December 2024

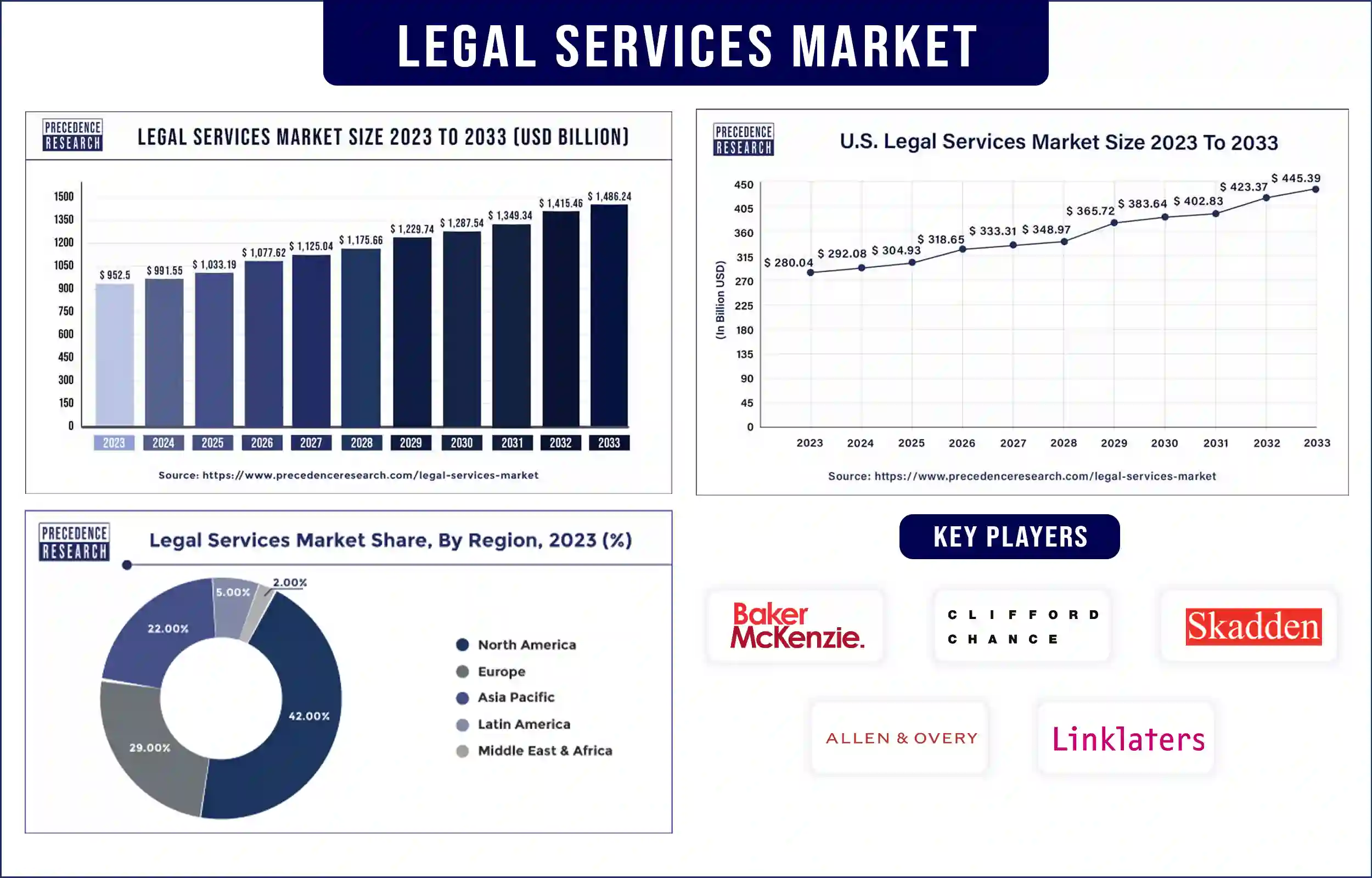

The global legal services market revenue was valued at USD 952.5 billion in 2023 and is poised to grow from USD 991.55 billion in 2024 to USD 1,486.24 billion by 2033, at a CAGR of 4.60% during the forecast period 2024 – 2033. The rising acceptance of advanced technologies and various macroeconomic factors like commoditization, Foreign Direct Investment (FDI), changing economic development, and business competition.

The legal services market encompasses a variety of professional help from lawyers and legal experts to businesses, personalities, and administrations. These facilities aim to circumnavigate and address legal matters, safeguarding acquiescence with laws and regulations. Common legal services comprise advice on agreements, representation in court, and support with legal credentials. Lawyers may specify numerous areas like family law, criminal law, or real estate, delivering proficiency personalized to exact requirements. Legal services play a vital role in protecting rights, sorting out arguments, and confirming justice within the context of the legal procedure.

The approach to legal services is essential for individuals looking for guidance, defense, and resolution in legal subjects, as well as for coming up with a reasonable and arranged society. This covers main international firms working in the legal services market, such as Latham & Watkins LLP, Kirkland & Ellis LLP, Baker McKenzie, Arps, Skadden, Clifford Chance, Meagher & Flom, and Slate, among others in terms of market segment, some chief firms presently lead the market. However, with technological progressions and revolution, mid-size to smaller players are growing their market appearance by securing new agreements and, as a result, tapping new markets.

Commercial requirements boosting the legal services market

The flow of commercial legal requirements has become an important driving force behind the rising mandate in the market. As industries enlarge and function in a progressively multifaceted environment, the requirement for legal proficiency within companies has increased rapidly. Corporations are struggling with complex legal trials, from controlling amenability to contractual details, encouraging greater support for dedicated legal service. With a keen focus on risk handling and legal obedience, businesses are progressively whirling to external legal provisions to direct these difficulties competently. This drift not only enhances the request for legal services but also inspires law firms to modify their deliverables to provide for the specific requirements of commercial clients. As a consequence, the legal services market is experiencing a prominent improvement, driven by the growing and complex legal landscape that industries navigate in the current corporate situation.

Government inventiveness in healthcare promotes the legal services market

Government inventiveness in healthcare can suggestively operate the market by generating a multifaceted controlling landscape that demands legal proficiency. As governments execute policies to report the developing healthcare landscape, like data protection laws, healthcare improvement, and changes in insurance guidelines, legal experts become important in navigating and confirming obedience within the healthcare segment. The complex nature of healthcare laws imposes legal services for healthcare workers, insurance establishments, and other shareholders to understand, adjust, and obey to new guidelines. This demand for legal advice in healthcare-related materials intensifies the legal services sector, making it a vital driver for development in the legal services market.

Confrontation to technology acceptance stances is a noteworthy limitation for the market. Contempt with the assistance that technology can deliver regarding effectiveness, cost-efficacy, and enhanced service offers, the legal firm has factually been conventional in acceptance of technological progressions. Lawyers may come across challenges in adjusting to new tools, stages, or automated procedures due to apprehensions about job dislocation, security matters, or a general unwillingness to leave from traditional performers. This confrontation can hamper the ability of the legal services market to influence revolutions efficiently, leading to slower acceptance rates and possibly obstructing the overall development of the industry and competitiveness in a progressively tech-driven corporate setting.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 991.55 Billion |

| Market Revenue by 2033 | USD 1,486.24 Billion |

| Market CAGR | 4.60% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Development by vLex

Recent Development by Proxiio Global Solutions Pvt Ltd

Asia-Pacific is expected to observe the fastest growth during the forecast period because of numerous issues. The robust financial growth of the region, growing cross-border transactions, and a growing middle class are increasing the request for legal proficiency. Moreover, developing controlling outlines and the upsurge of multifaceted corporate constructions subsidize heightened legal difficulties. As industries pursue legal provisions for extension and agreement, law firms and experts in the Asia-Pacific region are going through a flow of chances, creating a focal point for considerable development in the legal services segment.

North America dominated the legal services market in 2023 because of its mature legal organization, healthy controlling situation, and the occurrence of several worldwide businesses. The evolved legal technology acceptance of the region, the high demand for dedicated legal proficiency, and the occurrence of multifaceted regulatory outlines subsidize its chief market segment. Moreover, the attentiveness of principal law companies and legal service workers in North America additionally sets its situation as a key corporation in the worldwide legal services landscape.

In the meantime, Europe is undergoing prominent development in the legal services market because of several factors. The economic enlargement of the region, growing cross-border connections, and growing controlling landscapes are driving requests for legal proficiency. The request for specific legal services, mainly in areas like data safety and ecological law, additionally contributes to the growth of the market law firms adjust to meet the altering requirements of trades and entities in the European market.

Awareness of legal authorities and cost-effective solutions

The growing acceptance of Alternative Legal Service Providers (ALSPs) offers a prominent chance for the legal services market. ALSPs, which comprise legal procedure outsourcing businesses, technology-driven platforms, and focused legal service corporations, offer advanced and cost-operative solutions to traditional legal trials. Consumers are progressively open to exploiting these benefactors for exact legal tasks, like document assessment, investigation, and obedience, permitting traditional law organizations to emphasize the multifaceted and planned characteristics of legal practice.

This drift not only nurtures effectiveness but also presents a competitive authority, allowing the legal services market to widen its contributions, improve client approval, and adjust to the developing demands of the legal landscape. Acceptance of alternative legal service benefactors can, consequently, be a planned move for legal experts to stay alert and take advantage of the increasing prospects within the legal services segment.

Market Segmentation

By Service

By Firm Size

By Provider

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3696

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

December 2024

January 2025

April 2025

March 2025