April 2025

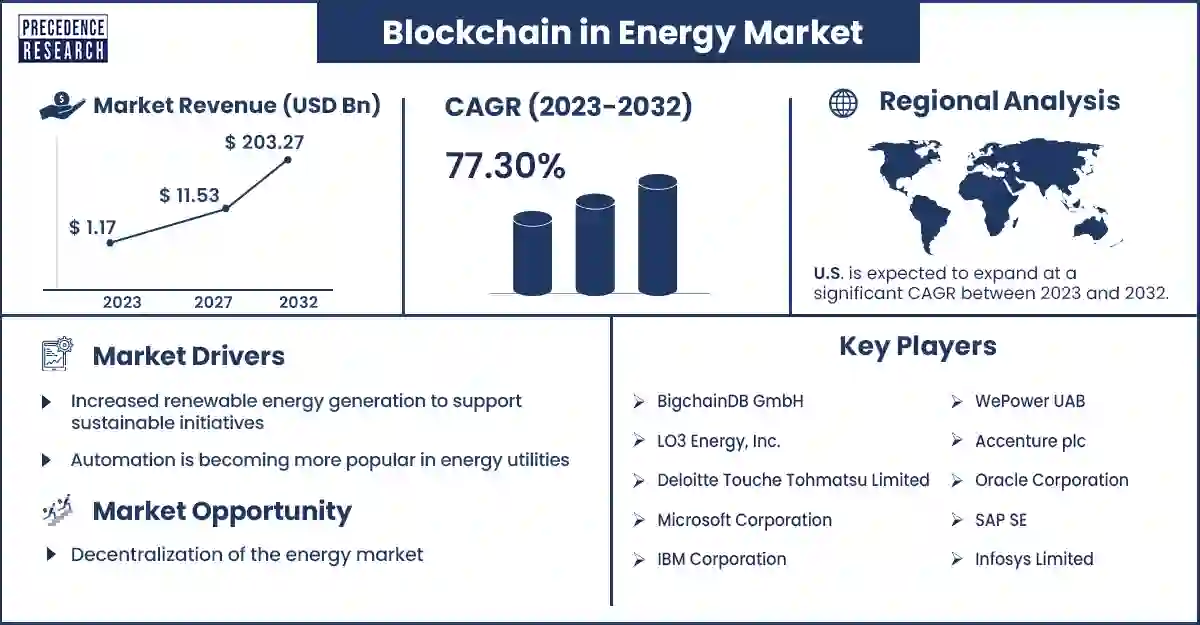

The global blockchain in energy market revenue was valued at USD 1.17 billion in 2023 and is poised to grow from USD 2.08 billion in 2024 to USD 203.27 billion by 2032, at a CAGR of 77.30% during the forecast period 2023 - 2032. The increasing renewable energy generation to support sustainable initiatives is attributed to the growth of the blockchain in the energy market.

Blockchain in energy market deals with the application of blockchain technology through the energy sector. Blockchain is the tamper-resistant and decentralized digital ledger used to transform traditional energy systems by offering efficient, transparent, and secure management of energy assets, data, and transactions.

The growing adoption of renewable and decentralized energy sources such as microgrids, wind turbines, and solar panels, various projects adopting blockchain, and growing investment and innovation in blockchain technology in the energy sector are expected to enhance the growth of the market. In addition, increasing focus on energy consumption in exploring the latent advantages of the technology for sustainability and low-carbon transition is further anticipated the growth of the blockchain in the energy market during the forecast period.

Improved transparency, decentralization, and programmability to fuel market growth

The major benefit of blockchain in energy is its ability to improve transparency across the network of various parties. Blockchain networks have separate copies of the blockchain's ledger. This data is recorded on that ledger and is easily demonstrable. The immutability of blockchain ensures that the records are already stored on the ledger, and it cannot be changed in any condition. Blockchain in energy can also improve regulatory compliance across the renewable or sustainable energy industry.

In addition, blockchain's decentralized nature, with the help of peer-to-peer networks influenced by the technology, may run without the need for central authority. Furthermore, smart contracts can control transactions between the network parties programmatically. Blockchain in energy helps speed up the integration of smart grids and smart meters to help more efficient energy use. Blockchain technology can also help merge end users easily with the grid. These are the major driving factors expected to accelerate the growth of the blockchain in the energy market.

However, gaining trust might be the major restrain of blockchain in the energy sector and may hinder the growth of the market. Blockchain also faces a major challenge in dealing with utility revenue due to outdated and unsustainable pricing structures. For instance, shared distribution infrastructure needs to be maintained for peer-to-peer transactions to enhance grid efficiency. In addition, the lack of clear global regulations is another major restraint faced by blockchain devices in energy. A future decentralized energy system of transaction reversals, disputes, power prices, and critical infrastructure requires regulations. These are the major challenges expected to restrain the growth of the blockchain in the energy market.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 2.08 Billion |

| Market Revenue by 2032 | USD 203.27 Billion |

| Market CAGR | 77.30% from 2023 to 2032 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Innovation in blockchain in energy market by Powerledger

Recent Innovation in blockchain in energy market by Blockchain for Energy (B4E)

North America dominated the blockchain in energy market in 2023. The U.S. and Canada are the major leading countries in North America. These countries spread awareness of the advantages of using blockchain technology among the people in this region. The government is taking steps to ensure that its people are using the new technologies and promoting the advantages of North America. In the U.S., blockchain in energy is revolutionizing the energy industry through blockchain technology and collaborative innovation. Microgrids enhance peer-to-peer energy trading in a secure and immutable product installation motivated by the ability to transform the infrastructure of the energy industry. These are the major factors driving the growth of the market in North America.

Europe also showed significant growth in the blockchain energy market during the forecast period. The increasingly favorable policy framework and legislative and growing collaboration and investment in blockchain technology within the energy sector are expected to drive market growth in Europe. By adopting various programs and initiatives that actively facilitate and encourage, Europe plays an important role in stimulating the energy sector market. Germany, the UK, and France are the major countries that dominate the market growth in Europe. These countries have various platforms and projects, such as the Powerpeers platform, the Electron platform, and the Enerchain project, that are applying various use applications and cases and are actively involved in the testing of blockchain. In addition, the market players are positively engaged in the development of blockchain technology to enhance its implementation in the energy sector and help in decentralized energy production. These are the major factors expected to accelerate the growth of blockchain in Europe's energy market.

Increasing growth in strategic initiatives

Numerous stakeholders, such as government entities, institutes, and large enterprises, are increasingly adopting strategic measures to develop the use of blockchain technology in the energy sector. Many companies are utilizing decentralized and open-source technology to expand the transition to sustainable energy. This advanced blockchain network helps develop a more efficient internet. Various prominent entities such as RMI, Volkswagen, Vodafone, and Shell are expanding their efforts to minimize carbon emissions. These are the major opportunities expected to enhance the growth of the blockchain in energy market in the coming years.

Market Segmentation

By Type

By Application

By End-Use

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2809

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

April 2025

April 2025

January 2025

January 2025