October 2024

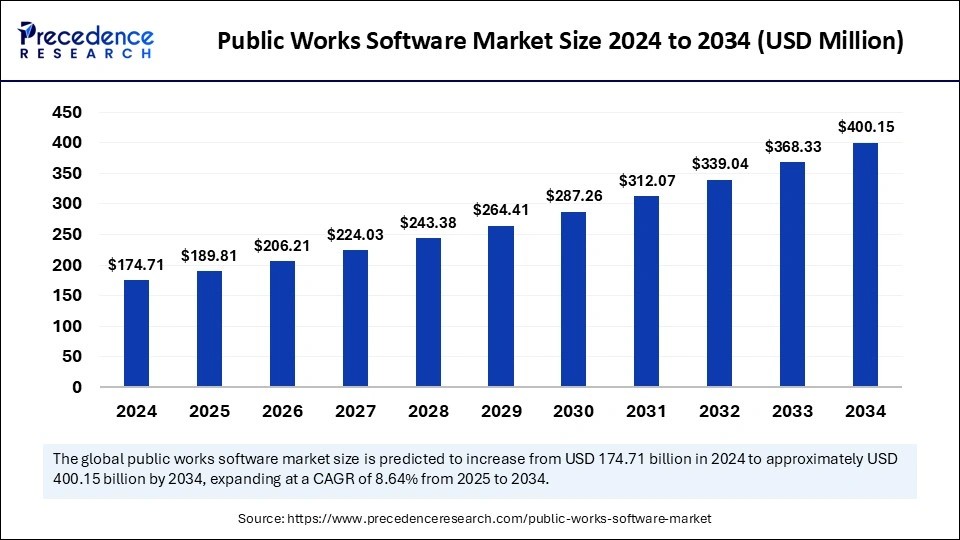

The global public works software market size is calculated at USD 189.81 million in 2025 and is forecasted to reach around USD 400.15 million by 2034, accelerating at a CAGR of 8.64% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global public works software market size accounted for USD 174.71 million in 2024 and is predicted to increase from USD 189.81 million in 2025 to approximately USD 400.15 million by 2034, expanding at a CAGR of 8.64 % from 2025 to 2034. The rising necessity of innovative solutions to streamline the operations of public entities significantly boosts the growth of the public works software market.

Artificial intelligence is revolutionizing the dynamics of every sector, including the public sector. In the realm of public works software, AI can help improve the functionalities and performance of these software. AI-driven public works software is being widely utilized to maintain and improve the infrastructures. With AI technology, the improvement of infrastructures, waste management, operational efficiency, and traffic control can be enhanced. AI enables a proactive approach to infrastructure maintenance that monitors factors like pressure, temperature, and structural strain. This further helps with predictive maintenance, reducing costs and increasing the reliability of the infrastructure.

AI-driven public works software can optimize resource allocation and create more accurate project schedules, allowing for better planning. This software further helps local government agencies optimize waste management, reduce emissions, and ensure regulatory compliance. It helps in sorting the waste more efficiently, reducing the amount of waste in landfills. AI technology can help manage city traffic more effectively through signal timing adjustments, real-time analysis, and response to traffic congestion.

Public works software is a suite of tools that are specifically designed to meet the requirements of different government agencies, institutions, and other public entities. This software helps manage and streamline the operations of public works departments. The public works software market is witnessing rapid growth due to the increasing need to meticulously manage resources. This software helps with project management, asset management, and workload management. Such benefits are encouraging the public as well as government entities to turn to public works software to streamline their operations.

Governments around the world are looking for solutions to improve transparency, efficiency, and service delivery in the public sector, which is boosting the growth of this market. The rising investments in developing and strengthening the infrastructure, especially in merging countries, further propels the market growth. Advancements in technology and integration of innovative technologies, like cloud computing, AI, and Internet of Things, support market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 400.15 million |

| Market Size in 2025 | USD 189.81 million |

| Market Size in 2024 | USD 174.71 million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.64% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment, Organization Size, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East |

Rising Adoption of Advanced Technologies

Governments, as well as public organizations, are increasingly adopting advanced technologies, such as IoT, AI, and data analytics, to optimize project management. These technologies optimize resource allocation, enhance decision-making, and improve overall efficiency. Governments around the world are investing heavily in infrastructure development, which is boosting the demand for public works software for resource allocation, project scheduling, and risk assessment. Adoption of the Internet of Things (IoT) and smart technologies helps amplify the efficiency and impact of this software that helps maintain and develop infrastructure. The growing focus on sustainable practices further contributes to the market's growth. Public works software helps track and manage environmental impact and resource allocations, promoting sustainable practices.

Interoperability Issues and Data Security Concerns

A key factor limiting the growth of the public works software market is the interoperability issues in software solutions. Different software systems often operate in silos, making it challenging to share data. Integrating new software solutions in outdated systems is challenging, requiring substantial investments in hardware and skilled expertise. A lack of standardization in technology and underdeveloped infrastructure for the public sector in some regions further affect the market’s growth. Moreover, the increasing concerns about data security and privacy limit the adoption of public work software. This software stores vast amounts of government data, making it vulnerable to cyber threats.

Need for Cybersecurity Measures

Since this software is vulnerable to cyber threats, there is a high need for robust cybersecurity measures, which creates immense opportunities in the public works software market. The rising number of incidences of cyberattacks and cyber threats has created a necessity for protecting sensitive data, especially for government entities where the data is more valuable. For instance, according to the Federal Bureau of Investigation (FBI), government entities ranked as the third-most targeted sector for ransomware attackers in 2024. The increase in the risk of leaks and breaches of sensitive data is encouraging public and government entities to establish robust security measures and invest in solutions that secure their infrastructure. Moreover, key players operating in the market are integrating advanced cybersecurity features, such as multi-factor authentication and data encryption, in their software in order to overcome data security concerns.

The project management segment led the public works software market with the largest share in 2024. The significant rise in the number of infrastructure development projects has increased the utilization of project management software across the world. This software helps organizations plan, track, and manage various infrastructure projects, like roads, bridges, and buildings. This software also helps with resource allocation. There is a heightened demand for project management software among large enterprises, as they work on multiple projects, requiring reliable software to streamline their operations.

The asset management software segment is expected to grow at a significant rate in the coming years. The rising focus on efficiently maintaining public works assets, such as equipment, buildings, infrastructure, and roads, propels the segmental growth. Asset management software allows organizations to track and manage their assets remotely. The improvement in operational efficiency through this software makes it a popular choice, especially among large enterprises that work simultaneously on multiple projects.

The cloud-based segment dominated the public works software market with the largest share in 2024. This is mainly due to its improved flexibility and scalability. Cloud-based deployment includes hosting the public works software solution on a remote server. This is managed by a third-party provider that accesses it over the Internet. The benefits of cost-effectiveness, scalability, and subscription-based pricing make it a popular choice among organizations. Cloud-based deployment’s subscription model does not require a huge upfront investment for hardware infrastructure or software licenses. These aspects make cloud-based deployment easier for organizations that have a limited budget. Moreover- cloud-based solutions can be easily scaled up or down according to requirements, making it ideal for managing workloads.

The on-premises segment is anticipated to grow at a notable rate during the projection period. This is mainly due to the rising concerns about the privacy and security of data and other valuable information. On-premises software offers great control and security over data, making it suitable for organizations, especially large organizations.

The small and medium-sized enterprises (SMEs) segment led the public works software market in 2024. This is mainly due to the increased focus on improving operational efficiency. SMEs often face budget constraints. However, the adoption of public works software helps them with resource allocation, reducing waste and saving costs. With public works software, SMEs can ensure compliance in documentation tracking, regulatory standards, and maintenance of audit trails. These software tools help SMEs avoid any non-compliance and legal liabilities. Public works software offers transparency as well as accountability in project management.

The large enterprises segment is expected to expand at the fastest rate in the coming years. The availability of necessary funds and infrastructure makes the integration of public works software easier for large enterprises. Moreover, large enterprises often manage complex projects and large amounts of data. Thus, they require reliable solutions to manage projects and streamline operations, supporting segmental growth.

The government agencies segment held a significant share of the public works software market in 2024 and is expected to maintain its growth trajectory in the near future. An increase in the number of infrastructure projects undertaken by the governments is a key factor supporting the segment’s growth. The necessity of government agencies to optimize operational efficiency and manage various projects is boosting the demand for public works software. Government agencies are increasingly adopting project and asset management software to improve efficiency and transparency. These agencies have recognized the benefits of public works software in project scheduling and management. The ability of this software to assign and track work orders, allocate resources, and track assets helps with report generation for projects, making them invaluable for government agencies.

North America dominated the public works software market with the largest share in 2024. This is mainly due to the presence of various government organizations that continuously invest in infrastructure development and improvement projects. An advanced foundation for administrative structures and monetary resources has eased the integration of public work software. The region is also home to a large number of key players. There is advanced technological infrastructure contributing to regional market growth.

The U.S. plays an important part in the North American public works software market. The U.S. government is increasingly investing in infrastructure development projects. This, in turn, boosts the adoption of project and asset management software to manage complex projects. Moreover, the presence of key market players in the country and the growing adoption of digital technologies to improve transparency and track project progress further contribute to market expansion.

Europe is the second-largest market, holding a significant share of the market in 2024. The region is anticipated to witness steady growth during the forecast period. This is mainly due to the increasing investments from governments and other agencies, like the European Union, in the development of sustainable infrastructure. The rising integration of smart technologies, IoT, and cloud-based computing in infrastructure development projects is further contributing to the growth of the market in Europe. Moreover, there is a high adoption of digital technologies to improve efficiency and transparency in public services, which supports the regional market growth.

Asia Pacific is expected to witness the fastest growth during the forecast period. This is mainly due to the increasing investments in the development and improvement of infrastructure. India is expected to lead the Asia Pacific public works software market in the foreseeable future. This is mainly due to the increasing government funding for infrastructure development and improvement. For instance, in July 2024, the Indian Government announced the plan to spend USD 132.85 million on infrastructure development. India is the country that has the largest number of projects for infrastructure development and modernization. Rapid urbanization and digital transformation are further boosting the utilization of public works software to enhance operational efficiency and establish transparency in project processes.

By Type

By Deployment

By Organization Size

By End-user

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

November 2024

January 2025

January 2025