December 2024

Power Sports Market (By Vehicle: Heavyweight Motorcycles, All-terrain Vehicles (ATVs), Side-by-side Vehicles, Personal Watercraft, Snowmobile; By Propulsion: Electric, Gasoline, Diesel; By Application: Off-Road, On-Road) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

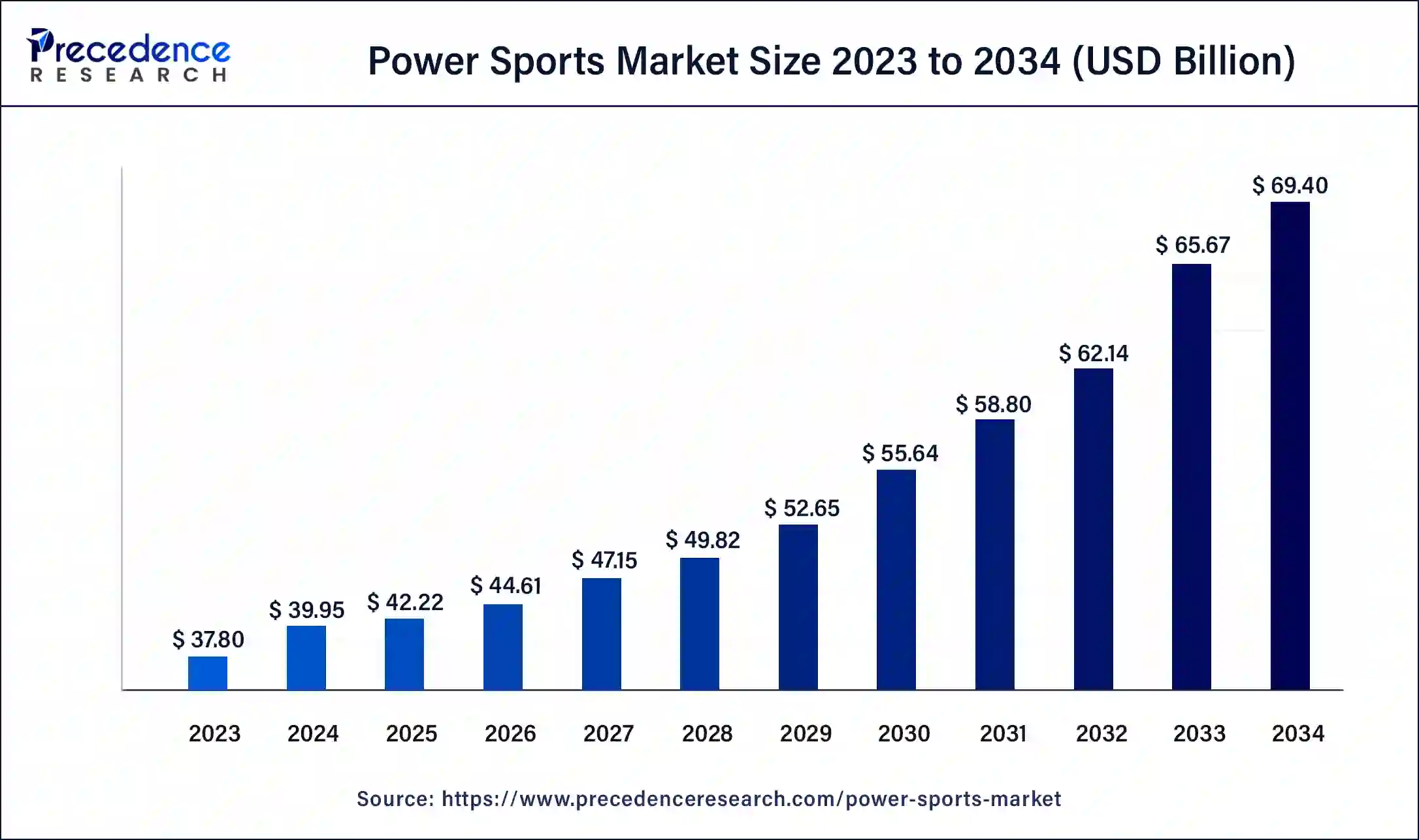

The global power sports market size was USD 37.80 billion in 2023, calculated at USD 39.95 billion in 2024 and is expected to reach around USD 69.40 billion by 2034, expanding at a CAGR of 5.67% from 2024 to 2034. The North America power sports market size reached USD 18.14 billion in 2023. The growth of the market is driven by the rising interstate towards the adventurous activities and the tourist activities are driving the growth of the power sports market.

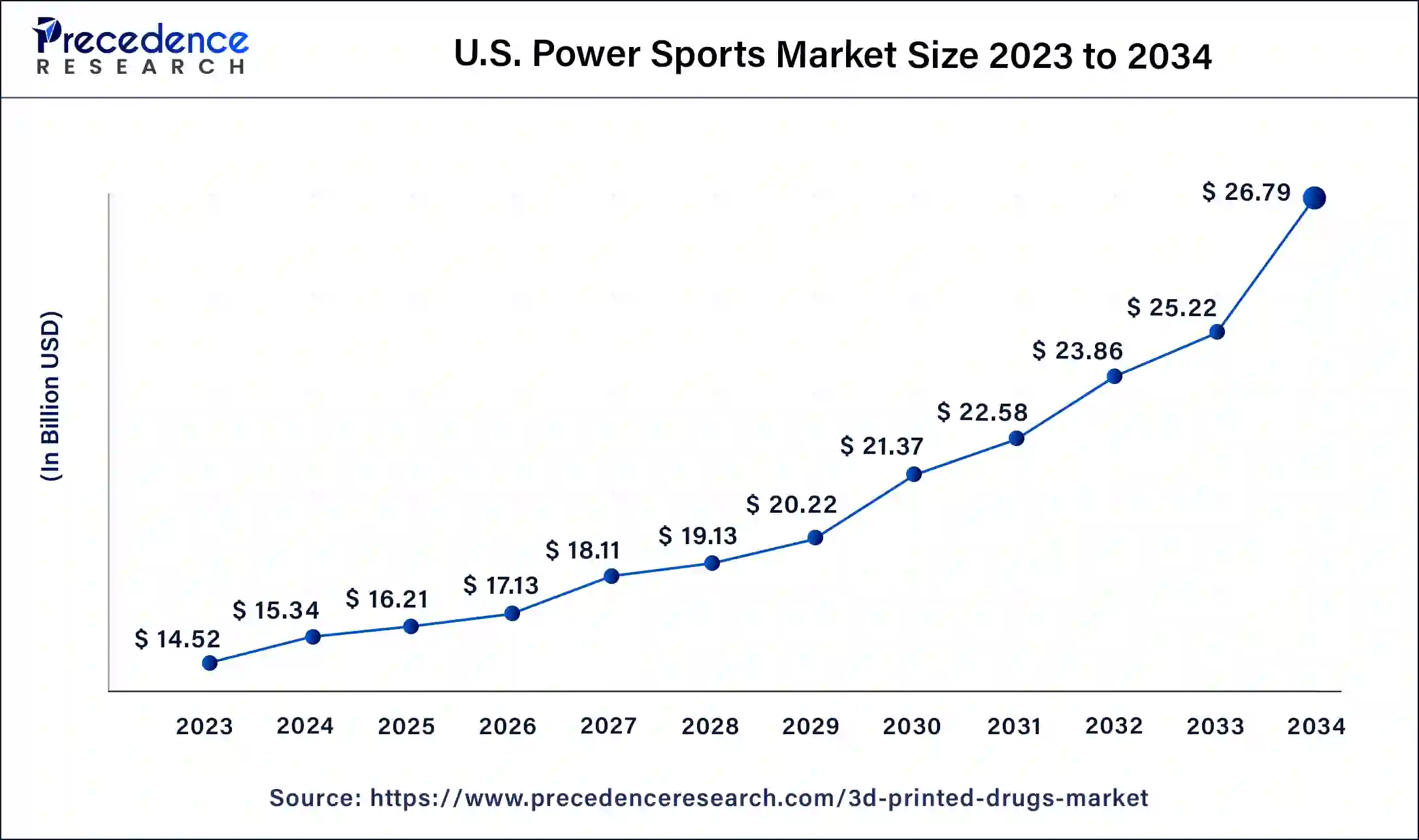

U.S. Power Sports Market Size and Growth 2024 to 2034

The U.S. power sports market size was exhibited at USD 14.53 billion in 2023 and is projected to be worth around USD 26.79 billion by 2034, poised to grow at a CAGR of 5.71% from 2024 to 2034.

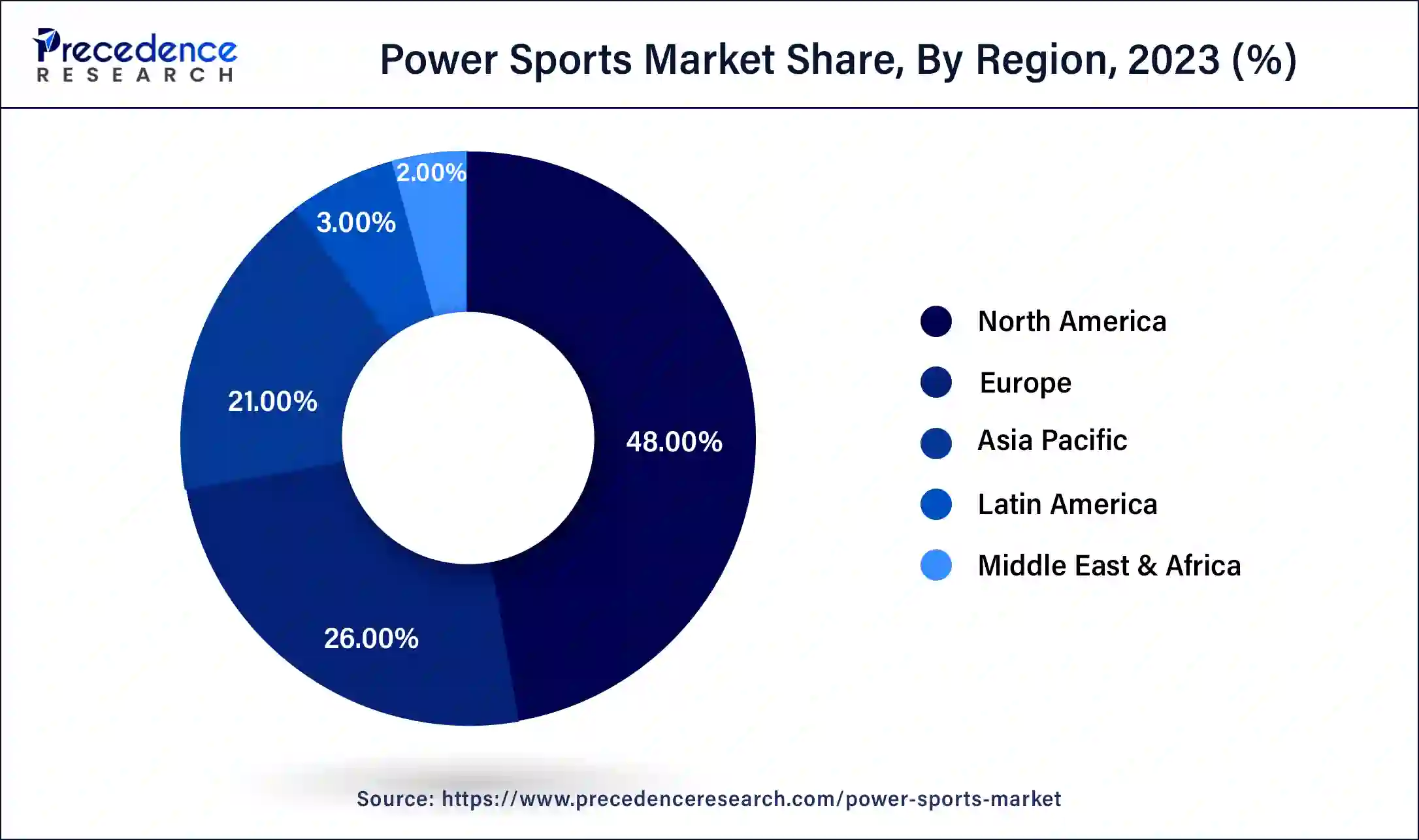

North America led the power sports market in 2023. The growth of the market in the region is increasing due to the rising competition in the power sports vehicle market, which enhances its growth. The rise in events like racing and auto launches in countries like the United States and Canada is accelerating the demand for power sports vehicles. The rising interest in adventure and leisure activities is driving the demand for power sports vehicles in the region, and the technological improvement in sports vehicles is also contributing to the growth of the market. The rising investment in research and development activities for the evaluation and the launch of new products are driving the growth of the market in the region.

Asia Pacific is expected to witness the fastest growth in the power sports market during the forecast period.  The growth of the segment is expected to increase due to the rising interest in sports activities and the younger generation's adoption of sports vehicles like bikes, which drives the demand for power sports vehicles in the market. Additionally, the rising competition among the manufacturers enhances the growth of the market. The rising involvement of the major manufacturers in the development of power sports vehicles like land vehicles, snowmobiles, etc, is contributing to the growth of the market. The increasing investments and the technological adoption of sports vehicles are driving the growth of the power sports market in the region.

Power sports vehicles are designed for racing and recreational pleasures. Power sports vehicles are operated on land, snow, and water. Power sports vehicles cater to adventure and heavy-duty tasks. Power sports vehicles are the segment of motorized vehicles designed for the adventurous pleasures of riding and for utility purposes. Power sports vehicles are not used as the standard vehicles that can be normally seen on the roads daily.

These types of vehicles are high-performance engines that are designed to deliver adrenaline-pumping experiences in several environments. Some of the segments are categorized as power sports vehicles, such as land-based power sports, water-based power sports, and air-based power sports. The rising interest in adventure activities and the rising tourism industry are driving the demand for the power sports market.

| Report Coverage | Details |

| Market Size by 2034 | USD 69.40 Billion |

| Market Size in 2023 | USD 37.80 Billion |

| Market Size in 2024 | USD 39.95 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.67% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle, Propulsion, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing sports culture

The rising interest in the sports culture and active tourism activities expands the demand for power sports vehicles such as ATVs. ATVs are highly popular among the younger generation due to their easy manure and low restrictions in terms of age. The ATVs have lower maintenance costs than other power sports vehicles. The affordability and the lower maintenance cost of the vehicle drive the expansion of ATVs as power sports vehicles. Additionally, the increasing technological advancement in ATV vehicle development further propels the growth of the power sports market.

Environmental impacts

The increasing power sports activities and the highly polluted engines of the sports vehicles are highly impacting the environment negatively due to higher carbon emission that limits the adoption of the vehicles as well as the higher cost of the power sports vehicles, which are collectively restraining the growth of the power sports market.

Technological advancements

The technological advancements in the power sports vehicles by the major manufacturers to stay ahead in the competition. The technological evaluation includes an increase in safety features like traction control, advanced braking system, and stability control. Additionally, combining smart technologies in the power sports vehicles, such as GPS navigation, digital display, and wireless connectivity, increases the consumer experience and makes it easier to operate the power sports vehicle. The advancements and the variants in the power sports vehicles, such as the hybrid and electric models of power sports vehicles, and the rising investments in the research and development activities in the expansion and the launch of new products are driving future opportunities in the power sports market.

The heavyweight motorcycle segment dominated the market in 2023. The growth of the segment is attributed to the rising adoption of the heavyweight motorcycle by the population, especially the younger generation, as the increased standard of living and the increasing sports culture drive the heavyweight motorcycle segment. The increasing competition and the ongoing technological evolution in the heavyweight motorcycle are boosting the demand for the segment.

The increasing number of major players in heavyweight sports bikes, such as Ducati, KTM, and Honda, are the major manufacturers of heavyweight motorcycles that are also arranging events like racing to showcase their bikes, contributing to the expansion of the heavyweight motorcycle segment. The increasing interstates in adventure and leisure activities are also contributing to the growth of the heavyweight motorcycle segment in the power sports market.

The all-terrain vehicles segment is expected to grow at the fastest rate in the power sports market over the forecast period. The all-terrain vehicles (ATVs) segment is expected to be the fastest growing in the market. Farmers and ranchers are using ATVs for various tasks such as transporting supplies, herding animals, and maintaining property. Their ability to navigate rough terrain makes them invaluable for these purposes.

There is an increasing trend toward outdoor recreational activities. ATVs offer a unique and exhilarating way to explore nature, making them popular among adventure enthusiasts. The popularity of ATV racing and other competitive events has increased, driving interest and participation in the sport. These events also help market and promote ATVs.

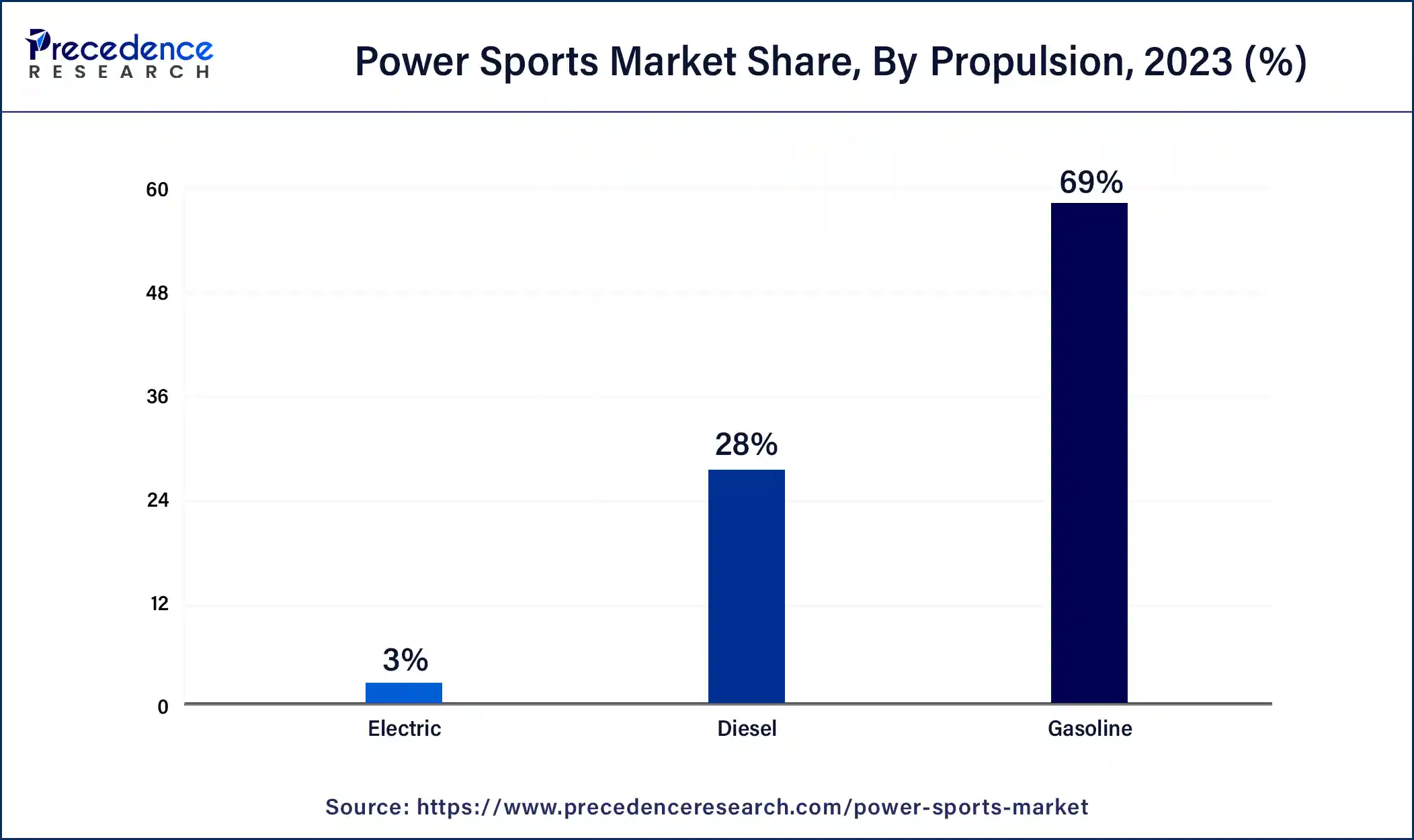

The gasoline segment dominated the global power sports market in 2023. Continuous innovation in gasoline engine technology has led to more efficient and powerful engines, maintaining consumer interest and driving growth in this segment. The infrastructure for gasoline engines is well-established, with extensive networks of fuel stations and maintenance services. The technology for gasoline engines has also been refined over many years, making them reliable and efficient. Gasoline engines generally have a lower initial cost compared to electric or hybrid engines. This lower entry price makes gasoline-powered vehicles more accessible to a broader range of consumers.

The electric propulsion segment is expected to gain a significant share in the power sports market over the forecast period. The growth of the segment is attributed to the rising interest in electric vehicles due to the rising environmental awareness regarding pollution that drives the growth of the electric propulsion segment. The electric model provides the vehicle engine with rapid torque and power. The rising pollution level and the rising concern over global warming due to the rising industrialization and the increasing number of fuel vehicles around the world are causing the increasing pollution level that is driving demand for the electric propulsion segment. The increasing investments in electric vehicles drive the growth of the segment in the power sports market.

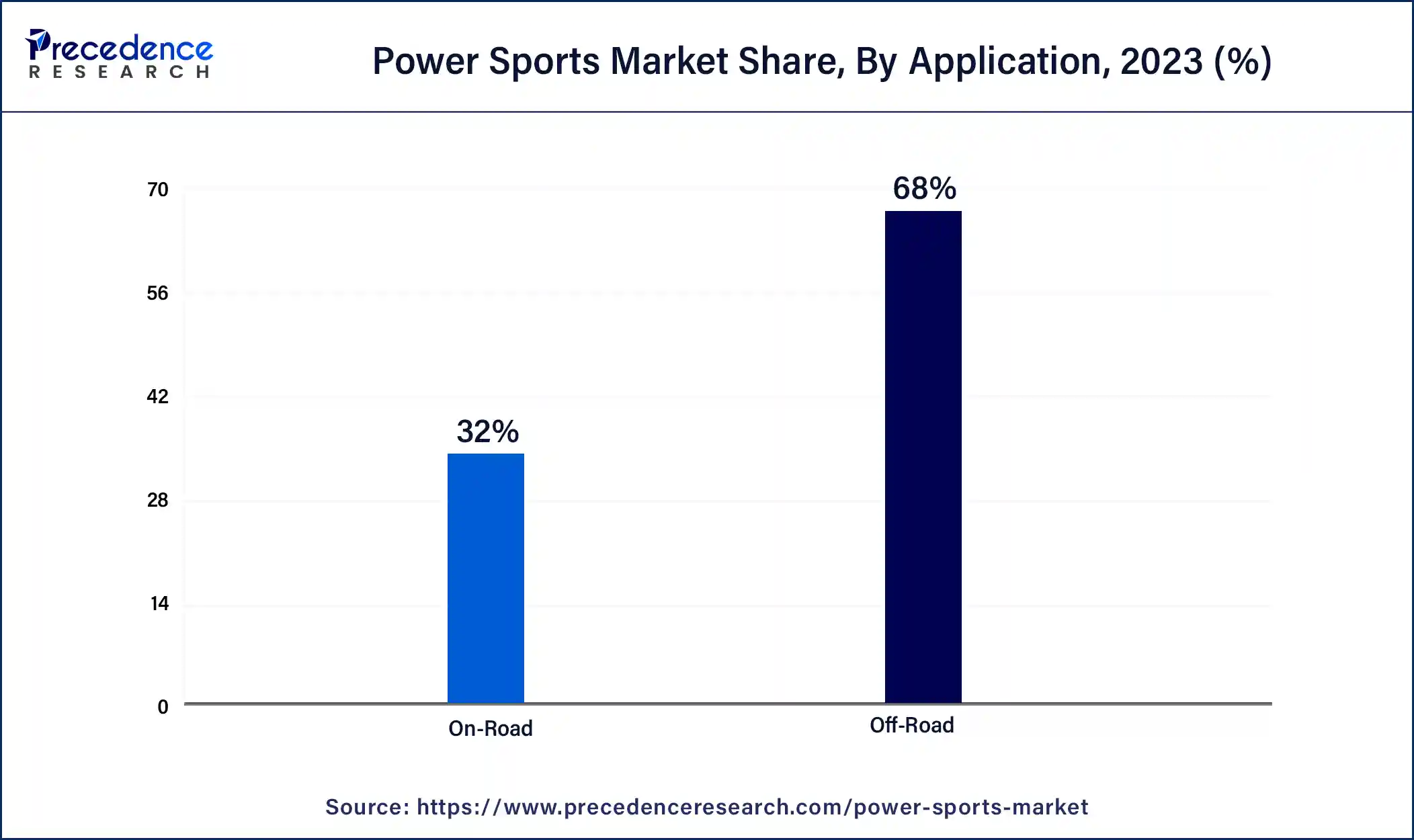

The off-road segment led the global power sports market in 2023. There's a rising trend in outdoor recreational activities, with more people seeking adventure and thrill in natural environments. This has led to a higher demand for off-road vehicles such as ATVs (All-Terrain Vehicles), UTVs (Utility Task Vehicles), and dirt bikes.

Innovations in off-road vehicle technology have significantly improved their performance, safety, and reliability. Features such as better suspension systems, more powerful engines, and enhanced durability make these vehicles more appealing to consumers.

Segments Covered in the Report

By Vehicle

By Propulsion

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

August 2023

July 2024

July 2024