212.79 billion in 2024, and is expected to reach around USD 388.33 billion by 2034, expanding at a CAGR of 6.2% from 2024 to 2034.

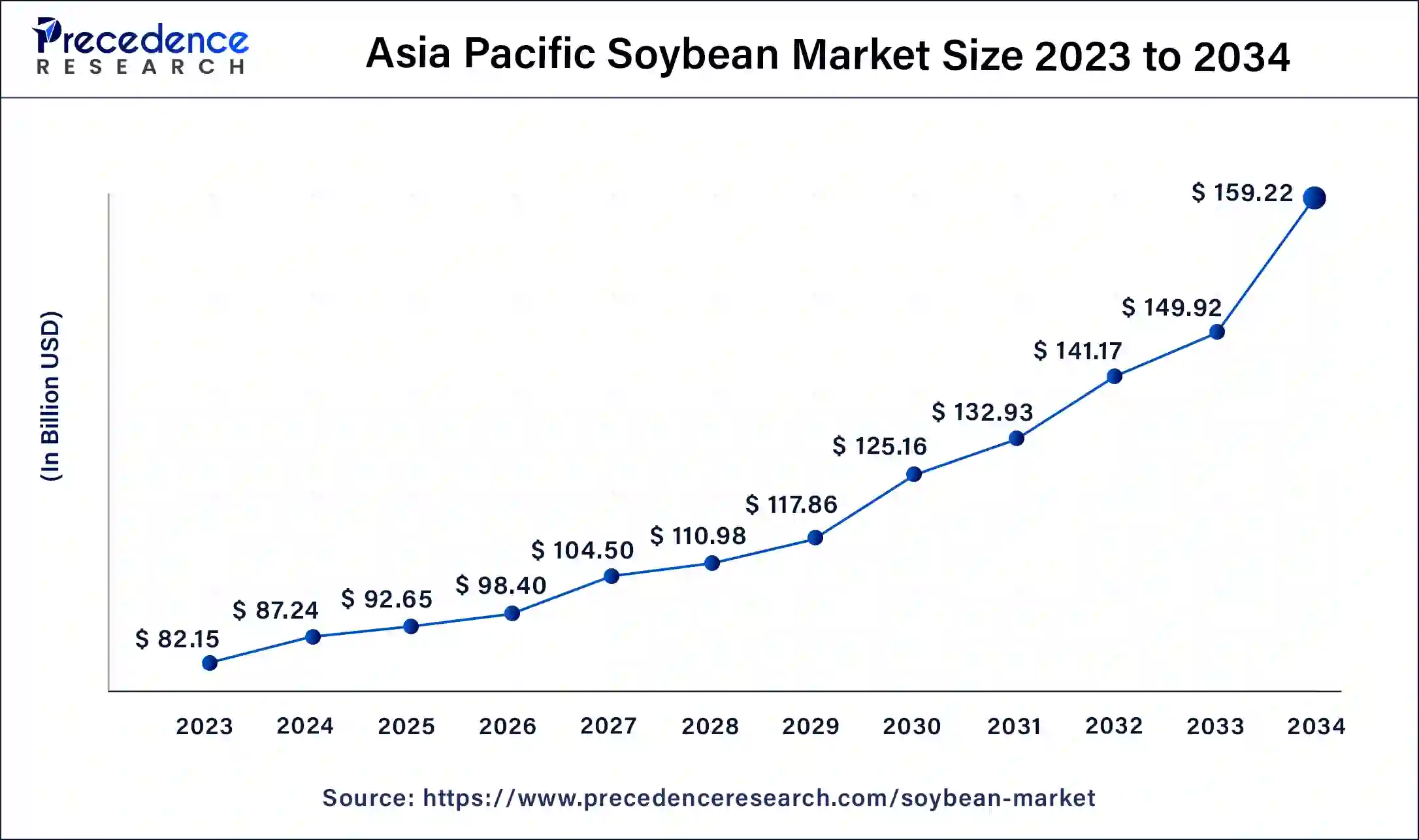

The Asia Pacific soybean market size was estimated at USD 82.15 billion in 2023 and is predicted to be worth around USD 159.22 billion by 2034, at a CAGR of 6.4% from 2024 to 2034.

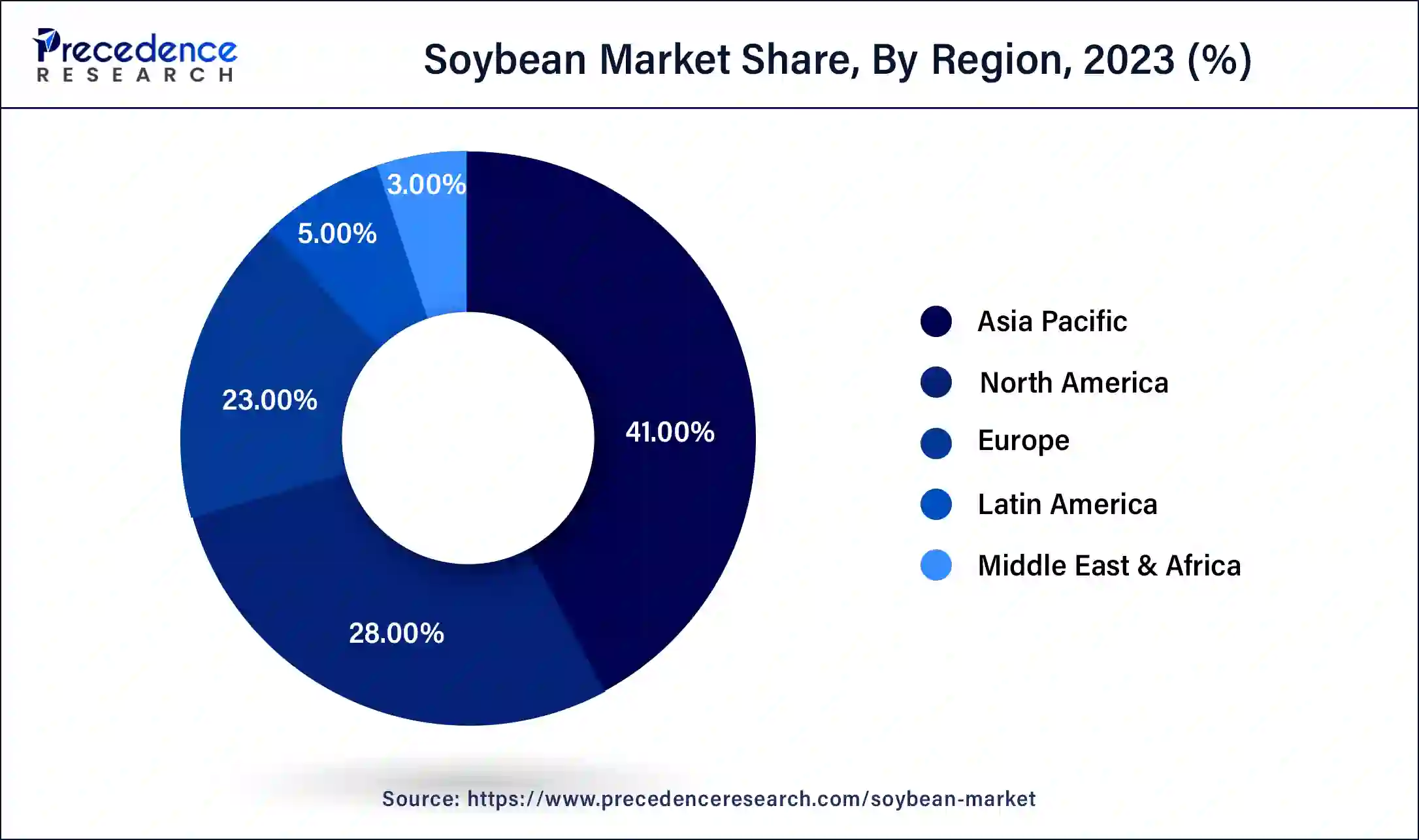

Asia Pacific held the largest share of the soybean market while contributing 41% of the market share in 2023, rooted in the crop's historical origins and its integral role in traditional diets across Eastern and Southeast Asia. The surge in global meat consumption, particularly in Asia, propels the demand for soybeans, with China emerging as a key driver, accounting for a significant portion of global demand growth. China's policies on international trade and domestic production significantly impact soybean market dynamics, influencing price volatility and farm prices due to its status as the world's largest soybean importer.

The soybean market refers to the global trade and production of soybeans, a versatile legume that is widely cultivated for its edible beans, oil, and protein-rich meal. Soybeans are one of the most important crops worldwide and are used extensively in various industries, including food, feed, biodiesel production, and industrial applications. Soybeans, primarily an industrial crop, are cultivated for oil and protein extraction. Despite their seed's modest oil content (around 20% on a moisture-free basis), soybeans are the world's largest source of edible oil, contributing roughly half of global oilseed production. Variations in soybean composition occur due to different varieties and growing conditions. Advances in plant breeding have resulted in protein levels between 40% and 45% and lipid levels between 18% and 20%. Typically, an increase of 1% in protein content corresponds to a 0.5% decrease in oil content.

For each ton of crude soybean oil produced, approximately 4.5 tons of soybean oil meal with a protein content of about 44% are generated. The commercial value of soybean oil meal often exceeds that of the oil, making it a valuable commodity rather than a by-product. The potential global protein yield from soybean production could meet approximately one-third of the world's food protein needs if fully utilized for human consumption.

World soybean production has surged eightfold over the past half-century to over 100 million metric tons annually. Key producers include the U.S.A. (45%), Brazil (20%), and China (12%). Improved yields resulting from plant breeding and advanced agricultural practices have significantly contributed to the growth of the soybean market. Many countries have initiated large-scale soybean production due to its economic benefits, leading to increased global production, with the rest of the world accounting for 23%.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.2% |

| Global Market Size in 2023 | USD 200.37 Billion |

| Global Market Size in 2024 | USD 212.79 Billion |

| Global Market Size by 2034 | USD 388.33 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Nature and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising business activities

With increasing industrialization and urbanization, there is a growing demand for meat and dairy products, particularly in emerging economies. Soybeans are a key ingredient in animal feed formulations, providing protein and essential nutrients to livestock such as poultry, swine, and cattle. As business activities expand and populations grow, the demand for animal feed rises, driving up the demand for soybeans.

Soybeans are widely used in the food processing industry to produce a variety of products, including soy milk, tofu, soy sauce, and cooking oil. As business activities increase and disposable incomes rise, there is a greater demand for processed food products, including soy-based alternatives to dairy and meat products. This trend fuels the demand for soybeans as a raw material for food processing.

Risk of allergies caused by soybean

Soy allergy, triggered by a reaction to soy protein, prompts an abnormal immune response, particularly prevalent among infants and children. Symptoms encompass itching, mouth and lip tingling, flushed skin, nausea, diarrhea, wheezing, hives, dizziness, and confusion. Such risks of allergies act as a significant restraint on the growth of the soybean market.

Climate variability

High temperatures and low soil moisture during the crucial summer crop reproductive phase pose the most significant threat to soybean yields. Heat exacerbates damage to soybean crops, particularly in dry conditions, while wet conditions mitigate its impact. Climate variability significantly affects crop yields, acting as a formidable restraint on the growth of the soybean market.

Advancements in technology

In recent years, ever-expanding world, the demand for food and fiber has reached unprecedented levels, necessitating the adoption of advanced agricultural technologies. For soybean farmers, embracing the latest advancements holds immense potential to enhance crop yields and profitability. With the rise of information technology, GPS-based equipment, and sophisticated management software, farmers can now gather comprehensive data on every aspect of their operations.

Despite some skepticism surrounding big data, stemming from concerns about ownership rights and privacy, these challenges also present an opportunity for the soybean market. By addressing these concerns and showcasing the benefits of technological integration, the soybean market players can seize the opportunity to meet global demands while ensuring sustainability and efficiency in farming practices.

Rising demand for biodiesel production

Soybean oil emerges as a promising contender for biodiesel production, buoyed by several advantages. Widely cultivated and supported by existing infrastructure, soybeans offer a readily available resource for biofuel manufacturing. The utilization of leftover soybean meal for animal feed further enhances its sustainability. With soybean acreage surpassing other oilseed crops, substantial production of soybean oil is ensured, driving its availability as a biofuel feedstock. The exponential growth in soybean capacity dedicated to biodiesel production, soaring from zero to over a billion gallons annually, underscores the significant potential of soybean oil in the biofuel market, presenting lucrative opportunities for industry stakeholders.

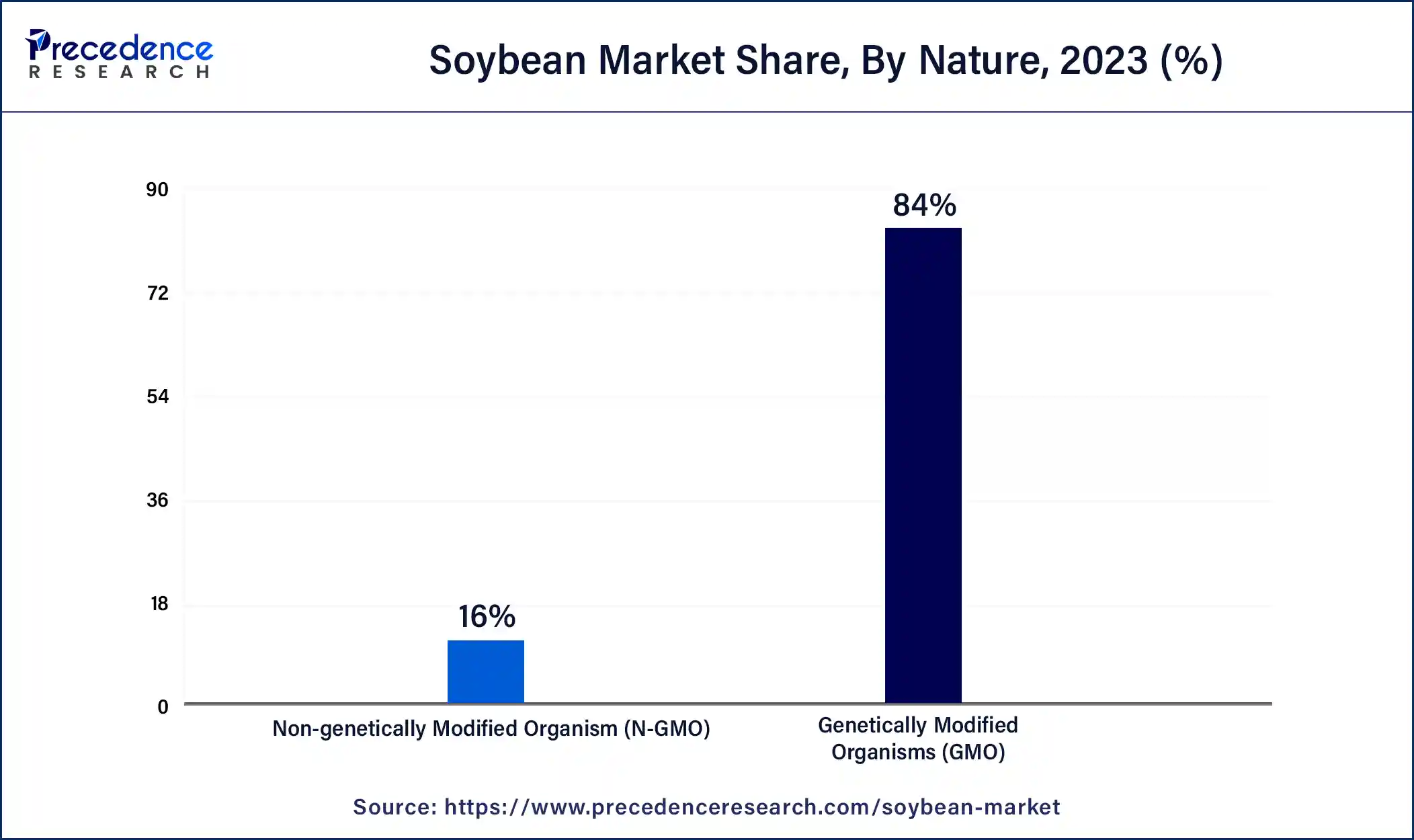

The genetically modified organisms (GMO) segment led the soybean market with 84% market share in 2023. GMO soybeans are engineered to resist pests, diseases, and herbicides, resulting in higher yields compared to conventional soybean varieties. Farmers benefit from increased productivity per acre, leading to higher profits and improved agricultural efficiency. GMO soybeans may contain genes that confer resistance to insect pests, such as the soybean aphid or corn earworm. This trait reduces the need for chemical insecticides, resulting in cost savings for farmers and reduced environmental impact.

The non-genetically modified organisms segment is observed to witness the fastest expansion during the forecast period. There is a growing consumer preference for non-GMO foods due to concerns about potential health risks, environmental impact, and ethical considerations associated with genetically modified organisms. As a result, food manufacturers, retailers, and consumers seek non-GMO soybeans and soy products to meet this demand. Non-GMO soybeans often command a price premium compared to GMO varieties due to their perceived higher quality, purity, and sustainability. Farmers who grow non-GMO soybeans may receive higher prices for their crops, providing economic incentives to produce non-GMO soybeans and meet market demand.

The animal feed segment held the dominating share of 73% in 2023 in the soybean market. Soybeans are a rich source of protein, making them an ideal ingredient for animal feed. Protein is essential for animal growth, muscle development, and overall health, making soybeans a valuable component in livestock diets. Soybeans contain essential nutrients such as amino acids, vitamins, and minerals, which are beneficial for animal health and productivity. Incorporating soybean meal into animal feed formulations helps ensure that animals receive a balanced diet that meets their nutritional requirements.

Soybean meal can be used in a wide range of animal feed formulations, including poultry feed, swine feed, cattle feed, and aquafeed. Its versatility and compatibility with various animal species make it a versatile ingredient that can address the nutritional needs of different livestock and poultry sectors.

The food and beverages segment is observed to witness the rapid growth in the soybean market during the forecast period. Soybeans are a highly versatile crop that can be processed into a wide range of food products, including tofu, soy milk, soy sauce, soy flour, and meat substitutes such as tofu and tempeh. These soy-based foods are popular among consumers seeking plant-based protein alternatives, vegetarian and vegan options, and nutritious dietary choices. With the growing global population and increasing demand for protein-rich foods, soybeans serve as a key source of plant-based protein for human consumption. Soy protein is comparable in quality to animal protein and is utilized in a variety of food applications, including meat analogs, dairy alternatives, snack foods, and baked goods.

Segments Covered in the Report

By Nature

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client