April 2025

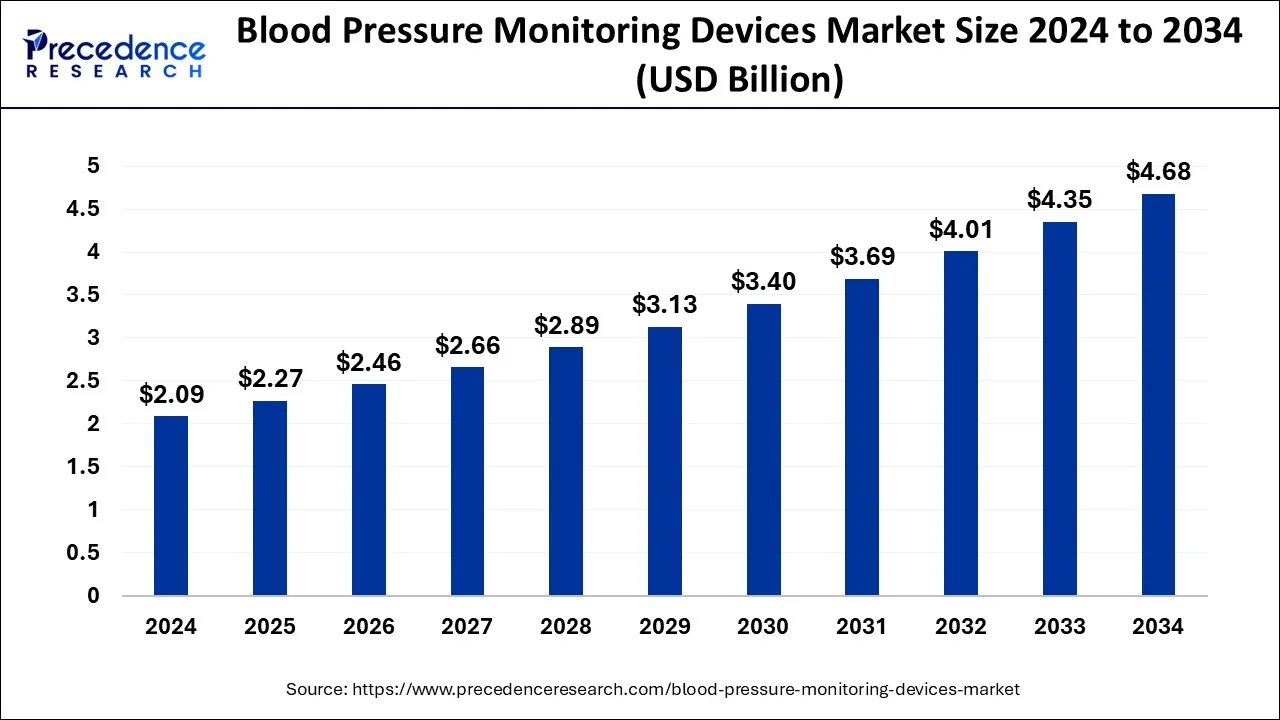

The global blood pressure monitoring devices market size is calculated at USD 2.27 billion in 2025 and is forecasted to reach around USD 4.68 billion by 2034, accelerating at a CAGR of 8.49% from 2025 to 2034. The North America blood pressure monitoring devices market size surpassed USD 780 million in 2024 and is expanding at a CAGR of 8.48% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global blood pressure monitoring devices market size was estimated at USD 2.09 billion in 2024 and is anticipated to reach around USD 4.68 billion by 2034 and is poised to grow at a CAGR of 8.49% during the forecast period 2025 to 2034. Obesity is a leading cause of rising blood pressure, which has increased the usage of blood pressure monitoring devices, ultimately promoting the market’s growth.

Artificial Intelligence (AI) has the potential to completely transform the healthcare industry, especially in the areas of blood pressure (BP) and vital sign monitoring. Despite their effectiveness, traditional approaches are frequently constrained by their dependence on irregular measurements and the requirement for specialized equipment. A new age of continuous, individualized, and data-driven healthcare is being ushered in by generative AI models, which provide fresh ways to get around these restrictions. AI's ability to provide frequent and simple remote data gathering is one of the most important ways it is revolutionizing vital signs monitoring. In a similar vein, AI-powered blood pressure monitoring is surpassing conventional cuff-based devices and may even do away with the necessity for a wearable.

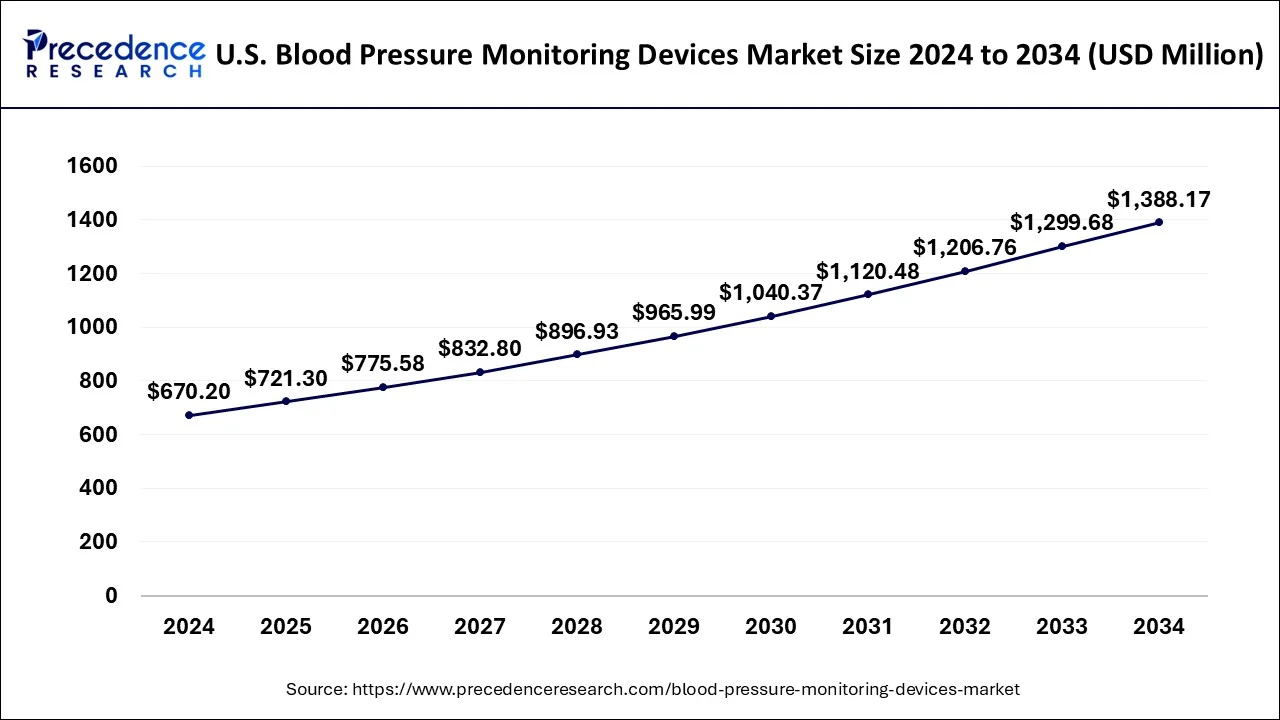

The U.S. blood pressure monitoring devices market size surpassed USD 670.20 million in 2024 and is predicted to be worth around USD 1388.17 million by 2034, at a CAGR of 7.64% from 2025 to 2034.

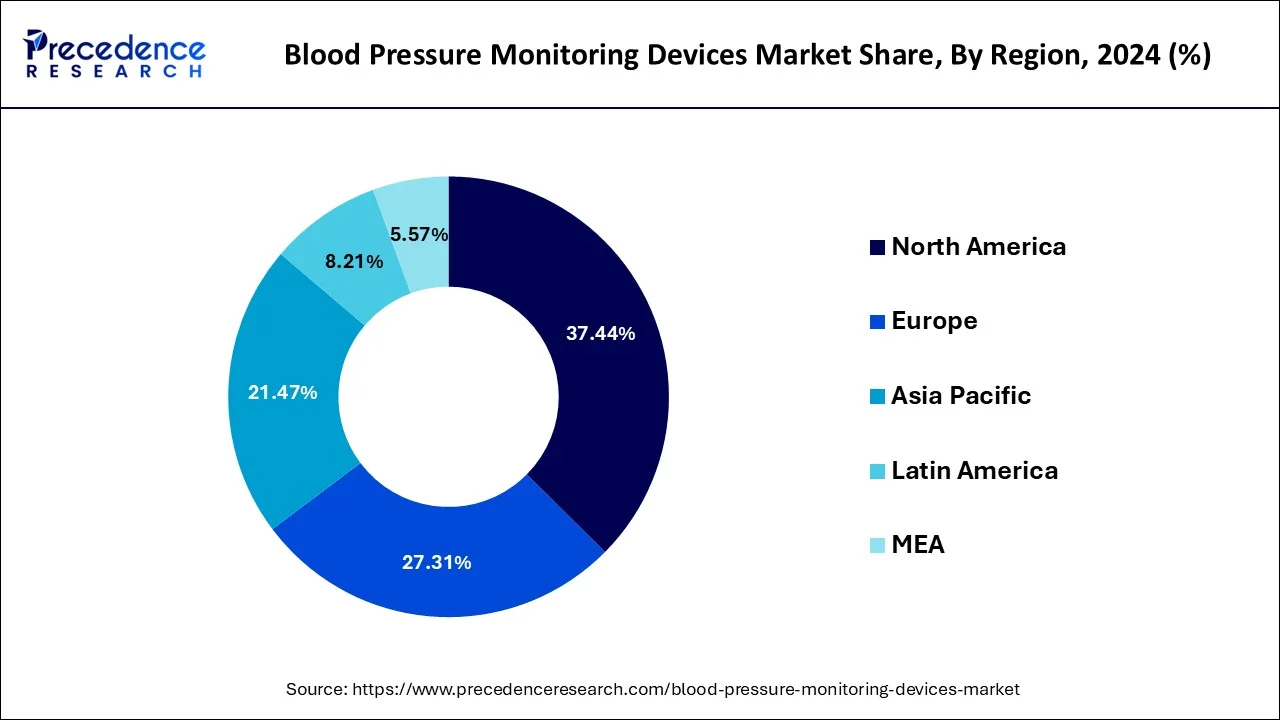

North America led the global blood pressure monitoring devices market with nearly half of the market value share in 2024. This is attributed to the developed healthcare infrastructure along with significant investment for the development of effective and accurate BP monitors in the region.

High blood pressure, often known as hypertension, raises the risk of heart disease and stroke, two of the top causes of mortality in the United States. Clinicians diagnose hypertension in patients and treat them by comparing their systolic and diastolic blood pressure measurements to specific criteria. The hypertension thresholds used by physicians for diagnostic and treatment strategies for patients may range from one clinician to the next:

Canada has been a world leader in hypertension screening, diagnosis, and management for the past two decades. Our national guideline program (which includes our guideline implementation and evaluation teams) has established a global benchmark for evidence-based hypertension care. However, cardiovascular disease remains Canada's greatest cause of death, and we will continue to work hard to prevent, identify, and manage hypertension to improve population cardiovascular health.

Mexico now boasts a population of about 130 million people, with 85 million individuals aged 20 and up. The demographic pyramid continues to have a broader base, which corresponds to persons under the age of 54. Despite projections made 20 years ago that the population pyramid will transition into a mushroom shape as a result of increased life expectancy and adult population growth, this change has not occurred. In Mexico, hypertension has emerged as the most serious noncommunicable chronic disease threat to public health.

Around 30% of the adult Mexican population has hypertension; 75% of them are under the age of 54 (productive age); 40% are unaware, while only 50% of the aware hypertensive population takes medication, and only 50% are under control (140/90 mmHg). Hypertension, dyslipidemia, obesity, and diabetes are all cardiovascular risk factors that frequently coexist in the same person and are amplified by shared pathophysiological pathways.

On the contrary, the Asia Pacific shows attractive growth opportunity in the coming years due to rising level health awareness among people, increasing investment from manufacturers, and rising incidences of hypertension. Chronic diseases such as cancer, diabetes, CVDs, and others are becoming more common as the population ages, resulting in a surge in demand for patient monitoring systems. The demand for wearable devices in the region will be driven by an increase in the prevalence of obesity and a growing awareness of fitness and preventative healthcare. Furthermore, the market is expected to rise faster as remote patient monitoring becomes more widely accepted in hospitals.

The remote patient monitoring market is predicted to grow at the fastest rate in Asia Pacific. Growth in the geriatric population, a quick rise in infectious diseases such as SARS (COVID-19), and increased investments by top industry players are some of the primary driving reasons for the remote patient monitoring market. Emerging economies like India and China have a lot of economic potential in the Asia-Pacific area. In nations like India and China, the fast-growing senior population increased awareness of remote patient monitoring, and rising disposable income presents a big market for remote patient monitoring systems.

Due to the rising aging of the population and the growth in the frequency of chronic diseases, it is projected that the demand for blood pressure monitoring devices will rise globally throughout market analysis. Furthermore, it is anticipated that the rise in healthcare spending in emerging nations and the strong need for proactive monitoring would open up new business prospects for industry participants. Blood pressure monitoring is crucial to assessing the severity of a patient's condition since high blood pressure is also a key cause of a number of illnesses, including heart attacks, strokes, and kidney failure. The rising prevalence of cardiovascular conditions like hypertension, the danger of high blood pressure in the elderly population, and the growing number of lifestyle disorders like diabetes and obesity are the main causes of the rise in the use of blood pressure monitoring devices.

| Report Highlights | Details |

| Market Size in 2024 | USD 2.09 Billion |

| Market Size in 2025 | USD 2.27 Billion |

| Market Size by 2034 | USD 4.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.49% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, and By End-User Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising aging population to drive the demand for blood pressure monitoring devices

The world continues to see an extraordinary and long-term shift in the age structure of the global population, owing to rising life expectancy and declining fertility rates.

Women, on average, live longer than men, therefore they make up the bulk of the elderly population, particularly at advanced ages. The number of elderly people worldwide is expected to more than double over the next three decades, reaching over 1.5 billion in 2050. Between 2020 and 2050, the number of elderly will grow in all regions. The proportion of the global population aged 65 and up is predicted to rise from 9.3% in 2020 to roughly 16% in 2050.

Increasing adoption of patient monitoring solutions to drive the demand for BP monitoring devices

HF management has substantial financial ramifications as well. While global estimates are difficult to come by, direct medical expenditures of HF care continue to climb as the disease's prevalence rises. In 2012, $30.7 billion was spent on HF care in the United States, with that figure expected to double by 2030. In many countries, quality programs have moved the financial burden of HF onto health systems, such as the Hospital Readmissions Reduction Program (HRRP) in the United States, where HF readmissions are the leading cause of Medicare reimbursement reductions. Given these clinical and financial reasons, as well as the inadequacies of present methods, considerable work has gone into establishing more effective HF management strategies.

Rise in cost due to technological advancements

The commercial expansion of blood pressure measurement equipment is seriously threatened by high costs, which continue to be a major problem. Compared to conventional manual devices, advanced blood pressure monitoring systems have greater starting prices and higher maintenance costs since they integrate digital features and artificial intelligence. Adoption rates may be hampered by this price disparity, particularly for poor groups, smaller clinics, and healthcare institutions.

Remote health monitoring and home-based care

The growing tendency of home care replacing hospital treatment is one of the enduring trends. To meet the needs of homecare patients, most major competitors, including Omron Healthcare, are constantly releasing new blood pressure monitors. The usage of Bluetooth-enabled monitors, which have a long battery life, a small form factor, and the ability to monitor themselves, is another trend. These gadgets guarantee patients receive more comprehensive follow-up treatment and assist in sending patient data to the physician.

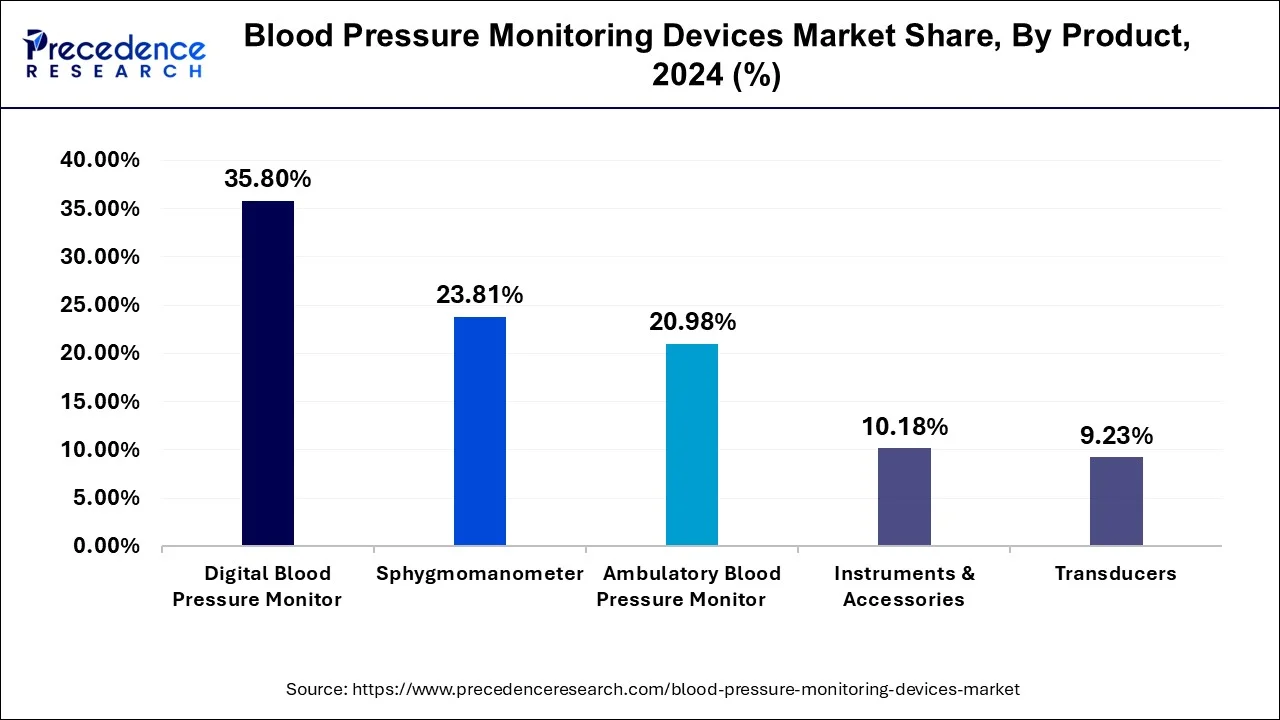

The digital blood pressure monitor segment emerged as a global leader and accounted for more than 35.80% of value share in the year 2024. Technological advancements along with new product launches anticipated to further augment the demand for sphygmomanometers globally. For example, in January 2017, Omron Healthcare, Inc. introduced Omron EVOLV, a wireless and portable upper arm blood pressure monitoring device. In addition, demand for digital sphygmomanometer projected to expand at lucrative CAGR owing to its associated advantages such as ease of use and accurate results.

However, blood pressure cuffs anticipated to grow at a rapid rate over the analysis period on account of rising usage of blood pressure monitors backed by the increasing incidences of high blood pressure. These BP cuffs are available in different sizes, as per the type of patients. Basically two types of cuffs are available in the market that includes reusable and disposable. Amongst them, the disposable cuff segment anticipated to register the highest CAGR due to rising adoption of ecofriendly products coupled with the increasing concern about cross-contamination events at hospitals.

Global Blood Pressure Monitoring Devices Market Revenue, By Product, 2021-2023 (USD Million)

| By Product | 2021 | 2022 | 2023 |

| Digital Blood Pressure Monitor | 577.1 | 631 | 689.2 |

| Sphygmomanometer | 400.6 | 428.8 | 458.4 |

| Ambulatory Blood Pressure Monitor | 333.8 | 367.4 | 403.8 |

| Transducers | 149.4 | 163 | 177.7 |

| Instruments & Accessories | 165.1 | 180 | 196 |

Hospitals segment addressed the largest market value share in the year 2024 attributed to the presence of large patient pool. Further, the rising need for accurate, fast, and effective diagnostic tools for better health outcome anticipated to surge the adoption of BP monitoring devices in the hospital & clinics segment. Rising investment from governments of various regions for the development of hospital & healthcare infrastructure accounts positively towards the growth of BP monitors. Rising investment influence hospital sector to adopt new technologies and devices for early diagnose the problem or disease and cure them.

On the other hand, home healthcare registers the fastest growth of around 12.9% over the analysis period. Increasing availability of smart wearables that provide mobility as well as cost-efficient option for the homecare application is the key factor that drives the overall market growth. Further, increasing cases of high blood pressure along with rising disposable income are the other significant key factors that propel the growth of home healthcare segment.

Blood Pressure Monitoring Devices Market, By End-User Revenue, 2021-2023 (USD Million)

| By End-User | 2021 | 2022 | 2023 |

| Ambulatory Surgical Centers & Clinics | 275.7 | 303.3 | 333.2 |

| Hospitals | 978.5 | 1,057.90 | 1,142.30 |

| Home Healthcare | 371.8 | 409 | 449.5 |

By Product

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

August 2024

March 2024

August 2024