December 2024

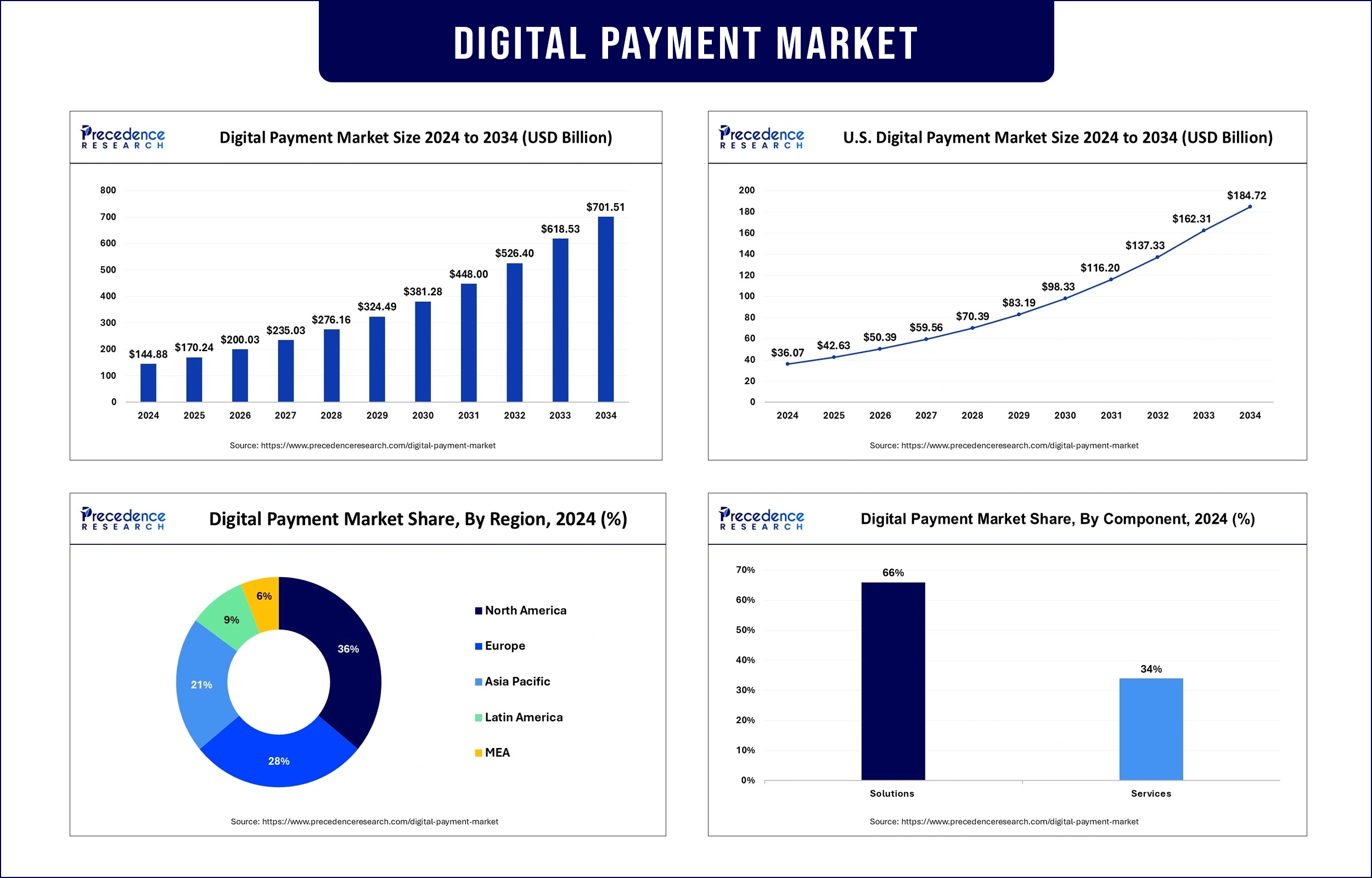

The global digital payment market revenue surpassed USD 170.24 billion in 2025 and is predicted to attain around USD 618.53 billion by 2033, growing at a CAGR of 17.09%. The demand for digital payment is increasing due to the rapid expansion of the e-commerce sector.

The digital payment market encompasses the money generated by setting optimizing electronic money transfers and transactions between accounts, utilizing digital channels such as cell phones, the internet, and automated devices. The market involves all institutions in payment processing, like fintech companies, banks, and other financial institutions. The payment methods include mobile wallets, contactless payments, bank transfers, QR codes, cryptocurrencies, and debit/credit card transactions.

Growing Usage of Smartphones

The increase in popularity of various crucial operating systems, particularly Android and iOS, is positively impacting the digital payment market. Google's Android is the most extensively used smartphone operating system in the world. Also, it is expected that the market will grow due to increasing demand and the launch of various Android-based smartphones. Governments across the globe are also imposing ICT to transform economies into a digital world.

Extensive Presence of Unbanked Population

A major portion of the global population lives in isolated and rural areas. Digital literacy and connectivity are limited in this demographic. Development organizations, governments, and private sector players know the need for financial services for people living in distant and rural areas. Furthermore, more individuals are receiving financial help. Hence, the advent of digital wallets can have a significant impact on market growth.

Integration with E-commerce

The integration of digital payment services into e-commerce platforms and marketplaces is the latest trend in the market. Smooth digital payment integration can optimize online transactions and enhance the overall customer experience. Moreover, collaboration between traditional financial institutions and digital payment providers can use the established infrastructure.

North America dominated the digital payment market in 2024. The dominance of the region can be attributed to the increasing deployment of technology enhancements in smart parking meters, coupled with the ongoing adoption of mobile payments and digital wallets by countries such as the U.S. and China. Moreover, technologies including biometric authentication, cloud computing, blockchain, and artificial intelligence are gaining traction in the region, further impacting positive market growth.

Asia Pacific is expected to grow at the fastest rate in the digital payment market over the forecast period. The growth of the region can be credited to the efforts taken by banks in the region to launch a new payment initiative meant to create a unified payment solution for consumers and merchants. Furthermore, the digital campaign launched in emerging economies like China and India to raise electronic payments in the nation is boosting the region's growth soon.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 170.24 Billion |

| Market Revenue by 2033 | USD 618.53 Billion |

| CAGR | 17.09% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Component

By Deployment Type

By Organization Size

By Industry Vertical

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/2137

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

December 2024

January 2025

April 2025

January 2025