February 2025

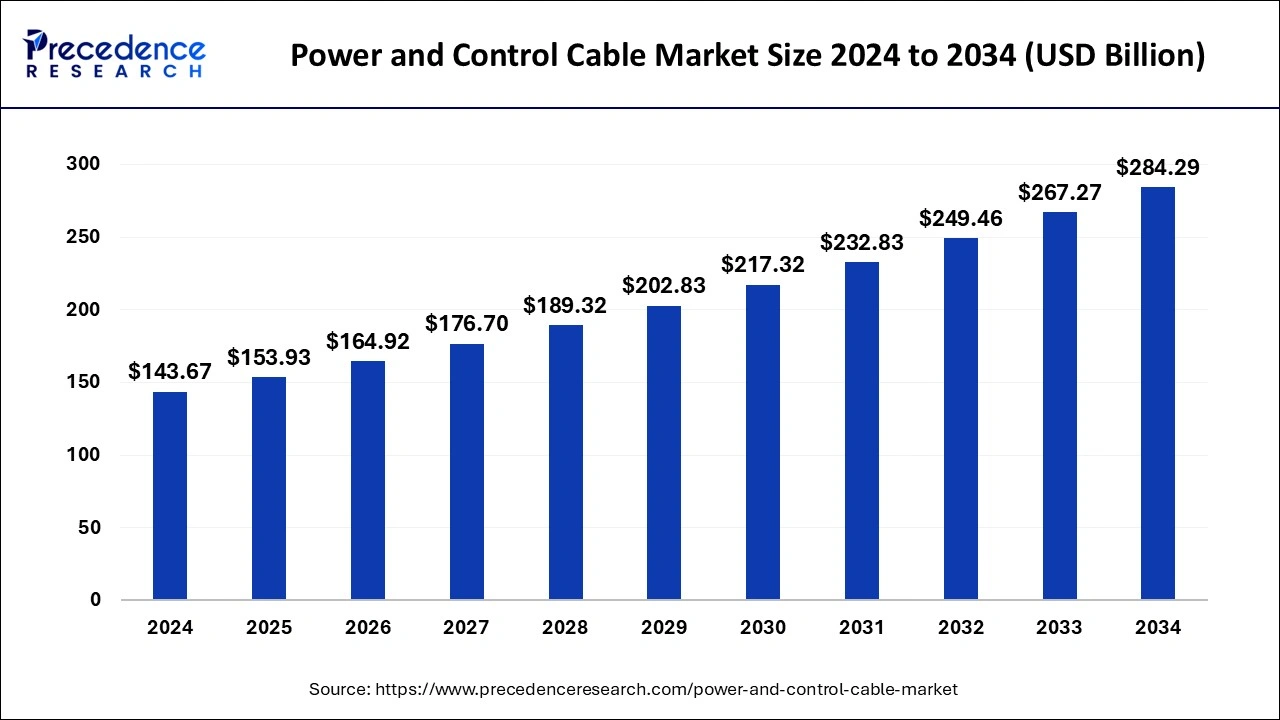

The global power and control cable market size is calculated at USD 153.93 billion in 2025 and is forecasted to reach around USD 284.29 billion by 2034, accelerating at a CAGR of 7.06% from 2025 to 2034. The Asia Pacific power and control cable market size surpassed USD 124.68 billion in 2025 and is expanding at a CAGR of 7.13% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global power and control cable market size was estimated at USD 143.67 billion in 2024 and is predicted to increase from USD 153.93 billion in 2025 to approximately USD 284.29 billion by 2034, expanding at a CAGR of 7.06% from 2025 to 2034. Thanks to advancements in cable technology, which include the creation of high-performance, eco-friendly cables, power, and control systems are becoming more efficient and safer.

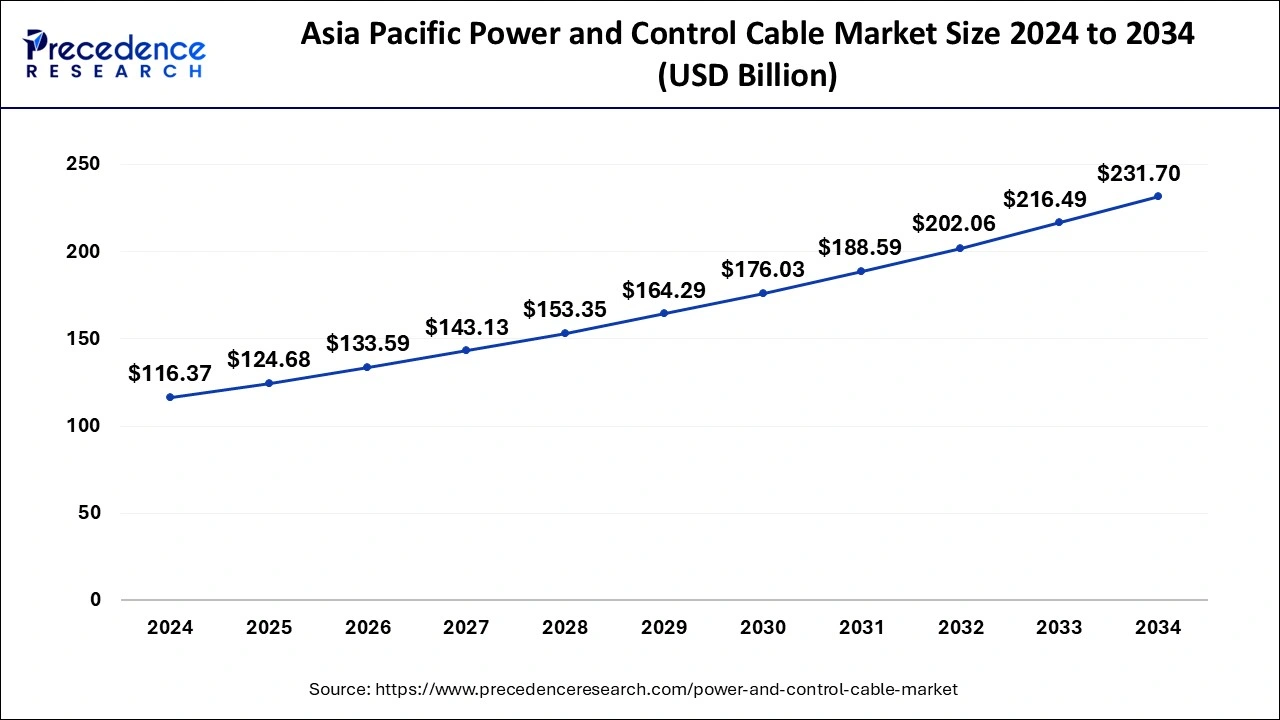

The Asia Pacific power and control cable market size was evaluated at USD 116.37 billion in 2024 and is predicted to be worth around USD 231.70 billion by 2034, rising at a CAGR of 7.13% from 2025 to 2034.

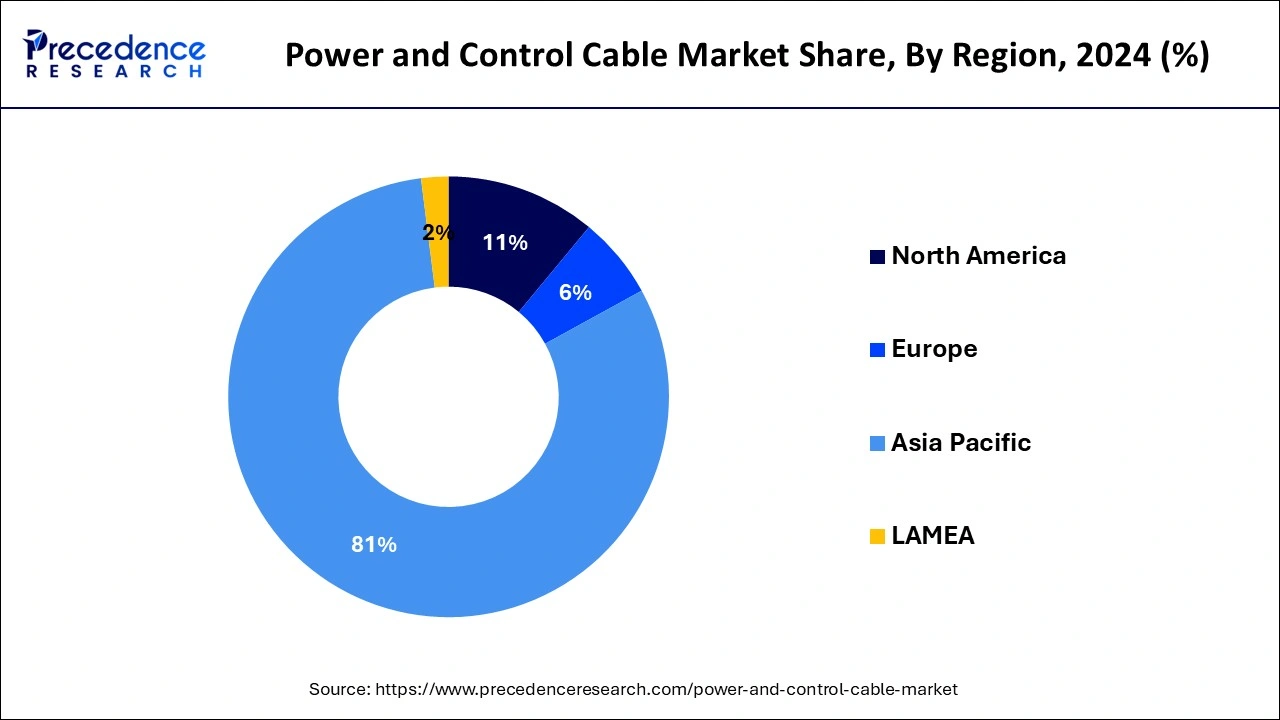

Asia Pacific held the dominating share of the power and control cable market in 2024. China and India are leading the way in industrialization, which has increased demand for innovative cabling solutions and dependable power supplies. The need for power lines is being driven by the need for significant infrastructure investments that come with rapid urbanization. High-quality cables that can support sophisticated technological infrastructures are becoming more in demand due to innovations like Industry 4.0 and the rollout of 5G networks. Countries with rapidly expanding economies, such as those in Southeast Asia, China, and India, are predicted to experience the highest growth rates. To support their expanding industrial sectors and urban populations, these nations are investing heavily in energy infrastructure.

North America is expected to grow at a significant rate in the global power and control cable market during the forecast period. Two of the biggest drivers are the expansion of smart grid networks and the renovation of the current grid infrastructure. These improvements are necessary to improve power distribution's dependability and efficiency as well as to meet the world's rising energy demands. Power and control connections are becoming more and more in demand as renewable energy sources like solar and wind power proliferate. These cables are essential for new renewable energy installations to be connected to the grid. The need for control cables, which are widely employed in automated systems to transmit data and control signals, has increased due to the development of smart manufacturing and industrial automation technologies.

Technological developments, urbanization, and industrial growth are some factors propelling the considerable rise of the global power and control cable market. Key factors are the growth of industrial sectors and the increasing urbanization of the population. The need for power and control cables is greatly increased by the growth of infrastructure projects, such as power plants, transmission lines, and distribution networks.

The power and control cable market is also driven by the increasing use of electric vehicles and the development of infrastructure for charging them. This expansion is further supported by advancements in cable technologies, such as increased voltage capacity and better insulation materials. The need for high-performance power cables is a result of the move toward renewable energy sources like solar and wind power, which demand efficient transmission networks.

Aluminum is the most popular material in the power and control cable market since it is a cost-effective and recyclable material that can be used for a wide range of purposes. Copper is still necessary for high-conductivity needs in high-voltage applications. The market includes a number of industries, such as infrastructure, utilities, telecommunications, and power transmission. Certain elements, such as the proliferation of telecom networks, the automation of production, and the rise in infrastructure projects, propel the growth of each sector.

Over the next ten years, the power and control cable market is expected to increase rapidly due to the continued construction of infrastructure projects, the switch to renewable energy sources, and technological developments in the cable manufacturing industry. Future developments in the business will be further shaped by ongoing R&D expenditures and clever partnerships between major participants.

| Report Coverage | Details |

| Market Size in 2025 | USD 153.93 Billion |

| Market Size by 2034 | USD 284.29 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.06% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Renewable energy expansion

One of the main forces is the global transition to renewable energy sources like wind and solar electricity. For the purpose of producing power, transmitting it to the grid, and distributing it, these projects need a lot of cabling. Strong power and control cables are essential for infrastructure development in emerging economies due to their growing urbanization and industry. This covers public infrastructure initiatives, commercial and residential buildings, and industrial facilities.

The need for power connections is also fueled by the continuous electrification of transportation, which includes the installation of EV charging stations. Power cables operate better and are safer because of advancements in cable technology, such as higher voltage capacity and better insulating materials.

Supply chain disruptions

Due to saving money and pent-up consumer desire, the COVID-19 epidemic caused a huge demand shock. Global supply networks in every industry, including the wire and cable sector, were put under pressure by this abrupt increase in demand. Production has been negatively hindered by shortages of vital resources like semiconductors, electrical steel, and other components.

Transportation and raw material prices have increased as a result of supply chain interruptions. The supply chain has had to absorb these additional costs, which has raised the final product's price. The situation has become more intricate due to inflationary pressures that have decreased the purchasing power of both firms and consumers.

Increasing demand for electricity and infrastructure

The world's rapidly increasing urbanization and industrialization are fueling the need for power and control cables as well as electricity. Large power infrastructure is needed in urban areas to sustain industrial, commercial, and residential activity. Advanced power and control cables are critical to the introduction of smart grid technology for effective energy management and distribution.

With the help of these cables, electrical flow can be monitored and controlled in real time, increasing system dependability and energy efficiency. Robust power and control connections are required to support the infrastructure powering data centers, which is driven by the expansion of data centers and the increasing demand for high-speed internet connectivity.

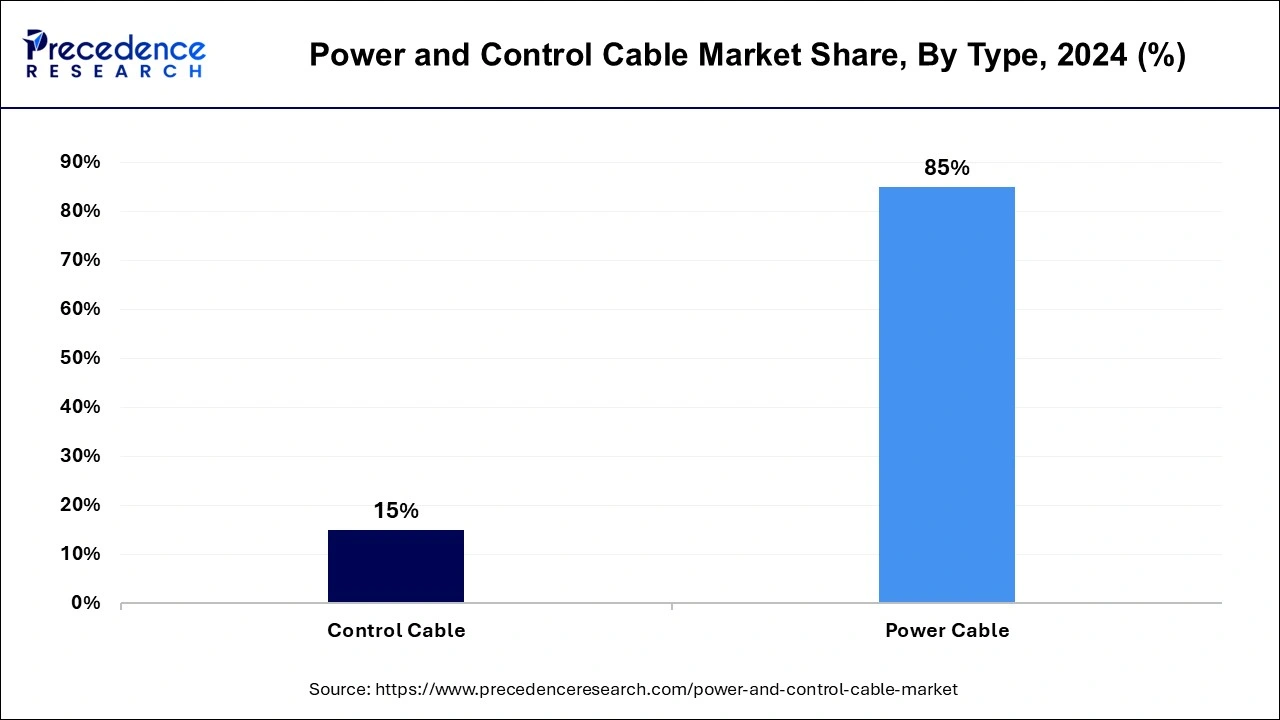

The power cables segment held the largest share of the power and control cable market in 2024. In the larger market for power and control cables, power cables are essential parts. They are essential to the efficient operation of many electrical systems because they transfer electrical energy from one place to another. Depending on the use, power cables are made to safely and effectively transport electricity over short or large distances. Urbanization, industrialization, the expansion of infrastructure, and the rising use of renewable energy sources like solar and wind power all have an impact on the need for power lines. Power cable sales are competitive, with a number of national and international producers vying for customers on attributes such as product quality, dependability, affordability, and technical innovation.

The control cable segment is expected to grow at the fastest rate in the global power and control cable market during the forecast period. Control cables are essential to the dependable transfer of electrical signals and data between machinery, equipment, and industrial automation systems. These cables are made expressly to transmit control signals, which regulate how motors, devices, and other electrical parts operate. Control cables are becoming more and more necessary as automation spreads throughout many industries. They serve as a means of facilitating communication between control systems and automated machinery. Power distribution systems need to be monitored and controlled by control cables as renewable energy sources such as solar and wind power grow in popularity. Market demand is maintained by the requirement for routine maintenance and replacement of aged control wire infrastructure in utilities and industrial facilities.

The utilities led the power and control cable market in 2024. Power cables are the means by which utilities move electricity from power plants to substations and ultimately to end consumers. High-voltage power cables are utilized to reduce energy losses during long-distance transmission. Utilities utilize power lines to distribute electricity in rural, suburban, and urban locations. Substations are connected to residential, commercial, and industrial consumers via these lines. To increase their grids' resilience, efficiency, and dependability, utilities make investments in their modernization and upgrading. This entails deploying dispersed energy resources, integrating smart grid technologies, and installing sophisticated power connections that can support heavier loads. In order to fulfill the increasing demand, utilities must expand their infrastructure as urbanization and industrialization continue.

The oil & gas segment is expected to show the fastest growth in the power and control cable market during the forecast period. Power and control cables are widely employed in the production and exploration of oil and gas. They supply power and control signals for numerous pieces of gear and equipment in drilling operations, subsea installations, and offshore platforms. Power and control cables are essential for running machinery, motors, and instrumentation systems in refineries and processing facilities. They make it easier to regulate and automate the different procedures that turn natural gas and crude oil into products that may be used, like petrochemicals, diesel, and gasoline. Power and control cables have strict requirements for durability, dependability, and safety because of the challenging working conditions seen in the oil and gas sector.

Segment Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024

August 2024

December 2024