January 2025

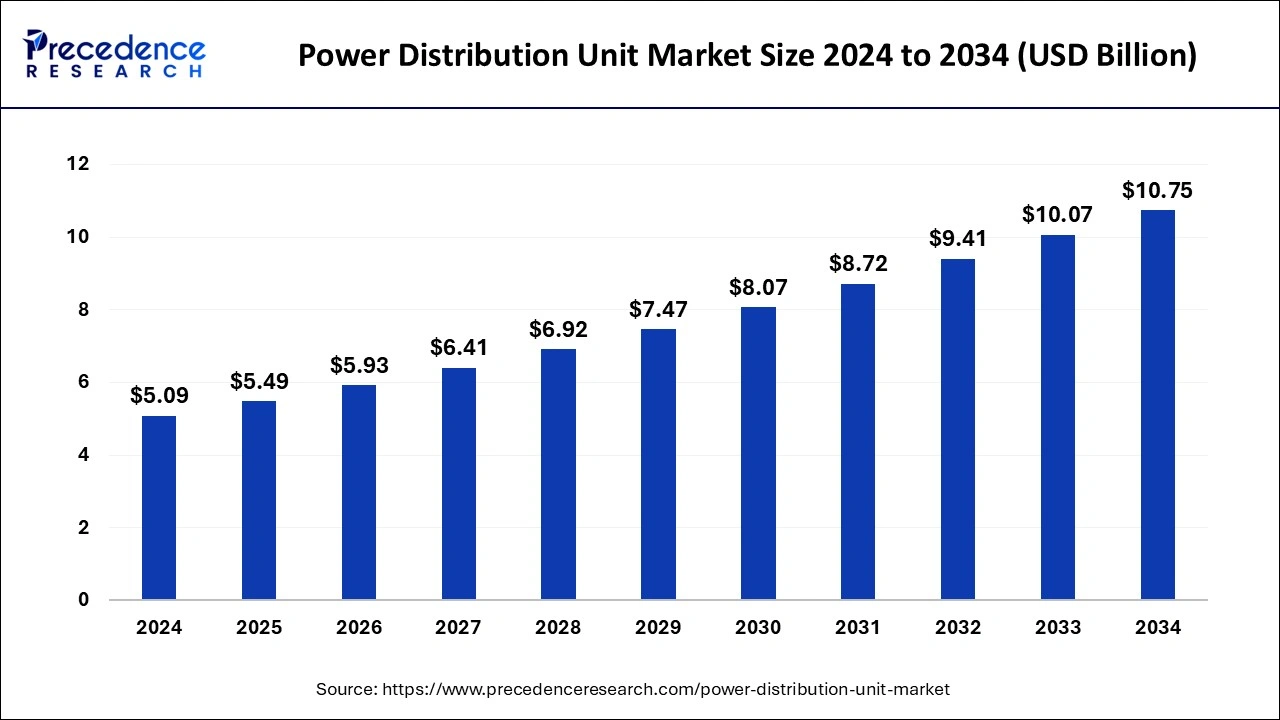

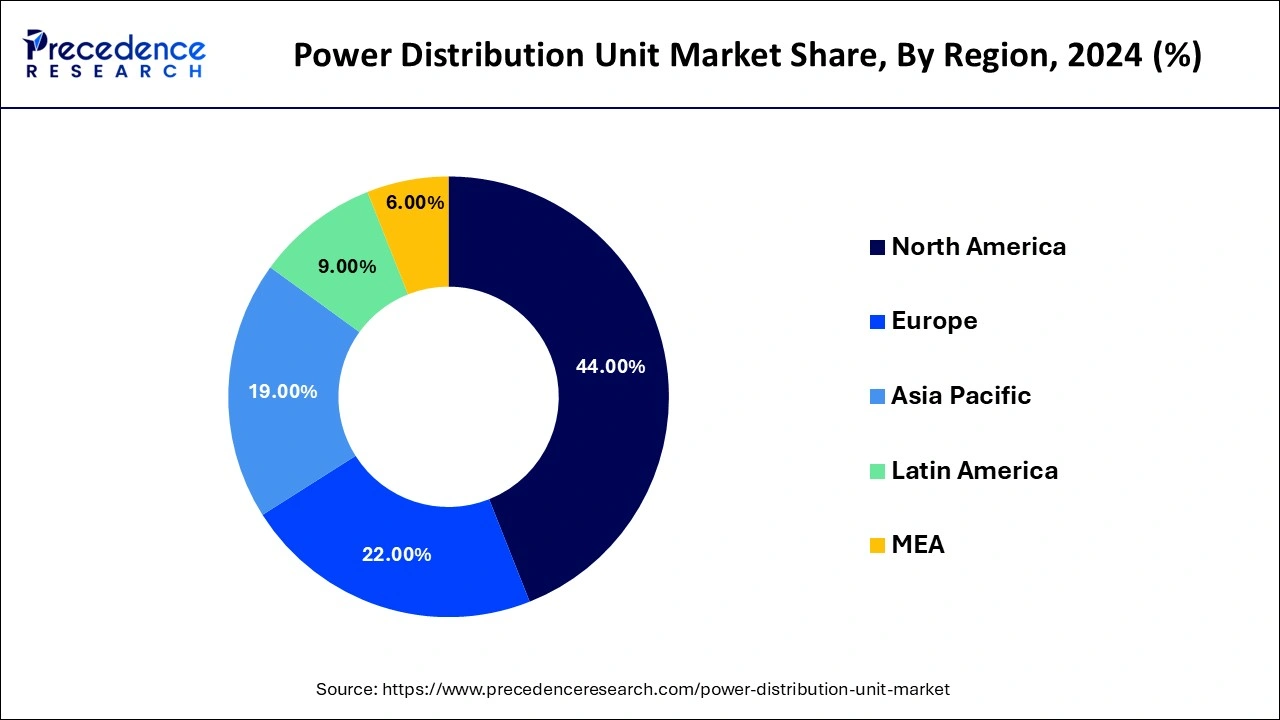

The global power distribution unit market size is calculated at USD 5.49 billion in 2025 and is forecasted to reach around USD 10.75 billion by 2034, accelerating at a CAGR of 7.76% from 2025 to 2034. The North America power distribution unit market size surpassed USD 2.24 billion in 2024 and is expanding at a CAGR of 7.78% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global power distribution unit market size reached USD 5.09 billion in 2024 and it is expected to hit around USD 10.75 billion by 2034, poised to grow at a CAGR of 7.76% over the forecast period from 2025 to 2034.

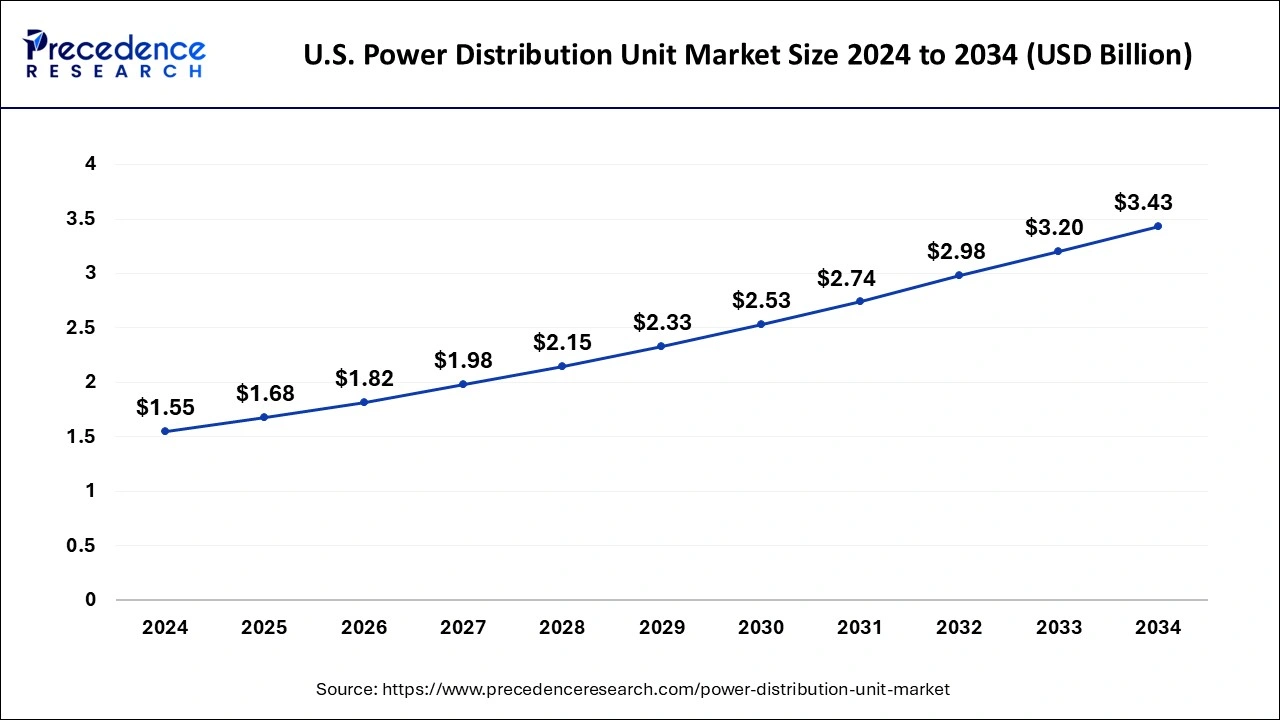

The U.S. power distribution unit market size was estimated at USD 1.55 billion in 2024 and is projected to surpass around USD 3.43 billion by 2034 at a CAGR of 8.27% from 2025 to 2034.

The North America region dominated the market in 2024. The surge in corporate infrastructures in emerging nations, combined with administration initiatives to boost the IT infrastructures ecosystem, will reinforce market development in the region. The growing establishment of IT infrastructure, mechanization, and cloud-oriented operations has additionally highlighted the significance of constant power supply and steady operation of data centers and server spaces.

Furthermore, there has been a noticeable rise in the sales and utilization of cutting-edge laboratory gadgets and the healthcare machinery that necessitates a regular power supply for crucial operations and the procedures, which propels the market’s demand in this area.

A power distribution unit (PDU) is a vital electrical device that enables the distribution of power to multiple devices in data centers, server rooms, or other similar facilities. IT equipment such as servers, networking equipment, and storage devices rely on PDUs to convert high-voltage power from the building's electrical system into lower-voltage power that they can use. PDUs come in different types based on their input voltage, number of outlets, and features. Some PDUs are designed to offer basic functionality, while others may have more advanced features such as remote monitoring, power usage tracking, and outlet-level control.

As an essential component in managing and distributing power in data centers and server rooms, PDUs are crucial to ensuring the efficient operation of IT equipment. PDUs provide monitoring and control functions, empowering data center managers to remotely track power consumption, regulate settings, and manage power distribution. Certain PDUs even offer smart features, such as load balancing, to optimize power utilization and minimize energy expenditures.

Due to growing server use, greater expenditure on manufacturing operations and increased awareness of cloud computing, the power distribution unit (PDU) market is anticipated to develop significantly on a worldwide scale. The market is expected to be pushed by the escalating need for data centres, declining power usage, fast rise in data generation, and expanding demand for data storage. However, the PDU market is expected to face challenges from the increasing complexity of data center servers.

To boost market growth, key trends in the PDU market include increased competition among vendors, cloud computing, the evolution of alternating phased power and virtualization. Rack power distribution units provide key features like tracking power usage, reducing overall power consumption, minimizing server downtime, and increasing uptime. In addition, power distribution units with high-amperage plugs can provide multiple low amperage outlets.

The rising volume of unstructured data, increased process automation in the power industry, and the increasing generation of machine sensor data are some of the key factors that are driving data center growth. The demand for data centers is expected to increase due to virtualization and the increased acceptance of cloud computing, positively impacting the power distribution unit market.

The PDU market is being driven by the rising demand for digital services. The growth of e-commerce, online banking, and other digital services has led to the need for reliable, high-speed connectivity and computing power, which can be met through data centers and other similar facilities. PDUs play a crucial role in these facilities by providing a reliable and efficient means to distribute power to servers, networking equipment, and other IT devices. By leveraging PDUs, these facilities can ensure that their IT infrastructure remains operational and stable, thus enabling them to deliver uninterrupted and high-quality digital services to their customers.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.76% |

| Market Size in 2025 | USD 5.49 Billion |

| Market Size by 2034 | USD 10.75 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Power Phase, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The growth of the power distribution unit market is anticipated to be propelled by the rising demand for monitoring solutions in data centers

A data center is a centralized location where an organization stores, manages, and disseminates its IT operations and equipment, providing a high level of security and reliability. Data center monitoring involves the manual or automated management and operation of data centers to optimize power usage and enhance security.

The increasing amount of data worldwide is a significant factor driving the growth of data centers and the global market. Raritan's PDU, for example, utilizes Xerus a firmware, the combination of hardware and software technologies that efficiently manages data centers for monitoring and supplying high computing power, ensuring security also providing complete visibility making advanced electricity supply alerts.

Limitations of the PDUs to Manage the Extreme Voltages and a High Current Fluctuation May impede Market Developments further

The current limitations of power distribution units (PDUs) to manage complex infrastructures and high voltage requirements can deter customers from seeking uninterrupted power supply solutions for their advanced data centers. Despite installing these units, downtime and interruptions can still occur due to overhead line sag, circuit breaker failures, overloading, high voltage transformer failures, and underground cable treeing.

Growing demand for intelligent PDUs

The power distribution unit (PDU) market presents a significant opportunity for growth with the increasing demand for intelligent PDUs that offer advanced features such as remote monitoring, real-time power consumption tracking, and predictive maintenance capabilities. As companies expand their IT infrastructure and adopt digital technologies, the need for efficient and reliable power distribution solutions has grown. Intelligent PDUs can provide crucial insights into power usage, identify potential issues before they occur, and enable remote management and control, thereby reducing downtime and enhancing overall efficiency. This market opportunity is projected to continue growing as the demand for data centers and cloud computing services increases globally. By investing in intelligent PDUs, companies can improve the reliability and efficiency of their power distribution solutions, leading to enhanced performance and cost savings in the long run.

The market for intelligent power distributions are projected to witness substantial growth, driven by the demand for the smart and technology-driven systems. These intelligent power distribution units (PDUs) are built with the core powers cycle which enables increased uptime, capacity planning, real-time data collection, green data center solutions also reduced cost and energy consumption, which are essential growth factors. For example, Hewlett Packard Enterprise's intelligent PDUs provide power consumption monitoring at the load segment, core, stick and outlet level, ensuring accuracy and precision, and improving power distribution flexibility and control to prevent downtime. Additionally, intelligent PDUs offer features as such power metering, and environmental monitoring, with remote outlet control that monitors circuit breakers and quickly reset them, making them an indispensable tool for data center administrators.

The triple-phase power type is a significant market segment in the power distribution unit industry, enabling devices to run at both 120 VAC and 208 VAC from the same power source by using mix-matched PDUs. This unit is widely utilized in various large industries and manufacturing plants across the globe. To ensure that the necessary power is utilized efficiently with the use of these units, effective operating systems are essential for critical industrial machines. Veritiv Group Corp., for example, has introduced a rack PDU that is specifically designed for powering critical IT equipment and can be remotely operated for functions like turning on, turning off, or rebooting the unit, which is anticipated to become a significant growth factor for the global market.

The power distribution unit (PDU) market is expected to witness significant growth in the commercial sector due to the rising number of infrastructure and commercial projects in emerging economies. Additionally, custom-designed electricity distribution systems for industrial purposes and military applications in mobile camps are likely to contribute to the growth of the PDU market. Marway Power Systems Inc. is an example of a company that offers units for aerospace, military, and defense applications, which are embedded in aircraft, ships, and submarines for energy management solutions. Furthermore, science and IT/commercial laboratories, which require PDUs to support their complex 24/7 operations, are also expected to play a significant role in driving market growth in the near future.

By Type

By Power Phase

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

August 2024

March 2025