July 2024

Property and Casualty Insurance Market (By Product: Homeowners Insurance, Renters Insurance, Condo Insurance, Landlord Insurance, Others; By Distribution: Tied Agents and Branches, Brokers, Others; By End-users: Individuals, Governments, Businesses) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

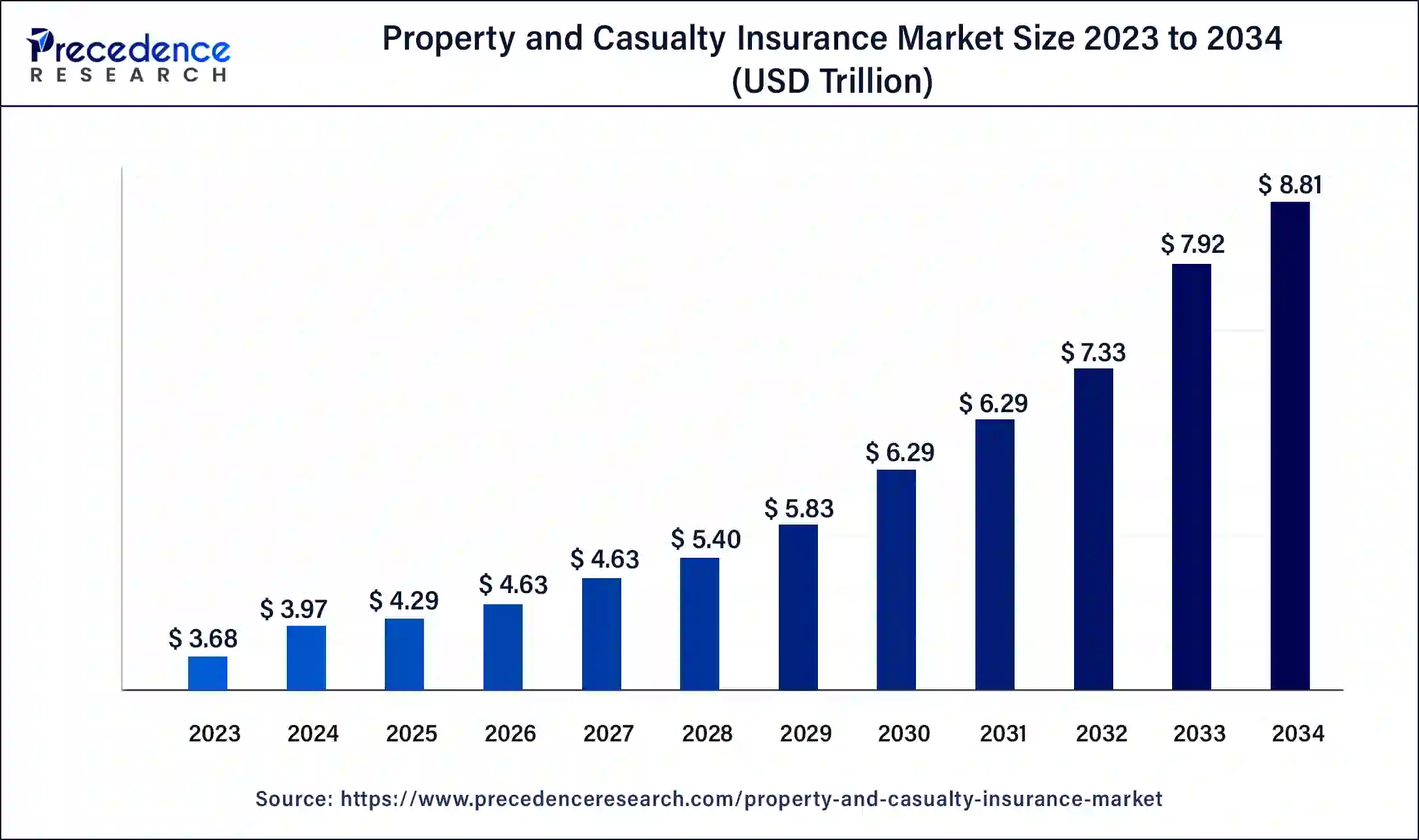

The global property and casualty insurance market size was USD 3.68 billion in 2023, calculated at USD 3.97 billion in 2024 and is expected to reach around USD 8.81 billion by 2034, expanding at a CAGR of 8.3% from 2024 to 2034.

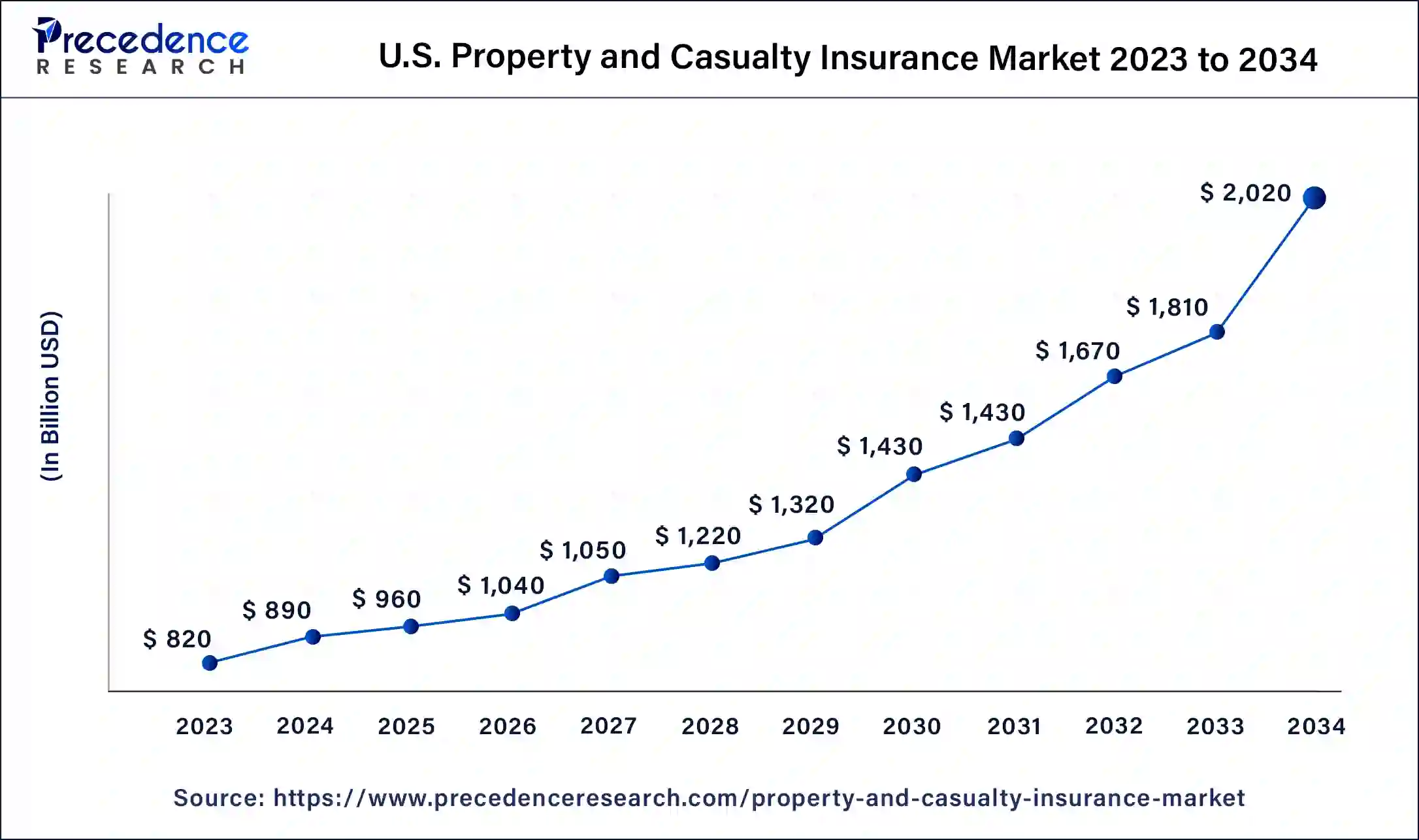

The U.S. property and casualty insurance market size was estimated at USD 820 billion in 2023 and is projected to hit around USD 2,020 billion by 2034, at a CAGR of 8.54% from 2024 to 2034.

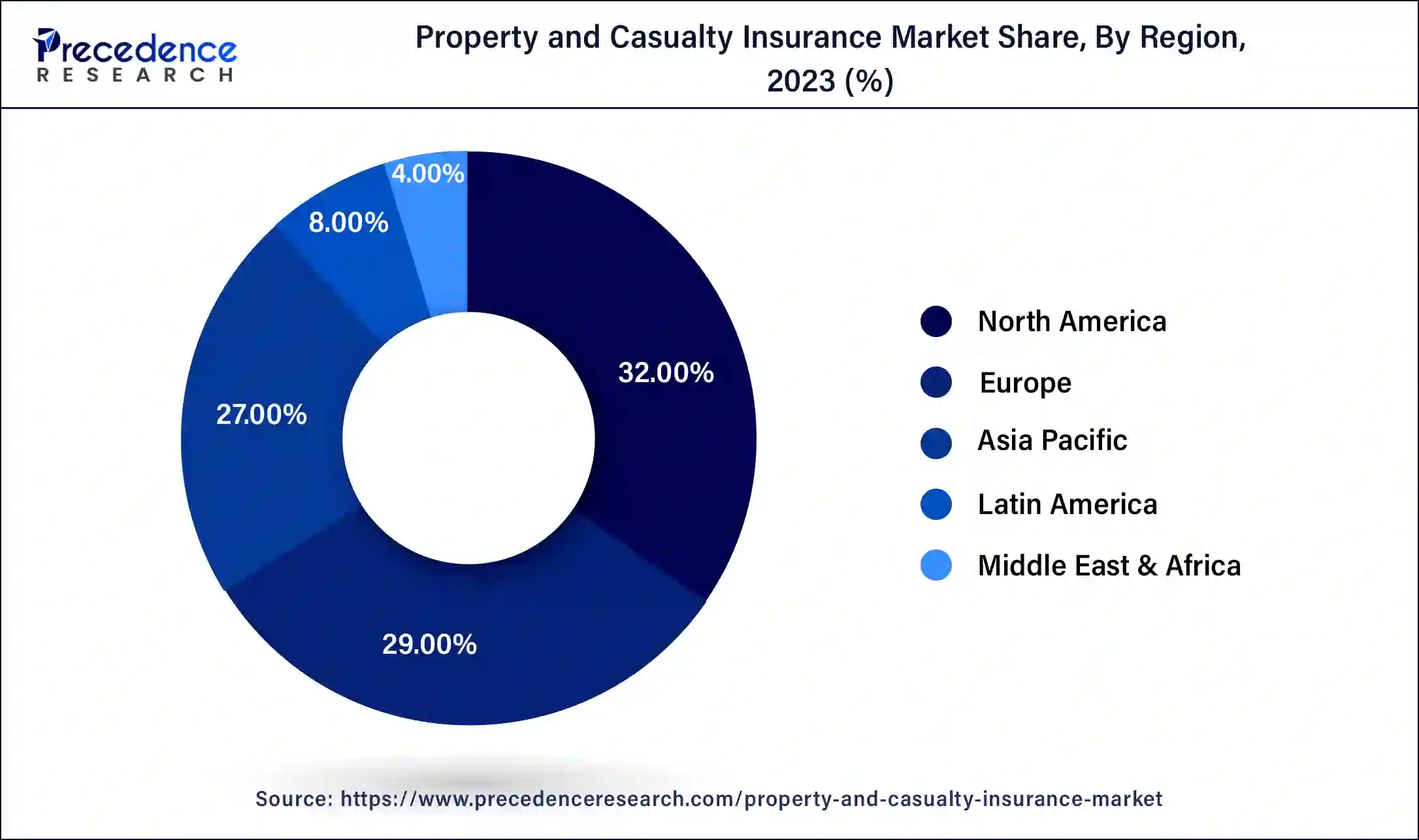

North America dominated the property and casualty insurance market in 2023 as the population here is more aware of the benefits of insurance. Along with this, there are many regulatory bodies, such as the state-based insurance regulatory system and the NAIC acts, which act as a forum for federal regulation of insurance. The U.S. has insurance groups that create awareness, and the benefit of having insurance groups is increased survivability. Along with that, Canada is also growing the market, increasing and more.

Asia Pacific is expected to grow at the fastest rate during the forecast period due to increased awareness of insurance benefits in the region and the importance of robust insurance along with natural disasters. also increases the insurance demand in the property and casualty insurance market. The region has countries like China and India, which boost the market. The increasing population of India and China are crucial factors in growth. In the region, countries such as India have many public and private organizations that provide insurance, and the most popular company is LIC, which provides insurance to consumers. Along with that, China is also growing the market, with increasing demand. China has two major organizations that make sure that all the rules and regulations related to insurance are followed properly. These organizations are the Insurance Association of China and the Insurance Institute of China.

The property and casualty insurance market provides car insurance, bike insurance, home insurance, life insurance, health insurance, and others, including liability insurance for any damage, injuries, and accidents. The market is continuously growing due to the growing number of benefits such as economic growth, capital generation, and certainty. Now, people are more educated and aware of the benefits and many types of insurance, and many companies provide so many types of insurance and use advanced technology that makes workflow easy for companies and increases the adoption of property and casualty, which leads to market growth.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 8.3% |

| Global Market Size in 2023 | USD 3.68 Trillion |

| Global Market Size in 2024 | USD 3.97 Trillion |

| Global Market Size by 2034 | USD 8.81 Trillion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Distribution, End-use. and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Benefits of different insurance

As the economy grows, the adoption of insurance increases, and people are investing so much in liabilities these days, which increases the insurance rate in the market. Also, people are now aware of the different types of benefits that insurance gives, such as providing protection, certainty, risk sharing, the value of risk, saving habits, and more. Many types of insurance provide benefits such as life, health, education, travel, and more. These benefits drive market growth.

Rise in cloudification and digital workplace adoption.

In the property and casualty insurance market, there is so much increased demand for all types of insurance, including health & life insurance, and some insurance, such as cars and bikes, is mandatory by the government for people to get. Due to this, there is so much insurance data for companies that it is hard to maintain and secure the information, where clarification is a significant solution, which so many companies use to increase their sales. Also, cloudification and digitalization provide some benefits, such as a smooth and fast app user experience, no outages for users and clients, ease of management, less operational cost, on-demand scaling for infrastructure, increased security, and more. These benefits enhance the user experience, and this technology provides a flexible way for consumers to get insurance from any application; in the insurance industry, the evolution of digital transformation makes insurance companies more profitable, and that increases market growth.

Increasing cyber-attacks and fraud

In the property and casualty insurance market, as the economy and technological advancements grow, the risk of cyber-attacks is increasing. This can be a barrier for companies as they face challenges in securing consumer data, and that also affects consumers' belief in the insurance market. During the COVID-19 pandemic, the use of digital platforms increased, which increased the number of cyber-attacks in the market. As the property and casualty insurance market grows, the market fraud is increasing. In the market, many fake companies scam people, and because of that, many people avoid investing in insurance, which negatively impacts the market growth.

Rise in the adoption of AI and advanced analytics

Advanced analytics and AI offer new opportunities in the property and casualty insurance market. The integration of AI and advanced analytics can be a significant solution to many problems in the market. Some companies are already using these technologies, such as touchless claims, chatbots, and self-service portals. Also, some insurance apps incorporate chatbots, which simplifies the workflow for companies. Along with that, using deep learning, many insurers are generating underwriting decisions for better accuracy.

Blockchain technology

The use of blockchain in the property and casualty insurance market can make work easier for companies and consumers by using blockchain technology, consumers can reduce the reviewing claims and third-party checking payment costs. Also, by using blockchain technology, consumers can save lost time because of these benefits, so many companies are using this technology and growing the market.

The homeowners insurance segment dominated the property and casualty insurance market in 2023 due to some benefits such as extensive protection and coverage against natural disasters, providing cost-efficient protection, protection against theft or third-party liability, protection towards the structure of the home like if a home got damaged such as from fire, hail, or any disaster that time home insurance will provide repairing the house and liability coverage. These benefits are the main reason behind the segment's growth. Along with that, people are now more aware of the benefits of home insurance, which also grows the market.

The renters insurance segment is also growing in the property and casualty insurance market because of some benefits, including relatively affordable liability coverage, which means protection while injured during accident time, and covers losses to personal property like if any personal thing such as clothes, luggage, furniture, and computer along with that some landlord might require it and that renters insurance cover additional living expenses.

The brokers segment dominated the property and casualty insurance market in 2023 due to benefits including competitive prices and providing insurance for all types of needs such as car, home, business, and farm insurance. Brokers also save lots of time and money in finding the best insurance and protection. Brokers now provide online services as well anywhere. They provide service on the phone by email or call, and that is best for people who don’t have enough time to research any type of insurance due to their hectic lifestyle, and these benefits are growing the segment in the market.

The tied agents and branches segment is expected to grow at the fastest rate during the forecast period. Because the client offers the best deal to the insurers, or they work as a localized point of content, and this localized approach provides face-to-face interaction. Tied agents and branches have in-depth knowledge about any insurance, and they meet face-to-face consumers, which increases the trust between consumer and broker, and this is growing the segment in the market.

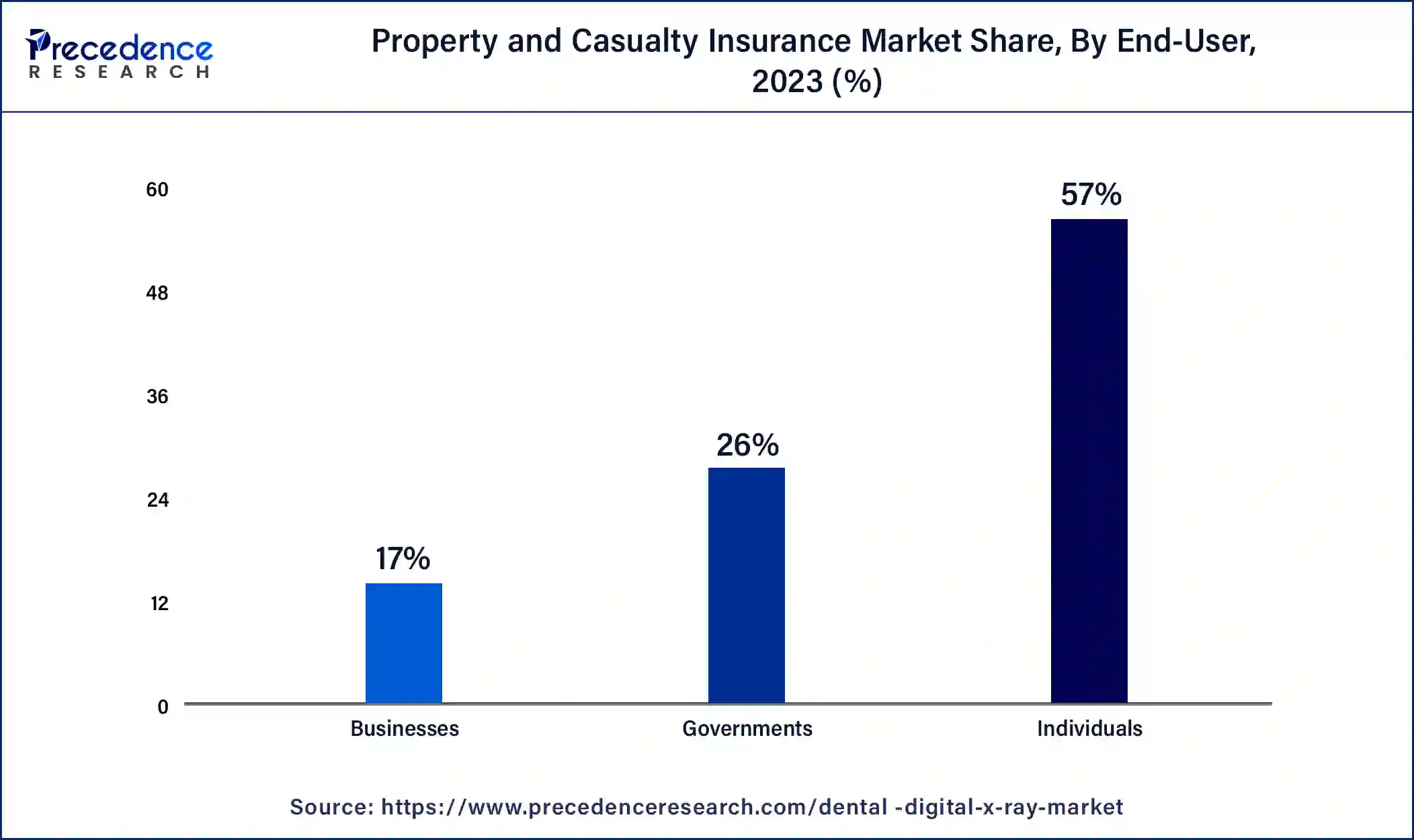

The individual segment dominated the property and casualty insurance market in 2023 due to some benefits, such as individual insurance, which is a medical or health-related plan that covers a single employee and their family. Individual insurance is good for people who want insurance for any specific need. It’s less typical insurance for employees. This insurance is for people such as independent contractors or freelancers, self-employed, and unemployed individuals.

The business segment is expected to grow at the fastest rate during the forecast period. This segment consists of businesses seeking insurance coverage for liability, property damage, and business interruption. This segment provides coverage tailored to the unique risks faced by businesses. Business insurance provides many benefits, including protecting employees like medical care, missed wages, and funeral benefits. Insurance protects your customers through public relations and liability. Also, business contracts may require insurance, such as renting a building from a landlord, loan agreements, client agreements, and more, which are growing the market.

Segments Covered in the Report

By Product

By Distribution

By End-users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

August 2024

September 2024

July 2024