December 2024

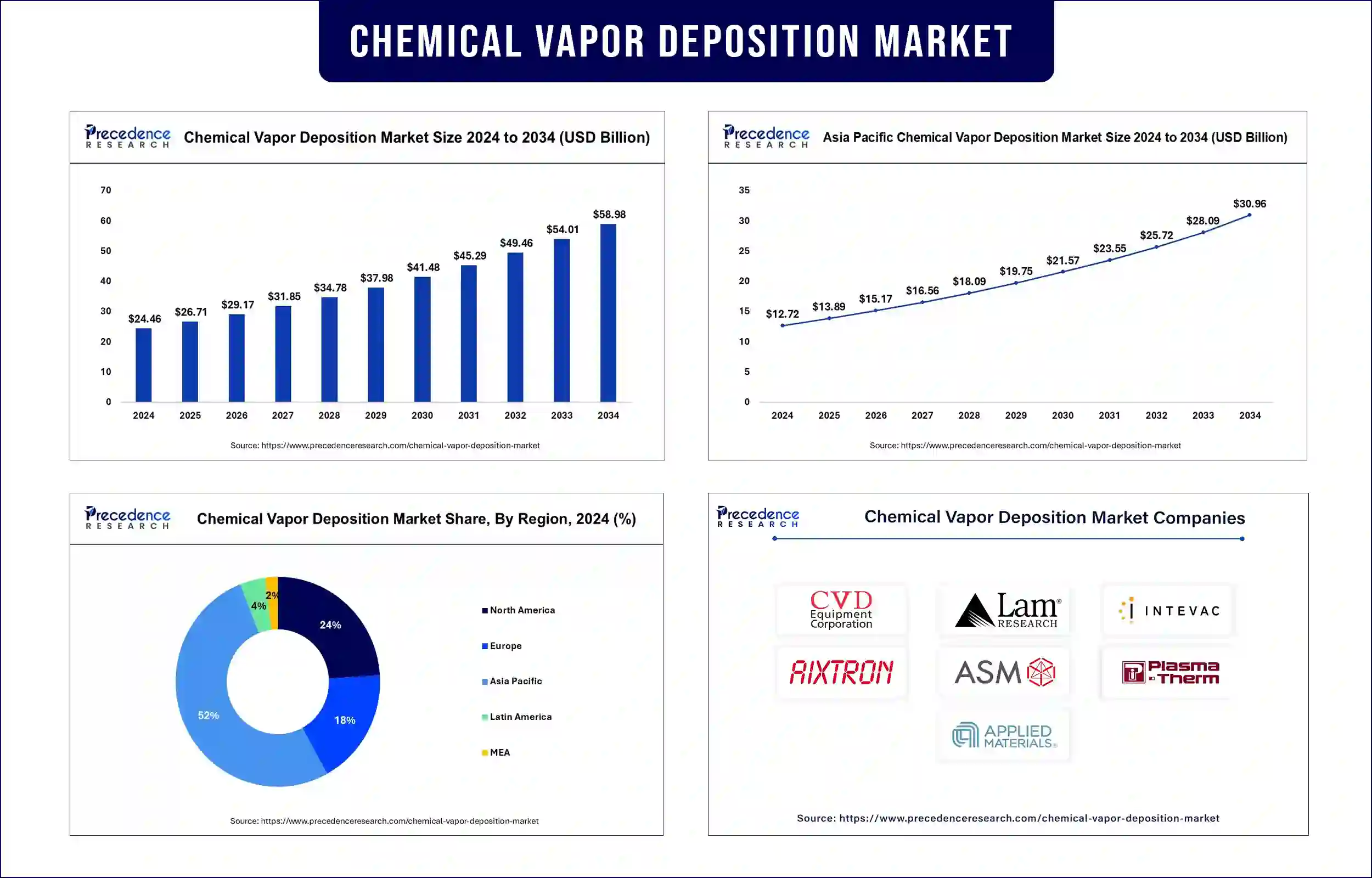

The global chemical vapor deposition market revenue was valued at USD 26.71 billion in 2025 and is expected to attain around USD 54.01 billion by 2033, growing at a CAGR of 9.2% during forecast period. The global market is witnessing significant growth, driven by increasing demand for high-performance coatings, advancements in semiconductor manufacturing, and expanding applications in the medical and aerospace industries.

High-purity materials with high-performance characteristics result from advanced chemical vapor deposition market techniques. CVD technology supports industrial production of thin films and coatings applied to electronic devices, cutting tools, solar panels and biomedical implants. Market expansion takes place as manufacturers need smaller and more efficient semiconductor devices while companies continue to use protective coatings across industrial operations.

Medical facilities use CVD technology to develop biocompatible implant coatings that improve both the durability and tissue integration of medical devices. Through CVD deposition of titanium nitride coatings, medical practitioners extend the operational lifespan of orthopedic implants by improving their resistance to wear. LEPECVD emerged as a result of modern CVD process innovation to achieve high-quality epitaxial growth at lower temperatures through low-energy plasma-enhanced chemical vapor deposition.

State-of-the-art equipment provides researchers the capability to manage atomic-scale computer chip layers for advanced semiconductor design work and development. Furthermore, through material production advances, CVD technology demonstrates its vital function for boosting multiple sectors, including healthcare and electronics, as it enables superior high-performance materials creation.

Growing Demand for Semiconductors and Electronics

The semiconductor industry keeps expanding due to the rising usage of AI, 5G, and IoT devices, which creates increased demand for the chemical vapor deposition market technology implementations. CVD processes appear in manufacturers' production lines to create microchips that perform better while using less energy. Thin films produced through CVD enable better performance and dimensional reduction of semiconductor components. Plasma-enhanced chemical vapor deposition (PECVD) optimization through recent innovations provides semiconductor development with enhanced film properties along with faster deposition rates.

Advancements in Coating Technologies for Industrial Applications

The adoption of CVD coatings in cutting tools, aerospace components, and medical implants is rising due to their superior hardness, wear resistance, and biocompatibility. Industries are leveraging CVD coatings to enhance the longevity and efficiency of critical components. CVD coatings, specifically titanium nitride (TiN) implemented on cutting tools, enhance their operational performance significantly. Companies insert these protective layers onto drill bits and milling cutters so they experience an increased operational lifetime of three to multiple times.

Medical applications incorporate CVD coatings as essential elements for improving the compatibility of implants plus their lifespan in body tissues. Orthopedic implants, which include hip and knee replacements, receive TiN coatings because these coatings enhance wear resistance while decreasing adverse reaction risks. The non-toxic chemical structure, together with FDA-approved standards, make them appropriate for medical applications. The developments made to CVD coating technologies confirm their essential position in enhancing component operational performance and longevity across numerous sectors.

Rising Adoption of CVD in Renewable Energy

The solar energy sector implements chemical vapor deposition (CVD) processes for making high-efficiency thin-film solar cells, as its increasing importance in the field. Various administrations worldwide direct investments toward photovoltaics to speed up the implementation of CVD systems, which provide sustainable energy alternatives to power sectors.

Sustainable energy solutions receive worldwide support through the solar sector's adoption of the chemical vapor deposition market technology. Future growth of solar adoption worldwide depends on government funding for photovoltaic technologies since CVD continues developing advanced solar cells with enhanced efficiency and flexibility.

Technological Innovations in CVD Equipment

Manufacturers in the chemical vapor deposition market continue to develop equipment by adding automatic mechanisms, better process controls, and environmentally friendly features. The development of atomic layer deposition (ALD) and hybrid CVD techniques permits accurate film deposition to meet the demands of new technology applications. Users achieve precise ultra-thin film layering through ALD, which represents a unique CVD technology.

Joint methods of CVD, known as plasma-enhanced chemical vapor deposition (PECVD), integrate existing CVD protocols along with plasma technologies to create coatings at reduced temperatures and enhanced film excellence. Furthermore, the technological advancements in CVD equipment enable multiple industries to advance through their ability to create materials with custom properties using precise fabrication methods.

North America is expected to maintain a strong presence in the chemical vapor deposition market, supported by advancements in semiconductor manufacturing, aerospace applications, and medical device innovations. The U.S. government's funding for microchip manufacturing and advanced production drives market expansion. The U.S. Department of Commerce approved a USD 123 million grant to Polar Semiconductor, which successfully increased its domestic power and sensor chip production capabilities by two times in 2024. The U.S. government pursues these initiatives to boost its semiconductor infrastructure.

Asia Pacific is projected to experience the fastest growth in the chemical vapor deposition market, supported by leading semiconductor manufacturers in China, Japan, South Korea, and Taiwan. The Chemical Vapor Deposition (CVD) market is expanding most rapidly in the region since major semiconductor manufacturers operate in China, Japan, South Korea, and Taiwan.

Public funding to advance domestic semiconductor manufacturing operates together with electronics and solar energy progress as fundamental market growth forces. The National Integrated Circuit Industry Investment Fund Phase III focuses on expanding the semiconductor industry through investments in big manufacturing zones together with equipment acquisition, material procurement, and artificial intelligence semiconductor research.

Japan and Taiwan have put forward policies to boost their semiconductor production capabilities. Japan adopted increased government financial support to domestic semiconductor companies in order to boost national technology sovereignty while decreasing international technology dependence. The nation devotes additional funds to research and development activities to sustain its superior position in leading-edge semiconductor technology manufacturing.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 26.71 Billion |

| Market Revenue by 2033 | USD 54.01 Billion |

| CAGR | 9.2% from 2025 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Category

By End-use

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/1050

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

December 2024

January 2025

April 2025

January 2025