February 2025

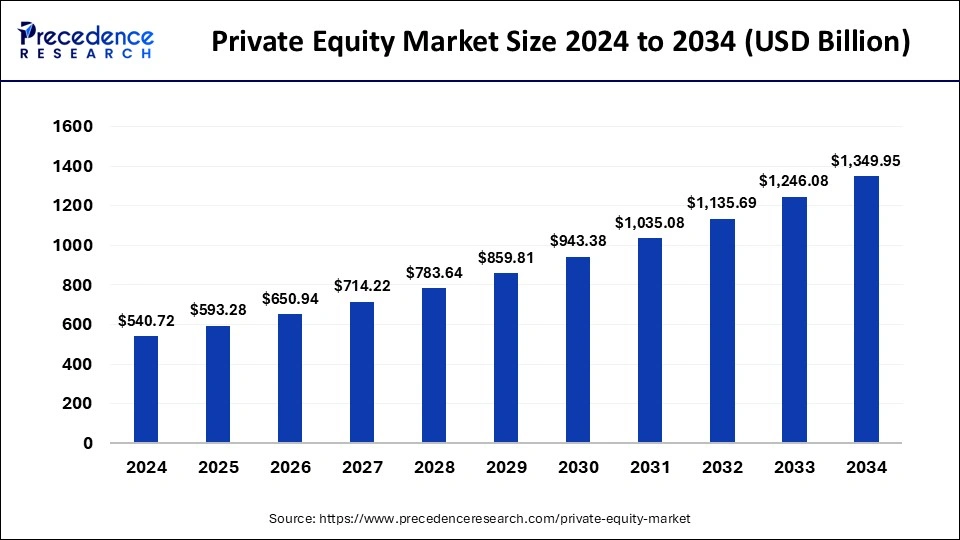

The global private equity market size is calculated at USD 593.28 billion in 2025 and is forecasted to reach around USD 1,349.95 billion by 2034, accelerating at a CAGR of 9.58% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global private equity market size was estimated at USD 540.72 billion in 2024 and is predicted to increase from USD 593.28 billion in 2025 to approximately USD 1,349.95 billion by 2034, expanding at a CAGR of 9.58% from 2025 to 2034. The rising start-up culture is boosting the growth of the private equity market.

Private equity is the process of investment partnership that manages and buys organizations before selling them. It manages investment funds on behalf of accredited investors and institutions. Private equity invests in buyouts as a part of consortium, it requires public and private companies it does not invest in the companies that listed in the stock exchange. It merged with hedge funds, or venture capital as an alternative investment. Private equity funds are working with the management of the acquired organizations, and enhanced strategic changes, working efficiency, and growth strategies to enhance performance and generate return on investment. The increasing demand for capital diversification is accelerating the growth of the private equity market.

Top private equity firms in the United States based on the asset under management (AUM) in as of the first quarter end of 2023:

| Report Coverage | Details |

| Market Size by 2034 | USD 1,349.95 Billion |

| Market Size in 2025 | USD 593.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.58% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fund Type, Sector, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Benefits associated with the private equity

Private equity firms often employ innovative financial structures, such as leveraged buyouts, which can enhance returns. These structures, while sometimes increasing risk, are appealing to investors looking for sophisticated investment strategies. Private equity provides access to unique investment opportunities not available in the public markets. This includes investments in privately held companies, distressed assets, and buyouts, which can offer attractive risk-reward profiles. Private equity typically involves long-term investments, which align with the goals of long-term investors such as pension funds and endowments. This long-term focus can lead to better strategic decisions and value creation that might be neglected in public companies due to short-term market pressures.

Stringent regulations

More stringent regulations typically require greater transparency and disclosure. While this is beneficial for investors, it can be a burden for private equity firms that prefer to operate with a certain level of confidentiality regarding their strategies and operations. This can deter some firms from entering or remaining in the market. Stringent regulations often come with rigid requirements that can limit the flexibility of private equity firms in structuring deals, managing portfolios, and executing investment strategies. This can make it harder for them to adapt to changing market conditions or pursue innovative investment opportunities.

Shift in trends and advancements

The rising market competition private equity is observed to result in the emergence of technological advancements that can help in generating value, creating robust track record for return generation, and making a strong relationship with the major industry players. Additionally, trends like rising interest in the niche markets, the consumer behavior is shifting towards the niche market is driving the further opportunity in the growth of the market. Private equity is gaining attraction from the niche market segment. Additionally, the wide range of industries such as healthcare, rising investment on the development on medical technology, home services, healthcare technology, specialty physicians practices, e-commerce logistics is accelerating the growth of the private equity market.

The buyout segment dominated the market with the largest market share in 2024. The increased adoption of private equity buyout strategies by advisers seeking the increased return value on their investment from traditional public equity. Buyout funds are the funds who are controlling the majority of the stake or ownership of the company, aiming to enhance the operations of the company. The lifecycle of the buyout funds are of the limited years that may have a 7 to 10 years with the different stages like fundraising, investment, and harvest. There are two types of buyouts transactions are leveraged buyout (LBO), and management buyout (MBO).

The venture capital segment is observed to grow at a notable rate. Venture capital investments, although risky, offer the potential for exceptionally high returns. Successful VC investments in companies like Facebook, Uber, and Airbnb have demonstrated the substantial profits that can be achieved, attracting more investors to the segment. Many governments offer incentives and support for innovation and entrepreneurship, which indirectly boosts the venture capital market. Policies such as tax benefits, grants, and favorable regulations for startups encourage venture capital investment.

The technology segment projected the largest market share in the private equity market in 2024. The growth of the segment is attributed to the ongoing development in the technology which more attracted the private equity to technology segment. The rising investment in technological evolution like artificial intelligence, IoT, big data, machine learning, and other advancements. The continuous research on the technological evolution for fulfilling the demand for the rising consumer demand for the technologies which gain the attraction of the private equity investments. Further the launch of technologically advanced products in consumer electronic products, industrial technologies are boosting the growth of private equity investment.

Technology companies typically invest heavily in research and development (R&D), leading to continuous innovation. This ongoing innovation cycle can create sustained growth and new investment opportunities, making the technology sector particularly attractive for private equity. The availability and use of big data and advanced analytics in technology companies allow private equity firms to make more informed investment decisions. Data-driven insights can enhance the ability to identify high-potential investments and manage portfolio companies more effectively.

The financial services segment is observed to grow at the fastest rate during the forecast period. Financial services often require significant capital investments, making them attractive targets for private equity firms that can provide substantial funding to support growth, expansion, or restructuring. Financial services, including banking, insurance, asset management, and fintech, have demonstrated strong profitability and growth potential. These sectors often benefit from steady revenue streams, scalability, and the potential for innovation, making them appealing for private equity investments.

Asia Pacific is expected to witness the fastest growth in the private equity market during the forecast period. The growth of the market in the region is attributed to the rising population and the increasing consumer base and surge in spending and investment on the business are accelerating the growth of the private equity market. The rising infrastructural investment, supportive demographic trends, government initiative, and technological advancements is boosting the growth of the private equity market in the region.

India’s private equity is significantly increasing and remains strong with the increase of approximately 10% against H2 2022 and reached $16.5 billion with the investment at 80%.

By Fund Type

By Sector

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

July 2024

January 2024