December 2024

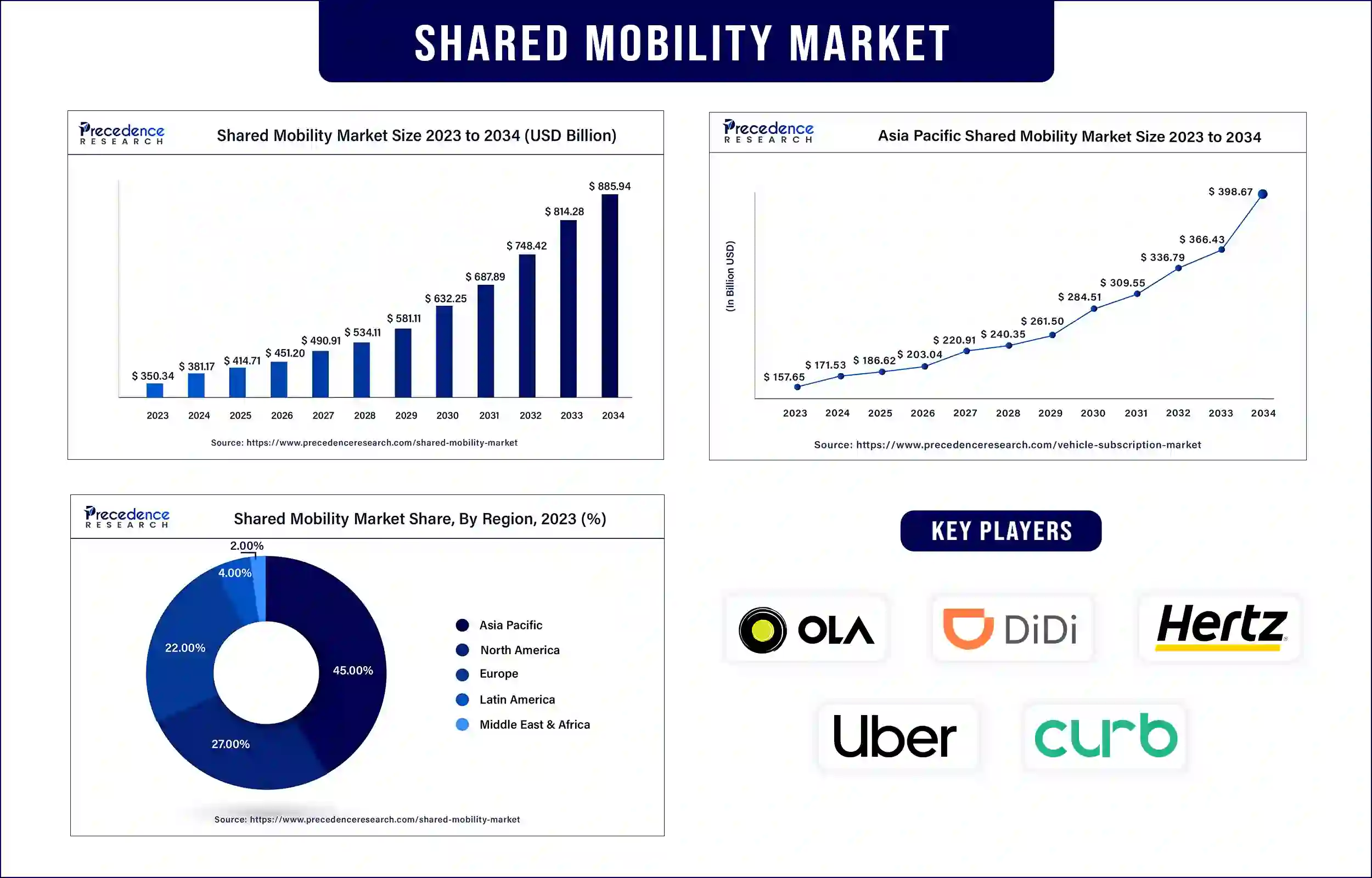

The global shared mobility market revenue reached USD 381.17 billion in 2024 and is predicted to attain around USD 814.28 billion by 2033 with a CAGR of 8.8% during the forecast period. The market's growth has been spurred by the rising use of the Internet and investments in shared mobility.

The term "shared mobility" refers to travel options that separate the use of mobility resources from their ownership to increase their practical utilization. Hence, shared mobility is the temporary usage of shared automobiles as needed and convenient for the user. The government's attempts to promote shared mobility solutions to minimize traffic congestion on highways and the fast-growing integrated ecosystem within the transportation industry drive the market. Since the use of automobiles has significantly increased pollution over the past ten years, governments worldwide are promoting the use of shared mobility services, which is driving the market's expansion. Shared mobility is less expensive than purchasing and maintaining a car compared to personal automobiles.

Reduced traffic, improved economic activity, and availability of eco-friendly transportation: Cities and commuters may both profit from shared transportation in numerous ways. During the COVID-19 epidemic, shared mobility's practicality and effectiveness stood up as a noteworthy advantage. Ride-sharing services have developed into a reliable and cost-effective substitute for public transit. During the epidemic, ride-sharing services for bicycles, electric bikes, and scooters were very helpful. Outside the pandemic, additional long-term benefits of shared mobility include lessened traffic congestion, improved economic activity, accessibility to more urban locations, availability of eco-friendly transportation, fewer carbon emissions, and inexpensive personal transportation.

Easy availability of services through mobile apps: The use of mobile applications to reserve transportation services like automobiles, motorcycles, scooters, or buses is made possible through carpooling and e-hailing services. Private cars are utilized to provide public transportation services for passengers and fleet operators when they are reserved through these platforms.

Rise in the investment: Shared mobility is on the rise as customers demand easy, affordable, and environmentally friendly transportation options in cities. Shared mobility has grown to be a lucrative industry over the last ten years. More than $100 billion has been invested in shared mobility enterprises since past ten years by private investors, technological firms, and other parties. To combat the climate catastrophe, cities are working to reduce their emissions, and this decade may witness an even more drastic transition toward flexible, shared, and sustainable modes of transportation. Now, efforts are being made in more than 150 communities to implement policies that would limit the use of private vehicles.

Asia Pacific dominated the shared mobility market in 2023. China and India seem to be the most promising markets due to their large population. Further, countries like India and Taiwan are focusing on expanding their transportation infrastructure. Moreover, there are many additional problems with owning vehicles in India, and finding parking, especially in metropolitan cities, is challenging. This, in turn, boosts the demand for shared mobility. On the other hand, North America is anticipated to be the fastest-growing region in the market during the forecast period. The region boasts a large number of market players, which are bolstering shared mobility in North America. The increasing demand for affordable transportation option propels the market in the region.

Market Segmentation

By Type

By Vehicle Type

By Business Model

By Vehicle Propulsion

By Sales Channel

By Sector Type

By Geography

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/1329

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

December 2024

January 2025

April 2025

January 2025