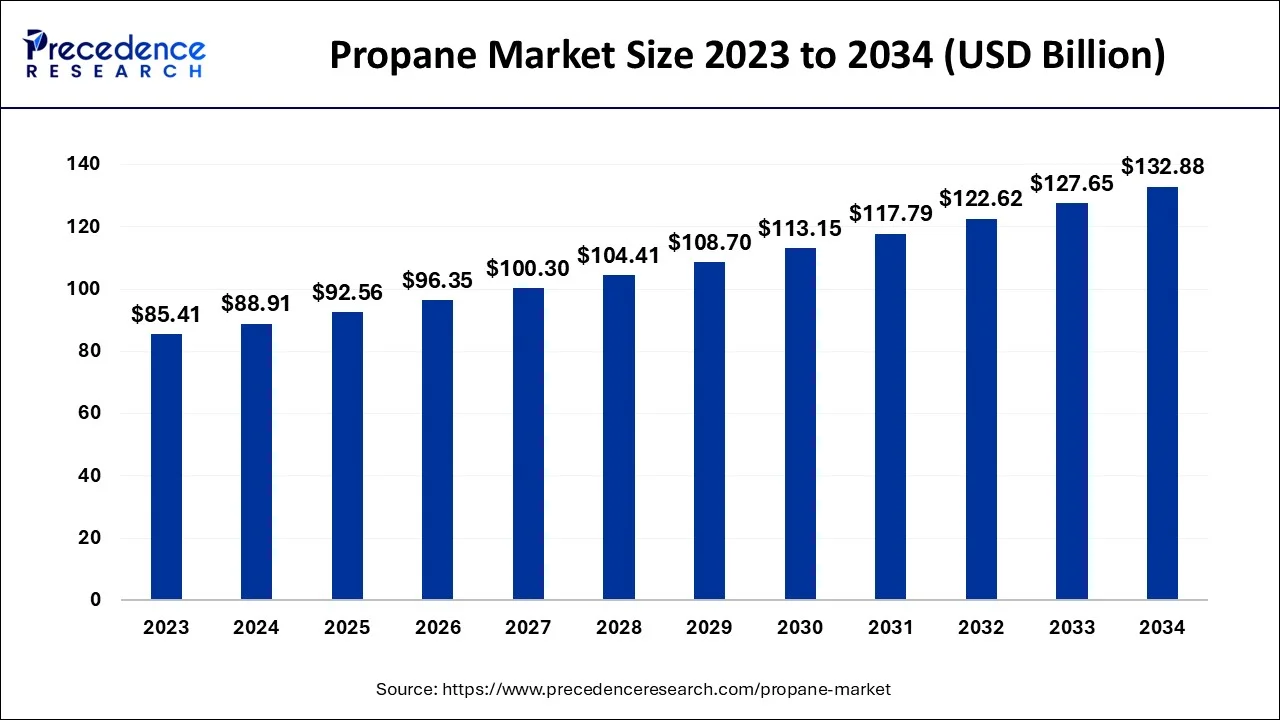

The global propane market size accounted for USD 88.91 billion in 2024, grew to USD 92.56 billion in 2025 and is predicted to surpass around USD 132.88 billion by 2034, representing a healthy CAGR of 4.10% between 2024 and 2034.

The global propane market size is estimated at USD 88.91 billion in 2024 and is anticipated to reach around USD 132.88 billion by 2034, expanding at a CAGR of 4.10% from 2024 to 2034.

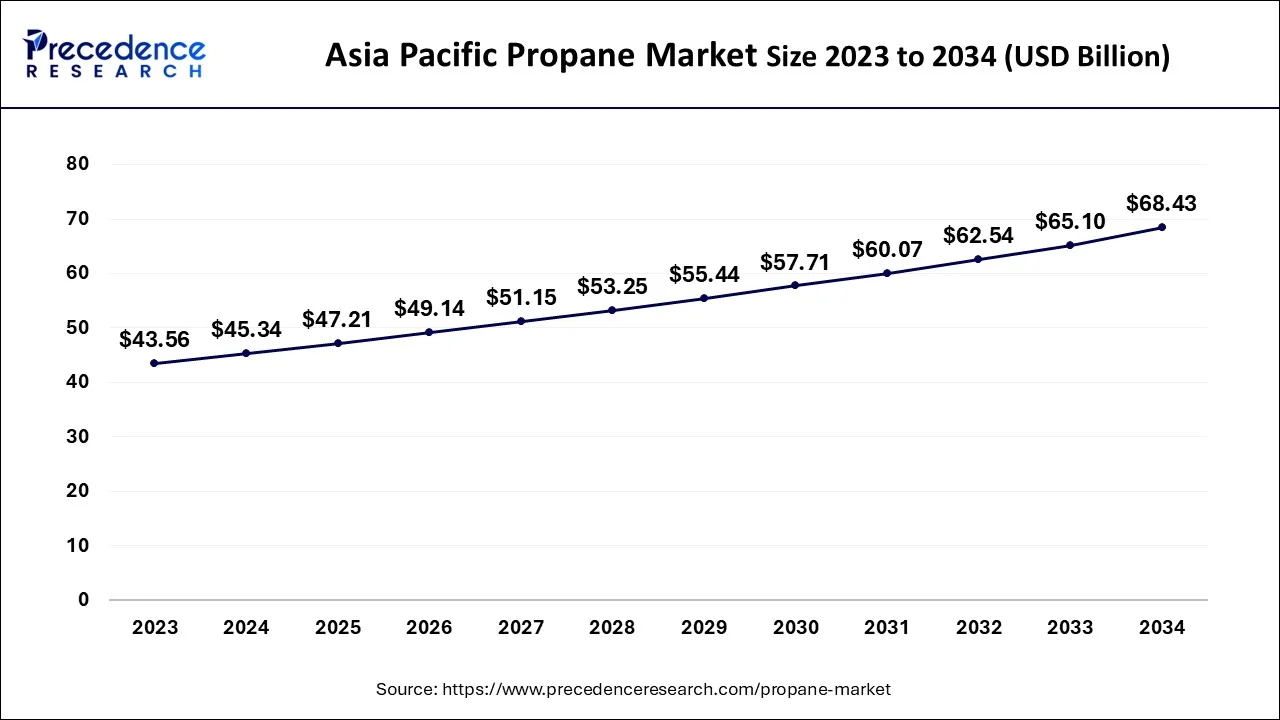

The Asia Pacific propane market size is estimated at USD 45.34 billion in 2024 and is expected to be worth around USD 68.43 billion by 2034, rising at a CAGR of 4.19% from 2024 to 2034.

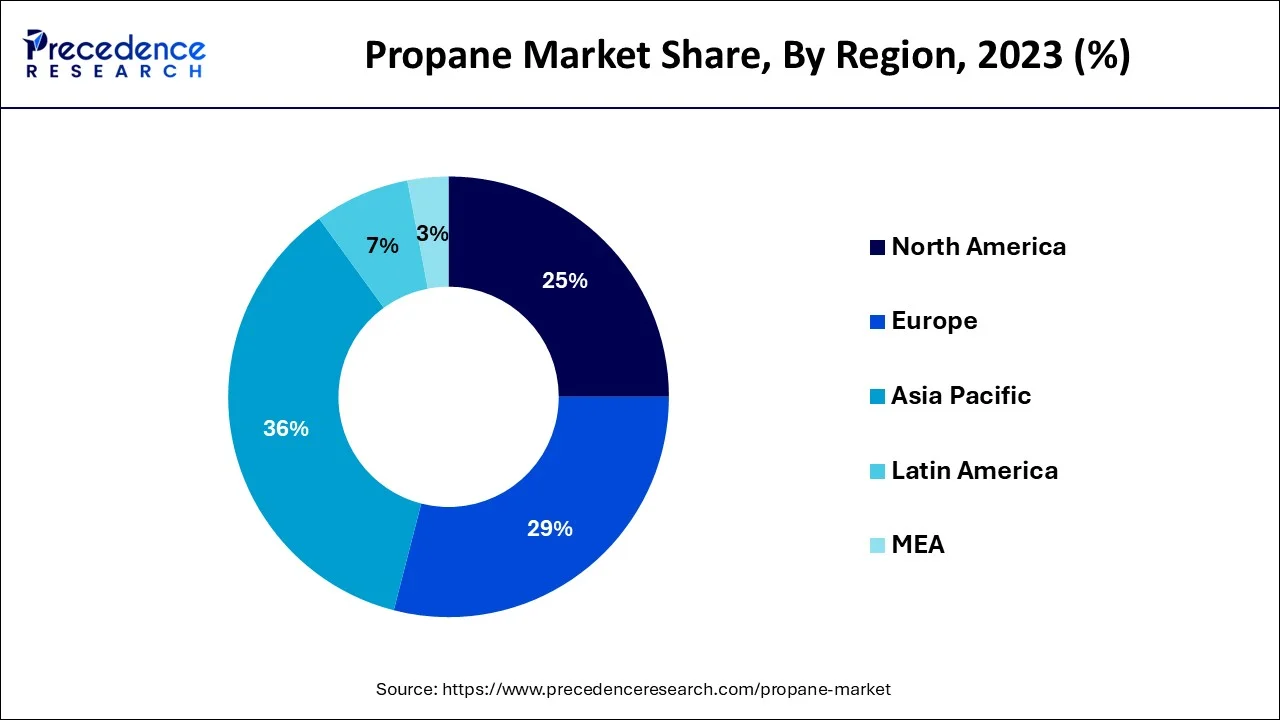

Manufacturing and commercial sectors are anticipated to increase as a result of rising countries like China, India, and Mexico's rapid industrialization and high GDP growth rate. India saw the maximum GDP growth rate in 2015, at 7.5%. Over the projection period, it is anticipated to increase production activities throughout the Asia Pacific, leading to a rise in the need for downstream chemical processing. In 2022, Europe was the top-performing area, contributing more than 30.2% of the total income. Eastern Europe's emerging economies, in particular, have been seeing rapid economic expansion. Future demand patterns in the area will be shaped by population increase and rising living standards. It is used in homes for cooking, lighting, chilling food, heating water, and air conditioning. Homes in Europe and North America frequently include a large tank that holds the gas under pressure as a liquid. Liquid gasoline may be stored in a conventional residential fuel tank for 500 - 1,000 gallons. Many people use propane-fueled grills all around the world. Recreational vehicles (RVs) are also equipped with technology that runs on this fuel as a portable energy source for hot water, cooking, and refrigeration. The United States was the largest manufacturer and user in the world. High economic growth in the United States is a contributing factor to the country's rapid urbanization and growing housing demand. People from rural regions are migrating to cities in pursuit of higher-paying jobs.

Following North America, Asia Pacific accounted for more than 21% of total sales in 2023. Regulations pertaining to quality and safety are what mostly determines the progress of consumption in the United States and Canada. Standardized regulations for the production, storage, and delivery of gases define the area. Additionally, the availability of raw materials and a sizable shale gas reserve are anticipated to fuel expansion throughout the projection period.

The residential sector's rising demand for furnaces, water heaters, air conditioners, fireplaces, and other home appliances, the automotive industry's rising demand for low-sustainability fuel, and rising construction activity demand in both developing and developed regions are all anticipated to support the growth of the global propane market. Additionally, it is projected that increased demand for uses such as metal-cutting torches and snow melting will fuel market expansion throughout the projection period. The total market, however, may be hampered by considerations including expensive installation and maintenance costs, safety concerns with propane handling, and the depletion of fossil resources.

Emerging markets' unrealized potential presents promising growth prospects. Due to its low carbon content, propane is gradually becoming a favored alternative to fossil fuels like gasoline and diesel. Because it is more widely accessible, affordable, and steady than other energy sources, propane is in high demand and its market is expanding quickly. Due to increased investments and the implementation of government initiatives to use cleaner fuel, the residential and commercial sectors are some of the predominant users of propane as a result of the rapid industrialization and urbanization in developing countries, supporting the industry's growth. Making the best use of natural resources is becoming increasingly important in the industrial sector in order to boost overall efficiency and profitability. As a result, the propane business is expanding at a faster rate.

Additionally, due to a significant rise in home demand for propane for domestic cooking during the COVID-19 epidemic, the market expanded positively. Additionally, the demand for propane in the Asia Pacific area is sharply increasing due to the growing pollution levels in nations like China and India. Propane's market growth is being positively impacted by the launch of several municipal programs that promote the use of alternative fuel as a way to reduce pollution in China, where the Autogas industry has grown significantly.

| Report Coverage | Details |

| Market Size in 2024 | USD 88.91 Billion |

| Market Size by 2034 | USD 132.88 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.10% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Increasing propane demand in the agriculture sector

Propane's status as a finite fossil fuel

LPG consumption will rise in residential applications

A combination of combustible hydrocarbon gases, which includes the often-used fuel propane, make up liquefied petroleum gas (LPG). The main component of LPG is propane. In certain countries, it makes up very close to 100% of the LPG component. The need for LPG for domestic energy needs is being driven by the rapid growth in disposable income around the world, especially in developing nations like India. A modern energy source with no impact on the atmosphere is LPG. It is used for a variety of purposes, including heating, cooking, agriculture, and entertainment. LPG supply has increased as shale gas extraction has increased. Global LPG usage has increased as a result of initiatives by local and international organizations to encourage consumers to convert from dirty to clean energy sources. Thus, throughout the projection period, growth in LPG usage for home purposes is expected to fuel propane demand all over the world.

In 2023, industrial grew to become a significant end-use sector and contributed to more than 39% of total sales. The expansion of the metal manufacturing industry is seen as a significant demand generator for the industrial sector during the next coming years, notably in Middle Eastern and Asian nations. In the Asia Pacific area, end-use businesses can afford to utilize pricey items because of low labor costs and reasonable operational costs. Because of the rising demand for manufactured goods, the industrial category is expected to continue to be a quickly expanding end-use industry. Metalworkers utilize tiny tanks with cutting torches in the industrial section. Wintertime comfort for construction and road workers is provided by gas-powered semi-portable as well as portable heaters. In addition, it is utilized to provide heat for new roadway construction and maintenance. Because propane burns cleanly, forklift trucks fueled by propane may securely work inside factories and warehouses. Additionally, because of its clean-burning properties, it is perfect for a variety of industrial applications, including cutting and brazing, soldering, preheating, shrink-wrapping, and heat treatment. It is a specialized gas that is blended and used in the petrochemical sector to standardize process control analyzers.

The item is also utilized in refrigerant blends, as an aerosol propellant, or as a refrigerant. Due to extensive use in hotels and restaurants for food preparation, commercial end-use is the second-largest market. During the projection period, the residential category is anticipated to rise at a CAGR of more than 5.2%. Propane is used for space heating, cooking, and burning in homes. In several nations, propane is utilized extensively for heating water as well as other purposes. The demand for propane will probably increase as a result in the coming years.

In 2022, the propane market's highest share belonged to the HD-5 category. Consumer-grade propane is referred to as HD-5-grade propane. Compared to HD-10 propane, commercial propane, and other types of accessible propane, it is the highest grade. HD-5 designates that propane can be used as an engine fuel. Propane that meets the HD-5 criteria must include at least 90% propane, no more than 5% propylene, and additional gases such as isobutane, butane, methane, and others in the remaining percentages. The term "highest quality propane" refers to propane that complies with the requirements necessary to sell and label as HD-5 propane. As a result, during the course of the projected period, the market for propane will expand in tandem with the expansion of the HD-5 propane sector.

By End Use

By Grade

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client