October 2024

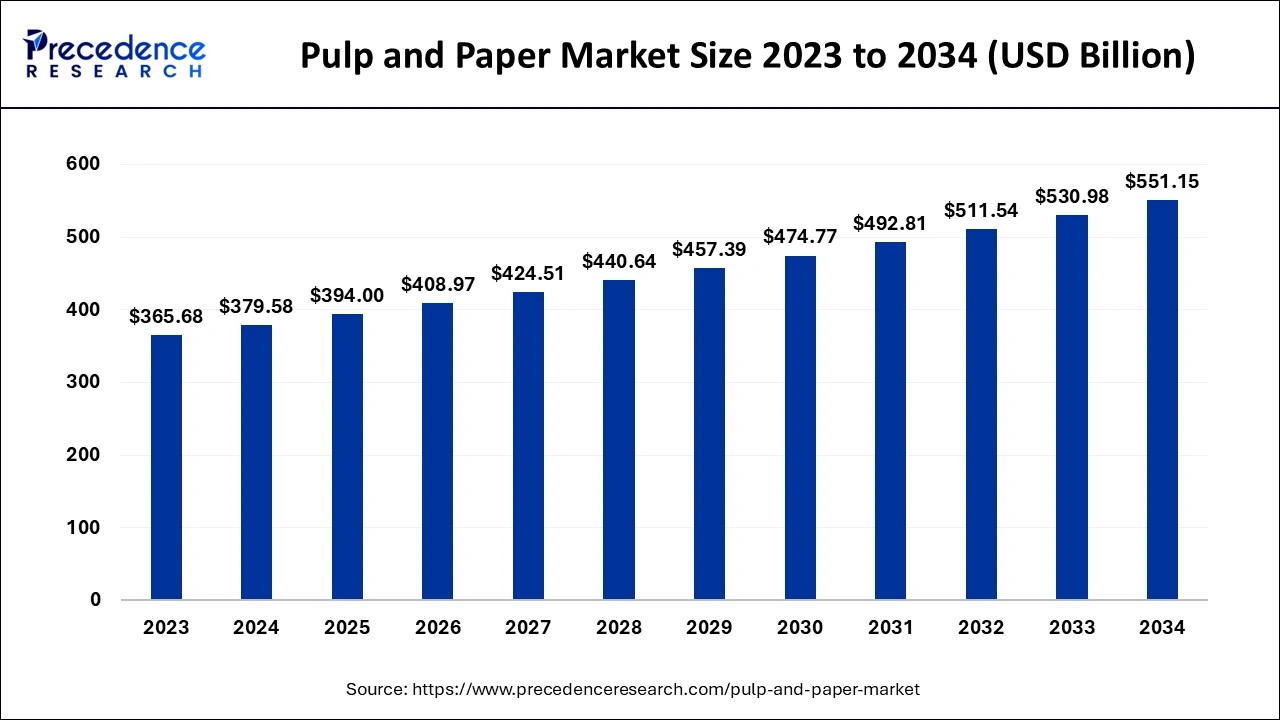

The global pulp and paper market size accounted for USD 379.58 billion in 2024, grew to USD 394 billion in 2025 and is predicted to surpass around USD 551.15 billion by 2034, representing a healthy CAGR of 3.80% between 2024 and 2034.

The global pulp and paper market size is estimated at USD 379.58 billion in 2024 and is anticipated to reach around USD 551.15 billion by 2034, expanding at a CAGR of 3.80% from 2024 to 2034.

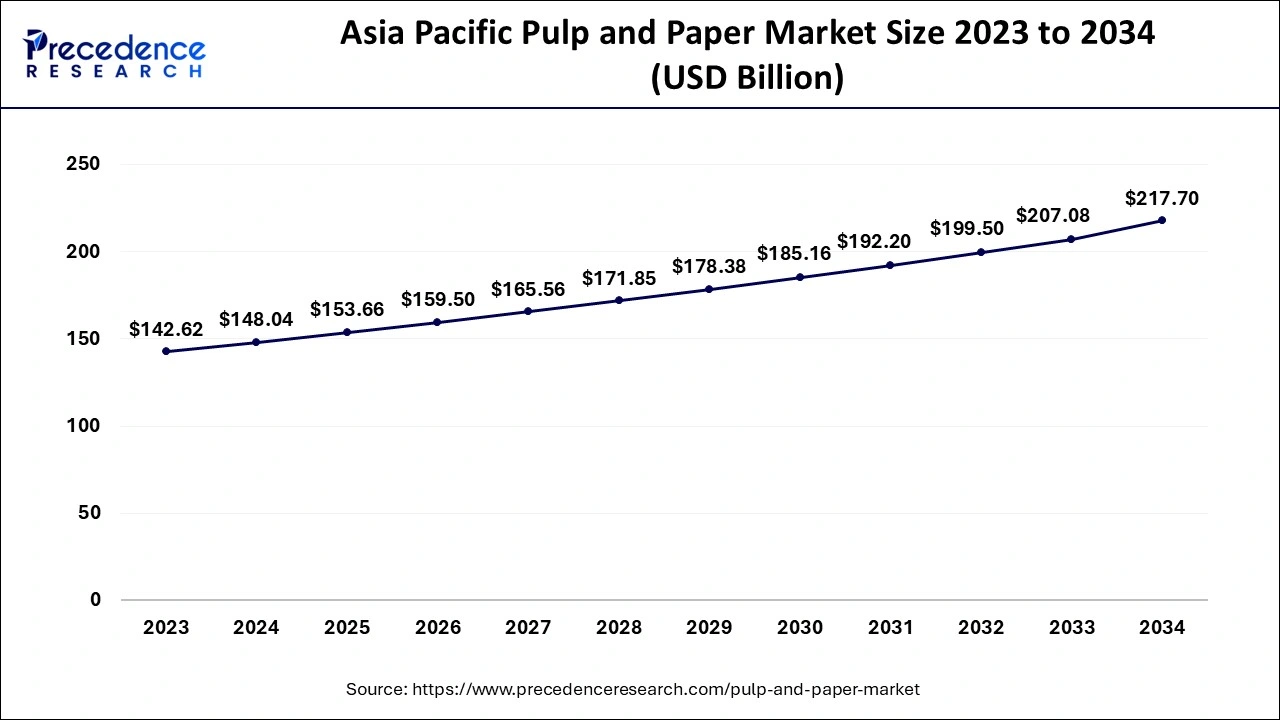

The Asia Pacific pulp and paper market size is evaluated at USD 148.04 billion in 2024 and is predicted to be worth around USD 217.70 billion by 2034, rising at a CAGR of 3.92% from 2024 to 2034.

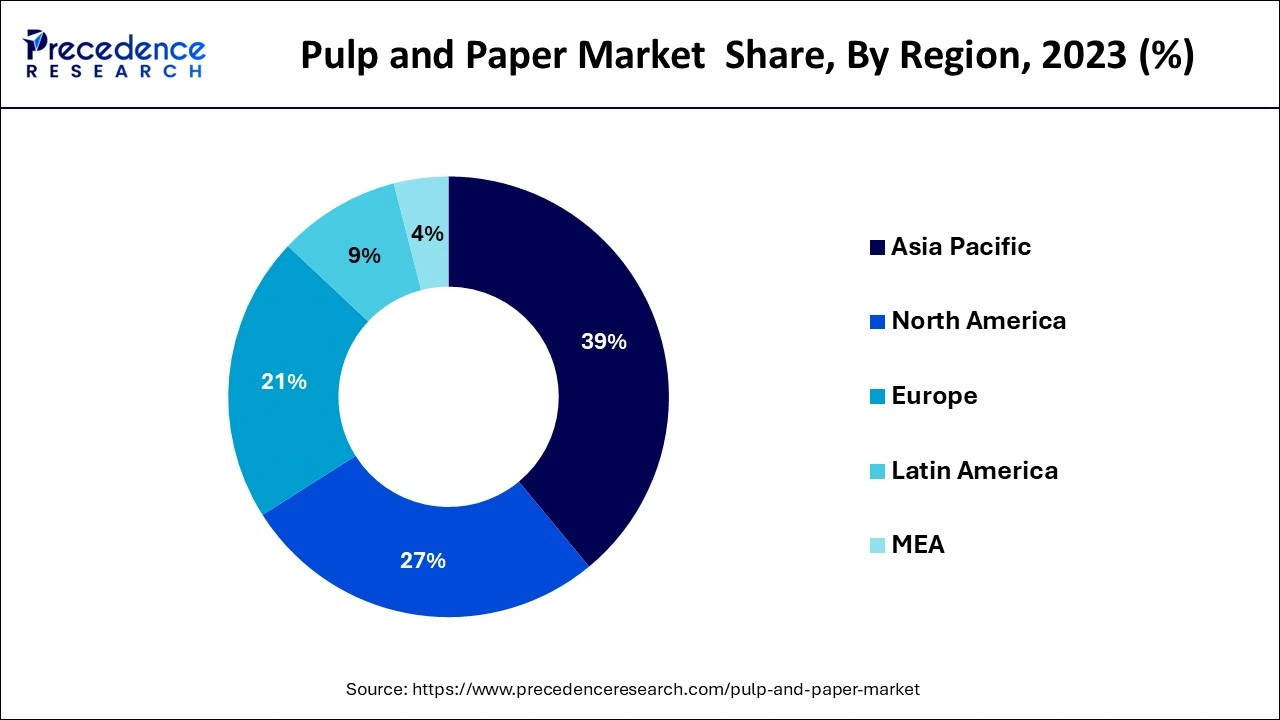

The Asia-Pacific region accounted largest revenue share 39% in 2023. Due to the rising need for food packaging and commercial printing in the region, Asia-Pacific currently controls the pulp and paper industry. Furthermore, it is projected that the rise of the regional market will be aided by the robust economic growth of developing countries like China, India, and Japan. The world's greatest user and producer of pulp and paper is China. Due to the increasing demand for paper-based products and the rising standard of living in Malaysia, Indonesia, and Vietnam, the industry is predicted to experience profitable expansion. Additionally, the increasing urbanization and population in APAC are the main factors driving the demand for commercial printing and food packaging.

The mature markets of Europe and North America are anticipated to grow slowly over the projected period. Growth in North America is predicted to be boosted by rising fast-moving consumer goods consumption, rising packaging paper demand in the U.S., and significant companies like WestRock, Georgia-Pacific, and International Paper. The rising emphasis on attaining sustainable goals by recycling paper-based products is likely to spur growth in Europe at the same time. Moreover, the presence of leading market players is anticipated to drive the market.

The pulp and paper sector is the largest and most significant forest-based sector in the world. The environmental impact of producing paper is substantial. Paper manufacture takes a significant amount of water, depending on the effectiveness of the mill, and uses more water than other industries like steel and gasoline. The sector is the fourth largest industry in terms of energy consumption. Indisputable advantages of pulp, paper, and packaging production, such as job creation, infrastructural enhancement, and economic growth, should not be disregarded. However, the manufacture and consumption of unsustainable paper contributes to the destruction of natural ecosystems and deforestation.

Cellulases and hemicelluloses have been used in the pulp and paper industry for biomechanical pulping. Enzymes are used in wood pulping to significantly reduce the energy needed. Enzymes are used in wood pulping to significantly reduce the energy needed. The necessity for environmentally responsible de-inking of printed paper is growing as recycling of paper is given more and more importance. In order to remove ink, coating, and toner from paper, cellulases are used.

Online retailing is on the rise in developing countries like India, China, Brazil, and other places due to the growing number of smartphone users and the quick internet adoption. This increases the demand for pulp and paper for packaging, as well as the rise of the e-commerce industry. Therefore, it is anticipated that the rapid expansion of online retail in developing countries will support the expansion of the pulp and paper market globally.

Consumers and manufacturers must now use sustainable paper packaging options due to the escalating environmental concerns. Advanced paper packaging solutions are likely to help the market because paper is an excellent recyclable and sustainable packaging material. Therefore, the market's expansion in the upcoming years is anticipated to be boosted by the rising demand for eco-friendly packaging materials. Moreover, it is currently the most recyclable and environmentally friendly packaging material available. Customers and producers are both adopting more environmentally friendly paper packaging solutions as a result of increased environmental concerns. To achieve their sustainability objectives, leading companies in the food, cosmetics, and FMCG sectors collaborate closely with paper manufacturers to develop cutting-edge paper packaging solutions. This should aid in the expansion of the pulp and paper sector over the foreseeable future.

In an effort to create a sustainable method of being environmentally friendly, a number of foreign countries have enacted a variety of regulations restricting the usage of conventional plastics. The demand for paper bags has also increased as a practical and cost-effective substitute for plastic bags. Because of all these restrictions and regulations, stores, supermarkets, and storage providers are more inclined to accept paper-based packaging.

| Report Coverage | Details |

| Market Size by 2024 | USD 379.58 Billion |

| Market Size by 2034 | USD 551.15 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.80% |

| Asia Pacific Market Share in 2023 | 39% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Raw Material, Manufacturing Process, End Use, Category, Geography |

On the basis raw material, wood based segment hold the major share in pulp and paper market. Wood pulp is currently the most widely used material for making all types of high-quality paper. It has a sizable amount of cellulose fiber, which has the consistency of thread and serves as the foundation for the finished product. To improve the pulp's brightness, stability, water resistance, and capacity to remove impurities, it is combined with various chemicals and papermaking agents.

The agro based raw material is widely used in papermaking. High-quality paper is created using stronger and more durable materials, such as cotton, linen, or hemp fibers. The paper is strengthened and stiffened using these raw components. Straw, bamboo, and esparto grass are alternative materials accustomed to manufacture fibers.

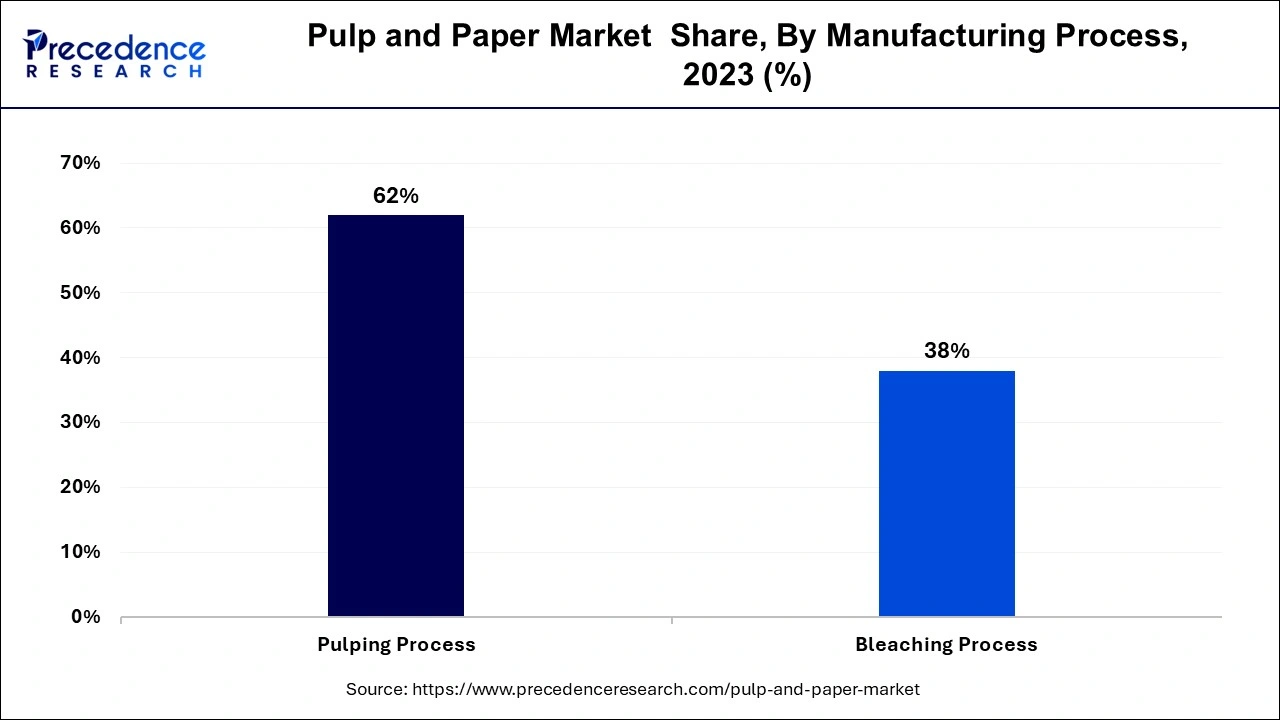

Depending upon the manufacturing process, the pulping process segment is expected to have the highest growth in the pulp and paper market in the forecast period. The main source of effluent in the manufacturing process is pulping. This method allows for the separation of impurities and cellulose fibers. The pulp processing system that gives the most versatility is the Kraft/Sulphate process. Long, thick cellulose fibers and little lignin are produced in the pulp. Its primary advantage is the production of long, dense pulp fibers using chemical pumping. Paper products that are substantially stiffer and stronger can be made using these extended cellulose fibers. Premium white paper and other high-quality paper goods are made using chemical pulp.

The other is bleaching process which is the removing or slightly modifying the pulp's colouring components. In order to get high-quality pulp with specific whiteness, cleanliness, purity, and superior physical and chemical features, pulp bleaching procedure is mostly used to improve the lightness of paper pulp. Applications for pulp bleaching processing expand. High-quality paper and refined pulp can be produced using bleached pulp.

On the basis of end use industry, the packaging segment is expected to maintain its dominance in the pulp and paper market. The packaging category continued to hold the largest position in the worldwide pulp and paper market due to the rapid globalization of the e-commerce and retail sectors, there is a great need for both wrapping and packaging paper. Additionally, consumers and businesses in developing economies are embracing paper packaging items due to a growing awareness of the environment. Paper packaging is in greater demand in the food and beverage industry due to its ease of recycling, potential to reduce air pollution, and ability to clean the environment. The development of packaging has had a considerable impact on soft drink consumption. The pulp and paper sector is expected to thrive as a consequence of an increase in consumer knowledge of the adverse environmental effects of plastic and the eco-friendliness of paper packaging made from fiber crops.

During the forecast period, the printing segment is anticipated to increase significantly. Due to a predicted uptick in the education sector, including rising enrollment, bettering literacy rates, and an increase in the number of schools and colleges, the need is likely to increase. Newsprint demand growth is anticipated to be supported by rising literacy rates, expanding circulation, and an increase in the quantity of newspapers and magazines. Food production in Russia has increased by 4.8% and beverage production raised by 3.2% in 2019.

By Raw Material

By Manufacturing Process

By End Use Industry

By Category

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

July 2024