July 2024

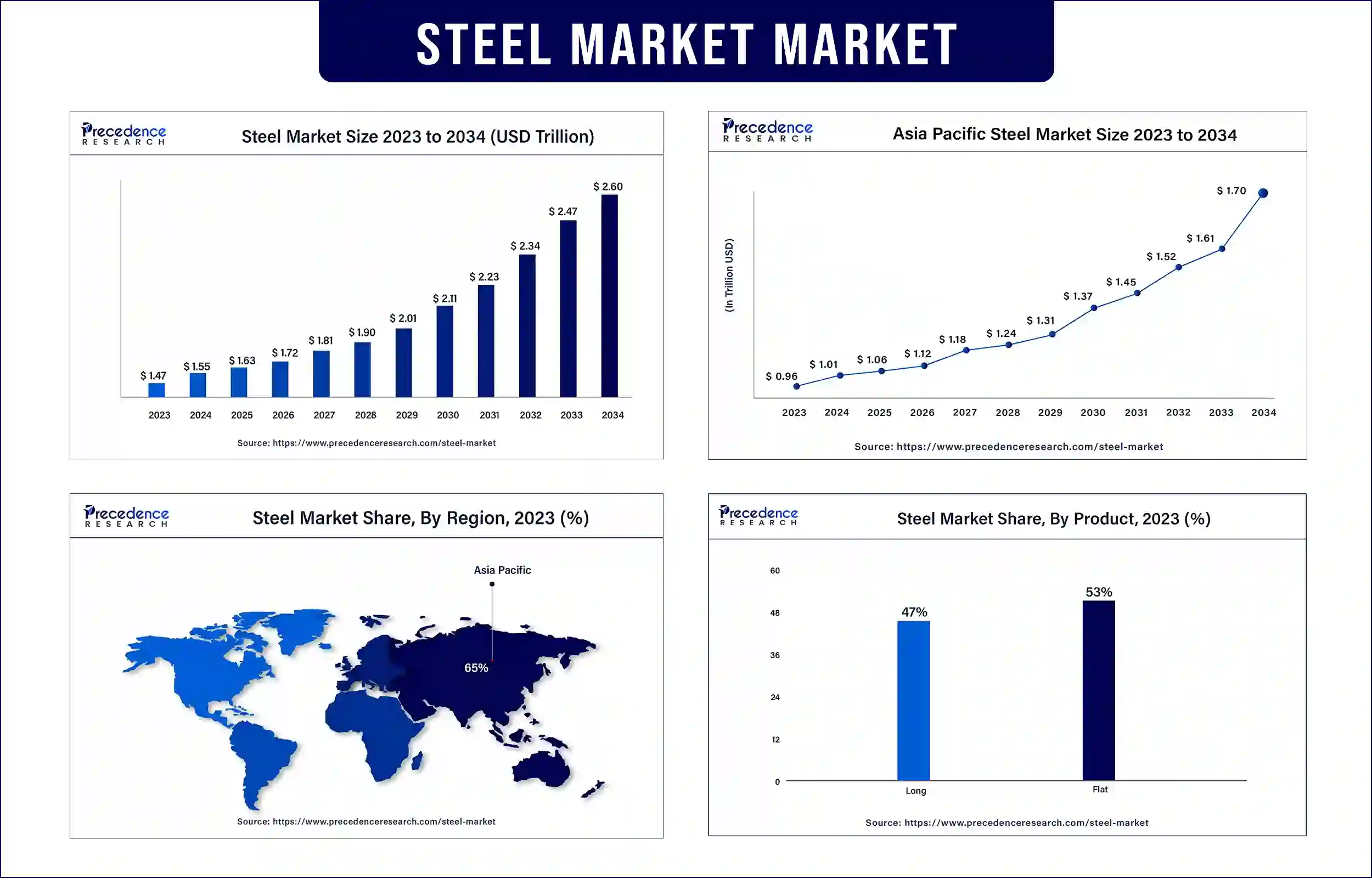

The global steel market was exhibited at USD 1.47 trillion in 2023 and is projected to attain around USD 2.47 trillion by 2033, poised to grow at a CAGR of 5.32% during the forecast period. The increasing environmental concern and the demand for the sustainable, and environmental free material with lower carbon footprint in the manufacturing of the different industrial products and equipments are driving the demand of the steel market.

The steel industry is one of the leading sectors in the industrial and commercial infrastructure. Steel is the most versatile and strong material that is used in a number of end-use industries. Steel is a mixed alloy combining a small amount of carbon and iron. The carbon is responsible for the strength and the durability. In the composition of the steel, iron metal is alloyed with less than 2% of the carbon element. Durability, strength, machinability, versatility, weldability, corrosion resistance, recyclability, and conductivity are some common characteristics of steel.

There are four main types of physical properties of steel: hardness, tensile strength, thermal expansion, and thermal conductivity. There are different types of steel used in production and requirements, including stainless steel, carbon steel, alloy steel, tool steel, weathering steel, high-speed steel, and electrical steel. Thus, the rising demand for steel material equipment or components is driving the growth of the steel market.

The increasing use of steel in the manufacturing industries

The rising population and the increasing demand for the various end-use industries drive the demand for manufacturing or production units, which drives the demand for steel material equipment, machinery, and other applications due to its increased strength, high tensile material, durability, machinability, versatility, weldability, conductivity, and corrosion resistance. The leading manufacturers from different industries are adopting steel as their basic component in the development of their manufacturing units. It has a lower maintenance cost and higher efficiency, which contributes to the higher demand for steel materials from the different end-use industries.

On the other hand, the size and shape are the biggest limitations of the material. Due to its large size and shape, it had higher transportation and logistics costs, which may hamper the growth of the steel market.

Recent Innovation by Nippon Steel Corporation in the Steel Market

| Company Name | Nippon Steel Corporation |

| Headquarters | Tokyo, Japan |

| Development | In August 2024, ArcelorMittal Nippon Steel India (AM/NS India), a joint venture of Nippon Steel and ArcelorMittal, the industrial leaders, launched Optigal—a top-tier color-coated steel brand with integrated Zinc-Aluminium-Magnesium (ZAM) metallic coating technology. |

Recent Innovation by Emirates Steel in the Steel Market

| Company Name | Emirates Steel |

| Headquarters | Musaffah, Abu Dhabi |

| Development | In July 2024, Emirates Steel, part of Emirates Steel Arkan Group, a leading publicly building materials manufacturer and traded steel in the region, collaborated with the Eversendai, a leading powerhouse in steel construction, to strengthen their partnership with the launch of NEOM Trojena Ski Village project in the NEOM, Saudi Arabia’s most ambitious giga project. |

North America is expected to have accountable growth during the forecast period. The growth of the market is expected to increase due to the rising demand for the steel-based component in industrial machinery and rising real estate infrastructure that drives the demand for steel as the basic material for construction activities to provide high tensile strength, anti-termite, corrosion resistance, and efficiently handles the environment challenges. Additionally, the well-established automotive industry, which is one of the leading consumers of steel components, accelerated the growth of the steel market across the region.

Asia Pacific dominated the steel market in 2023. The growth of the market is increasing due to the rising population and the demand for various end-use industries such as construction and building, manufacturing, automotive, healthcare, and others. Regional countries like China and India are among the leading producers of steel. Additionally, the rising government intervention in the steel production industries is driving the growth of the steel market in the region.

Technological advancements in the steel industry

The integration of technologies plays a significant role in the steel industry. Technologies such as advanced monitoring sensors, automated robotic systems, and data analytics collectively contributed to the expansion and increasing efficiency of the steel industry. All these advancements have efficiently increased the efficiency of operations and production capacity, reduced environmental impacts, and streamlined operations, and other advanced technologies could emerge as major opportunities in the growth of the steel market.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 1.55 Trillion |

| Market Revenue by 2033 | USD 2.47 Trillion |

| CAGR | 5.32% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Product

By End-use

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/4920

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

July 2024

January 2024

February 2025

April 2024