March 2024

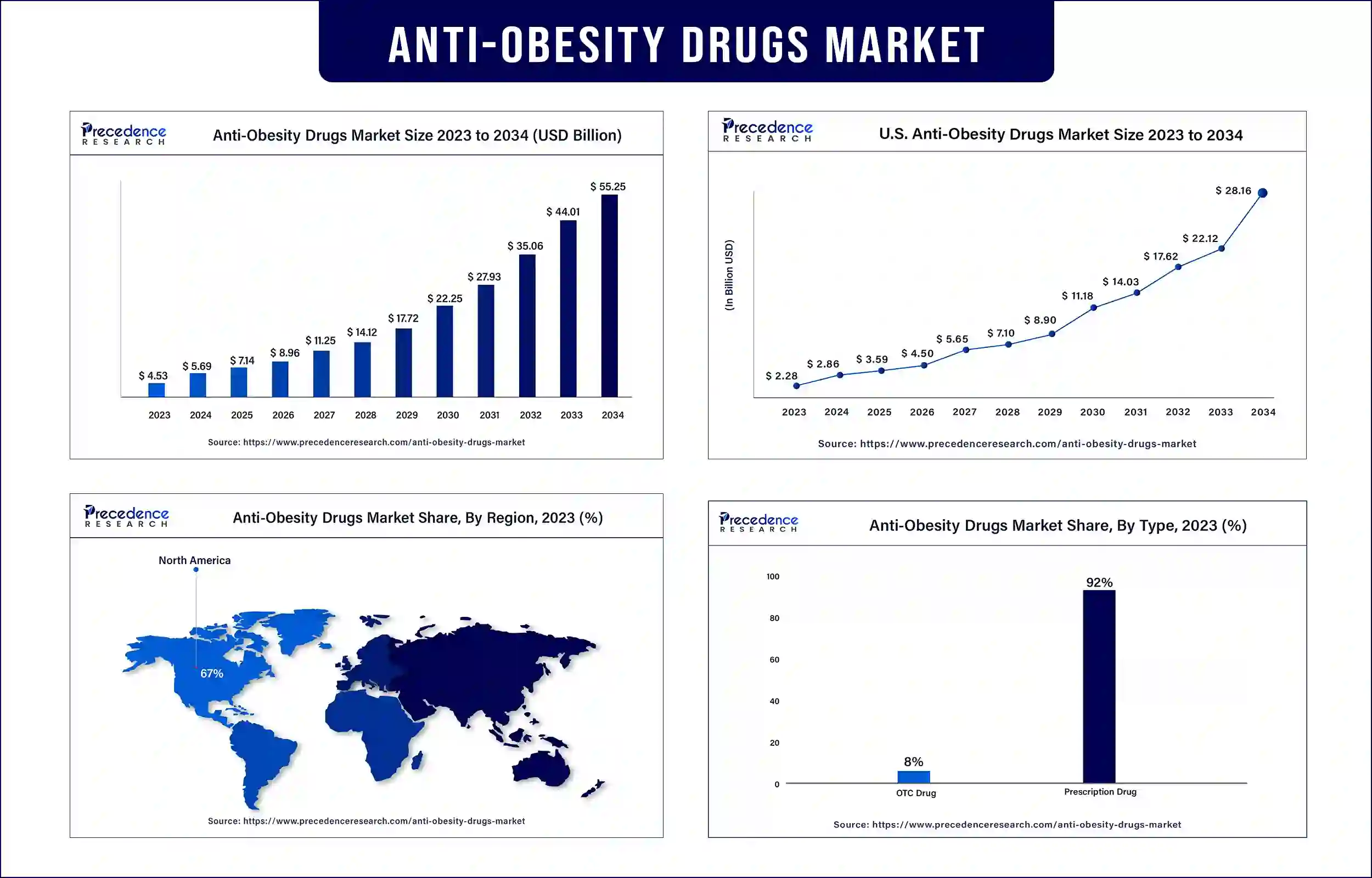

The global anti-obesity drugs market surpassed USD 4.53 billion in 2023 and is predicted to attain around USD 44.01 billion by 2033, growing at a CAGR of 5.53% during the forecast period. The rising awareness about health and its associated co-morbid conditions like diabetes, cardiovascular diseases is expected to contribute to the demand of Anti-Obesity Drugs market. Additionally, the advancements made in the drug technologies and the investments in the R&D sector are poised to grow the market to combat the weight related issues.

Anti-obesity drugs are used in the conditions of overweight or to lose weight. These medications work differently either by reducing appetite, speeding the body’s metabolism or preventing the body from absorbing the fat food. They are categorized mainly into three types based on its action like those that inhibit the fat from being absorbed, those that suppress appetite and those that help the body burn more fat.

The anti-obesity drugs offer various medications to reduce weight and health related diseases and works in different ways by inhibiting the food intake capacity, hanging the neurotransmitter levels that ultimately affects the metabolism. Many healthcare professionals recommend these medications along with lifestyle change and dietary changes.

Increasing incidences of obesity boost the market growth

Obesity is much more common globally, but the rate of incidence varies significantly from country to country. The rise in disease is mostly due to the people’s lifestyle changes and unhealthy diet. But there is no direct correlation between country’s economy and obesity rate; wealthy countries often take initiatives to conduct various programs and campaigns to educate the people about healthy lifestyle and dietary patterns.

Obesity affects the society in various ways both directly and indirectly and with a considerable strain on healthcare and social services. Some of the countries in Europe like Hungary, Malta and Lithuania are mostly affected with the obesity epidemic.

Obesity has become a global epidemic with a death rate of 2.8 million people dying each year due to obesity according to the WHO reports. As obesity continues to rise the need for effective treatment also increases. In addition, the rising demand leads to the more demand of manufacturing of the Anti-Obesity drugs and many companies are focusing on the research and development to manufacture drugs that could meet the rising demand.

For instance, Innovent Biologics Inc., in May 2023, conducted a Phase 2 Clinical study of Mazdutide (IBI362) with a 9 mg dose that resulted in positive outcomes in Chinese adults with obesity. Such advances in the product lead for a better potential and future.

Strict Drug Policies Hinder the Market Growth

Although with the increasing need for the effective anti-obesity medications the strict regulatory policies are one the main reason that stops the market growth. Also, the difficulty in the drug approval process of the anti-obesity drugs that influence many biopharmaceutical companies from investing into the market. Moreover, the increasing R&D cost required for the manufacturing of new anti-obesity drugs restraints the market growth.

By region North America dominated the anti-obesity drugs market globally in 2023 due to various factors like incidence rates of obesity, approval of new medications by the U.S. FDA and advancements made in the drug development technologies. Additionally the high-income regions with high healthcare infrastructure also contribute to the growth in this region.

The U.S. is expected to lead the anti-obesity drugs market due to the large obese population and the approval of new anti-obesity drugs by the FDA. For instance, the article published by BioPharma in April 2024 reports that the U.S. is expected to grow in the new obesity drug market in the coming years as over the past decades the increase in the obesity population is continuing upward trend.

Asia-Pacific is the fastest growing market for the anti-obesity drugs market during the forecast period due to the prevalence of obesity, sedentary lifestyles and unhealthy food habits. In addition the increasing awareness regarding the obesity and its associated risk like diabetes, heart disease and cancer and the rising medication use in the countries like India, Japan, China and South Korea are contributing for the market growth.

Top Companies in the Anti-obesity Drugs Market:

Recent Development in Anti-Obesity by Eli Lilly

| Company Name | Eli Lilly |

| Headquarter | United States |

| Recent Development | Eli Lilly has announced its new weight-loss drug Zepbound for half of the price of its original price, sold as an injector pen that packages drug together with the needle used to administer. |

Recent Development in Anti-Obesity by Novo Nordisk

| Company Name | Novo Nordisk |

| Headquarter | Denmark |

| Recent Development | Novo Nordisk has announced that the European Regulatory Authority Committee for Medicinal Products for Human Use (CHMP) recommended and adopted the marketing authorization of Wegovy for the treatment of chronic weight management in adults. |

A significant shift towards the anti-obesity drugs is due to the rising incidences of morbid obesity. The growing prevalence of morbid obesity is because of factors associated with increased demand of healthcare resources. Also, the procedures like blood withdrawals, X-rays, CT scans and bedside ultrasounds are more time consuming for individuals with morbid obesity. Therefore, the incidences of morbid obesity are expected to drive the market growth during the forecast period.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 5.69 Billion |

| Market Revenue by 2033 | USD 44.01Billion |

| CAGR | 5.53% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Type

By Distribution Channel

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/4896

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

March 2024

March 2024

July 2024

February 2024