April 2025

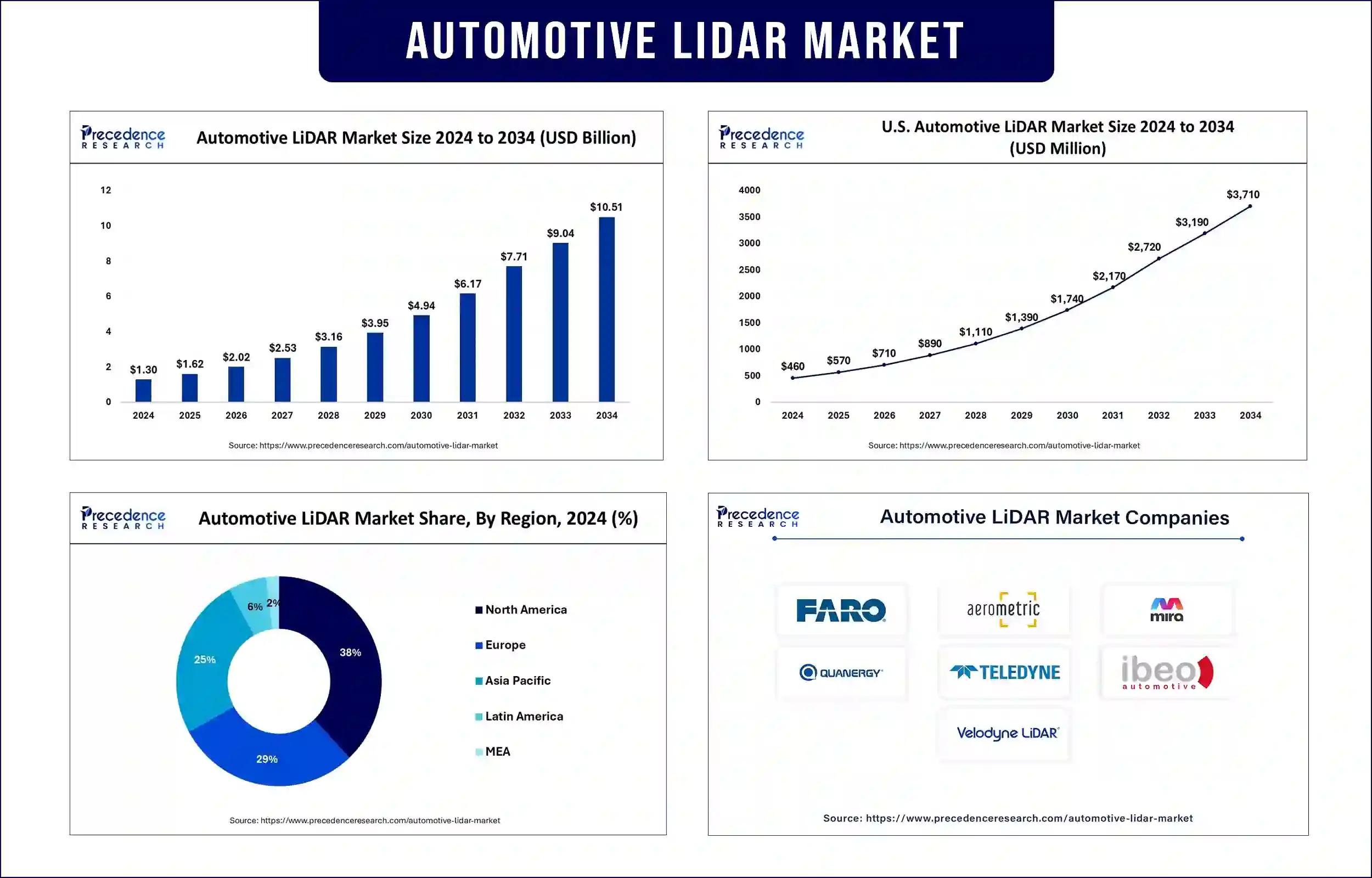

The global automotive LiDAR market revenue reached USD 1.62 billion in 2025 and is predicted to attain around USD 9.04 billion by 2033 with a CAGR of 23%. The market is experiencing significant growth, driven by the rising adoption of autonomous and semi-autonomous vehicles, advancements in LiDAR technology, and increasing regulatory support for advanced driver-assistance systems (ADAS).

The automotive LiDAR market benefits from sensing technologies that use laser pulses for creating precise 3D vehicle surrounding maps. These sensors make vehicles safer by delivering exact depth understanding and accurate object recognition functions that ADAS systems, along with autonomous vehicles, depend on. Better and less expensive LiDAR sensors became available following recent technological advancements in the field.

Government initiatives have become vital by adopting LiDAR technology in order to enhance road safety programs. The December 2023 National Highway Traffic Safety Administration (NHTSA) submission to Congress presented results of research into connected vehicle technologies, such as LiDAR, to improve vulnerable road user detection regardless of environmental challenges. Furthermore, the combination of technological progress and supportive legislative environments indicates that LiDAR technology is gaining speed in vehicle integration, which boosts vehicle safety functions and autonomous driving systems.

Rising Demand for Autonomous Vehicles

Self-driving technology interest has contributed to the rapid adoption of LiDAR sensors by the market. LiDAR system installation on passenger cars exceeded 760,000 units during 2023, marking a major growth milestone, according to the Yolo Group 2024 report. The Chinese manufacturers dominate the LiDAR market through their market leaders, RoboSense and Hesai. High-resolution LiDAR adoption rates continue to rise as it delivers critical functions for safety and precise navigation within complicated road conditions.

Advancements in LiDAR Technology

Ongoing LiDAR technological improvements regarding sensor range quality and price reductions make this technology accessible for mainstream automotive applications. The implementation of frequency-modulated continuous wave LiDAR technology results in improved detection performance together with reduced power requirements. Solid-state LiDAR technology enabled developers to create smaller and tougher sensors that streamline their installation in vehicles. New technological improvements lead toward effective autonomous driving systems, which function with increased reliability.

Government Regulations Promoting Vehicle Safety

Regulatory agencies across the world now demand stricter safety measures through regulations that drive LiDAR systems into advanced driver-assistance systems (ADAS) and autonomous driving solutions. Despite the 2024 target date of GSR2 under the General Safety Regulation of the EU proclaiming that all new vehicles must feature advanced safety elements, it serves as a catalyst for LiDAR implementation to increase road safety features. The U.S. National Highway Traffic Safety Administration supports active research that promotes LiDAR-based system implementation to enhance vehicle safety.

Integration of AI and Machine Learning

Machine Learning, along with artificial intelligence, serves automakers and technology companies to enhance LiDAR data processing capabilities. System accuracy and reliability improve substantially for autonomous driving through advanced perception algorithms that enhance object recognition. The combination creates immediate decisions that lead to better safety for autonomous vehicle systems during operation. The AI integration at Waymo enables the company to develop robotaxi models that need fewer sensors, as these new designs maintain superior performance standards.

North America is expected to maintain its leadership in the automotive LiDAR market due to strong investments in autonomous vehicle development, government safety regulations, and the presence of leading technology companies. Through funding and support, the U.S. Department of Transportation (USDOT) runs research activities and pilot tests for vehicle safety systems that use LiDAR. The USDOT presented research funding priorities through its Fiscal Years 2024-2025 Annual Modal Research Plan, which focused on propelling advanced transportation technologies.

National Highway Traffic Safety Administration (NHTSA) carries out connected vehicle technology research that includes ongoing LiDAR and LiDAR/thermal detection fusion systems data collection activities for improving vehicle safety and performance. Furthermore, the U.S. Department of Transportation has been actively supporting research and pilot programs for LiDAR-based vehicle safety applications.

Asia Pacific is projected to experience the fastest growth in the automotive LiDAR market, supported by increasing adoption of ADAS-equipped vehicles, advancements in sensor manufacturing, and rising investments in autonomous mobility projects. The three countries of China, Japan, and South Korea lead LiDAR technology adoption for the upcoming generation of vehicles. Hesai Group announced through its Chinese headquarters that it intends to cut LiDAR prices by half during 2025, which increase LiDAR access for electric vehicle applications across the market.

Bilateral discussions between the European Commission and Chinese, South Korean, and Japanese authorities work to solve regulatory problems, thus enabling the standardization of automotive technical specifications, which include LiDAR technology. The Automotive LiDAR project combined other European initiatives to develop miniature and economical LiDAR systems with advanced resolution for automated vehicles and self-driving cars through integrated research.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 1.62 Billion |

| Market Revenue by 2033 | USD 9.04 Billion |

| CAGR | 23% from 2025 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Product Type

By Components

By Application

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview

@ https://www.precedenceresearch.com/sample/1033

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

April 2025

January 2025

April 2025

January 2025