April 2025

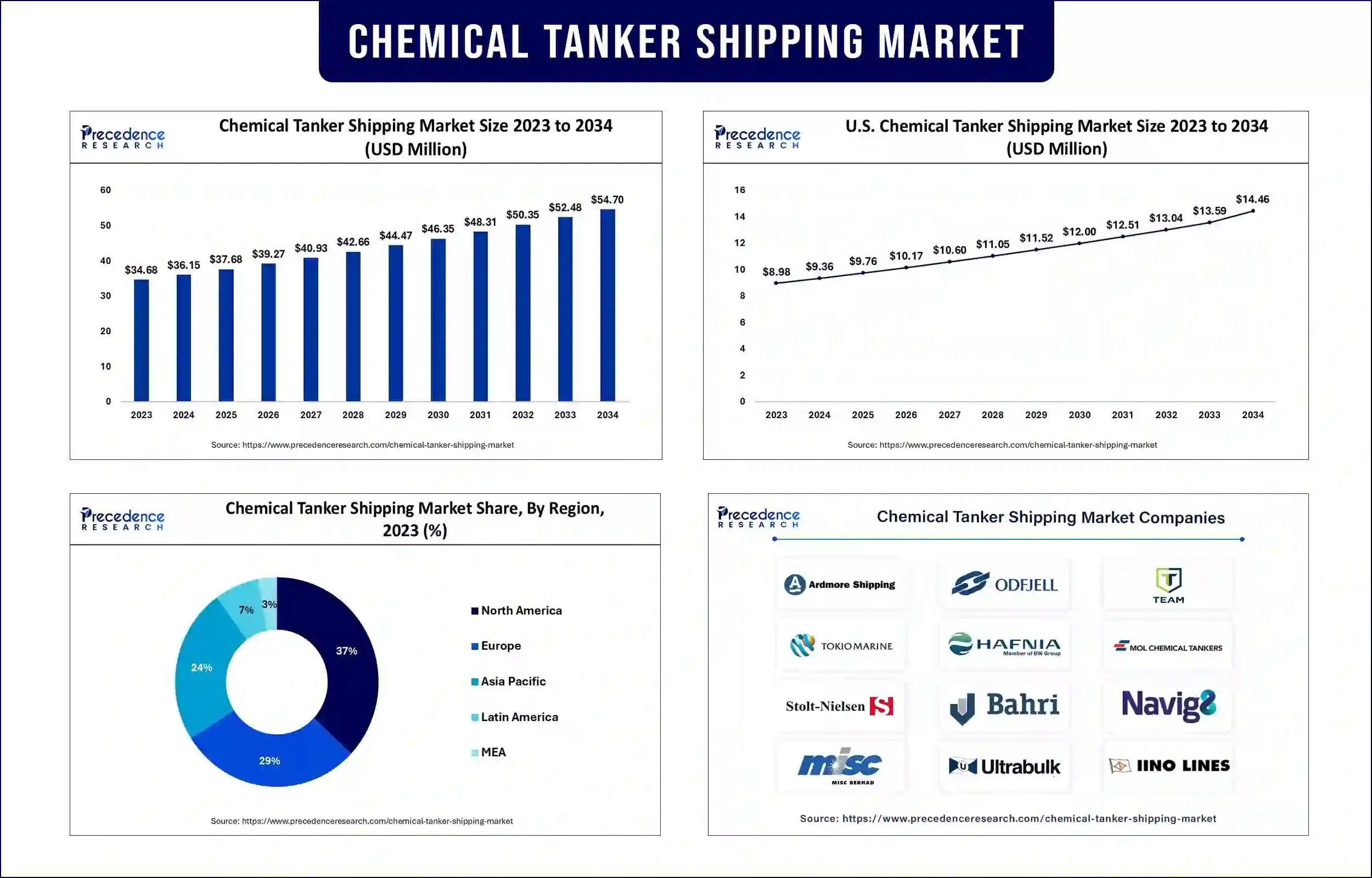

The global chemical tanker shipping market revenue reached USD 36.15 million in 2024 and is predicted to attain around USD 52.48 million by 2033 with a CAGR of 4.23%. The rising demand for chemicals across several industries, such as pharmaceuticals, personal care, and food processing, demands efficient and safe transportation. Also, innovations are being made in tank designs for safety, and the use of marine coatings for corrosion resistance fuels the chemical tanker shipping market.

The chemical tanker shipping market involves the transportation of chemicals such as organic and inorganic chemicals, liquefied gases, common vegetable oils, and hazardous substances through specialized vessels. The rising industrialization, population, and consumer goods, as well as the demand for chemical production with efficient transportation services.

The rising environmental concerns and strict regulatory policies for the transport of hazardous chemicals fuel the market for chemical tanker shipping. In addition, with the demand for eco-friendly and sustainable shipping solutions for reducing carbon emissions and minimizing environmental impact, many companies are adopting alternative fuels, energy-efficient technologies, and green initiatives, creating opportunities and attracting consumers.

Emerging chemical industries

The expanding chemical industries and the need for chemicals in daily life are fueling chemical tanker shipping. Chemical industries are used across several applications like agriculture, hygiene, mobility, and several others and are also used in the manufacturing of polymers and plastics. They also play a significant role in the manufacturing of pesticides, fertilizers, personal products, and food industries, creating the need for safe transportation of these products.

Rising import and export activities

The increasing international trade between countries for the transportation of chemicals for import and export activities is driving the growth of the market. Moreover, the demand for chemical industries for personal care and food processing is expanding the market for chemical tanker shipping. In addition, there is a rising demand for petrochemical products and crude oil across borders for efficient transportation.

Increasing environmental concerns

With increasing environmental regulations to reduce the environmental impact of shipping operations, many manufacturers are investing in advanced technologies to reduce carbon emissions and improve environmental performance. Moreover, environmental regulations play a significant role in the region.

North America dominated the global chemical tanker shipping market in 2023 as the rising oil refining industries and strict environmental regulations, along with the adoption of sustainable practices and increased investments. In addition, investments in logistics should be made to improve the loading and unloading of the processes and the overall process time.

The U.S. holds the largest share of the chemical tanker shipping market as their emphasis on sustainable practices rises, and many manufacturers are investing heavily in the safe transportation of chemicals, driving market growth. Mexico is also expected to grow in the coming years due to its geographic location, which serves as a major part of the export of chemicals.

Asia Pacific is expected to witness the fastest growth in the chemical tanker shipping market during the forecast period as the rising population and economic development in countries like India, China, and Japan result in rising industrialization and transportation across boundaries, driving the market growth. Moreover, there is an increasing demand for petrochemical and pharmaceutical chemicals in the gas and oil industries.

China accounted for the largest share of the chemical tanker shipping market as the advanced chemical industries, rising exports, developing infrastructure, supportive government policies, and advanced technologies are fueling the market within the region. India is expected to grow in the coming years with the expansion of chemical industries and rising infrastructure, as well as strict environmental policies.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 36.15 Million |

| Market Revenue by 2033 | USD 52.48 Million |

| CAGR | 4.23% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Fleet Type

By Product

By Application

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/5301

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

April 2025

January 2025

April 2025

May 2025