October 2024

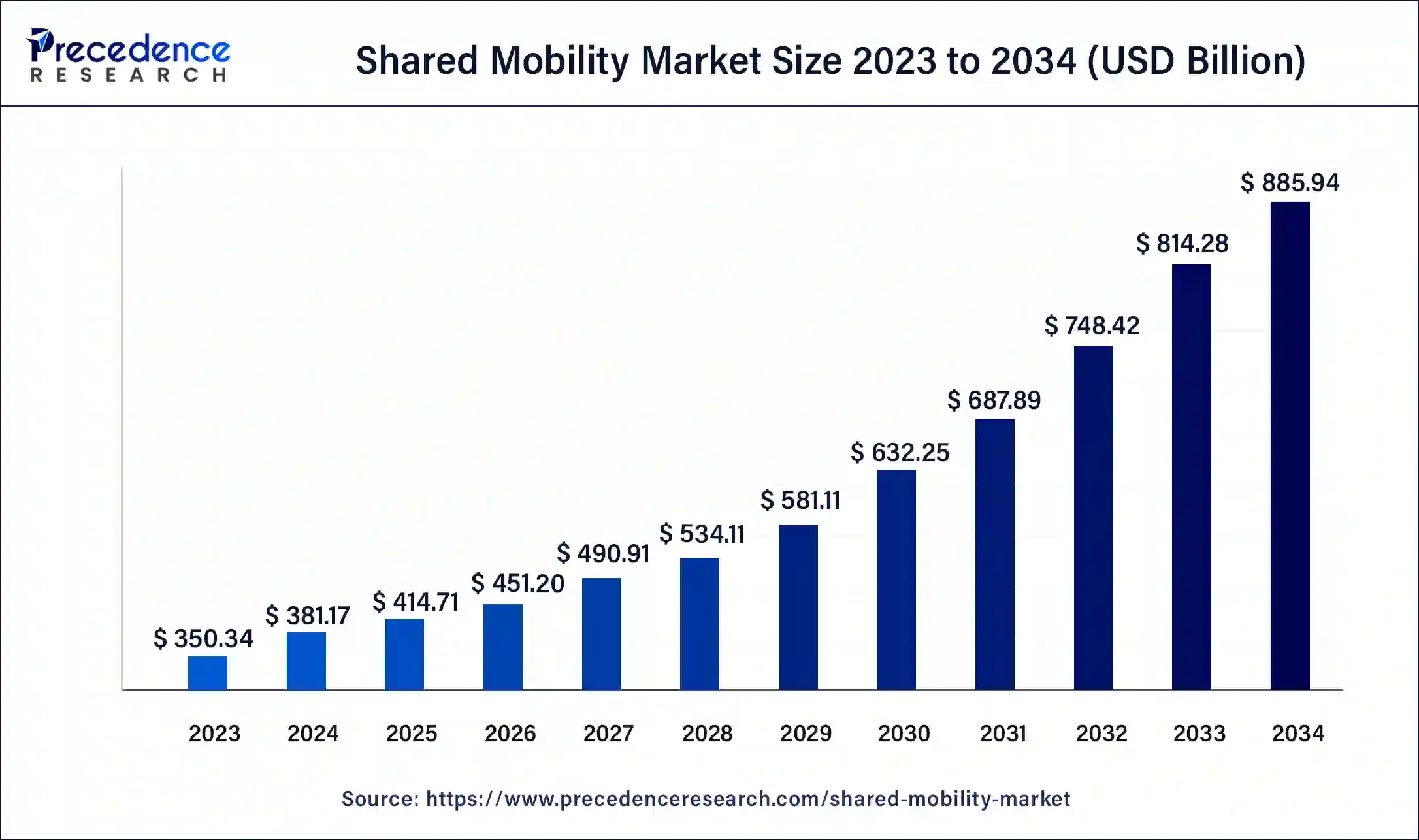

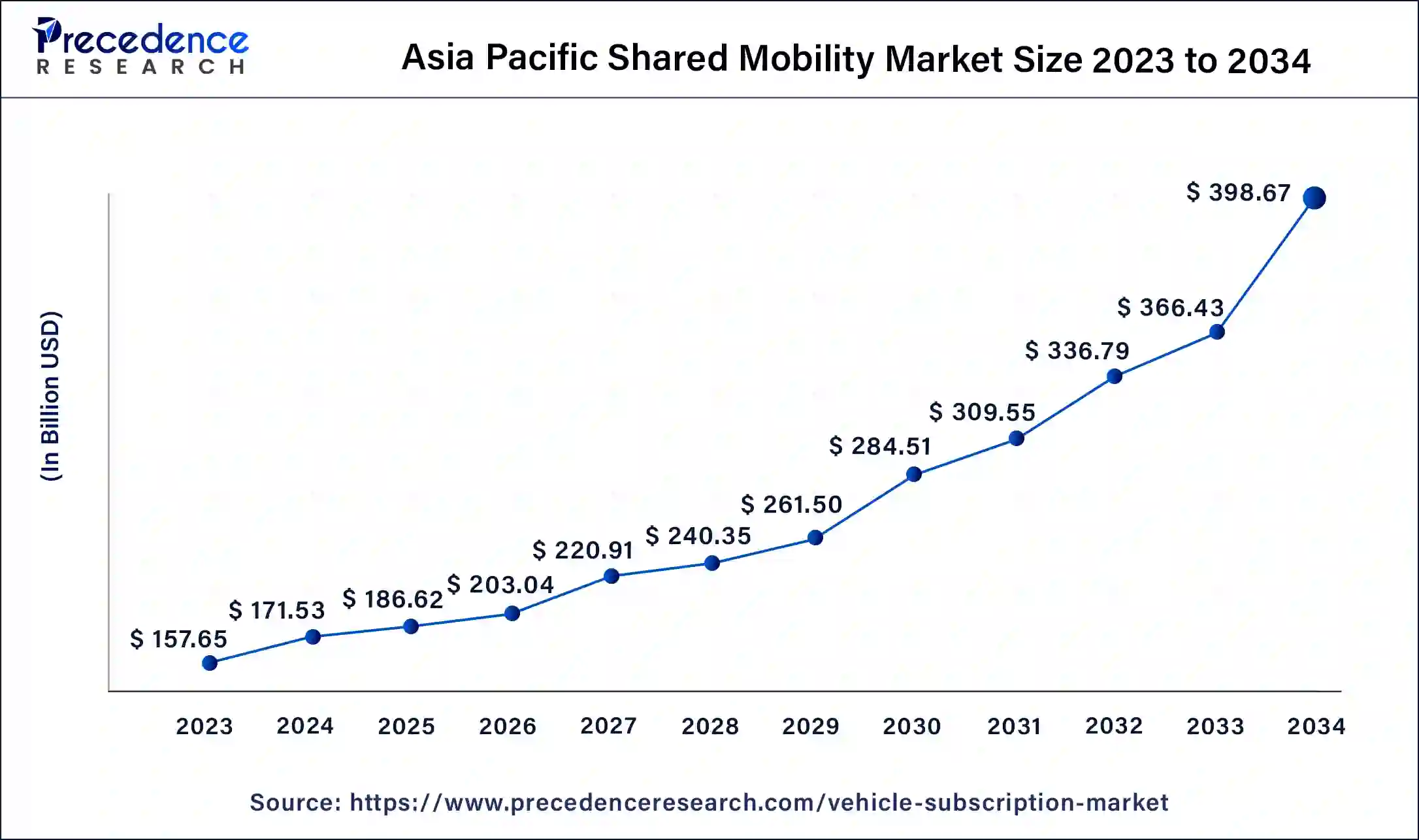

The global shared mobility market size is calculated at USD 414.71 billion in 2025 and is projected to surpass around USD 885.94 billion by 2034, expanding at a CAGR of 8.8% from 2025 to 2034. The Asia Pacific market size accounted for USD 171.53 billion in 2024 and is expanding at a CAGR of 9% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global shared mobility market size accounted for USD 381.17 billion in 2024 and is expected to be worth around USD 885.94 billion by 2034, at a CAGR of 8.8% from 2024 to 2034. The shared mobility market is observed to get accelerated with the rising concerns over environmental issues and the inclination towards sustainable transportation options. Electric scooters, bikes, and shared electric vehicles contribute to eco-friendly alternatives, appealing to environmentally conscious consumers.

The Asia Pacific shared mobility market size is exhibited at USD 186.62 billion in 2025 and is predicted to be worth around USD 398.67 billion by 2034, at a CAGR of 9% from 2025 to 2034.

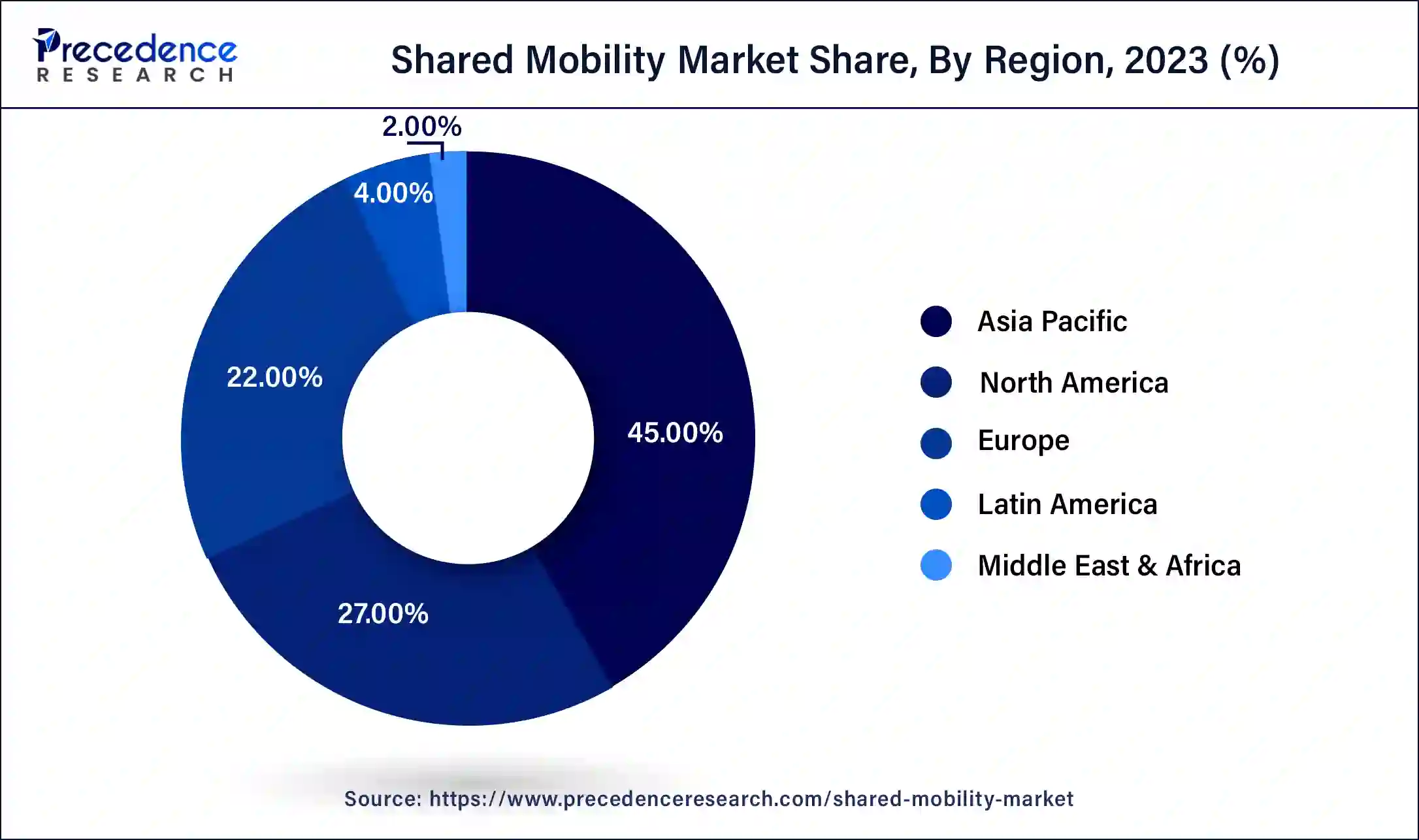

Asia Pacific is expected to contribute the largest revenue share of more than 45% in 2024. It is because of the rise in On-road vehicle traffic and costs of vehicle ownership in countries such as China and India. The presence of higher population in these countries of the region is a major factor that drives the growth of Shared Mobility Market in Asia Pacific region. For instance, On 5th October 2021, OLA announced that it has acquired GeoSpoc, a geospatial services provider that will help OLA to bring geospatial technologies to the mass market. Together these two companies will develop technologies which will make mobility universally accessible, sustainable, personalized, and convenient, across shared and personal vehicles.

Asia Pacific is dominating the shared mobility market. The urbanization sector is contributing to the growth of this market in the region. The rising demand for sustainable transportation facilities at an affordable rate is stimulating innovative growth and development.

LAMEA is also expected to grow significantly during the forecast period owing to surge in demand for shared transportation solutions due to increasing number of corporate travelers in this region.

Technological advancements in the shared mobility market feature mobility-as-a-service, blockchain, and AI and machine learning. Mobility-as-a-service (MaaS) is a platform to several transportation modes such as bike sharing, public transit, and ride sharing. It is acquired in a single application, delivering personalization and improving the mobility experience. This platform offers fascinating features such as trip planning and booking services.

Blockchain technology is mainly used in payment systems to secure the money transfer process. It also calculates vehicle usage. AI and machine learning eliminate delay by predicting traffic, and artificial intelligence AI algorithms optimize routes to benefit ride-sharing services. These technologies are the future for logistics and transportation and a contribution to the shared mobility market.

The increasing internet penetration and the surge in investment for shared mobility businesses have accelerated the growth of the market. Also, the rising on road traffic congestion, lack of parking spaces, high fuel prices, and high cost of personal vehicle ownership are the key attributes that triggers the growth of the shared mobility market.

The rapid growth of the automobile industry along with the growth of an integrated ecosystem within the transport industry and the Government initiatives in promoting the shared mobility solutions in order to reduce traffic congestion on roads is anticipated to fuel the growth of the shared mobility market. For instance, On 12th October 2021, HERE Technologies, the leading location data and technology platform, announced HERE Probe Data, a new data service delivering useful information on how road users and vehicles move across the transportation network. This service addresses the growing demand from public transport agencies, cities, and companies across the automotive, transport and logistics industries, to better understand road-centric mobility patterns.

In the past decade, there has been a significant rise in pollution due to the use of automobile and therefore in order to reduce the amount of air pollution the Governing agencies across the globe are encouraging the use of shared mobility services and this factor drive the market growth. Also, Shared mobility is economical when compared with personal vehicles as it is less expensive than acquiring and maintaining a vehicle and this accelerates the market growth. For instance, On 7th October 2021, DB Regio AG and ZF Friedrichshafen AG announced that they are collaborating in bringing highly automated and autonomous bus shuttles onto the roads in Germany more quickly.

| Report Highlights | Details |

| Market Size by 2034 | USD 885.94 Billion |

| Market Size in 2025 | USD 414.71 Billion |

| Market Size in 2024 | USD 381.17 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.8% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Vehicle Type, Business Model, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

The shared mobility market is divided into ride-sharing, vehicle rental/leasing, ride sourcing and private. The vehicle rental/leasing type segment is expected to witness the highest growth accounting for more than 41% of revenue share in 2024 and also it is anticipated to grow at a decent pace during the forecast period owing to increase in population specially in the developing countries.

Furthermore, ride-sharing type segment is also growing significantly during the forecast period owing to the desire of customers opting for more cost-effective and elegant modes of transportation over personal driving preferences. All these factors are estimated to drive the growth of the market. For instance, On 30th September 2021, Europe's leading free-floating car sharing provider SHARE NOW announced that it will use artificial intelligence in overcoming traffic in cities. With the introducing of AI in the car sharing services, Share Now will efficiently manage and control its vehicle fleet.

The shared mobility market is divided into Passenger Cars, LCVs, Busses & Coaches and Micro Mobility. The passenger cars in this segment is forecasted to contribute the largest revenue share of more than 51% in 2024 and is estimated to grow remarkably over the forecast period. It is because of the lucrative features provided in the passenger cars and the driving experience it provides. Also, launch of new services by ride-hailing providers is expected to boost the market growth. For instance, On 6th August 2021, Rapido India's largest bike taxi platform announced their expansion of its auto service to Bengaluru, taking the service to a total of 26 cities in India. These services aim to give them access to safer and more affordable commute options and provide other avenues of earning for the auto drivers.

The Shared Mobility Market is divided into P2P, B2B and B2C. The P2P business model segment is expected to witness a significant revenue share during the forecast period amounting to more than 55% of the global share. It is also anticipated to grow significantly during the forecast period. It is due to the surge in use of automobiles for rental and leasing services.

By Type

By Vehicle Type

By Business Model

By Vehicle Propulsion

By Sales Channel

By Sector Type

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

May 2025

June 2025

January 2025