December 2024

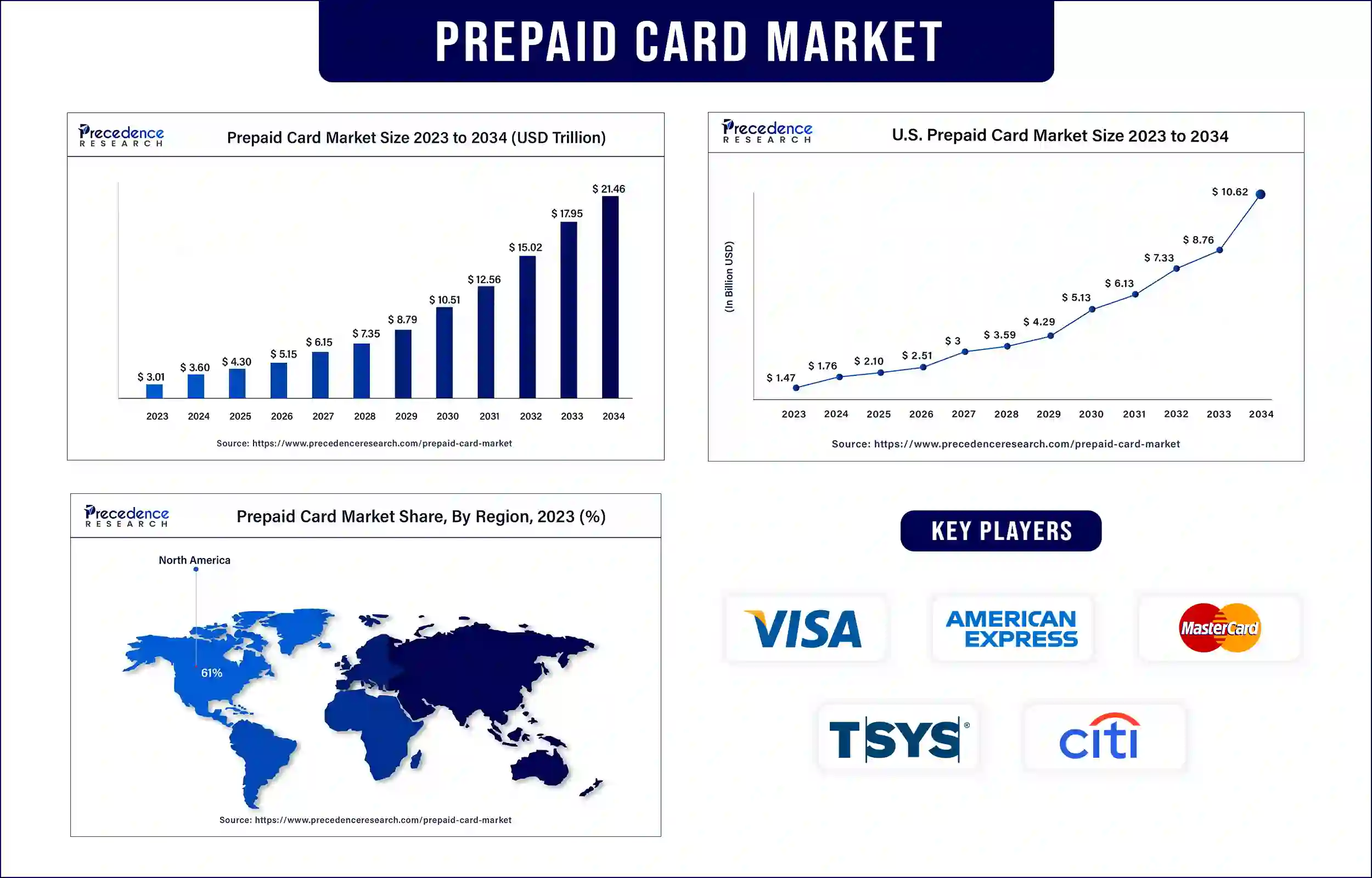

The global prepaid card market was exhibited at USD 3.01 trillion in 2023 and is anticipated to touch around USD 17.95 trillion by 2033, poised to grow at a CAGR of 19.54% during the forecast period. The rising trend of online shopping is expected to drive the growth of the prepared card market.

The prepared card market deals with payment cards that are preloaded with a particular amount of money. The prepared cards are used for making various financial transactions such as paying bills among others, withdrawing cash from ATMs, and in-store or online purchases. A wide range of prepared cards are issued such as incentive cards, travel cards, government benefit cards, gift cards, heat saving account cards, and others. The increasing consumer interest in cashless transactions has played an important factor in the prepared card market growth.

In addition, the rise of mobile wallets, contactless cards, and digital payment platforms has transformed the way consumers make purchases. The attractive discount offer, and cashback offer from card payment, increasing consumer demand for ease of payment during international journeys, increasing online and e-commerce shopping, and increasing digitalization across the BFSI industry, are further anticipated to boost the market growth during the forecast period.

The increasing use of prepared cards to fuel market growth

To pay for a purchase without opening a bank account or opening a credit line, prepared cards are a reasonably straightforward way. Prepared cards can be a significant option for parents who want to provide their children with spending money without giving them cash, which they can never get back and easily lose. Overspending on credit or debit cards may harm their credit or be financially costly, but prepared cards can be a trustable and safer option for some customers. The other kinds of plastics, such as credit or debit cards, can make it simple or easy to spend more than the client has imposed overdraft penalties and budgeted for. A prepared card pushes consumers to stay within a budget, by denying purchases exceeding the customer’s account balance. These factors are expected to enhance the growth of the prepared card market.

However, high fees for prepared cards may restrain the market growth

The major challenge of the prepared card is the high fees. Cardholders may be subjected to several costs, such as inactivity fees or reloading fees, monthly fees, transaction fees, ATM withdrawal fees, and activation fees. These card fees may create challenges in the use of prepared cards across the end customers as compared to credit or debit cards. These factors are expected to restrain the growth of the prepared card market during the forecast period.

Recent Innovation in the Prepared Card Market by Mastercard

| Company Name | Mastercard |

| Headquarters | New Delhi, India |

| Recent Development | In February 2023, a financial inclusion card for smallholder farmers and rural communities was launched by Mastercard in collaboration with Obopay. The prepared card builds a transaction history based on their income and expenditure to access customized credit options, spend their earnings to make purchases even in remote locations that have poor or no connectivity, and allow farmers to receive the sale proceeds for their crop digitally, Powered by Mastercard’s Community Pass digital infrastructure. |

Recent Innovation in the Prepared Card Market by Mastercard ICICI Bank

| Company Name | ICICI Bank |

| Headquarters | |

| Recent Development | In July 2023, a premium forex prepaid card, ‘Student Sapphiro Forex Card’ was launched by ICICI Bank. This prepared card was crafted specifically for students who are going abroad for higher education. This card provided exclusive convenience and benefits to students and their parents to manage education-related expenses. |

North America held the highest market share in the prepaid card market in 2023. The rising popularity of e-commerce and online shopping, rising technical improvements, digital payment usage, rising well-established financial infrastructure, and increasing mobile payment options are expected to drive market growth in the region. The diversified population in the region, which includes both unbanked and banked persons, improves the demand for flexible payment options.

The U.S. and Canada are the major countries in the region. Research and development investments enable players to continuously improve upon features offered through prepaid cards such as better integration, increased data security, and better user interface with digital payments through smartphones.

Asia Pacific is expected to grow fastest during the forecast period. The prepared card market is attributed to the rising financial inclusion measures, increasing digital use, rapid technical advances and expanding middle class. Corporate market players are using prepaid cards to provide benefits including employee perks. In addition, Governments in the region are also utilizing prepaid cards to incentivize the use of digital payment methods and to disperse benefit of payments. China, India, Japan, and South Korea are the major countries in the region.

Integration with emerging technologies and expansion to offer Potential

Adopting technologies such as machine learning and artificial intelligence can improve fraud detection and provide personalized user experiences. These technologies contributed to propel the growth of the prepared card market. Extending the services to rural areas, where full access to traditional banking is very sufficient or limited, may create a significant growth opportunity. Tailored services and products that address the specific demands of these communities can improve adoption.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 3.60 Trillion |

| Market Revenue by 2033 | USD 17.95 Trillion |

| CAGR | 19.54% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Offering

By Card Type

By End User

Buy this Research Report@ https://www.precedenceresearch.com/checkout/4814

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

December 2024

April 2024

March 2024

January 2025