April 2025

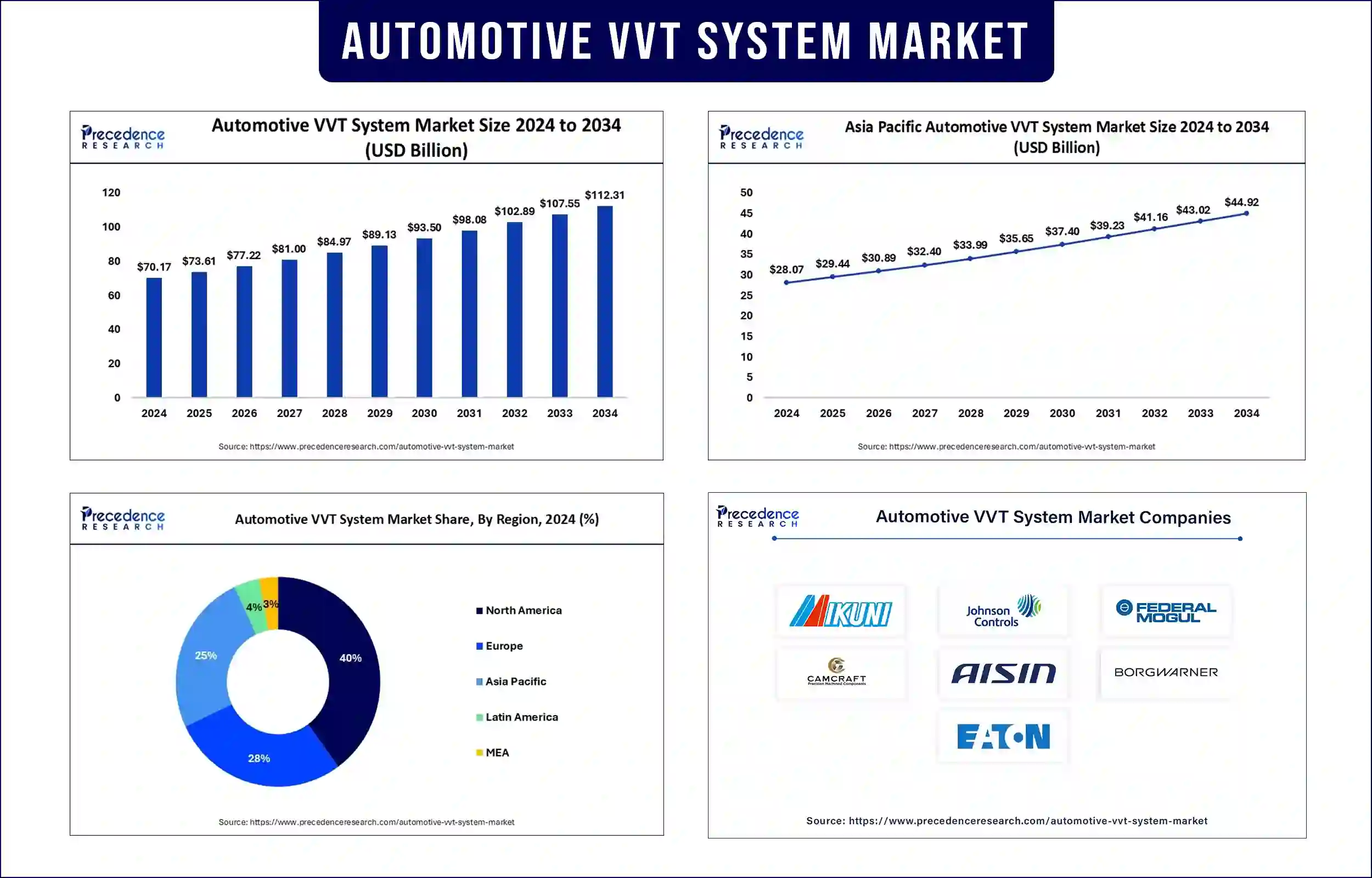

The global automotive VVT system market revenue was valued at USD 73.61 billion in 2025 and is expected to attain around USD 107.55 billion by 2033, growing at a CAGR of 4.82% during forecast period. The demand for automotive variable valve timing (VVT) systems ara driven by the increasing need for fuel-efficient and low-emission vehicles, stringent environmental regulations, and advancements in engine performance technologies.

The automotive VVT system market encompasses advanced engine control technologies that adjust valve timing in response to changing driving conditions. The functionality of VVT systems through the adjustment of valve timing enables better air-fuel flow control and exhaust management, which results in enhanced engine efficiency and decreased fuel consumption, with better emission results. The strict emission regulations force manufacturers to implement VVT systems through advanced technological advancements.

The automotive sector intensifies its efforts for engine technology development through advanced techniques including VVT systems, as it desires better fuel economy performance together with reduced emissions. Furthermore, the growing adoption of hybrid vehicles and continuous developments in engine downsizing are further accelerating the automotive VVT system market expansion.

The Environmental Protection Agency approved California's vehicle gasoline ban for 2035 through its Clean Air Act waiver establishment in April 2024. The 2035 deadline sets a requirement that threatens electric models to become 80% of all new car sales yet permits up to 20% of plugin hybrid model sales.

Report Highlights

Growing Demand for Fuel-Efficient Vehicles

Automotive manufacturers enhance their vehicle performance together with better fuel efficiency through the usage of variable valve timing systems. The U.S. Environmental Protection Agency (EPA) and the European Commission direct automakers to implement automotive VVT system market technology through their progressive emission regulations.

New emission regulations have forced manufacturers to install VVT systems as well as other advanced technologies to meet strict compliance standards. The automotive sector now invests time and resources into VVT system development as part of its pursuit to create more energy-efficient engines and lower pollution levels. Furthermore, the future of VVT systems remains prominent in powertrain technology, as industry responses combine with regulatory measures to fulfill both environmental regulations and customer requirements for efficient vehicles.

Integration of VVT in Hybrid Powertrains

With the rising demand for hybrid vehicles, VVT systems are being integrated into hybrid powertrains to improve fuel economy and reduce dependency on battery power. The adoption of electric vehicles creates this trend, most notably in markets such as China, Japan, and Europe. During 2024, China experienced increasing car sales performance as electric vehicle (EV) and plug-in hybrid sales rates exceeded all previous records. The combined effect of intense price competition and public incentives for exchanging vehicles for greener models has caused this market surge.

An increase in European tariffs for Chinese electric vehicles induces Chinese car manufacturers to investigate the potential market launch of hybrid models in Europe. GAC representative in 2024 announced that their Chinese state-owned car company intends to start hybrid vehicle production in Europe because pure battery-powered vehicles face duties exceeding 45%. The markets' ongoing adoption of hybrid technology requires VVT systems to play an essential role in achieving consumer goals and regulatory requirements related to fuel efficiency together with emissions control.

Automakers achieve better fuel economy without neglecting performance by combining cylinder deactivation technology with variable valve timing systems, which allows them to deactivate specific engine cylinders when under light-load conditions. With MultiAir technology, Fiat implements an electro-hydraulic air intake system that optimizes both engine torque and power and decreases fuel usage and pollutant generation. Engine development companies push their efforts toward creating efficient systems that lower emissions along with optimizing engine performance. These systems achieve sustainability in automotive engineering through their automatic capability to regulate valve performance and cylinder functions.

Manufacturers create electrically controlled variable valve timing systems to switch away from traditional hydraulic systems through electronic actuators, as this produces better engine results. The new systems deliver better control alongside faster engine responses and maintain superior compatibility with electric and hybrid power systems. Through electric actuation, the system provides swift and precise engine control, especially during low-speed operation and cold temperature conditions where a wide range of adjustments is achieved. Engine performance gains and higher mileage, together with lower exhaust emissions, become possible because of this technology.

BMW launched Valvetronic as part of its 2001 316ti compact introduction to use electric motors for eccentric shaft adjustment that positions intermediate arms near the camshaft and rocker arms. The specific valve lift management through this system structure leads to improved gas consumption together with lower emissions. Electrically controlled VVT systems join the automotive sector as it is shifting toward hybrid and electric-powered vehicles. These systems enable manufacturers to satisfy strict emission limits while improving fuel economy standards because of their flexible design, which makes them vital for present-day powertrain creation.

Asia Pacific dominated the global automotive VVT system market, supported by rising vehicle production, increasing consumer preference for fuel-efficient cars, and aggressive government policies aimed at reducing vehicular emissions. The countries of China, India, and South Korea lead the way in this expansion trend. The Chinese government enforces strict air pollution regulations to manage growing automobile pollution in its vehicle market. The demanding regulatory environment stimulates VVT technology integration because it helps manufacturers achieve strict performance targets.

The Indian government motivates citizens to choose electric vehicles (EVs) as a way to fight pollution. The current transition period requires increased attention to improving internal combustion engine performance through VVT system deployment, even though electrification remains the primary initiative. Furthermore, these Asian-Pacific countries use coordinated strategies, which include tough emissions rules, alternative fuel promotion, and clean technology rewards to advance VVT system uptake throughout Asia Pacific.

Europe is witnessing significant growth in the adoption of the automotive VVT system market due to stringent CO2 emission reduction targets and the increasing penetration of hybrid and plug-in hybrid vehicles. Automotive companies dedicate substantial funding to enhance engine efficiency because Euro 7 regulations are approaching. Hybrid cars achieved higher vehicle registrations than petrol cars in this region, thus indicating a substantial rise in electric vehicle adoption.

Advanced VVT systems enable improved engine function and operation efficiency, which fulfills demanding emission restrictions. Rising regulatory requirements push manufacturers to hurry up their research into electric vehicles and hybrid cars. The European market now embraces both electric vehicles together with strict emission standards, which act as major drivers for VVT system adoption. The path towards sustainable transportation in Europe demands VVT technology to play a critical role in achieving both higher engine performance and reduced emissions.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 73.61 Billion |

| Market Revenue by 2033 | USD 107.55 Billion |

| CAGR | 4.82% from 2025 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Fuel Type

By Methods

By System

By Valve Train

By Vehicle Type

By Actuation Type

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/1052

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

April 2025

January 2025

April 2025

January 2025