January 2025

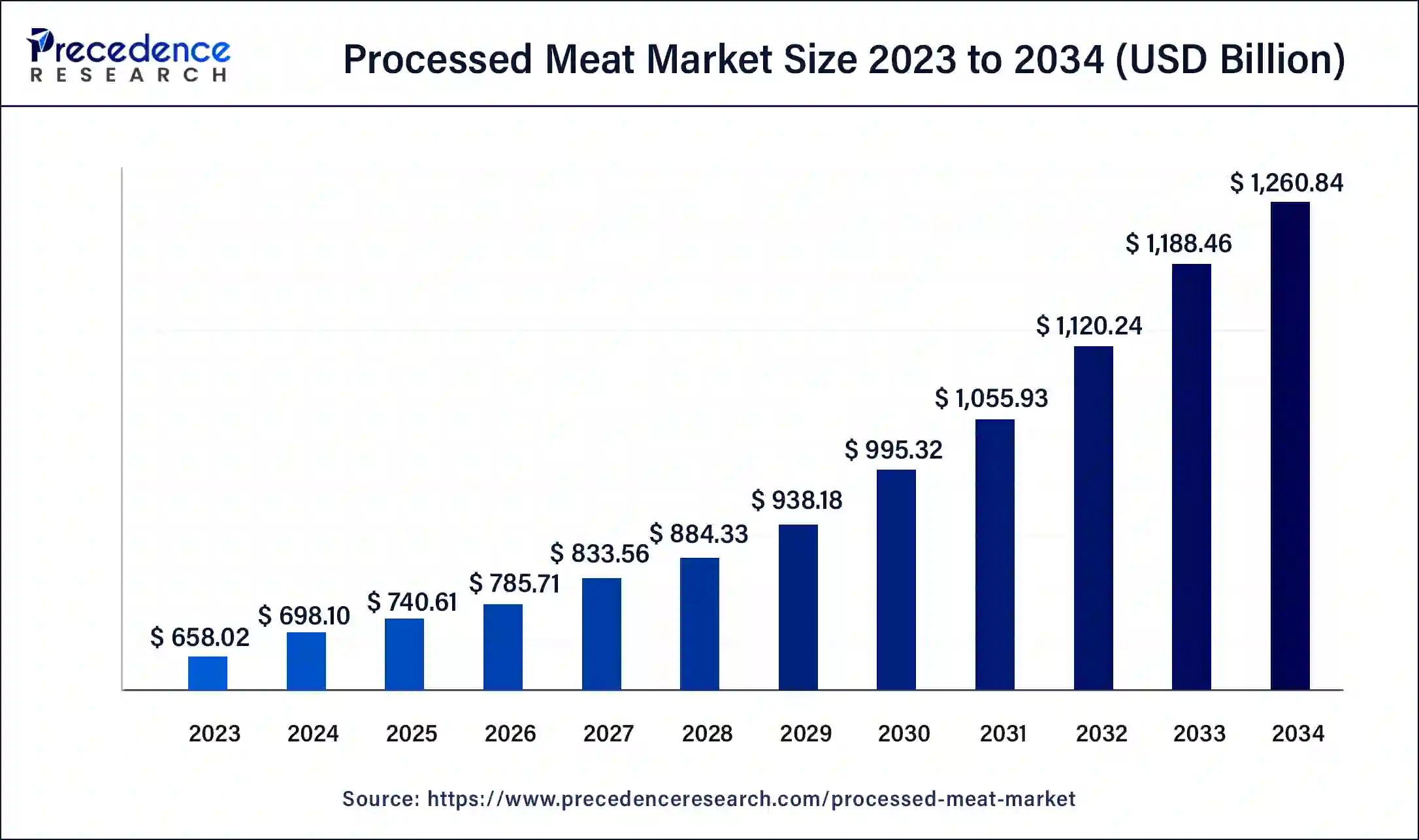

The global processed meat market size was USD 658.02 billion in 2023, calculated at USD 698.10 billion in 2024 and is expected to be worth around USD 1,260.84 billion by 2034. The market is slated to expand at 6.09% CAGR from 2024 to 2034.

The global processed meat market size is expected to be worth USD 698.10 billion in 2024 and is anticipated to reach around USD 1,260.84 billion by 2034, growing at a solid CAGR of 6.09% over the forecast period 2024 to 2034.The rapid expansion of fast-food chains such as Burger King, KFC, McDonald's, Subway, and Taco Bell has significantly influenced the increase the demand of the processed meat market.

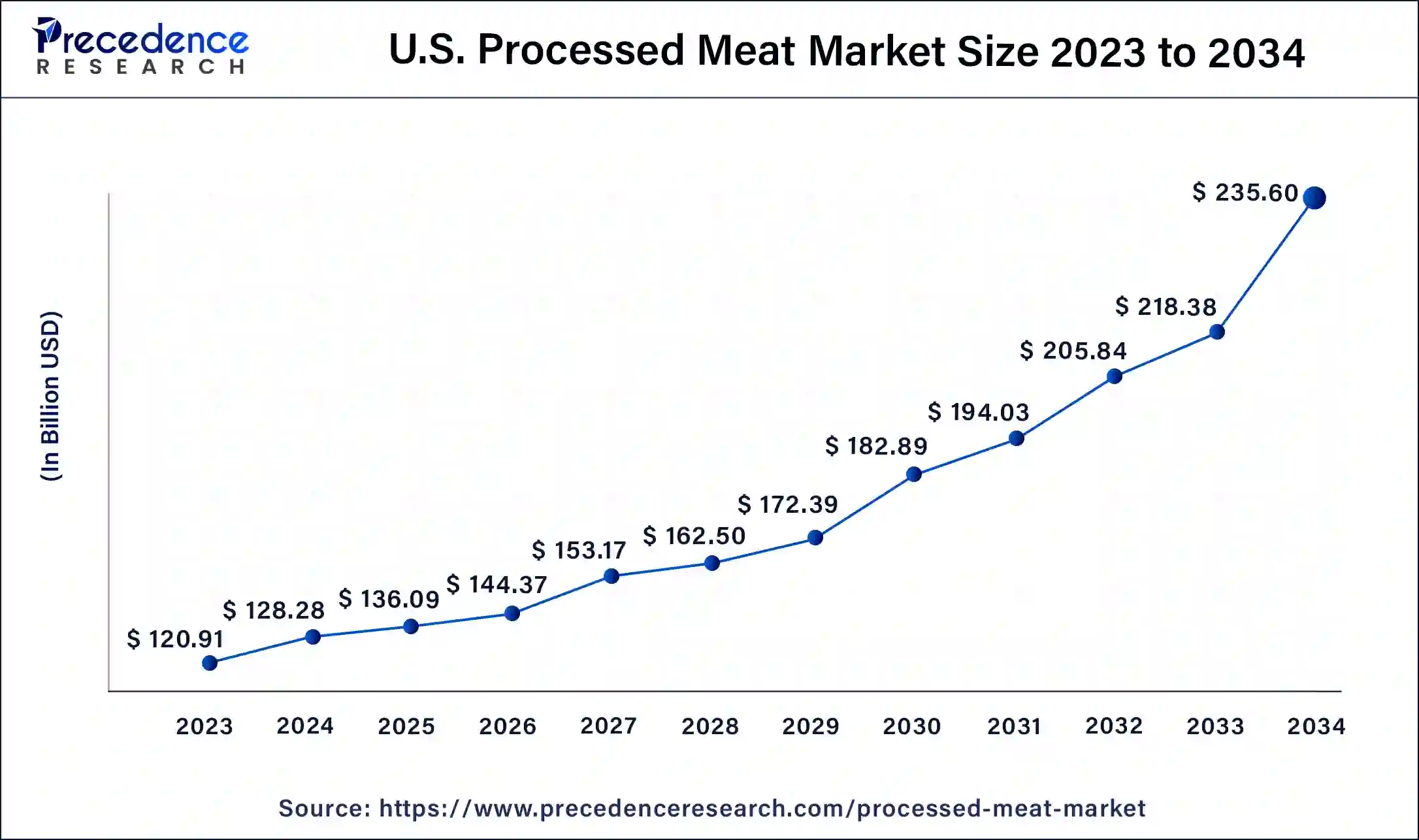

The U.S. processed meat market size was exhibited at USD 120.91 billion in 2023 and is projected to be worth around USD 235.60 billion by 2034, poised to grow at a CAGR of 6.25% from 2024 to 2034.

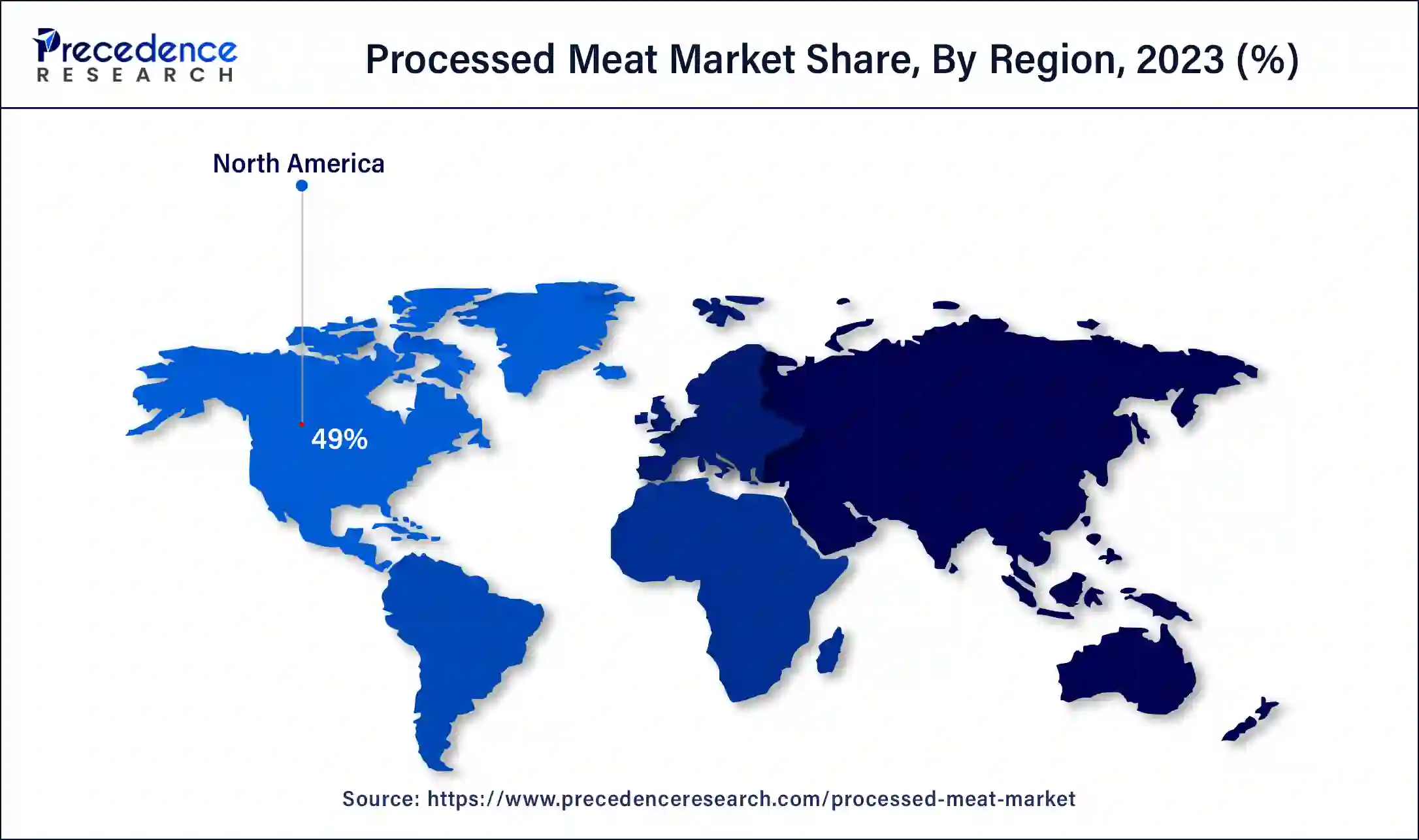

North America dominated the processed meat market in 2023. The demand for ground beef from restaurants and cafes has increased significantly. This growth is driven by a rising preference for ready-to-cook and ready-to-eat foods in the region. In North America, especially in the United States and Canada, consumers are shifting their tastes towards meat-based breakfast options like bacon instead of traditional choices such as pancakes. Due to their hectic schedules, people in this area are increasingly looking for high-quality, great-tasting, ready-to-eat, and ready-to-cook meat products.

Europe is expected to show the fastest growth in the processed meat market over the forecast period, where there is a notable preference for high-quality and traditional meat products. The region is renowned for its strict food safety standards, which have influenced consumer expectations for meat. European buyers place a high value on products with geographical indications, organic certifications, and transparent ingredient labeling.

Processed meat refers to meat preserved through methods such as smoking, salting, fermenting, or adding chemicals to enhance its shelf life and flavor. Commonly processed meats include beef, pork, turkey, chicken, and lamb, which are used to create products like pepperoni, jerky, hot dogs, and sausages. Preservatives are added to these meats to prevent spoilage caused by bacteria and other microorganisms. The processed meat market is widely utilized in both retail and institutional settings. Retail sales are prominent due to consumer preference for purchasing at supermarkets, hypermarkets, and online platforms, while the food service industry, particularly the HoReCa sector, drives additional demand.

The U.S. and China are the primary consumers of chicken in absolute numbers. They rank 7th and 112th, respectively, based on poultry consumption and per capita. Various island nations like Trinidad and Tobago, St. Vincent and the Grenadines, Samoa, and Israel eat more than 60 kilograms of poultry meat per person every year. Moreover, poultry consumption spans America, the UK, Australia, South Africa, and the Middle East.

Argentina's 46 million population eats approximately 47kg of bovine meat per person annually, which is the highest among other countries. South American countries have an intimate culinary history with beef. Because the Spanish settlers brought cattle into this region, which flourished on the green grass. Also, Argentina, Uruguay, and parts of Brazil rank 5th in bovine meat consumption.

Top Bovine Meat Consuming Countries (2020, Food and Agriculture Organization of the United Nations)

| Country | Meat Consumption (Per Capita) |

| Argentina | 46.9 Kg |

| Zimbabwe | 42.3 Kg |

| United States | 37.9 Kg |

| Australia | 37.0 Kg |

| Brazil | 35.4 Kg |

| Uzbekistan | 31.6 Kg |

| Canada | 27.5 Kg |

How is AI innovating the Meat Processing Market?

AI technology holds the potential to enhance both significant production efficiency and product quality in the processed meat market. By deploying AI algorithms, meat processors can achieve precise carcass classification, automate multiple processing tasks, and assess meat quality with greater accuracy. This advanced technology can also be utilized to optimize cutting processes within meat processing facilities and to identify ideal flavor combinations for value-added products. Retailers can leverage AI at the store level to better forecast demand and allow for more accurate assortment and pricing strategies.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,260.84 Billion |

| Market Size in 2023 | USD 658.02 Billion |

| Market Size in 2024 | USD 698.10 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.09% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Animal Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Drivers

Growing demand for protein-rich diets

The rising global awareness of health has driven an increased demand for diets rich in protein, placing meats at the center of many people’s nutritional choices. Protein plays an important role in various bodily functions, such as muscle growth, repair, and overall health maintenance. As a high-protein food source, meats conveniently fulfill these dietary requirements. In response, the market is evolving by offering a broader range of meat products that are processed to preserve nutritional benefits while enhancing flavor and extending shelf life. Moreover, advances in meat processing technologies have also contributed to minimizing unhealthy additives and preservatives, which make meats more attractive to health-conscious consumers. Thus, driving the growth of the processed meat market.

Ethical and environmental concerns

Growing awareness of issues related to animal welfare and the environmental impacts of meat production, including greenhouse gas emissions and deforestation, could lead to a decrease in meat consumption, which can affect the processed meat market. Additionally, incidents of foodborne illnesses, contamination events, or negative media coverage concerning processing practices may undermine consumer trust in processed meat products.

Increasing focus on packaging innovations

Rising focus on packaging innovations is the primary factor shaping market growth. The key players use advanced packaging to stay ahead of the market competition. Other than that, innovative packaging also supports raising the shelf life of products, which makes them tougher. The implementation of innovative packaging such as MAP (modified atmosphere packaging), vacuum skin packaging, and vacuum packaging by companies is making it more convenient to handle. Furthermore, the rising need for such advanced packaging solutions can encourage key market players to come up with new solutions. Which can attract customers and thus present several opportunities in the processed meat market.

The frozen segment dominated the processed meat market in 2023. Frozen meats are increasingly popular with consumers due to their convenience, extended shelf life, and ability to retain nutritional value. From whole cuts to pre-cooked and ready-to-cook varieties, frozen meats offer versatile solutions for different meal preparations. This segment benefits from evolving consumer lifestyles that prioritize ease and Flexibility in meal planning. Furthermore, Advances in freezing technology have enhanced the taste and texture of frozen meats, making them an attractive choice for those who value both quality and convenience in their food options.

The chilled segment is expected to grow at the fastest rate in the processed meat market over the forecast period. This is because chilled beef is primarily used as a buffer between the manufacturing, transportation, and consumption stages. When stored, the meat undergoes aging, during which enzymes naturally break down proteins, gradually making the meat more tender and enhancing its flavor.

The poultry segment led the global processed meat market in 2023. Poultry, particularly chicken, is popular due to its broad consumer acceptance, health benefits, and versatility in various cuisines. As a lean protein source with lower saturated fats compared to red meats, it aligns well with health-conscious trends. Moreover, its widespread availability and affordability further solidify its leading position in the market. Advances in poultry processing, packaging, and flavoring have expanded the range of products, which meets diverse consumer tastes and preferences.

The pork segment is observed to grow at a notable rate in the processed meat market during the forecast period. Pork enjoys a significant consumer following, especially in Asia, Europe, and the Americas. Its popularity stems from its versatility, flavor, and fat content, which make it ideal for a variety of processed products like bacon, ham, sausages, and salami. Demand for pork products is strongly influenced by cultural acceptance and dietary preferences.

The supermarkets/hypermarkets segment held the largest share of the global processed meat market in 2023. Supermarkets, smaller than hypermarkets, provide a broad selection of everyday items, including groceries, household products, and personal care essentials. Hypermarkets, in contrast, are much larger and combine the functions of both a supermarket and a department store. Moreover, retailers are concentrating on developing advanced retail formats and sophisticated shopping environments, which are expected to further drive growth in these market segments.

The online retail segment is observed to witness the fastest growth in the processed meat market during the forecast period. This is due to direct-to-consumer (D2C) e-commerce becoming increasingly popular in the food industry. Online sales have surged by 200% compared to traditional in-store purchases. Home cooks prefer buying directly from farms to reduce the risk of adulteration. Additionally, 54% of these buyers have also shopped for meat online. Two-thirds of online meat shoppers are likely to recommend it to others, which can further drive growth in this segment.

Segments Covered in the Report

By Type

By Animal Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

August 2024

August 2024