January 2025

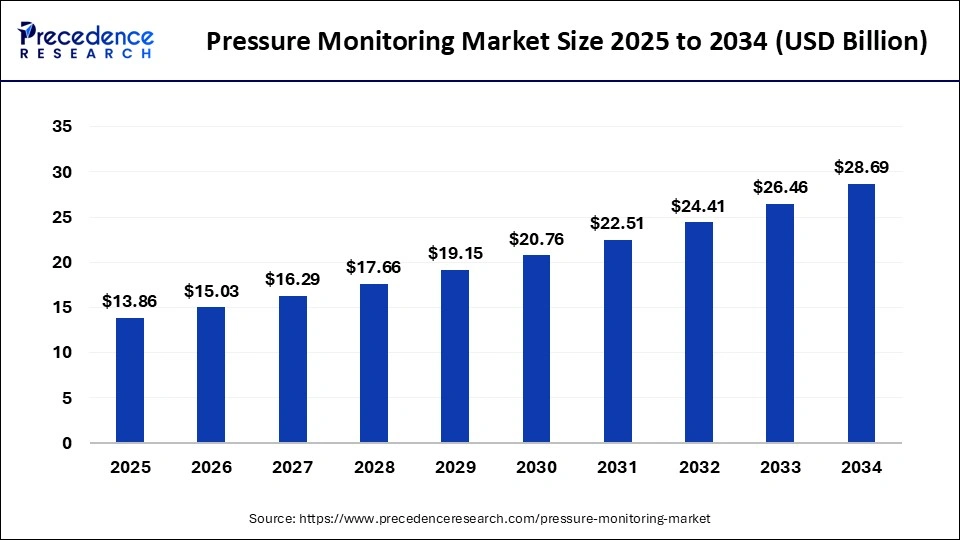

The global pressure monitoring market size was USD 11.79 billion in 2023, calculated at USD 12.78 billion in 2024 and is expected to be worth around USD 28.69 billion by 2034. The market is slated to expand at 8.42% CAGR from 2024 to 2034.

The global pressure monitoring market size is projected to be worth around USD 28.69 billion by 2034 from USD 12.78 billion in 2024, at a CAGR of 8.42% from 2024 to 2034. The rising prevalence of chronic diseases, such as hypertension and cardiovascular diseases, is the key factor driving pressure monitoring market growth. The increasing population of senior people can fuel market growth further.

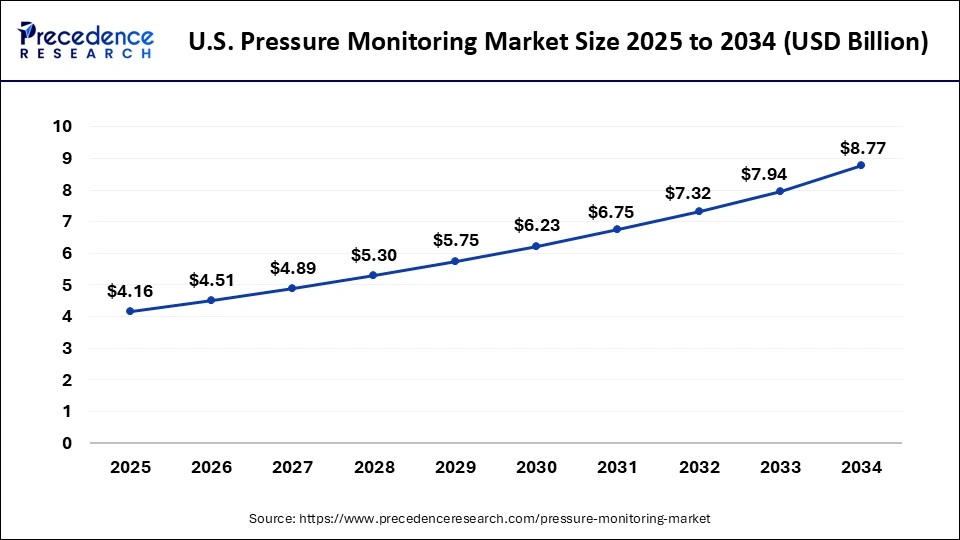

The U.S. pressure monitoring market size was exhibited at USD 3.54 billion in 2023 and is projected to be worth around USD 8.77 billion by 2034, poised to grow at a CAGR of 8.59% from 2024 to 2034.

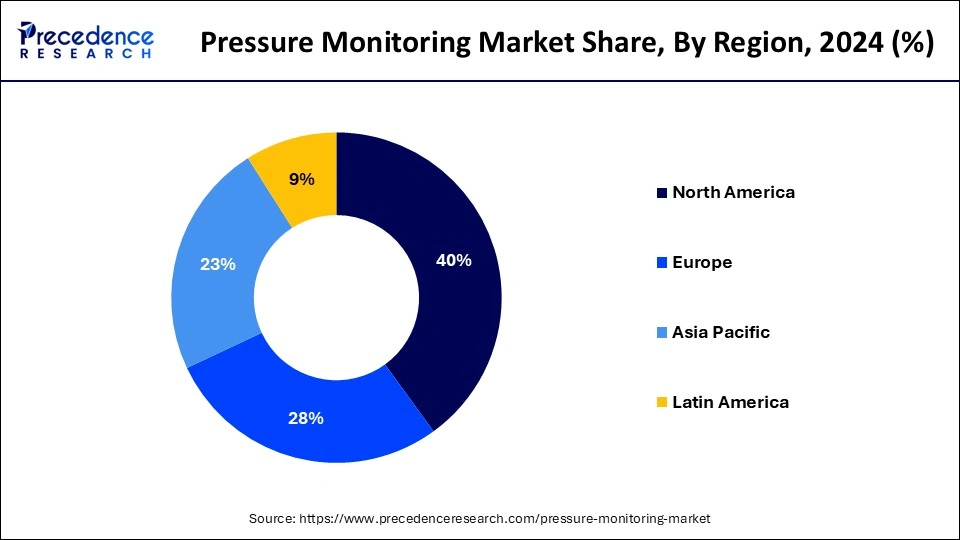

North America dominated the pressure monitoring market in 2023. The region's growth can be credited to the rising incidence of hypertension and high blood pressure, along with innovative monitoring technologies and increasing health awareness among most of the population. Furthermore, more precise and user-friendly home monitoring devices are increasingly establishing an extensive trend toward preventive healthcare.

Asia Pacific is expected to grow at a significant rate in the pressure monitoring market over the studied period. The rise of online healthcare platforms stimulates easy access to innovative monitoring devices, which enables individuals to manage their blood pressure at home. Moreover, the China pressure monitoring market is experiencing advances due to significant healthcare investments coupled with the strong presence of key players in the region.

Top 10 countries with the highest hypertension treatment rate in women in 2019

| Ranking | Country | Rate as % of all Women with Hypertension |

| 1. | Republic of Korea | 77% |

| 2. | Costa Rica | 76% |

| 3. | Kazakhstan | 74% |

| 4. | United States | 73% |

| 5. | Iceland | 72% |

| 6. | Venezuela | 71% |

| 7. | El Salvador | 71% |

| 8. | Portugal | 71% |

| 9. | Canada | 71% |

| 10. | Slovakia | 70% |

Pressure monitoring devices are tools designed to monitor and measure pressure in different systems and environments. Pressure is defined as the force applied over a given area, which has a unit called Pascal’s. Monitoring pressure is important in various medical, industrial, and environmental applications. Pressure monitoring devices have sensors that often utilize technologies such as strain gauges, piezoelectric, and capacitive sensing to detect accurate pressure changes. Pressure transducers are extensively used in medical, automotive, and industrial applications for accurate pressure measurement and control.

AI has shown notable results in managing and predicting hypertension during pregnancy. In the pressure monitoring market, the integration of telemedicine into postmortem and prenatal care was boosted during the pandemic, which allows better BP monitoring and outpatient management. Furthermore, research using ML technology has helped develop personalized care models and understand the risks associated with them.

| Report Coverage | Details |

| Market Size by 2034 | USD 28.69 Billion |

| Market Size in 2023 | USD 11.79 Billion |

| Market Size in 2024 | USD 12.78 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.42% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Procedure, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing preference for home monitoring

The increasing preference for home monitoring is substantially fueling the pressure monitoring market. Many individuals nowadays take charge of their health and wellness. Additionally, there is a growing trend towards monitoring key signs within the comfort of one's home. Devices like respiratory pressure monitors and blood pressure monitors have become necessary tools for people managing chronic conditions like respiratory disorders and hypertension. These devices also help individuals to check their health regularly.

Lack of awareness regarding hypertension treatment in developing economies

High blood pressure is the most prevalent form of disease in developing nations. These regions also have much higher BP averages than the rest of the world. In the pressure monitoring market, individuals with high blood pressure are somewhat ignorant of their illness because of a lack of access to medications that might help them control their BP and lessen the fatal risk associated with heart disease and stroke.

The growing popularity of wearable home blood pressure monitoring devices

The rising trend of utilizing wearable home blood pressure monitoring devices and their integration with smartphone apps can create lucrative opportunities for the pressure monitoring market. Furthermore, wearable patient-monitoring equipment observes different signs of a person, including respiratory rate, heart rate, and blood pressure. The devices also produce a large amount of data that can be used to analyze and predict the future results of patient monitoring. Moreover, smartphone apps are necessary for better analysis and processing of provided health information.

The BP monitors/cardiac pressure monitors segment led the pressure monitoring market in 2023 and is expected to grow rapidly over the forecast period. The growth of the segment can be attributed to the rising prevalence of CVD and hypertension along with Technological advancements like wearable wireless devices. Additionally, the growth of home healthcare solutions and telehealth services can contribute significantly to segment growth. By making these devices more convenient and accessible for patients globally.

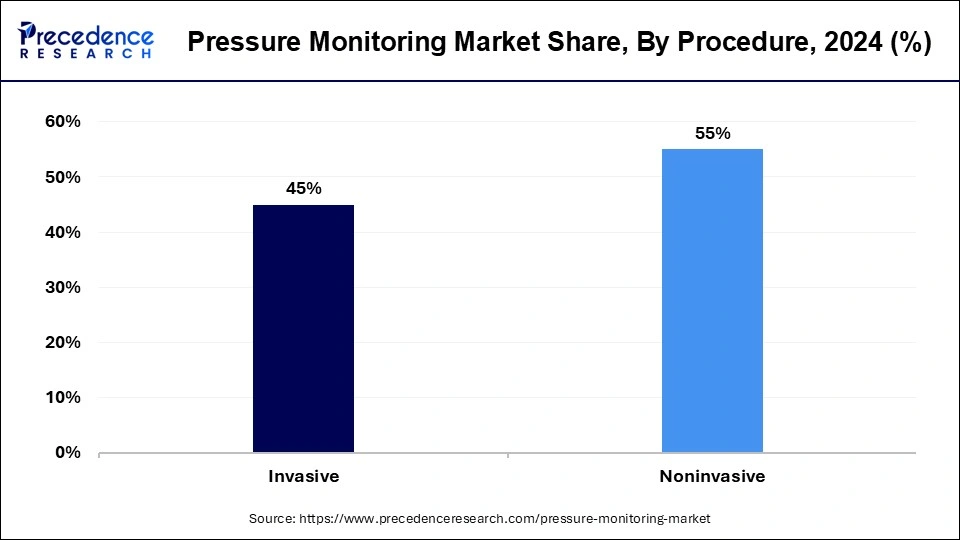

The noninvasive segment dominated the pressure monitoring market in 2023. The growth and dominance of the segment can be credited to the rising patient preference for noninvasive methods because of their comfort, safety, and reduced risk of major complications compared to invasive procedures.

Furthermore, the growing incidence of chronic diseases, with the increasing awareness about daily health monitoring, drives their demand further.

The cardiac disorders segment dominated the pressure monitoring market in 2023. This is due to the rising aging populations and increasing incidence of cardiovascular disorders among elderly populations. Also, enhanced healthcare infrastructure and ongoing government initiatives further boost market growth.

The respiratory disorders segment is anticipated to grow at the fastest rate in the pressure monitoring market over the projected period. The growth of the segment can be linked to the rising prevalence of conditions like chronic obstructive pulmonary disease (COPD), asthma, and pulmonary hypertension. Moreover, advancements in pressure monitoring technology, including noninvasive and portable devices, have enhanced patient outcomes and disease management.

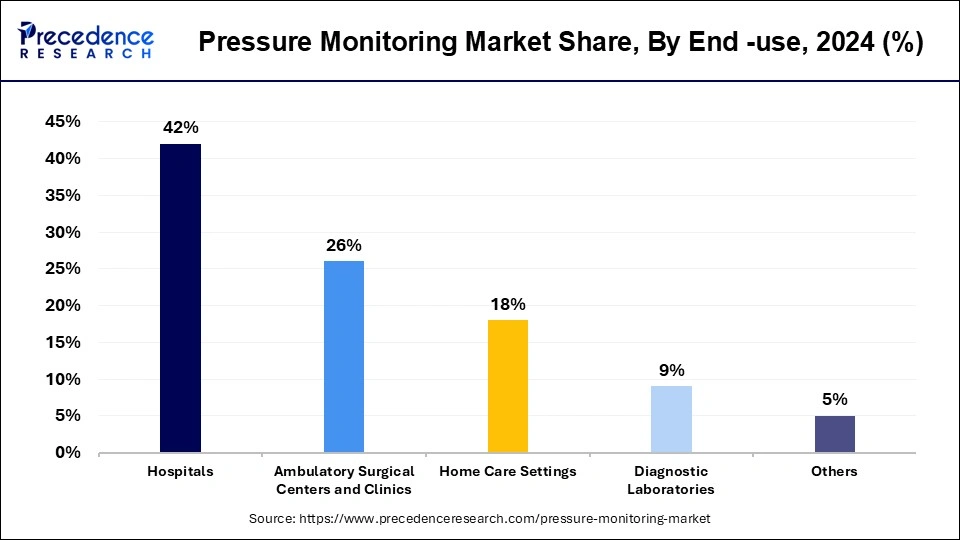

The hospital's segment led the pressure monitoring market in 2023. This is because of the rising need for continuous and accurate patient monitoring along with the advancement in medical technology. Additionally, the growth of healthcare infrastructure improves the adoption of convenient pressure monitoring devices in hospitals by enhancing patient care and outcomes.

The home monitoring segment is expected to witness rapid growth in the pressure monitoring market throughout the forecast period. The growth of the segment can be driven by a rising preference for home-based health management systems and the increasing availability of user-friendly monitoring devices. Furthermore, technological developments have made it easier for individuals to track their blood pressure and vital signals from home, which can help patients control their chronic conditions effectively.

Segments Covered in the Report

By Product

By Procedure

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

December 2024

February 2025