March 2025

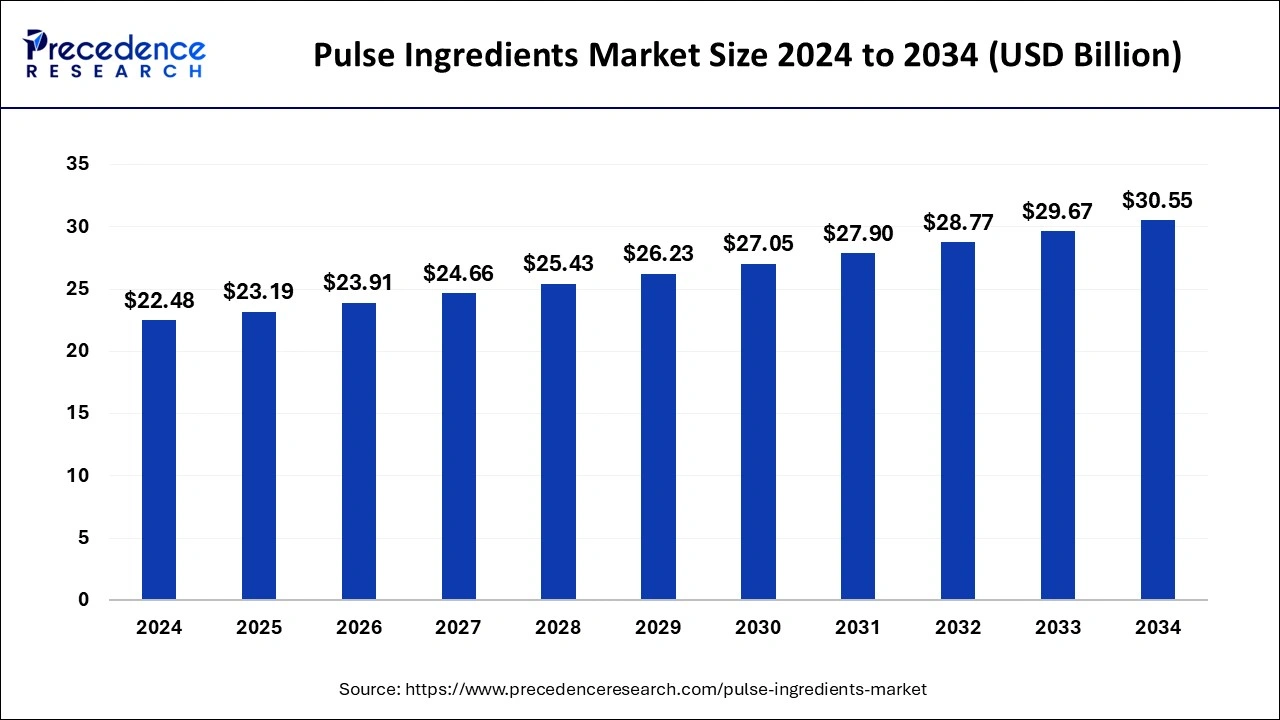

The global pulse ingredients market size is calculated at USD 23.19 billion in 2025 and is forecasted to reach around USD 30.55 billion by 2034, accelerating at a CAGR of 3.11% from 2025 to 2034. The Asia Pacific pulse ingredients market size surpassed USD 7.88 billion in 2025 and is expanding at a CAGR of 3.31% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pulse ingredients market size was estimated at USD 22.48 billion in 2024 and is predicted to increase from USD 23.19 billion in 2025 to approximately USD 30.55 billion by 2034, expanding at a CAGR of 3.11% from 2025 to 2034. The multipurpose use of pulse ingredients in various processes and other food items drives the growth of the market.

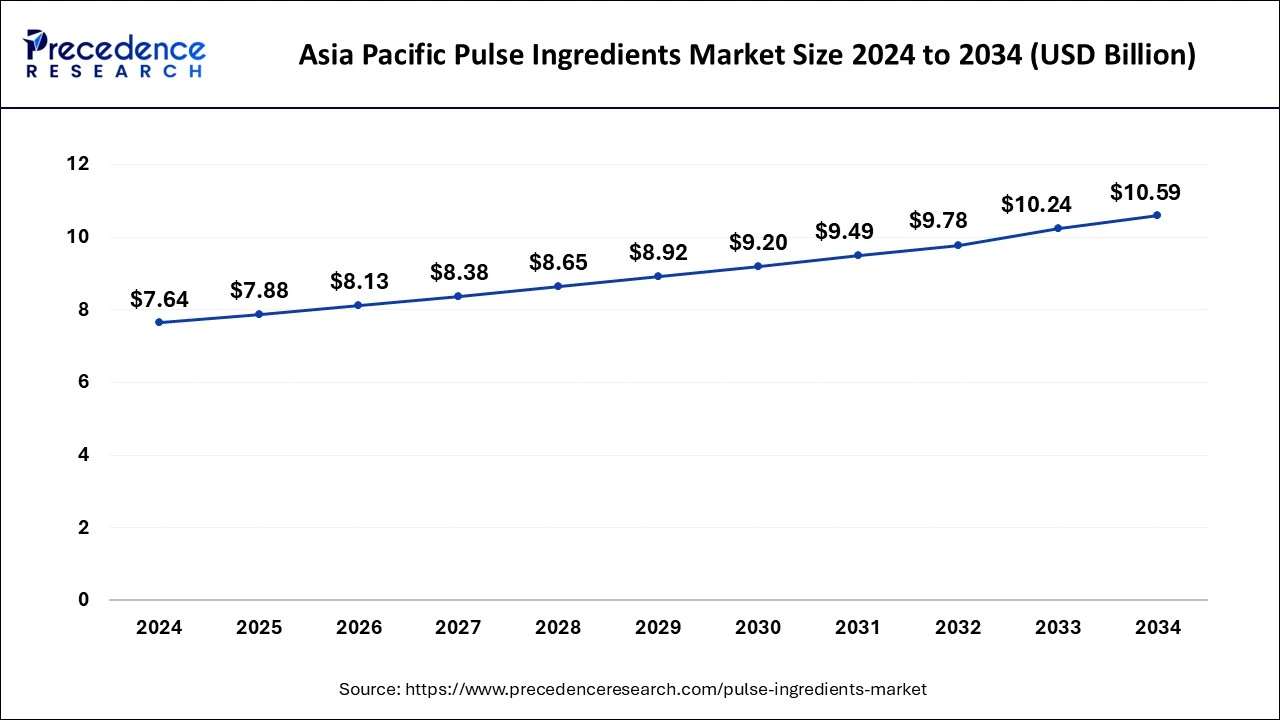

The Asia Pacific pulse ingredients market size was valued at USD 7.64 billion in 2024 and is expected to be worth around USD 10.59 billion by 2034, at a CAGR of 3.31% from 2025 to 2034.

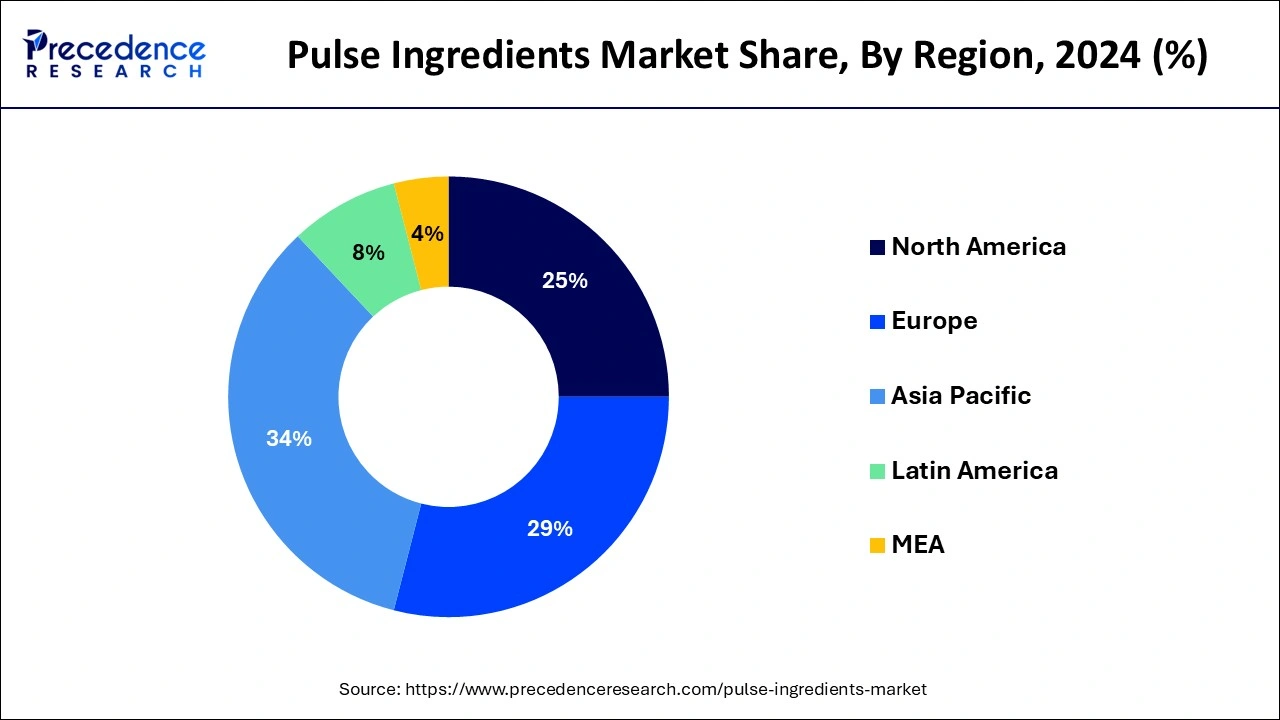

Asia Pacific dominated the pulse ingredients market in 2024 and is expected to dominate the market during the forecast period. The growth of the region is attributed to the presence of an established food & beverages industry, an increasing consumer preference towards healthy food products, increasing awareness regarding the health benefits of pulses, a rise in disposable income, and a growing demand for convenience foods. The easy availability of raw materials, along with the rise in the major production of pulse ingredients, is likely to fuel the growth of the pulse ingredients market in the region.

Moreover, the rising need for high-protein foods due to a rise in the vegan & vegetarian population in the region is driving the demand for pulse ingredients. Among all countries, China and India are the major contributors to the market, India being the largest producer, especially of lentils, which is expected to accelerate the market’s expansion. Governments and agricultural organizations in these countries are actively engaged in promoting the cultivation and consumption of pulses to minimize the reliance on imported food products for nutrition.

According to the India Pulses and Grains Association (IPGA) in June 2023

According to the Indian Council of Agricultural Research report, Indian Farming February 2024:

On the other hand, North America had a significant share of the pulse ingredients market in 2023, including rising health-conscious consumers, robust growth of food & beverages, rising disposable incomes, supportive government policy, and growing demand for pulse ingredients as clean-label alternatives. In addition, there is rising awareness of the health benefits associated among the vegan population with the consumption of pulses, such as lentils, chickpeas, beans, and peas, as these pulses are rich in fiber, protein, minerals, and other essential nutrients. North American countries such as the U.S., Canada, and Mexico. Canada witnessed the rising production of pulses and is the highest producer of lentils in the region, which is anticipated to contribute to the market’s revenue in the region.

Canada is one of the largest pulse exporters in the world. Over 80 percent of what is grown domestically is shipped elsewhere, including 74 percent of field peas and 81 percent of lentils. Saskatchewan grows the most chickpeas, peas, and lentils nationwide, while Manitoba is the largest producer of dry beans.

Consumers are actively seeking nutritious and delicious products with enhanced protein and good taste, which drives the growth of the pulse ingredients market. Pulse ingredients are widely used in the food and beverage industry due to their various health benefits and functional properties. Pulse ingredients are part of the legume plants, which contain dry edible seeds such as peas, chickpeas, lentils, and beans. Pulse ingredients derived from lentils, chickpeas, peas, and beans are rich sources of nutrients such as minerals, vitamins, fibers, and proteins. Naturally, pulses are both gluten and allergen-free. Pulses are generally well-known as environmentally sustainable crops owing to their potential to create nutrient-rich soil by fixing nitrogen in the soil. They require less water during production than animal-based proteins.

| Report Coverage | Details |

| Market Size in 2025 | USD 23.19 Billion |

| Market Size by 2034 | USD 30.55 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.11% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Application, Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising consumer inclination toward nutritious food products

The rising consumer inclination toward nutritious food products is expected to accelerate the growth of the pulse ingredients market. Consumers are highly preferring nutritious options in their daily diet plan. Health-conscious individuals actively look for nutrient-dense foods due to their high nutritional profile. Pulses are considered highly nutritionally superior to cereals and other food crops. Pulse constitutes a vital dietary constituent. Pulses contain proteins ranging from 20 to 27 percent and vitamins, essential minerals, and dietary fibers. The protein content in grain legumes is double that of wheat and three times that of rice. Pulses are widely used as a complement to cereals, which makes them the best solution for protein-calorie malnutrition. Therefore, rising consumption of natural and nutritious food products is anticipated to spur the demand for pulse ingredients during the forecast period.

Supply chain issues

Disruptions in the supply chain might restrict the growth of the worldwide market for pulse ingredients. The availability of components for pulse recipes can be impacted by weather variations in crop yields, which can also have an influence on cost.

Increase in vegetarian and vegan population.

The rising vegetarian and vegan population is projected to create a significant growth opportunity for the pulse ingredients market during the forecast period. Vegetarianism and the vegan population focus on a plant-based diet. These populations prefer eating food obtained from plants and avoid meat products to enhance their diet with wholesome. Pulses have become an integral part of the dietary system in vegetarian and vegan populations due to their rich sources of fiber, essential amino acids, vitamins, protein, and minerals.

The rising demand for plant-based protein sources among vegetarian and vegan populations led to a spurring of the consumption of pulse ingredients. Additionally, the clean label movement is increasingly becoming popular due to the rising demand of consumers for natural ingredients, no preservatives, no additives, no artificial colors, and flavors. Thus, boosting the pulse ingredients market’s growth in the coming years.

The chickpeas segment dominated the pulse ingredients market in the year 2024 and is expected to grow at the fastest CAGR during the forecast period. Chickpeas provide an adequate source of plant-based protein, which makes them appealing to health-conscious individuals following vegetarian, vegan, or flexitarian diets. Chickpeas have a low glycemic index and are a good source of fiber and protein, which assist in controlling blood sugar, reducing cholesterol, and minimizing cancer risk. In addition, the rising incidence of obesity, diabetes, heart disease, and several other health concerns are compelling individuals to opt for healthy dietary options.

On the other hand, the lentils segment estimated to have considerable growth in the global pulse ingredients market over the forecast period. Lentils contain more than 25 percent protein, which makes them a well-suited alternative to meat. Lentils are a rich source of iron, a mineral that is often lacking in vegetarian diets. Moreover, Lentils are also considered good sources of B vitamins, magnesium, potassium, iron, and zinc, which add to a nutrient-rich diet.

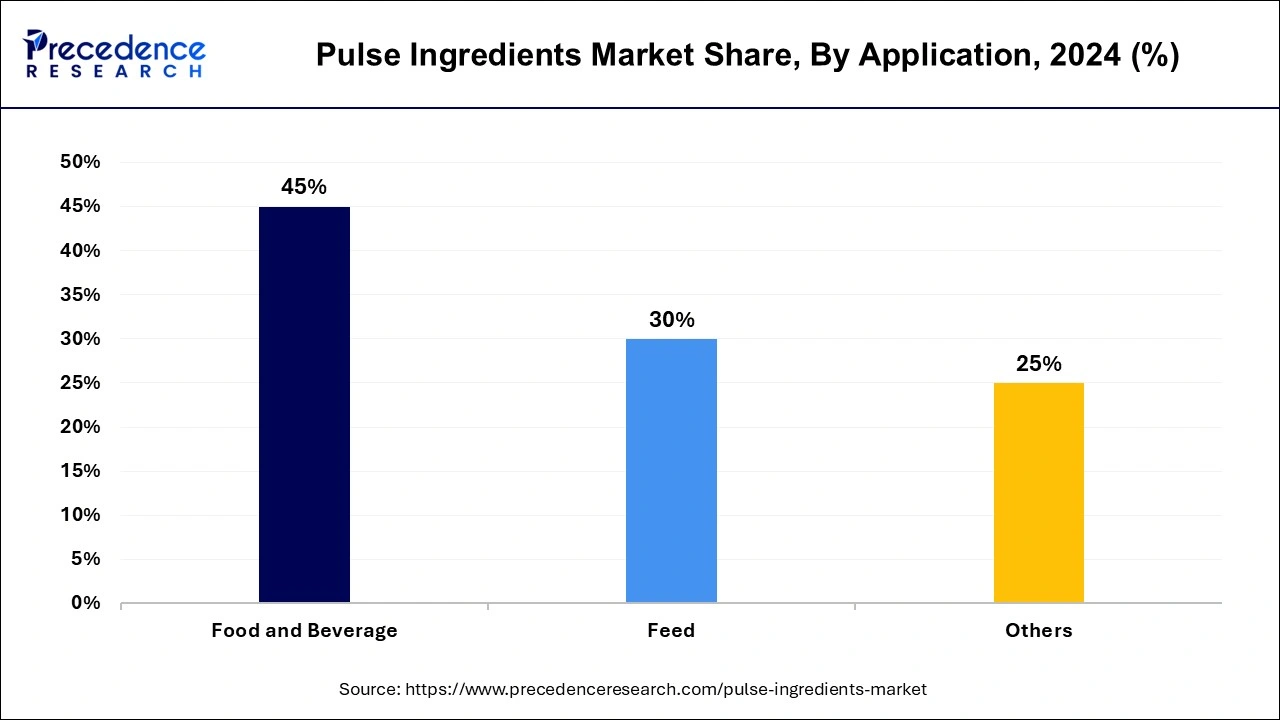

The food & beverages segment dominated the pulse ingredients market in 2024. The growth of the segment is primarily driven by the increasing awareness regarding the health benefits associated with pulse ingredients. Pulse ingredients have several applications in snacks, bakery products, and other dairy alternatives as protein sources. Pulse ingredients have been widely used in spreads, bread, soups, pasta, noodles, salads, snacks, and others. Pulse contains high protein ranging from 20 to 40%, which makes pulses gain significant interest as sustainable protein sources. Pulse ingredients can be used to enhance protein content and the potential for gluten-free formulations. Thereby, rising demand for sustainable sources of protein drives the segment’s growth.

On the other hand, the feed segment is expected to grow at a notable rate owing to the rising demand for protein-rich diets in animals, which provides an alternative protein source to soybean meal, fish meal, and other non-vegetarian meals. Pulse ingredients are an important component of branded feed products, including pet foods and aquaculture, due to their high nutritional value. It includes a diverse portfolio of pulse ingredients such as pulse fibers, pulse proteins, pulse starch, and pulse flour.

The pulse flour segment held the largest share of the pulse ingredients market in 2024, and the segment is expected to sustain its position throughout the forecast period. The segment’s growth is attributed to the growing demand for nutritious and plant-based food products. Pulse flour contains excellent amounts of protein and fiber and is a key ingredient in various gluten-free baked goods. In the bakery, baked snacks and pasta applications use pulse ingredients to replace wheat flour in gluten-free formulations. Pulse flours are naturally gluten-free, and they are made by grinding or milling pulses into flour. During the milling process, nothing is removed.

On the other hand, the pulse protein segment is expected to grow at the fastest rate during the forecast period, owing to the expansion of the food and beverage industry offering pulse protein. Nearly 10-20% of pulse proteins are water-soluble albumins. Pulse proteins offer several health benefits and improve the quality as well as the performance of bakery products.

By Source

By Application

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

December 2024

October 2024

February 2025