April 2025

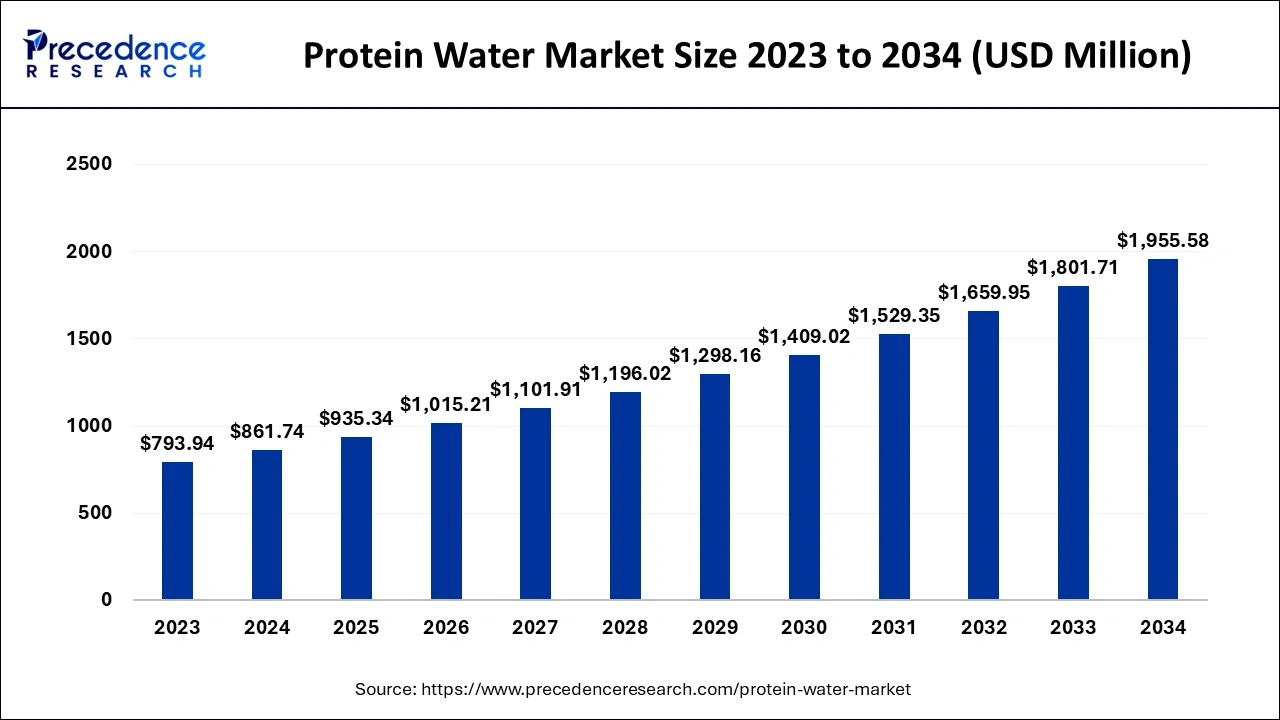

The global protein water market size accounted for USD 861.74 million in 2024, grew to USD 935.34 million in 2025 and is projected to surpass around USD 1,955.58 million by 2034, representing a CAGR of 8.54% between 2024 and 2034. The North America protein water market size is calculated at USD 318.84 million in 2024 and is expected to grow at a notable CAGR of 8.67% during the forecast year.

The global protein water market size is calculated at USD 861.74 million in 2024 and is predicted to reach around USD 1,955.58 million by 2034, expanding at a CAGR of 8.54% from 2024 to 2034. The evolving sports culture, rising awareness about health, and demand for additional supplements and nutrition in their diet are driving the growth of the market.

AI-powered technologies provide reliable answers to older systems' drawbacks. Beverage businesses may improve data analytics and gain a more sophisticated grasp of customer behavior and industry trends by incorporating artificial intelligence (AI) into their regular operations. Better decision-making skills and more strategic planning agility are the outcomes of this.

The overhead involved in managing intricate supply chains may be greatly decreased by using AI to automate critical procedures and optimize logistics. This may significantly save expenses, particularly in fields like inventory management, where AI can forecast the ideal stock levels based on current market trends and sales data. AI technologies also make it possible to quickly and accurately analyze enormous datasets, yielding insights that are essential for supply chain optimization and marketing strategy refinement.

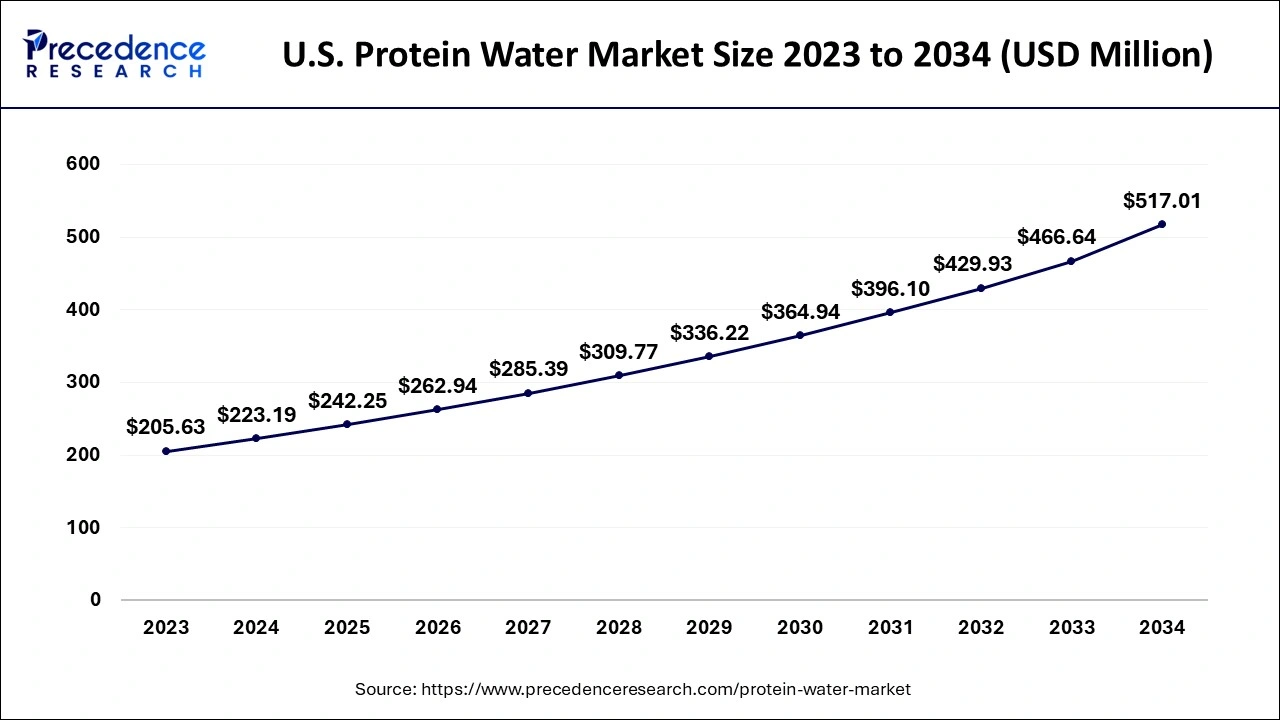

The U.S. protein water market size is exhibited at USD 223.19 million in 2024 and is expected to be worth around USD 517.01 million by 2034, growing at a CAGR of 8.74% from 2024 to 2034.

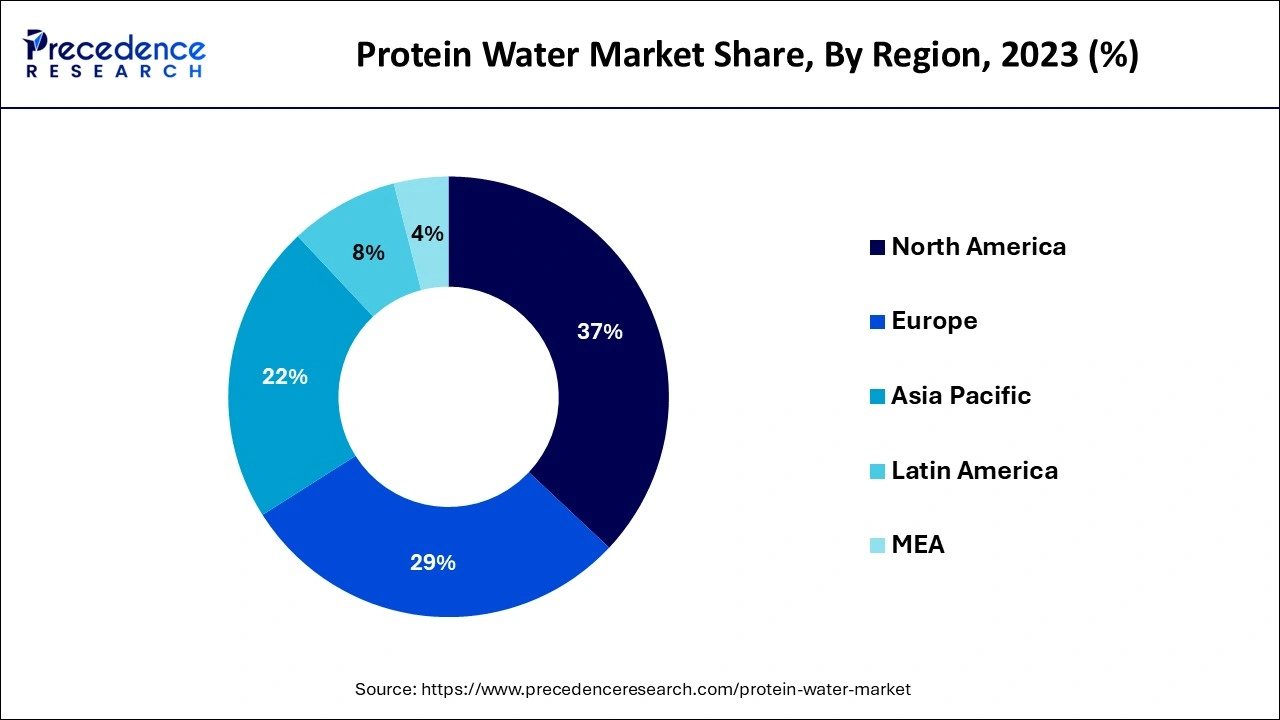

North America dominated the protein water market in 2023. The growth of the market is attributed to the rising awareness about health and body by the regional population; people are diverting to physical fitness, which drives the demand for additional supplements to their diet, which drives the growth of the market. The increasing disposable income, busy lifestyle, and demand for convenience food and drinks are driving the growth of the ready-to-drink type of package drinks. Additionally, the higher presence of the leading producer of the product is also contributing to the expansion of the protein water market in the region.

Asia Pacific expects the fastest growth in the market during the forecast period. The growth of the market is expected to increase with the rising population and the growing number of younger populations diverting towards physical and mental health, which drives the demand for nutrition supplements in their regular diet, which boosts the sales of protein water in the region. The increasing participation of the leading market players in protein drinks and packaged drinking water is driving the expansion of the protein water market across the region.

The Department of Biotechnology (DBT) instituted the sectoral committee on smart protein, in which they invested in the smart protein industry to improve India’s bioeconomy in 2022. The regional government has realized the importance of investment in smart protein, and the Maharashtra government has set the target to achieve a $1 trillion economy by 2030.

The protein water is the integration of the whey protein isolated in water and hydrolyzed collagen. Several leading players are investing in the development and further launch of the new variant in protein water. The rising awareness about health and maintaining physics are driving the demand for added nutritional supplements in their regular diet. And the increasing sport culture further drives the expansion of the protein water market.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,955.58 Million |

| Market Size in 2024 | USD 861.74 Million |

| Market Size in 2025 | USD 935.34 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.54% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Benefits associated with protein water

The rising awareness regarding protein water in the population and the benefits associated with the products in the human body is driving the growth of the protein water market. The protein water is highly capable of boosting energy levels and the immune system, helping reduce weight and maintain constant body weight. The protein water helps in hydrating the skin due to the availability of collagen, which serves the proper nutrition to the skin, makes the skin more hydrated, and also works as an anti-aging product.

Side effects of products

Protein drinks sometimes cause severe side effects on the human body due to the long-term use of protein water, and it may cause digestion problems that collectively restrain the growth of the protein water market.

Rising interventions of new market players

The increasing participation of the new market players and the increased availability of the existing market players with the wide range of products inclusive of different flavors and sizes. Additionally, the disposable income, busy lifestyle in the population, and the demand for ready-to-drink packaged drinking products with the addition of protein components and flavors collectively drive the opportunity in the market’s expansion.

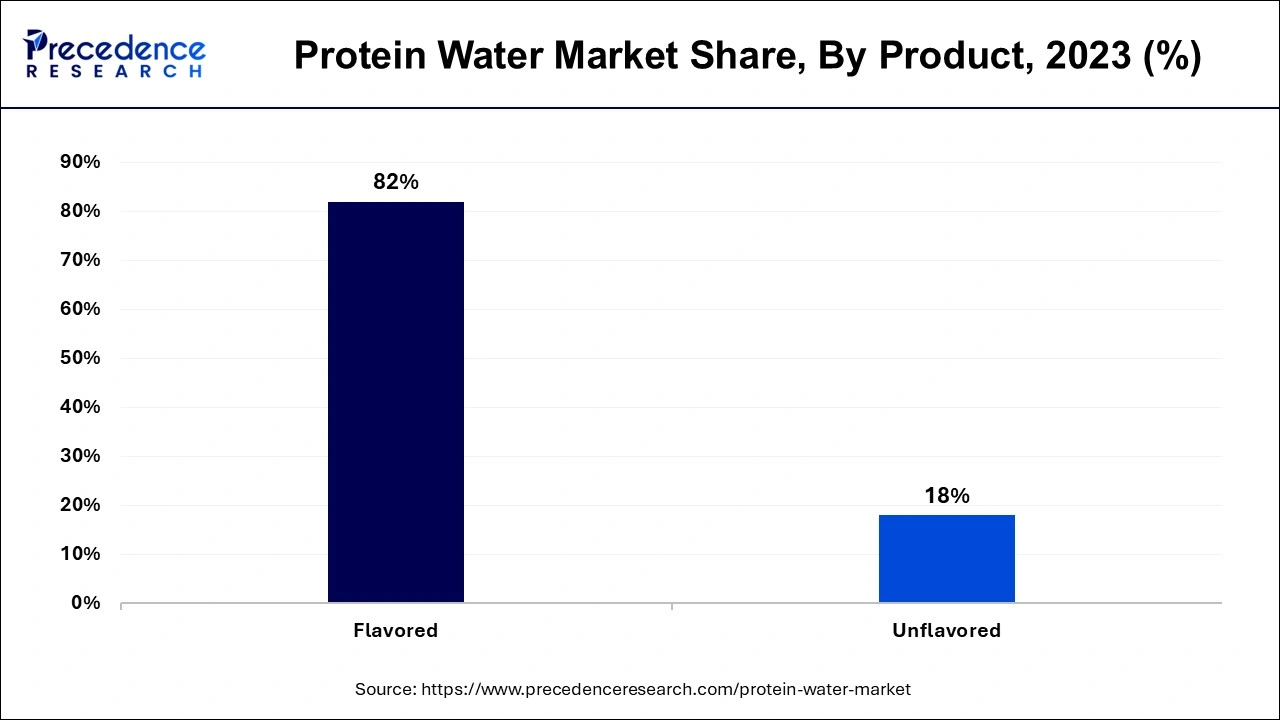

The flavored protein water segment dominated the protein water market in 2023. Flavored protein powder is one of the most popular products used by consumers in diet plans and workout routines. Flavored protein water consists of different types of fruit flavors that are added to it, which enhance the overall taste of the drink or protein water. The protein water is a combination of the protein powder and water. There is a rising concern about health and increasing spending on healthcare, gyms, and other types of workout sessions to maintain their body in shape. Flavored protein water is largely accepted by consumers due to its taste and other nutritional properties. The rising availability of the different types of flavored protein water and a number of players are heavily investing in the development and further launch of flavored protein water, which boosts the growth of the segment.

The unflavored segment expects accountable growth in the protein water market during the forecast period. The rising preference towards unflavored protein water by consumers due to the consumer preference to add their own customization in flavors and increasing concern towards the sugar intake and low sugar diet is driving the adoption of unflavored protein water. The increasing cases of allergies due to the added flavors and sweeteners cause a negative impact on consumer health, which is also propelling the use of unflavored protein water segment.

The hypermarket and supermarket segment led the protein water market in 2023. The rising preference acceptance of hypermarkets and supermarkets for personal and household shopping preferences is due to the wide availability of products under one roof that provide convenience in shopping to customers. The hypermarkets and supermarkets offer several discounts on products. Supermarkets and hypermarkets are great advertising platforms for showcasing brands and creating awareness regarding their products to consumers, which also contributes to increasing the sale of protein water by the hypermarket and supermarket segment.

The online channel segment is expecting significant growth in the market during the forecast period. The increase in the e-commerce industry and the rise in internet penetration in the population are among the leading contributors to the increase in the sale of protein water by the online segment. The increasingly younger generation and the rising preference for online shopping due to the convenience in shopping, door-delivery system, great offers and discounts, EMI offers, and the wider availability of products with different brands, sizes, and flavors, which drives the expansion of the online distribution segment.

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

August 2024

December 2024

February 2025