January 2025

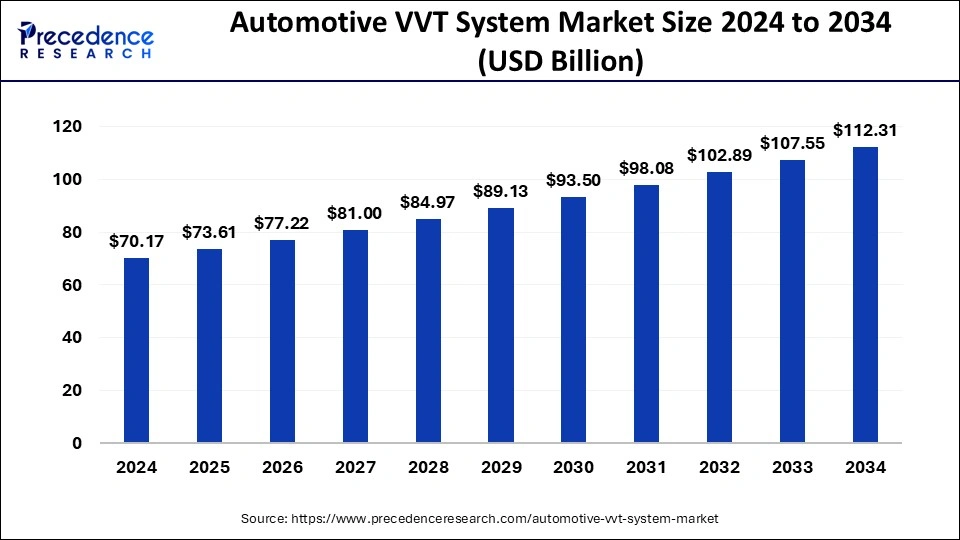

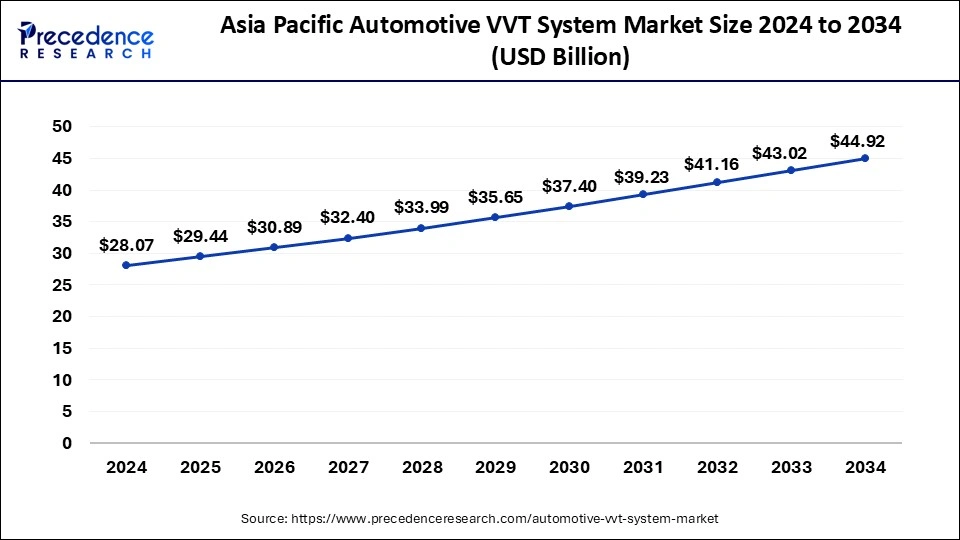

The global automotive VVT system market size is calculated at USD 73.61 billion in 2025 and is forecasted to reach around USD 112.31 billion by 2034, accelerating at a CAGR of 4.82% from 2025 to 2034. The Asia Pacific market size surpassed USD 28.07 billion in 2024 and is expanding at a CAGR of 5.00% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive VVT system market size accounted for USD 70.17 billion in 2024 and is predicted to increase from USD 73.61 billion in 2025 to approximately USD 112.31 billion by 2034, expanding at a CAGR of 4.82%.

The Asia Pacific automotive VVT system market size was exhibited at USD 28.07 billion in 2024 and is projected to be worth around USD 44.92 billion by 2034, growing at a CAGR of 5.00%.

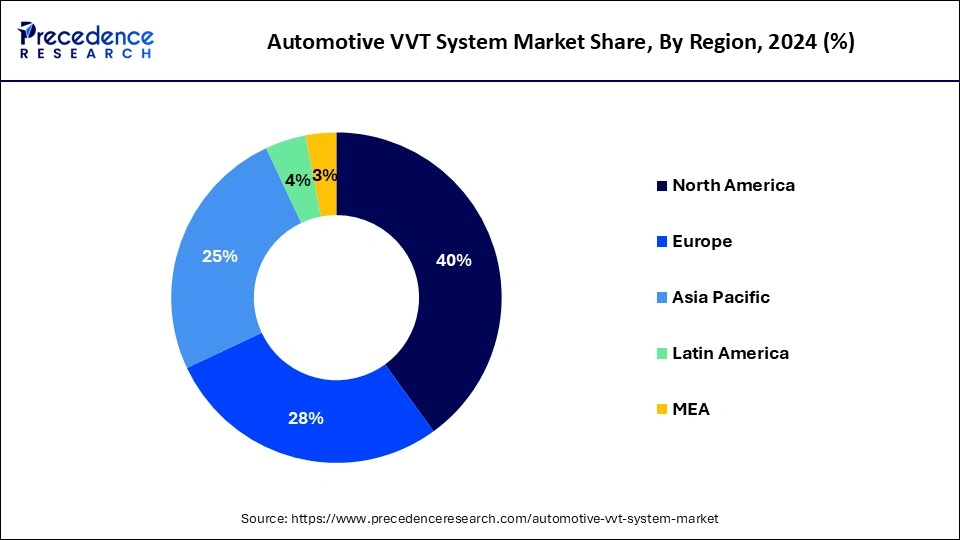

In 2024, the Asia Pacific held a considerable market value share and expected to exhibit substantial growth over the forecast period. Rapid growth in sale of passenger vehicles is one of the prime factors that boost the market growth. Furthermore, rising price of gasoline and petrol evoke demand for fuel-efficient engine, thereby propelling the growth of VVT systems. Besides this, government encouragement to consumers for adopting battery-powered vehicles to curb the environment degradation analyzed to hamper the growth of VVT systems in the region.

On the other hand, Europe and North America are the other major regions for the automotive VVT system market as they encounter significant sale of passenger as well as commercial vehicles in the region. Moreover, the regions have adopted several measures to cut down the fuel consumption, thereby improving the fuel efficiency of the vehicle.

Emission from an automobile contributes for nearly 28% of the total greenhouse gases produced including methane and carbon dioxide. This hampers the environment, thereby affecting the health of human beings. Regulatory bodies are enacting stringent rules for the emission of harmful gases from vehicle to curb such situation. The automotive Variable Valve Timing (VVT) system helps in changing the timing of the valve as per the Internal Combustion (IC) engine cycle. This reduces the overall carbon emission from a vehicle. This sequentially, anticipated to boost the market growth for automotive VVT system. An automotive VVT system also improves the engine life by maintaining proper cycle of the engine. Furthermore, rising sale of passenger cars along with increasing purchasing power of consumers is likely to fuel the market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 112.31 Billion |

| Market Size in 2025 | USD 73.61 Billion |

| Market Size in 2024 | USD 70.17 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.82% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fuel Type, Methods, System, Number of Valves, Valve Train, Technology, Vehicle Type, Actuation Type, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Double Over Head Cam valve train design enables broader angle among exhaust valve and intake valve compared to Over Head Valve (OHV) and Single Over Head Cam (SOHC). In consequence to this, DOHC valve train design holds the maximum share in the automotive VVT system market and anticipated to grow at a significant rate over the analysis period. DOHC consists of two cam shafts located overhead for operating different intake and exhaust valves. The DOHC has double inlet and exhaust valves compared to SOHC that makes the engine cooler. This helps the engine to make less noise, run smoothly, and provide superior performance. Increasing demand for high fuel efficiency, on-going research & development in engine management systems, constant rise in sales of vehicles, and rise in demand for high power engines are further predicted to flourish the demand for DOHC in the global automotive variable valve timing (VVT) market during the analysis period.

Based on vehicle type, the global automotive VVT system market is bifurcated into passenger vehicles, electric vehicles, and commercial vehicle. Passenger vehicle expected to dominate the global automotive VVT market and accounted to more than 65% value share. The continuous rise in demand for passenger vehicles along with their upgradation has prompted the international automobile manufacturers to extend their production capacities.

As specified by the International Organization of Motor Vehicle Manufacturers (OICA), in 2018, the overall production of passenger cars surpassed 70 Million units. Rising per capita income, increase in purchasing power of consumers, rising demand for comfort in travelling, and growth in economy of developing countries are some of the prominent factors that drives the market growth of passenger vehicles.

The global automotive VVT system market has few major players operating in the market due to expensive and complicated manufacturing process of VVT systems. Major market players are strategically adopting merger & acquisition strategy of regional players to extend their portfolio in the fabrication of different components of VVT system to develop their business. In addition, they also emphasize on R&D to improve their efficiency and functionality of the VVT systems.

By Fuel Type

By Methods

By System

By Number of Valves

By Valve Train

By Technology

By Vehicle Type

By Actuation Type

By End-use

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025