April 2025

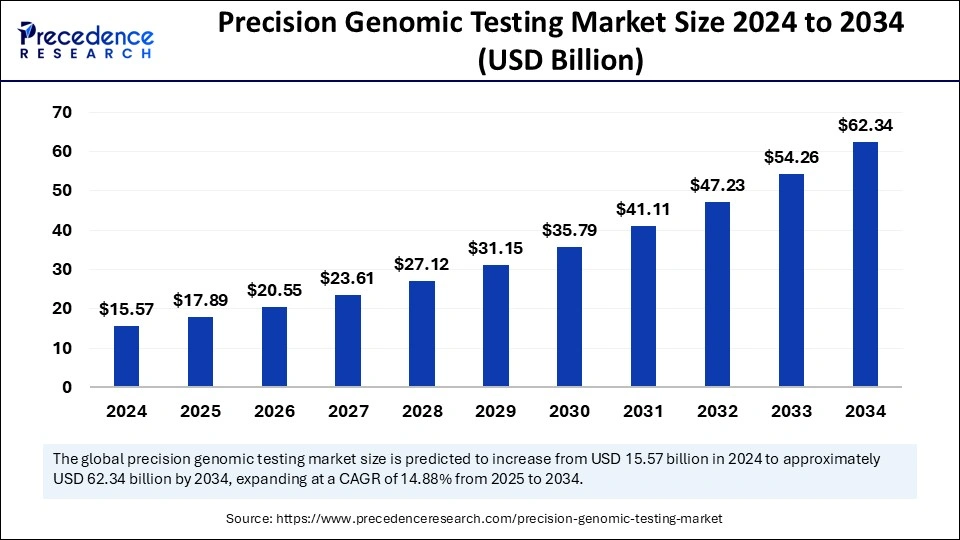

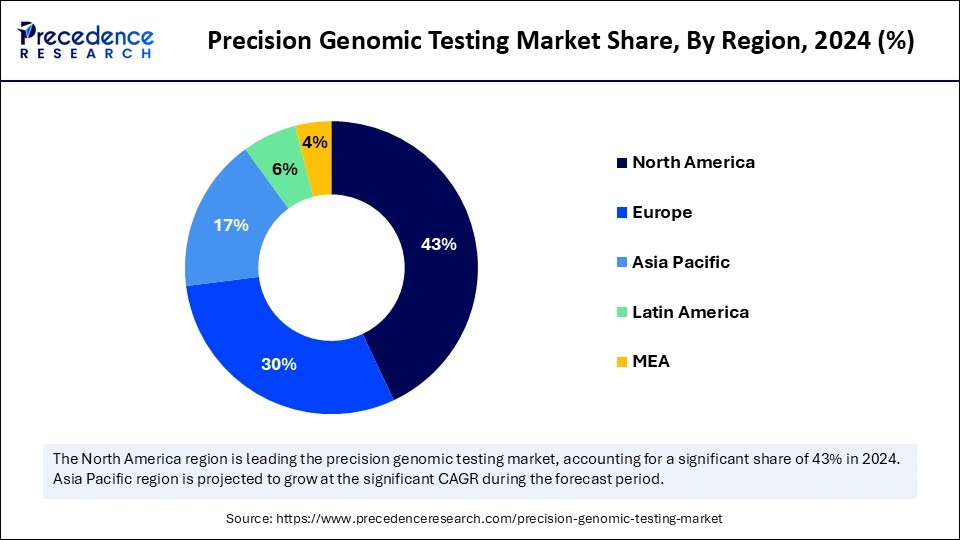

The global precision genomic testing market size is calculated at USD 17.89 billion in 2025 and is forecasted to reach around USD 62.34 billion by 2034, accelerating at a CAGR of 14.88% from 2025 to 2034. The North America market size surpassed USD 6.70 billion in 2024 and is expanding at a CAGR of 15.00% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global precision genomic testing market size accounted for USD 15.57 billion in 2024 and is predicted to increase from USD 17.89 billion in 2025 to approximately USD 62.34 billion by 2034, expanding at a CAGR of 14.88% from 2025 to 2034. Advancements in genomic technologies are the key factor driving market growth. Also, the growing focus on personalized medicine coupled with the growing demand for precision genomic testing can fuel market growth further.

Artificial intelligence is significantly transforming the field of genomics. By using machine learning algorithms in the precision genomic testing market, AI systems can detect patterns and correlations within large amounts of genetic information. Furthermore, Artificial Intelligence in genomics has the ability to revolutionize medical care by offering more precise diagnoses, novel therapeutic targets, and individualized treatment plans.

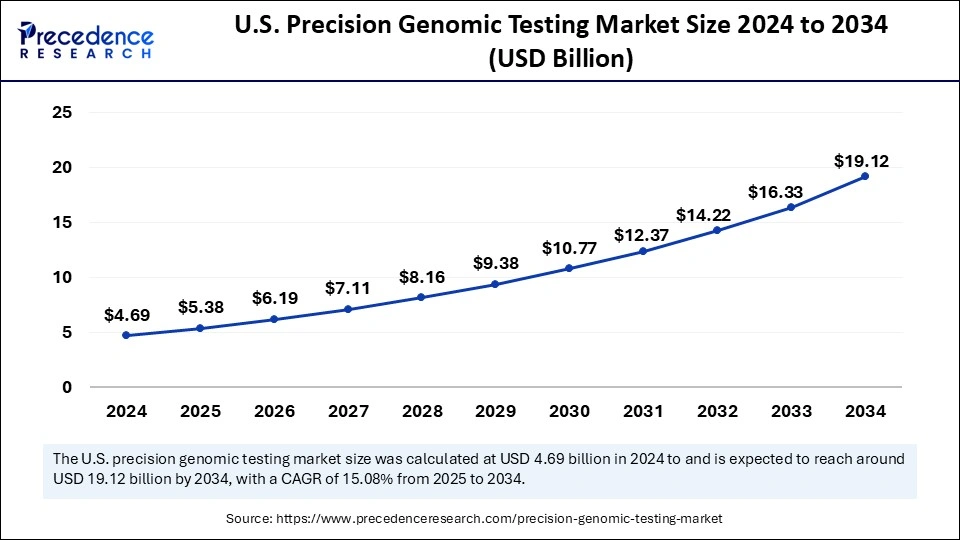

The U.S. precision genomic testing market size was exhibited at USD 4.69 billion in 2024 and is projected to be worth around USD 19.12 billion by 2034, growing at a CAGR of 15.08% from 2025 to 2034.

North America dominated the precision genomic testing market in 2024. The dominance of the region can be attributed to the advancements in bioinformatics and next-generation sequencing (NGS) is boosting the market growth, enabling improved genomic analysis and individualized medicine applications.

U.S. Precision Genomic Testing Market Trends

In North America, the U.S. led the market owing to the increasing collaboration between research institutions and market leaders. These partnerships propel innovations and boost the development of innovative genomic technologies, improving overall diagnostic capabilities.

Asia Pacific is expected to grow at the fastest rate over the forecast period. The growth of the region can be credited to the substantial investments in research and development. These high investments are fuelling technological advancements in genomic sequencing and diagnostics, improving the region's abilities in individualized healthcare solutions.

China Precision Genomic Testing Market Trends

In Asia Pacific, China is expected to grow at the fastest rate, due to the strategic partnerships with international players coupled with the global expansion efforts in genomic testing. These partnerships improve access to innovative genomic technologies and expertise, supporting the market's expansion in the region.

Europe is expected to show notable growth in upcoming years. This growth is owing to the ongoing investments in research and development. This surge in funding supports innovations in genomic technologies, boosting market growth in the region further.

UK Precision Genomic Testing Market Trends

In Europe, the UK is witnessing substantial growth in the foreseeable future. The growth of this country can be attributed to the growing adoption of precision medicine, innovative healthcare infrastructure, and a well-established genomics sector backed by major pharmaceutical and biotechnology companies.

Precision genomic testing is the process of analyzing a person's DNA to offer insights into disease conditions and provide treatment decisions that cater to genetic profile-based medical interventions. As medical systems across the globe are shifting towards precision medicine, the precision genomic testing market is becoming more crucial in medicine. The rapid evolution of f next-generation sequencing (NGS)has enhanced the process of genomic testing and also lowered its overall costs.

| Report Coverage | Details |

| Market Size by 2034 | USD 62.34 Billion |

| Market Size in 2025 | USD 17.89 Billion |

| Market Size in 2024 | USD 15.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.88% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing demand for personalized medicine

The increase in demand for personalized medicine is a major driver fuelling the precision genomic testing market growth. As the medical industry evolves, there is an increasing focus on treatments specific to personalized genetic profiles. In addition, Personalized medicine enables effective treatment plans and precise diagnosis and decreases the risk of potential side effects. This shift is backed by innovations in genomic technologies.

Ethical and regulatory complexities

The regulatory scenario for precision genomic testing changes extensively across various regions, generating hurdles for market growth. Many nations have strict guidelines regarding the utilization, storage, and collection of genetic data. Moreover, ethical concerns associated with the misuse and privacy of genetic data information and implementation can hinder market growth further.

Growing application in oncology

The increasing incidence of cancer and rising prevalence of neurological diseases create future opportunities in the market. Various healthcare organizations are collaborating to develop drugs created to treat a specific group of patients in accordance with their tailored requirements, hence growing the number of clinical trials, which can lead to a surge in disease diagnostics.

The consumables segment held the largest precision genomic testing market share in 2024. The dominance of the segment can be attributed to the ongoing advancements in genomic technology and new product launches. Additionally, major market players are bringing advanced consumables like kits, reagents, and assay components to cater to genomic sequencing and analysis.

The services segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing demand for analysis services and specialized testing. Companies providing clinical trial support, genetic counseling, and interpretation of genomic data are increasing their service offerings, impacting the segment's growth positively.

The next-generation sequencing segment dominated the precision genomic testing market in 2024. The dominance of the segment is owning to the ongoing strategic partnerships among market players along with the continuous advancements in NGS technologies. Furthermore, these collaborations among key players will optimize the translation of advanced research into clinical applications.

The microarray technology segment is anticipated to grow at the fastest rate during the projected period. The growth of the segment is due to the technological developments in microarray technology. Improved microarray platforms provide greater accuracy and high resolution, facilitating comprehensive analysis of gene expression and genetic variations.

The oncology segment led the precision genomic testing market in 2024. The dominance of the segment can be linked to advancements in cancer genomics, such as comprehensive genomic profiling, liquid biopsy techniques, and targeted therapy developments. These innovations are improving disease detection, diagnosis, and individualized treatment of cancers, driving the segment's growth further.

The neurological disorders segment is expected to show the fastest growth over the forecast period. The growth of the segment can be driven by increased investment in the genomics sector and ongoing innovations in genomic technologies. Moreover, technologies such as CRISPR and next-generation sequencing (NGS) are facilitating more accurate detection of genetic mutations related to neurological conditions like epilepsy and Alzheimer's.

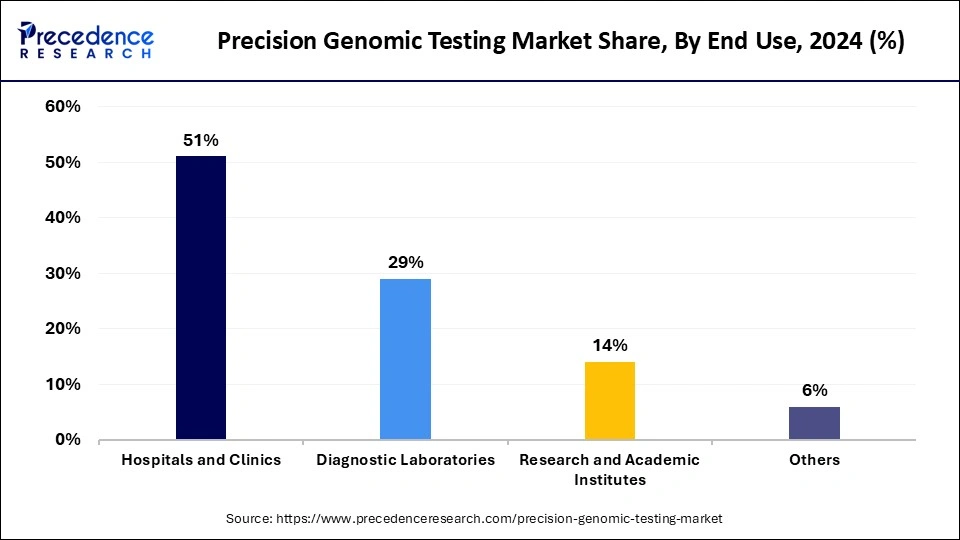

In 2024, the hospitals and clinics companies segment led the precision genomic testing market by holding the largest market share. The dominance of the segment can be linked to the increasing incidence of genetic disorders and growing funding in hospitals and clinics. In addition, financial support from private investments and government initiatives are improving the capabilities of healthcare infrastructure.

The diagnostic laboratories segment is projected to grow at the fastest rate during the forecast period. The growth of the segment is because of the growing demand for clinical testing of various diseases, ongoing research, and innovations in technology. These labs are deploying advanced genomic technologies to improve the genomic process, impacting positive segment growth shortly.

By Product & Service

By Technology

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2023

January 2025

November 2024