December 2024

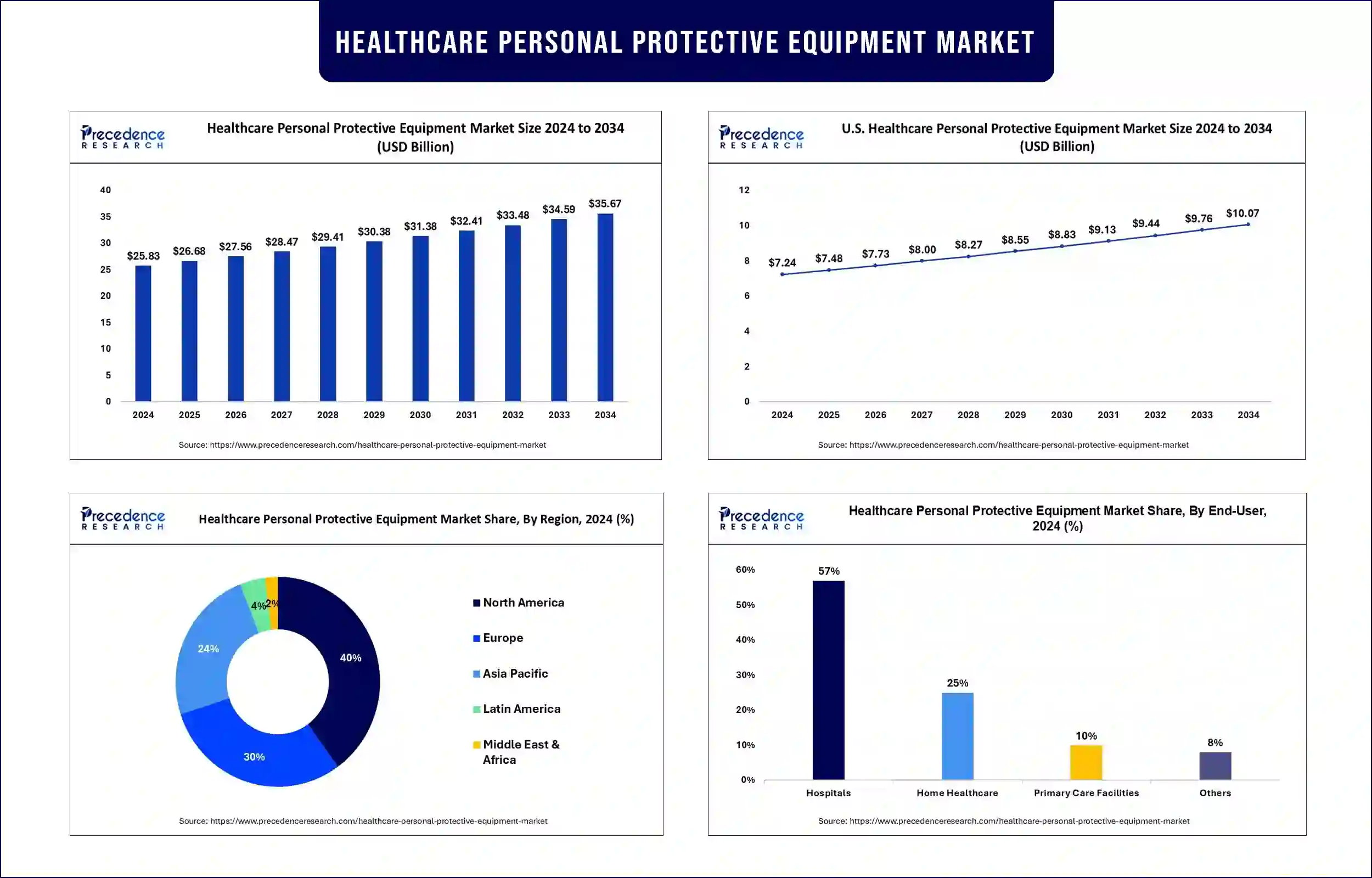

The healthcare personal protective equipment market revenue reached USD 25.83 billion in 2024 and is predicted to attain around USD 34.59 billion by 2033 with a CAGR of 3.28% during the forecast period. The global healthcare personal protective equipment (PPE) market is witnessing substantial growth, driven by increasing awareness of infection control, stringent regulatory guidelines, and the rising incidence of healthcare-associated infections (HAIs).

The healthcare personal protective equipment market encompasses a wide range of protective equipment designed to minimize the risk of contamination and transmission of pathogens in medical settings. The PPE demand has increased significantly as healthcare organizations have adopted enhanced infection control protocols together with improved readiness to manage emerging disease outbreaks. Protection equipment gains improved performance and comfort through recent antimicrobial coating breakthroughs alongside developments in breathable fabrics combined with sustainable materials. Global health organizations currently emphasize PPE stockpiling strategies as they want to ensure emergency preparedness.

The World Health Organization made updated guidelines in 2023 for infection prevention and control while recognizing PPE as a fundamental protective measure for healthcare workers and patients. Healthcare personnel need proper PPE usage training according to the Centers for Disease Control and Prevention (CDC) draft 2024 Guideline to Prevent Transmission of Pathogens in Healthcare Settings. The world demonstrates a shared dedication to boosting infection control strategies through qualitative developments within healthcare settings. Furthermore, the demand for PPE has surged due to heightened infection prevention measures and increased preparedness for emerging infectious diseases.

Regulatory bodies such as the Centers for Disease Control and Prevention (CDC) and the World Health Organization (WHO) are reinforcing infection prevention guidelines, leading to higher demand for certified PPE in healthcare settings. The seventh edition of World Health Organization (WHO) COVID-19 infection prevention and control guidelines became available in December 2023, as they combined previous technical guidance to enhance healthcare safety procedures.

The Centers for Disease Control and Prevention (CDC) issued new isolation precaution guidelines in June 2023 to address current infectious disease situations while reinforcing how certified PPE helps reduce transmission risks during healthcare operations. Leading health authorities strengthen their global efforts toward strict infection control policies, which produce elevated demand for healthcare facilities to adopt certified personal protective equipment.

The integration of smart technologies into PPE, such as IoT-enabled masks and gloves with real-time monitoring sensors, is enhancing workplace safety and infection control. Smart healthcare technologies provide medical staff members with real-time contamination status updates, which help them maintain their protection level in high-risk situations. The evolution of PPE technology for medical use demonstrates an international consensus to utilize technological advances to boost the protection and performance standards of medical protective equipment.

Growing concerns over medical waste are driving the development of eco-friendly PPE options. Reusable masks, along with biodegradable gloves and recyclable gowns, continue to become more popular within hospitals as they reduce environmental impacts. The World Health Organization (WHO) understands the necessity to create lasting solutions for PPE equipment because healthcare waste emissions need proper mitigation. Furthermore, the healthcare facilities show enhanced environmental dedication through initiatives that unite infection prevention measures with ecological conservation efforts.

Governments worldwide are investing in domestic PPE production to reduce dependency on imports and ensure supply chain resilience. Initiatives supporting local manufacturing are strengthening regional markets and improving emergency preparedness. The regional healthcare personal protective equipment market expansion with locally produced products creates improved emergency preparedness lines while building domestic manufacturing power and regional market strength.

Regional Analysis

North America is expected to maintain its leadership in the healthcare personal protective equipment market, driven by robust healthcare policies, strong regulatory compliance, and continuous investments in infection prevention measures. The U.S. government has made strong investments to produce PPE within national borders as part of its initiatives for supply chain protection and emergency readiness.

Through strategic initiatives, North America proves its dedication to a strong healthcare infrastructure response system, which secures its leadership position in the global healthcare PPE sector. Furthermore, the region's strong healthcare regulations alongside continued policy support and commitments to infection prevention initiatives.

Asia Pacific is projected to experience the fastest growth in the healthcare personal protective equipment market, supported by rising healthcare expenditures, an expanding hospital network, and increasing awareness of healthcare-associated infections. Countries, including China, India, and Japan, are strengthening their PPE supply chains to meet growing demand. Additionally, India's focus on research and development in PPE has opened export opportunities, promoting international collaborations and strategic alliances.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 25.83 Billion |

| Market Revenue by 2033 | USD 34.59 Billion |

| CAGR | 3.28% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Product

By End-use

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/1060

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

December 2024

January 2025

April 2025

January 2025