Centrifugal Pump Market Revenue to Attain USD 57.99 Bn by 20

Centrifugal Pump Market Revenue and Trends 2025 to 2033

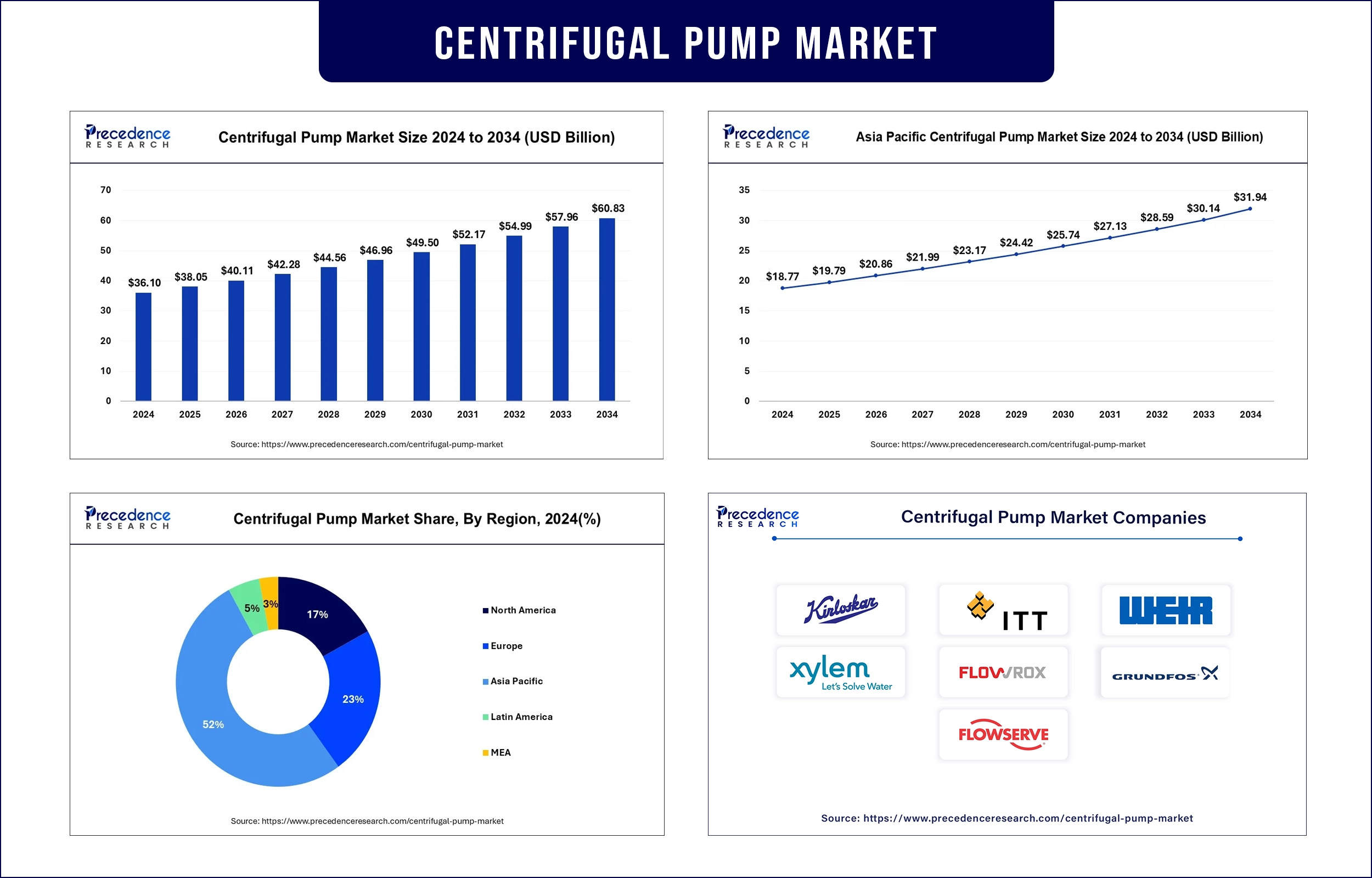

The global centrifugal pump market revenue surpassed USD 38.05 billion in 2025 and is predicted to attain around USD 57.99 billion by 2033, growing at a CAGR of 5.36%. The global market is projected to experience substantial growth over the coming years, driven by rising industrialization, increasing demand for efficient water management systems, and the need for reliable fluid handling technologies across industries such as oil and gas, chemicals, and power generation.

Market Overview

The water transfer activities in multiple industrial settings depend on centrifugal pumps for their dependable performance alongside straightforward operation. Different centrifugal pump types include end-suction, split-case, and vertical pumps. They serve water supply along with wastewater treatment, chemical, and oil processing applications. The market demand increases, as government sustainability and water infrastructure policies launch initiatives to enhance performance.

The World Health Organization (WHO) documented in 2024 that 2 billion people remain without access to secure drinking water services, which further creates enhanced water supply systems that require centrifugal pumps for these crucial infrastructure projects.

Report Highlights

Type Insight

- The vertically suspended segment dominates the centrifugal pump market due to its high performance in deep well and cooling water applications.

- The between-bearing segment is growing rapidly due to widely used in large-scale industrial operations for its durability and balance.

Flow Insight

- The radial flow segment dominates the market as it offers high head at low flow rates, ideal for irrigation and high-rise buildings.

- The axial flow segment is expanding significantly as it is used for high flow, low head applications, especially in flood control and large water transfers.

Operation Type Insight

- The electrical segment dominates due to its energy efficiency and compatibility with automated systems.

- The hydraulic segment is growing at the fastest rate where electrical power is inaccessible or unsafe.

Impeller Type Insight

- The open segment dominates due to its suitability in handling solids-laden fluids in wastewater and slurry applications.

- The enclosed segment offers high efficiency and is preferred in clean liquid applications across the pharmaceutical and food industries.

Application Insight

- The multistage segment dominates owing to its high-pressure capabilities for water supply and boiler feed.

- The single-stage segment is preferred in low-pressure systems for its cost-effectiveness and compact design.

End User Insight

- The industrial segment dominates centrifugal pump demand owing to continuous operations in manufacturing and process industries.

Market Trends

Technological Advancements in Pump Efficiency

Current developments show the centrifugal pump market continues to experience accelerated improvements throughout pump engineering solutions and energy efficiency improvements. The combination of smart pumps with internet of things functionality allows industries to achieve better pump performance. These technological innovations promise to boost centrifugal pump operational effectiveness. During 2024, the U.S. Environmental Protection Agency (EPA) began emphasizing the rising relevance of energy-efficient technologies, including pump systems for industrial applications, with a focus on environmental sustainability targets.

Growing Demand for Sustainable Water Management Solutions

The global demand for the centrifugal pump market keeps rising, with developing areas in all regions requiring efficient, sustainable water management systems. International agencies, along with government bodies, work to enhance water infrastructure through sound sanitation systems, thus driving increased pump requirements. The demand for sustainable centrifugal pumps that meet demanding water requirements despite changes in water sources and environmental conditions supports global sustainable water management.

Focus on Energy-Efficient and Low-Maintenance Pumps

Centrifugal pump producers now concentrate their efforts on developing energy-efficient equipment that requires minimal upkeep. Industrial operations need lower environmental impact as well as diminishing costs because operational expenses continue to rise. Modern innovations make these pumps more efficient while increasing their longevity, particularly in severe industrial conditions, including the oil and gas sector.

The U.S. Environmental Protection Agency (EPA) launched new programs in 2024 to support industrial systems efficiency, which includes implementing centrifugal pumps as they pursue greenhouse gas emission reduction and industrial energy consumption minimization. Furthermore, the growing focus on energy-efficient water technology is expected to fuel the demand for centrifugal pumps in the coming years.

Rising Adoption of Automation and Digitalization

Industrial sectors boost their demand for centrifugal pumps with the increasing adoption of automation and digital technologies in their fields. Through IoT technology, centrifugal pumps offer continuous monitoring alongside predictive maintenance functions to improve system uptime while lowering running expenses. These recent developments prove especially important to power generation and chemical processing facilities, which operate continuously.

The Centers for Disease Control and Prevention (CDC) recognizes automated pumps connected to IoT networks to collect real-time data, which guarantees a steady water supply regardless of emergencies. Moreover, the digital technological implementations ensure that fluid handling needs receive satisfactory service from centrifugal pumps while advancing operational sustainability toward worldwide sustainability targets.

Regional Insights

Asia Pacific dominates the centrifugal pump market, owing to its fast industrial development and investments in water resource projects. China and India lead the market growth for centrifugal pumps, as they undertake major infrastructure development projects across water treatment facilities, construction sites, and power generation infrastructure.

Remote areas across South-East Asia showed that in 2024, the World Health Organization (WHO) identified 40% of residents without accessibility to safe and managed sanitation facilities, thus demonstrating the necessity for better water treatment infrastructure.

Furthermore, the rapid increase of digital technology adoption in pump management occurs simultaneously in countries like India, thus further facilitating the market in the coming years.

North America is anticipated to grow at the fastest rate in the centrifugal pump market during the forecast period, due to the developing infrastructure standards and rising investments in energy-efficient systems. The U.S. Environmental Protection Agency (EPA) launched programs to enhance water treatment facilities as well as wastewater systems. This creates higher market demand for centrifugal pumps used in municipal and industrial applications.

The energy-efficient centrifugal pumps are gaining popularity among North American industries operating in oil and gas production, power generation, and chemical manufacturing. These sectors seek to minimize operational costs and reduce their environmental impact. Furthermore, the automation and digitalization trends are leading industries to adopt IoT-enabled pumps to monitor operations in real-time while performing predictive maintenance activities for improved operational efficiency and less downtime.

Centrifugal Pump Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 38.05 Billion |

| Market Revenue by 2033 | USD 57.96 Billion |

| CAGR | 5.36% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In March 2025, Sulzer introduced the Sulzer Optimization Services, an initiative designed to enhance energy efficiency and reduce carbon emissions across energy-intensive sectors, including power generation, oil and gas, chemicals, and water desalination. This service leverages digital analysis, machine learning, and real-time monitoring combined with Sulzer's extensive engineering experience to optimize the performance of centrifugal pumps over their entire lifecycle.

- In January 2024, DESMI launched a new mag-drive centrifugal pump integrating magnetic coupling technology into its centrifugal pump lineup. This innovation eliminates the need for a traditional shaft seal, improving operational reliability and reducing maintenance demand.

- In February 2023, CPC pumps expanded its portfolio 2023 with the launch of its first BB5 centrifugal pump. Known for their application in the refining and petrochemical industries. The newly introduced model is engineered for use in the carbon capture, utilization, and storage process while helping industries achieve low CO2 emissions.

Centrifugal Pump Market Key Players

- Kirloskar Brothers Limited

- ITT Corporation.

- The Weir Group PLC

- Xylem

- Flowrox

- GRUNDFOS

- Flowserve Corporation

- Ebara Corporation

- Dover Corporation

- Sulzer

Segments Covered in the Report

By Type

- Vertically Suspended

- Between Bearing

- Overhung Impeller

By Application

- Multistage

- Single Stage

By Flow

- Axial Flow

- Radial Flow

- Mixed Flow

By Operation type

- Electrical

- Hydraulic

- Air-Driven

By End user

- Industrial

- Oil and Gas

- Water and Wastewater

- Mining and Metal

- Chemicals

- Power Generation

- Food and Beverages

- Pharmaceuticals

- Pulp and Paper

- Agriculture

- Automotive

- Textiles

- Commercial & Residential

By Impeller Type

- Open

- Partially Open

- Enclosed

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/1891

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344