December 2024

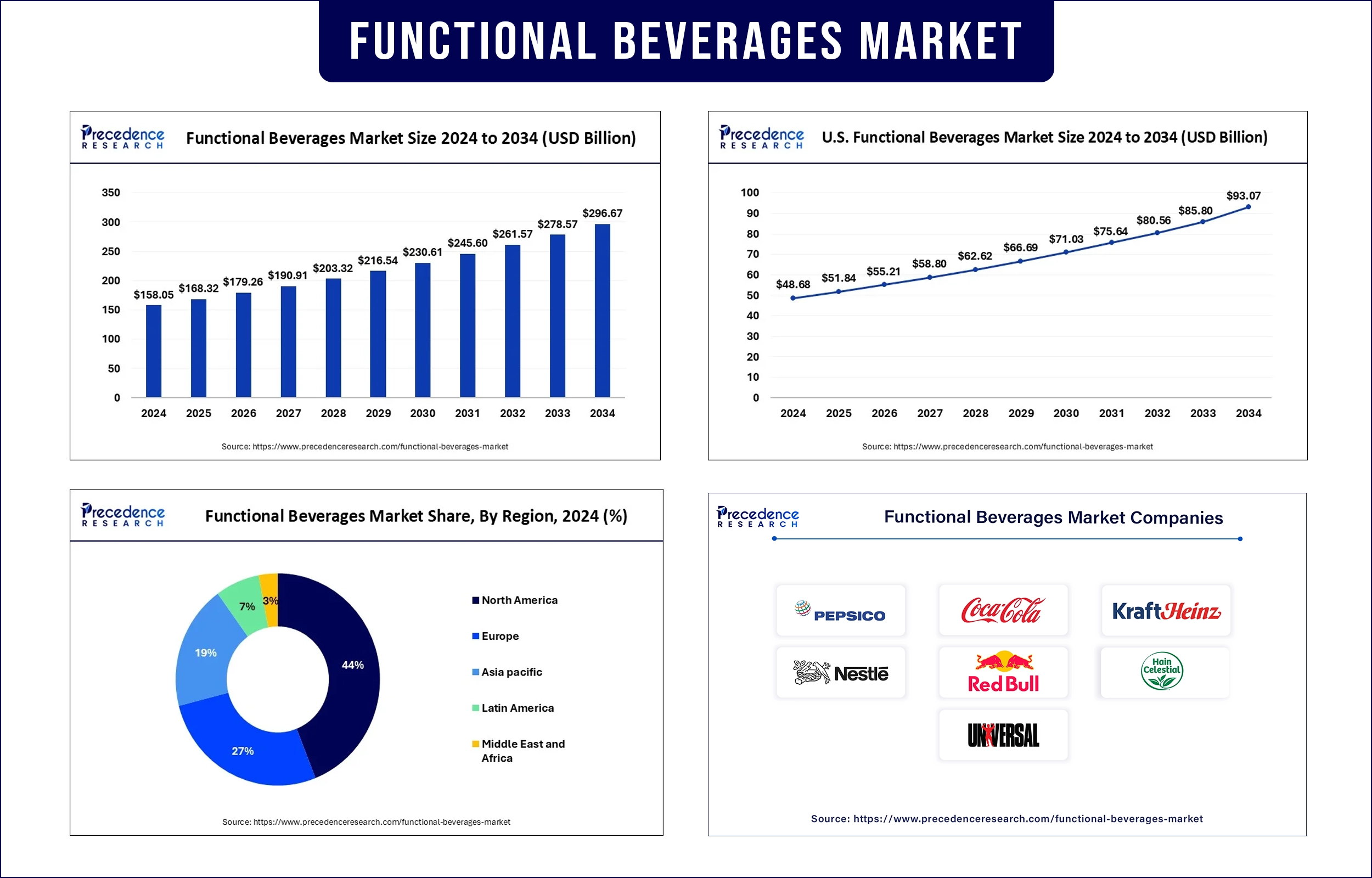

The global functional beverages market revenue reached USD 168.32 billion in 2025 and is predicted to attain around USD 278.57 billion by 2033 with a CAGR of 6.50%. The growing consumer preference for health-boosting products, rising demand for clean-label ingredients, and increasing adoption of functional drinks as part of daily wellness routines are major factors driving the growth of the functional beverages market.

Functional beverages are drinks containing specific components to deliver health advantages beyond normal hydration and nutritional content. A variety of beverages exist that enhance the human body's functions while supplying hydration, boosting energy, and promoting gut health. The demand for functional and natural beverages is rising due to consumers becoming more aware of health and wellness. The rising obesity rates in the population are compelling consumers to seek health-promoting beverages, thus fuelling the market growth.

Type Insights

The energy drink segment accounted for the largest market share in 2023. This is mainly due to the increase in the demand for energy drinks from young adults, athletes, and working professionals who are seeking to boost physical stamina and performance.

The caffeinated beverages segment is expected to expand rapidly in the coming years due to the rising awareness of cognitive health and alertness benefits.

End-user Insights

The fitness lifestyle users segment led the market in 2023. The growth of the segment is driven by the increasing gym memberships, active living trends, and the popularity of functional drinks that support hydration, post-workout recovery, and nutrient replenishment.

The athletes segment is projected to grow at a significant rate during the forecast period. This is mainly due to the rising demand for beverages that help manage weight and digestion. Drinks containing apple cider vinegar, fiber, and plant-based thermogenic compounds are increasingly consumed as part of broader wellness routines.

Distribution Channel Insights

The supermarket and hypermarket segment held the dominant share of the market in 2023. This is mainly due to the easy availability of a range of beverages from multiple brands under one roof, allowing consumers to choose as per their requirements.

Surge in Health and Wellness Awareness

More consumers now shift toward functional beverages because they want to fortify their immunity, control their weight, and improve their digestive health while enhancing mental concentration. The post-pandemic era has increased this consumer trend as wellness is a main element in people's lifestyle decisions. In 2023, the World Health Organization identified growth in worldwide interest in functional foods and beverages, as people believed these products offered health advantages. Furthermore, functional drinks containing bioactive elements are expected to drive the market in the coming years.

Demand for Plant-Based and Clean-Label Products

Functional plant-based beverages are becoming more popular specifically, as they include no added sugar, non-GMO components, and organic ingredients. Beverage makers have started creating new product formulations, which include botanical extracts and adaptogens alongside natural sweeteners, because consumers are changing their preferences. FDA released draft guidance in February 2023, which let plant-based milk alternatives use “milk” labels while suggesting optional statements about nutrient variations compared to dairy milk.

Personalized Nutrition and Functional Blends

Consumers' data analysis progress allows brands to design customized drink products that align with their health objectives and tastes. New product development through this innovation has produced beverages with multiple functionalities that address hydration needs, promote cognitive function and mood, and help support recovery. The National Institutes of Health (NIH) promotes individualized nutrition plans, as customized eating plans generate better health results for cardiometabolic health.

Premiumization and Lifestyle Branding

Functional beverage brand packaging features sleek designs while using ethically procured components and influencer promotions to reposition their beverages as essential lifestyle items. Premium products now match consumer values for wellness, sustainability, and attractive appearance. Companies now market their beverages by adding plant-based elements, reduced sugar content, and nutritional value to attract wellness-focused buyers, thus further fueling the market in the coming years.

North America led the functional beverages market in 2024. This is mainly due to increased awareness of health and wellness among the North American population. The region has a wide network of retail stores, boosting the accessibility to a range of functional beverages. There is a high demand for plant-based and sugar-free beverages, especially among the health-conscious population. The increased awareness among people about the benefits of functional beverages further bolstered the market in the region.

Asia Pacific is anticipated to witness the fastest growth, driven by a rising middle-class customer base seeking different alternatives to soft drinks. The consumer base in China, India, and Japan shows increasing interest in fortified and herbal beverages, which aid natural holistic wellness. Japanese public health authorities are promoting functional foods through the FOSHU program. Furthermore, there is a high demand for beverages that meet health requirements. Changing consumer dietary preferences further supports market growth.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 168.32 Billion |

| Market Revenue by 2033 | USD 278.57 Billion |

| CAGR | 6.50% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Type

By Application

By Ingredient Type

By End User

By Distribution Channel

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @ https://www.precedenceresearch.com/sample/1825

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

December 2024

January 2025

April 2025

January 2025