January 2025

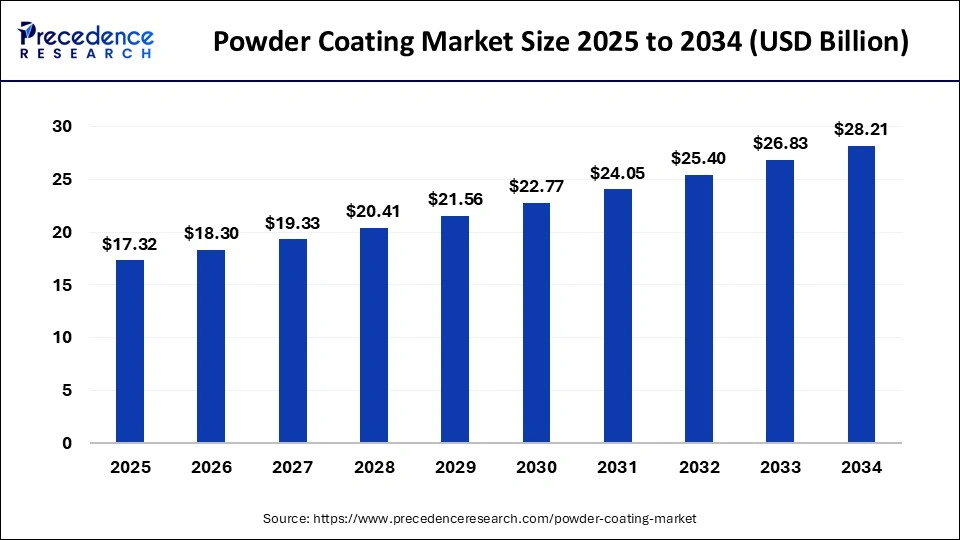

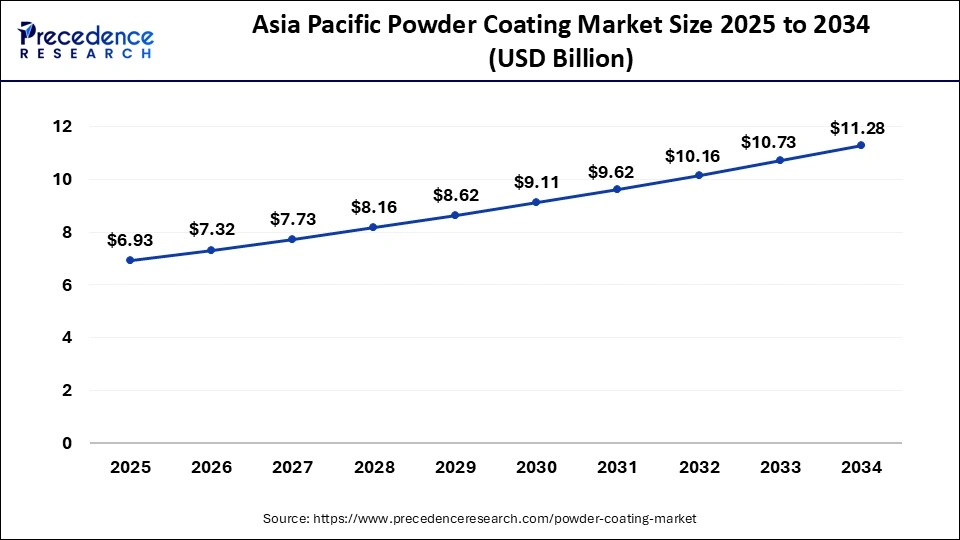

The global powder coating market size is expected to reach at USD 17.32 billion in 2025 and is anticipated to grow around USD 28.21 billion by 2034, expanding at a CAGR of 5.57% from 2025 to 2034. The Asia Pacific powder coating market size is valued at USD 6.93 billion in 2025 and is expanding at a CAGR of 6% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global powder coating market size was valued at USD 16.4 billion in 2024 and is anticipated to reach around USD 17.32 billion by 2025, to approximately USD 28.21 billion by 2034, expanding at a CAGR of 5.57% from 2025 to 2034.

The Asia Pacific powder coating market size reached USD 6.56 billion in 2024 and is expected to be worth around USD 11.28 billion by 2034, poised to grow at a CAGR of 6% from 2025 to 2034.

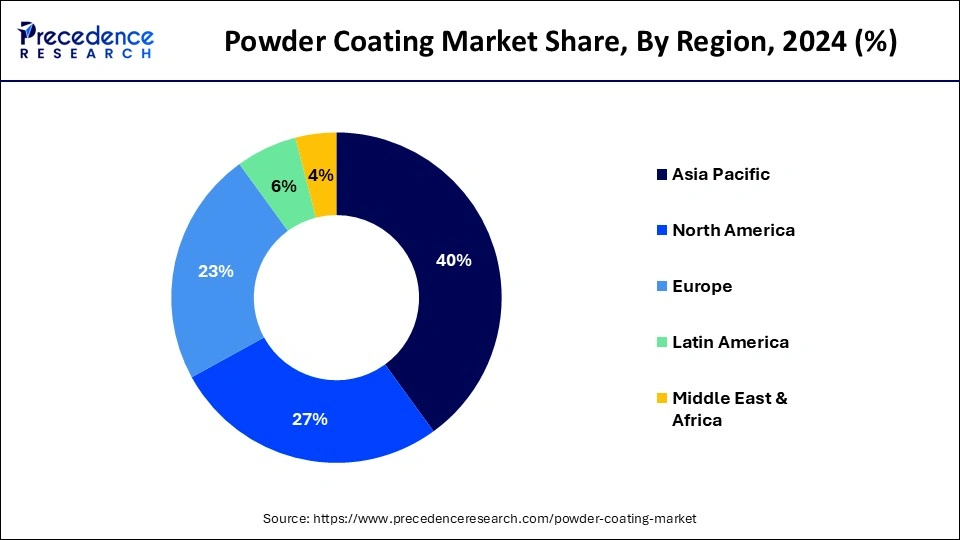

Asia Pacific emerged as largest market for powder coating industry in 2024. The optimistic stance towards the construction sector of South Korea, India, China, Japan, Malaysia, Indonesia and Vietnam is proposed to endorse the practice of powder coatings. Besides, promising government guidelines with an objective to create investments public-private collaborations and from FDI is further complementing the growth of the market. Automotive sector in Asia Pacific is projected to advance significantly on account progress in transportation infrastructure, increasing disposable income and shifting lifestyle. The green coatings engineering corporations and research institutions have profoundly capitalized to improve eco-friendly, cutting-edge, and harmless powder coatings.

Asia-Pacific

Solid protection, sleek finish: The powder-coating boom

North America is expected to grow at the fastest rate throughout the projection period. The market growth in the region is mainly attributed to the rising usage of powder coatings over liquid coatings in numerous industries, like automotive and construction. Moreover, the rapid shift toward eco-friendly coating solutions is projected to boost the market in the region.

The U.S. perceives higher powder application in the architectural sector whereas conventionally it’s prominently liquid. China is sighted a huge wave of powder usage in numerous industrial areas like ACE and commercial vehicles. Powder on dissimilar substrates in the place of traditional ones is also a drift that is achieving tractions as the application competence and powder technology progresses.

North America

The growing power of powder coatings (Major factors contributing towards growth)

Powder coating is applied as a dry, free-flowing powder. It is a convenient method used to finish surfaces of different materials, including plastics, metals, and ceramics. It is a finishing process in which powder coating is applied using a spray gun that electrostatically charges the powder particles and resin onto a surface or object and then cures the coating by heat, which then forms a hard finish. This coating has a high recyclable content and better abrasion resistance and durability, making it suitable for industrial, architectural, and automotive applications. Furthermore, this coating is available in a range of textures and colors.

Underlining need for more sustainable solutions and progress in construction and manufacturing industries is developing new openings for powder coatings sector. Coating formulators and raw material providers are responding with the improvement of novel powder coating technologies that can be manufactured and applied more proficiently, show enhanced performance characteristics, and possess a superior variety of prospective end uses. For the previous numerous years, the powder coatings sector has been, and endures to be, in a phase of growth and revolution during manifold market spaces. The emergence of technologies that address the current issues for manufacturing productivities and cost are driving these needs. One instance is the expansion and development of compact process systems.

Development of global powder coatings market is credited to influences like augmented consumer expenditure, climbing per capita income, fluctuating consumer inclinations plus progression in technology. Greater utilization rate as than liquid forms are amongst the fundamental reasons impacting the complete product application possibility. The infrastructural development is also a crucial factor motivating the product requirement on an international scale. Proficiency and over spray are amongst the vital aspects leading the market economics.

However, current pandemic of COVID-19 has disturbed the production of raw materials employed for coatings and paints manufacturing. Major economies of Asia Pacific such as Japan, India, China, Thailand and Singapore are the centers for paints and coatings manufacturing industry. Present pandemic of COVID-19 in this region severely impacted the affected the supply of these raw materials.

| Report Coverage | Details |

| Market Size by 2034 | USD 28.21 Billion |

| Market Size in 2025 | USD 17.32 Billion |

| Market Size in 2024 | USD 16.4 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.57% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin Type, Application Type, Region Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for sustainable coating solutions

Powder coatings are environmentally friendly, as they do not contain VOCs and create less wastage than the other finishing processes, like liquid coating. Furthermore, the proper utilization of powder coating can help in eliminating waste because after the usage, the waste powder can be reused further. This type of recycling practice helps in reducing costs and minimizing environmental impacts. The rising adoption of powder coatings over liquid coatings in various industries boosts the market.

High initial investment can impede market growth

Setting up a powder coatings workshop requires a high initial investment in equipment such as spray guns, a curing oven, and a spray booth. The size of the curing oven purchased must be taken into consideration while handling the equipment effectively. The thicker, larger, and heavier parts need a more powerful oven, which might be costly, further adding to the overall equipment costs. Moreover, powder coatings typically form a thick coat on surfaces, creating challenges in obtaining thin film.

Increasing demand in the automotive industry

The increasing demand for powder coatings in the automotive industry creates immense opportunities in the market. These coatings can be applied to various substrates, such as plastic and metals. This versatility makes them suitable for automotive applications. These coatings are used to coat various components, such as wheels, chassis, and engine. Furthermore, advancements in powder coating technology led to the development of new formulations with enhanced durability and performance.

The consumer goods segment dominated the market in 2024. Application of powdered enamels is a superior resource-conserving and environmental friendly process in the arena of industrial coating technology. As a result, powder coatings have recognized themselves in the numerous applications in a countless range of industries such as furniture manufacturing, household appliances, architecture, equipment and machinery manufacturing, automotive industry and consumer goods. There is constant growth in the sale of powder coatings with innovative applications being established. Among different application segments assessed in this report, furniture and appliances segment is considered to advance at a stable pace during the prediction period. Furthermore, new application market such as IT and telecom are also expected to offer lucrative growth where uses of powder coatings are broadly explored.

The emergence of powder-on-powder application which involves application of topcoat and primer with one cure step has offered novel prospects for powder coatings. Further, powder coatings have attained more extensive access in new-fangled applications. It is, precisely, lower baking temperatures that have allowed access to innovative substrates such as MDF, wood and plastic. The technology is unveiling new fangled likelihoods and novel markets. This drift is vastly reinforced by enhancements in process control and application equipment that provide a broader range of application sectors such as dry-on-dry systems.

Out of different types of resins, polyester resin type occupied highest revenue share in 2024. This progress is credited to its advantageous characteristics including chemical resistance, quick-drying, quick-drying, temperature resistance, surface protection and abrasion resistance. Rush in demand of product in applications such radiator grills, as door handles, bumpers, wheel rims, metallic structural components and bicycle is expected to bolster growth of the market during next few years.

The epoxy-polyester segment is expected to expand at the fastest growth rate during the forecast period. The growth of the segment is attributed to exceptional hardness and corrosion resistance properties of epoxy polymers. Epoxies exhibit excellent adhesion when applied to metals. Moreover, the low costs of epoxy-polyester coatings contribute to their increased adoption.

Growing stipulation to augment the outdoor and indoor air quality taking into account the health effects of VOC’s, moving producers emphasis on plummeting VOC content. Nominal VOC emissions, than liquid paints would deliver robust business prospect for industry participants as they can obey economically and easily with the guidelines of U.S. environmental protection agency.

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2024 to 2034. This report contains market breakdown and its revenue estimation by classifying it on the basis of resin type, application and region as follows:

By Resin

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025