September 2024

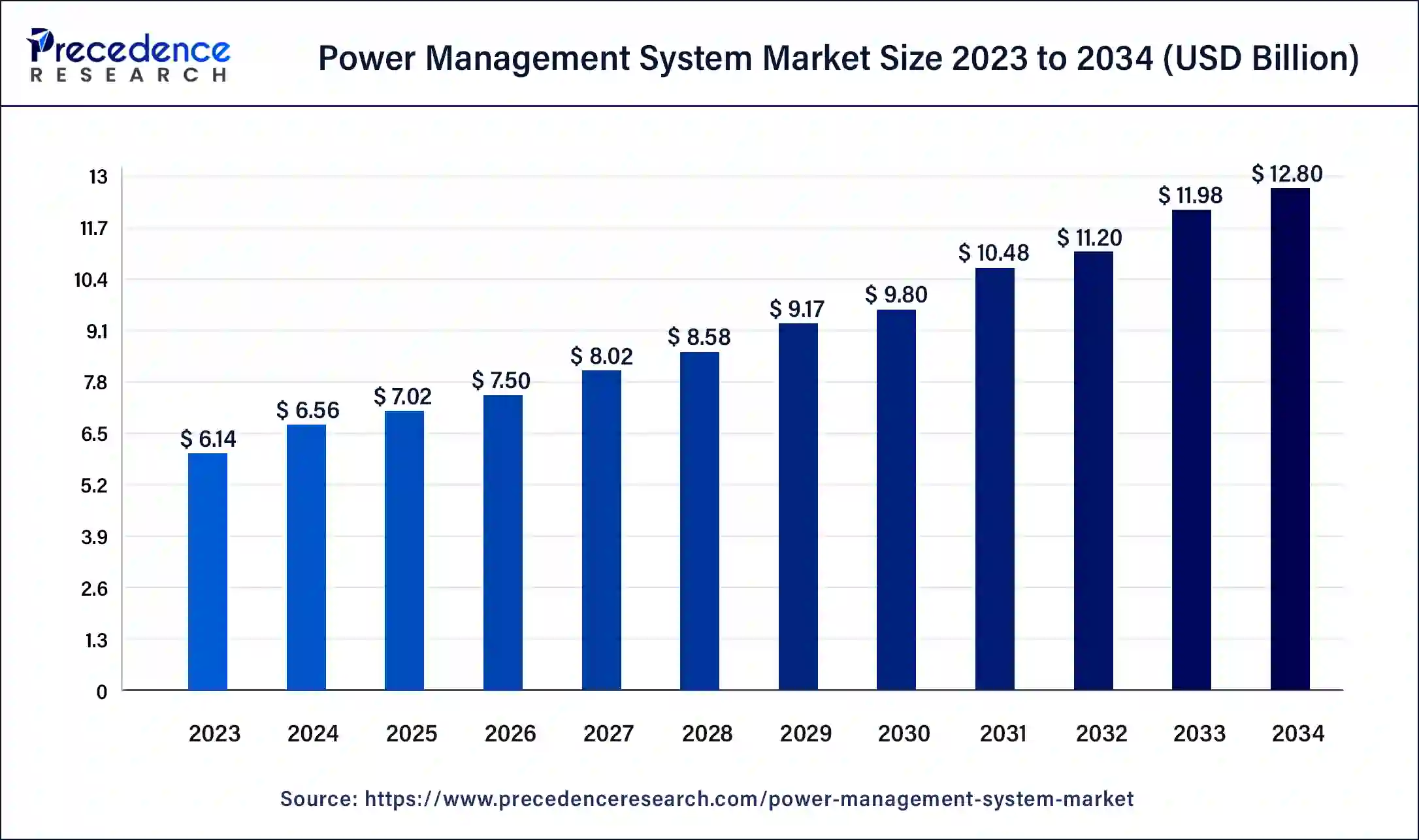

The global power management system market size was USD 6.14 billion in 2023, calculated at USD 6.56 billion in 2024 and is expected to be worth around USD 12.80 billion by 2034. The market is slated to expand at 6.91% CAGR from 2024 to 2034.

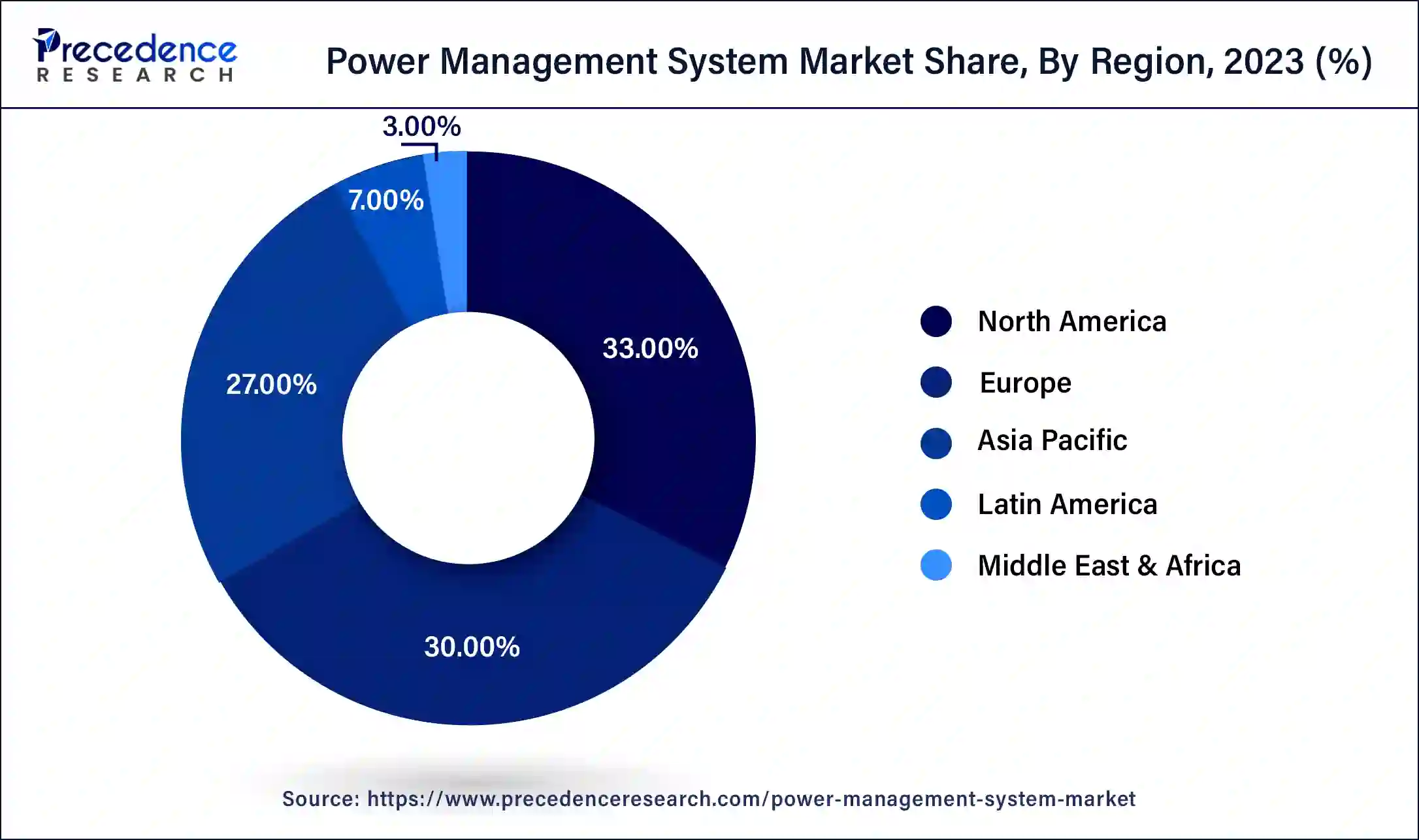

The global power management system market size is worth around USD 6.56 billion in 2024 and is anticipated to reach around USD 12.80 billion by 2034, growing at a CAGR of 6.91% over the forecast period 2024 to 2034. The North America power management system market size reached USD 2.03 billion in 2023. The benefits of power management include preventing shock and to avoid electrical fires, maintaining compliance with standards and regulations for power management, power quality, and carbon emissions, and helping the growth of the market.

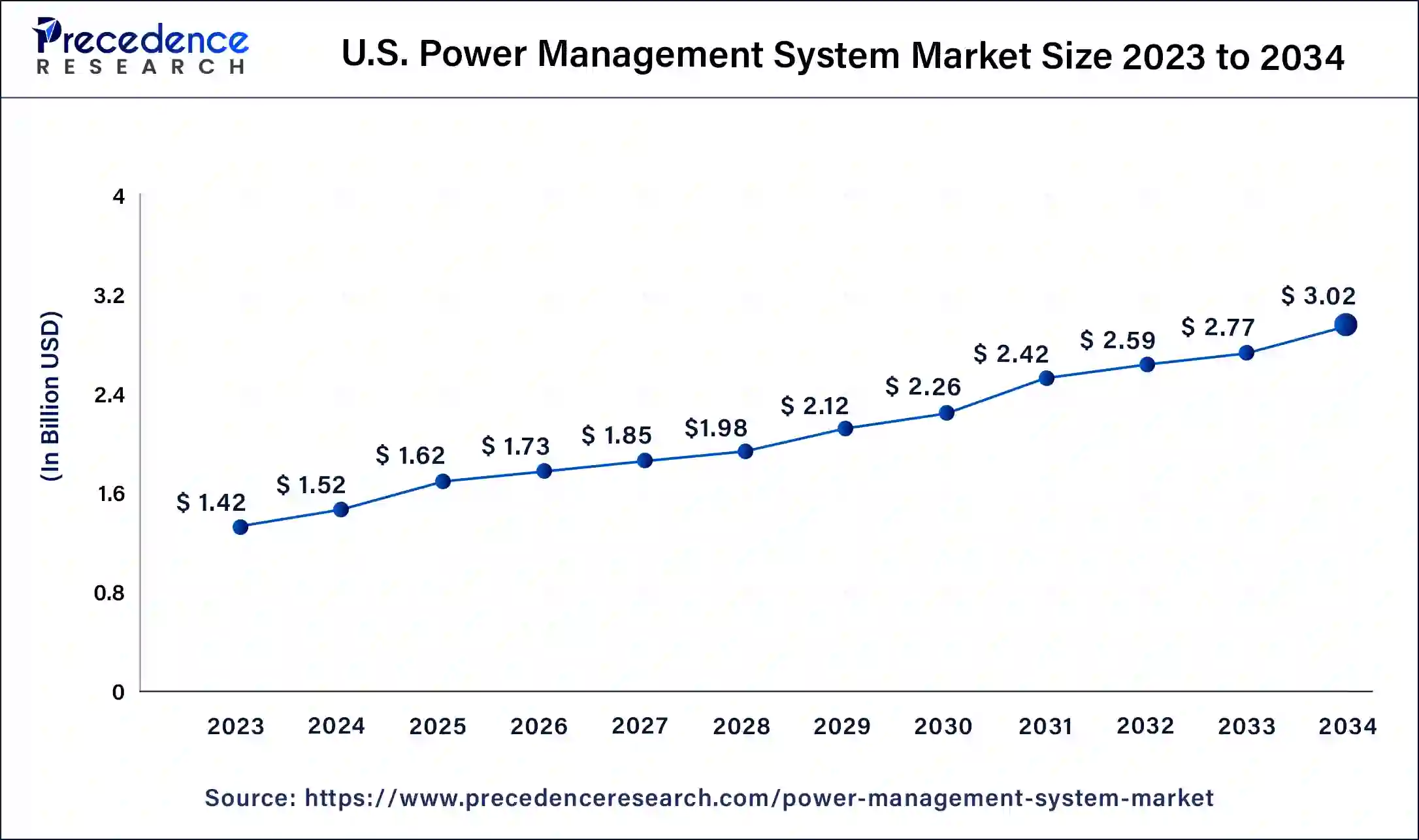

The U.S. power management system market size was exhibited at USD 1.42 billion in 2023 and is projected to be worth around USD 3.02 billion by 2034, poised to grow at a CAGR of 7.10% from 2024 to 2034.

North America dominated the power management system market in 2023. The rising use of IoT technologies and smart grids driving the power management systems growth as it allows better control and monitoring of energy consumption. There is a rising demand for IoT-based technology, and key players are increasing investment in new power management capabilities and manufacturing plants. In the United States, because of the increasing need for energy efficiency, there is a high demand for power management systems.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2034. The power management system market is increasing in the Asia Pacific region because of the increased adoption of power management systems that handle irregularity and variability linked with renewable energy sources like wind and solar. Renewable energy sources are increasing investment in this region because they reduce fossil fuel dependence and environmental concerns. China and India are the leading countries for the growth of the market in the Asia Pacific region.

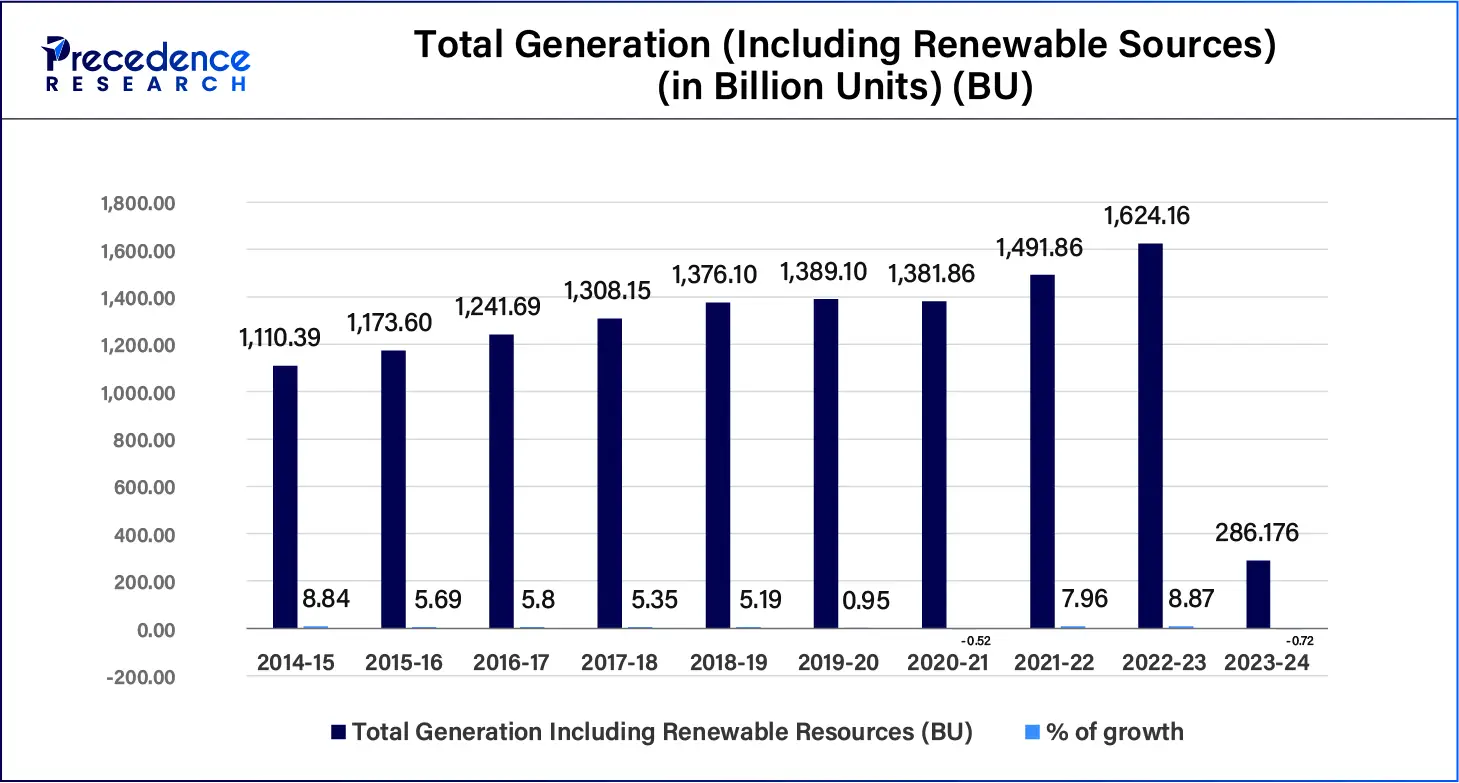

According to a report published by the Government of India Ministry of Power, the performance of electricity generation, including renewable sources

The goal for generating power using renewable energy in 2023–2024 has been set at 1750 billion units (BU). i.e., an increase of almost 7.2% over the 1624.158 BU that was actually generated in the preceding year (2022–2023). While 1491.859 BU were created in 2021–22, 1624.158 BU were generated in 2022–23, indicating an increase of almost 8.87%.

Total generation and growth over the previous year in the country during 2014-15 to 2023-24

The power management system market refers to buyers and sellers of power management systems that are in charge of electrical systems and ensure that the electrical system is efficient and safe. Power management is computing device characteristics that allow users to control the electrical power amount consumed by an underlying device with minimum impact on performance. The power management system can help prevent shock and avoid electrical fires, as well as simplify the process of maintaining and acquiring compliance with legislations, standards, and regulations for things like carbon emissions, power quality, and energy engagement.

How can AI improve the Power Management?

The use of artificial intelligence (AI) can transform how electric vehicles manage power by improving battery performance to improve charging infrastructure and integrating electric vehicles with the grid, which helps the growth of the power management system market. As the demand for electric vehicles grows, there is a need for AI-based power management solutions that make electric vehicles more sustainable, efficient, and reliable. The use of AI technology for the automation of power management can help to improve the effectiveness of electrical automation management and reduce the risks of accidents.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.80 Billion |

| Market Size in 2024 | USD 6.14 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.91% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising energy efficiency demand

Power management helps in power density and highest efficiency. Proper energy and power management systems may help to meet sustainability goals, reduce costs, and enhance operational efficiency. The benefits of energy efficiency include reducing the increasing electricity prices, investing in energy efficiency that can earn high returns, and saving energy that can also help to eliminate costs, reduce utility bills, protect the environment, etc. These factors help the growth of the power management system market.

High initial investments and limitations of infrastructure

The high initial investments and limitations of infrastructure can hamper the growth of the power management system market. A high initial investment is required for the installation and development of advanced power management solutions, specifically for large-scale projects, which can be a barrier to the growth of the market. There is a requirement for investment in infrastructure like storage facilities and grid upgrades to support the use of advanced power management solutions, which can be a barrier.

Increasing investment

The increasing investment in renewable energy sources and charging stations can be an opportunity for the growth of the power management system market. Electric vehicle's power management is increasing by improving battery performance to improve charging stations and use electric vehicles with the grid. Charging stations can oversee how power is used across the infrastructure and can communicate with each other. Investment in renewable energy sources includes wind, solar, and hydroelectric energy, which have the benefits of reducing carbon emissions and achieving energy independence.

The hardware segment dominated the power management system market in 2023 and is expected to dominate during the forecast period. Hardware power management includes two types- dynamic power management and static power management. At the time of the design stage, power management is done using the static power management (SPM) method. The hardware-powered power management includes varying frequency and voltage of the processor according to the performance needs. Effective methods use runtime behavioral changes to eliminate the power consumed in the system. The benefits of hardware power management include improved scalability, productivity, data security, real-time processing, reliability, efficiency, speed, and compatibility with operating systems and many devices.

The software segment is estimated to be the fastest-growing during the forecast period. Software-based power management systems provide control over how to manage the use of electricity. They allow us to renegotiate rates, control demand to avoid penalties, prevent expensive power quality issues, and identify and correct power delivery problems. The benefits of software-based power management include increased sales potential, better customer service, improved analysis, enhanced productivity, better planning, increased work efficiency, ease of use, great support from software developers, etc., helping the growth of the power management system market.

The load shedding & management segment dominated the power management system market in 2023. The power management process controls the demand and supply of electricity to ensure efficiency and sustainability. Load shedding is a method of power management that includes turning off power to some devices and customers when the demand exceeds the supply. This supports the prevention of dangerous imbalances that may cause damage or blackouts to the power system. Load-shedding benefits include eliminating the flow of network traffic, preventing system collapse and instability of distribution systems, and electrical generation.

The power control & monitoring segment is expected to be the fastest-growing during the forecast period. Power management helps in power control and power management, including power event analysis, equipment monitoring, capacity management, electrical system efficiency, and health. They can help find a way to reduce energy costs, prevent shock and avoid electrical fires, recover from outages more safely and quickly, etc., helping the growth of the power management system market.

The oil & gas segment dominated the power management system market in 2023 and is expected to grow significantly during the forecast period. Power management systems play an important role in the oil and gas industry. The use of energy or power management systems with data management systems and advanced technologies to control and analyze energy use in the refining and production processes is one of the main ways that industries in the oil and gas sector can start to improve efficiency.

The IT & data centers segment is anticipated to be the fastest-growing during the forecast period. It is necessary to optimize and monitor power usage for many reasons, including capacity planning and cost management. Power monitoring can help in identifying potential areas of improvement or bottlenecks and capacity planning. Improving and monitoring power use in IT & data centers may help to eliminate operating costs linked with electricity consumption, resulting in significant savings for the organization. These factors help the growth of the power management system market.

Segments Covered in the Report

By Component

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

August 2024