July 2024

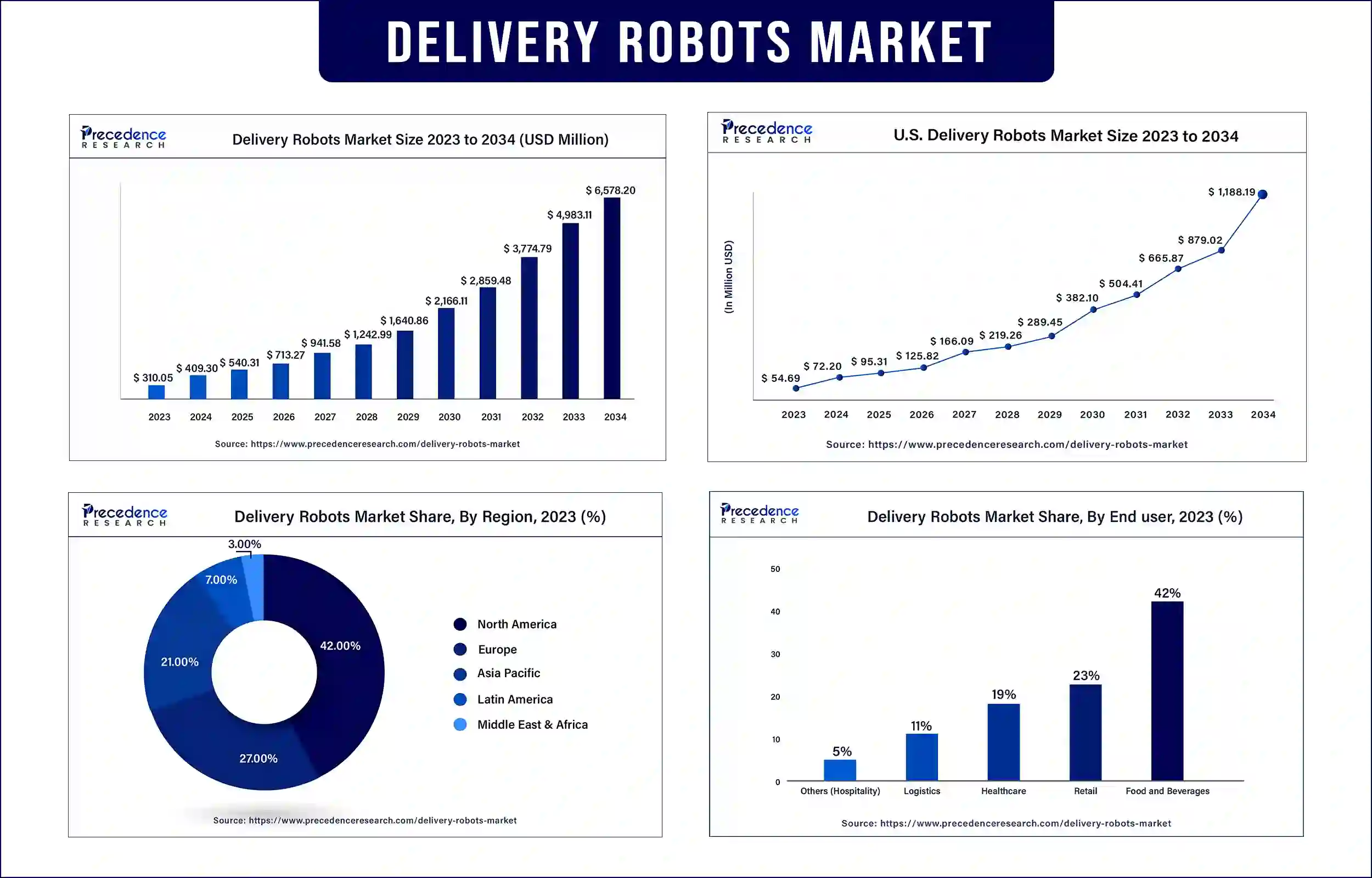

The global delivery robots market was exhibited at USD 310.05 million in 2023 and is anticipated to touch around USD 4,983.11 million by 2033, poised to grow at a CAGR of 32.01% during the forecast period. Labor shortages, the efficiency of the autonomous robots and rise in the global e-commerce industry are some of the factors contributing to the growth of the delivery robots’ market.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4796

Delivery robots are self-contained equipment designed for 'last mile' delivery services. Delivery robots use a variety of components, including cameras, GPS navigation, and sensors, to navigate their routes and prevent collisions with humans, objects, and autos. These machines rely on complicated locomotion, sensing, navigation, and cognition systems to function. To complete delivery tasks, the robots make algorithm-based decisions and use artificial intelligence in conjunction with their hardware. These devices can be fully autonomous, or a human operator can take over the controls remotely to lead the robot through specific conditions. Food, grocery, and package delivery businesses, as well as hospitals and hotels, make extensive use of delivery robot devices.

Impact of AI to Act as a Driver for the Market

Global labour shortages, especially after the pandemic and technological breakthroughs in artificial intelligence and robotics, have significantly spurred demand for delivery robots in the market. However, as the adoption of delivery robots increases, safety concerns and stricter government regulations around their operation are posing a challenge to growth in the market. As AI gets more advanced, the decision-making abilities of these robots get better, presenting opportunities for growth in the delivery robots market.

Advancements In AMRs to Open Market Potential

Recent technological advances in autonomous mobile robotics are enabling scales of equity in the industry. Widespread 5G+ adoption, simultaneous localization and mapping, signal processing, LiDAR, edge computing, and machine vision are culminating to render robots able to govern and perform assigned tasks in their surroundings.

It also empowers innovation with AI-driven optimization powered by advanced analytics and machine learning that automates operations and network processes with expanded problem-solving capabilities. Adoption of such sizing has rocketed, with autonomous delivery vans, sidewalk pods, and drone pods helping to alleviate the cost of the last mile of package delivery. Besides, operators are able to take emergency control of the robots at any time by using cloud-based monitoring consoles.

Recent Development by Uber Eats

| Company Name | Recent Developments |

| Uber eats | In February 2024, uber eats collaborated with Mitsubishi electric and cartken debut the ‘model c’ robot in Japan to conduct food deliveries. |

| Starship technologies | In February 2024, starship technologies announced it had raised $83.6 million, co-led by plural and iconical, for the continued development of its delivery robots |

North America dominated the delivery robots market in 2023, therefore it holds a larger market share. Ongoing research and development operations in the region, together with developments in robotics and artificial intelligence, labor shortages, and the presence of a strong IT infrastructure, will drive high demand in the delivery robot industry. The presence of multiple robot manufacturing companies in the vicinity was also a factor in predicting tremendous demand. The American economy has also seen the Great Resignation (also known as the Big Quit), in which large numbers of workers resigned their employment voluntarily in early 2021, during the pandemic. Over the last decade, the United States has had the lowest rates of labor activity. Market forces have led.

The delivery robots market in Asia Pacific is estimated to experience the fastest growth during the forecast period between 2024 and 2033. Urbanization rates have surged over the last couple of years, and consumer demographics are changing at an alarming rate. E-commerce sales have hit the roof. Countries such as Japan, India, South Korea, and China in Asia are experiencing an increase in internet coverage, and the number of applications related to food delivery is growing by the day, which has catalyzed the growth of the delivery robots market in the region.

Over the years, Japan has been allowing self-driving delivery robots to address some of the challenges brought about by an aging population. Then, the country relaxed its laws on traffic to allow the self-driven delivery robots to operate on the streets and pavements. The changes within the supply chains of the country include the new set of laws limiting the overtime that truck drivers work, which has left businesses unable to beat deadlines on their delivery demands.

Market Potential

The next generation of delivery robots will be increasingly safer and more autonomous, minimizing the need for human intervention as autonomous robots advance. The more businesses embrace the idea of connectivity via the Internet of Things, the more advanced communications can be between equipment and systems for delivery robots; this improves coordination and overall efficiency. Advanced IoT connectivity will enable real-time data collecting, significantly improving SLAM. It will ensure that future delivery robots respond faster to changes in their surroundings and make better decisions while working jointly with other systems.

Once delivery robots become popular, they will be utilized by a wide range of industries, allowing for faster, more efficient, and cost-effective delivery services.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 409.30 Billion |

| Market Revenue by 2033 | USD 4,983.11 Billion |

| CAGR | 32.01% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Type

By Load-Carrying Capacity

By Number of Wheels

By End-user

Buy this Research Report@ https://www.precedenceresearch.com/checkout/4796

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

July 2024

January 2024

April 2024

July 2024