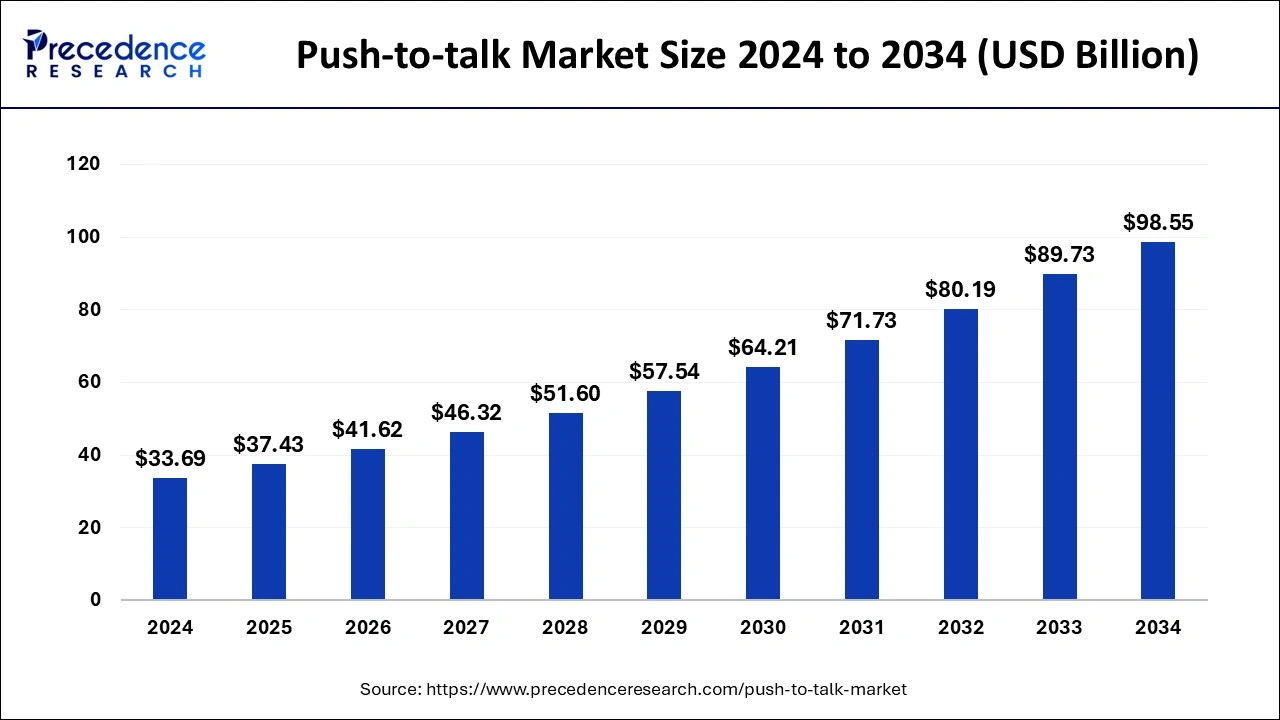

The global push-to-talk market size is accounted at USD 37.43 billion in 2025 and is forecasted to hit around USD 98.55 billion by 2034, representing a CAGR of 11.33% from 2025 to 2034. The North America market size was estimated at USD 10.78 billion in 2024 and is expanding at a CAGR of 11.35% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global push-to-talk market size was estimated at USD 33.69 billion in 2024 and is predicted to increase from USD 37.43 billion in 2025 to approximately USD 38.55 billion by 2034, expanding at a CAGR of 11.33% from 2025 to 2034.

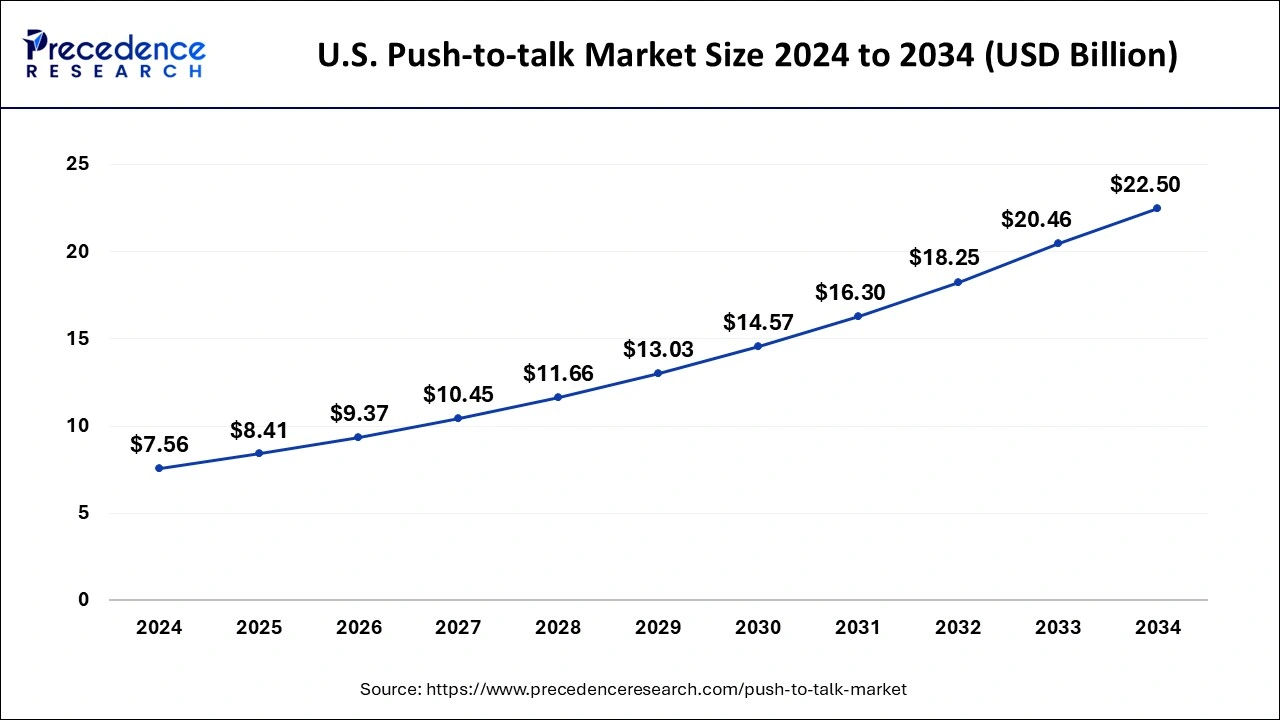

The U.S. push-to-talk market size was exhibited at USD 7.56 billion in 2024 and is projected to be worth around USD 22.50 billion by 2034, growing at a CAGR of 11.52% from 2025 to 2034.

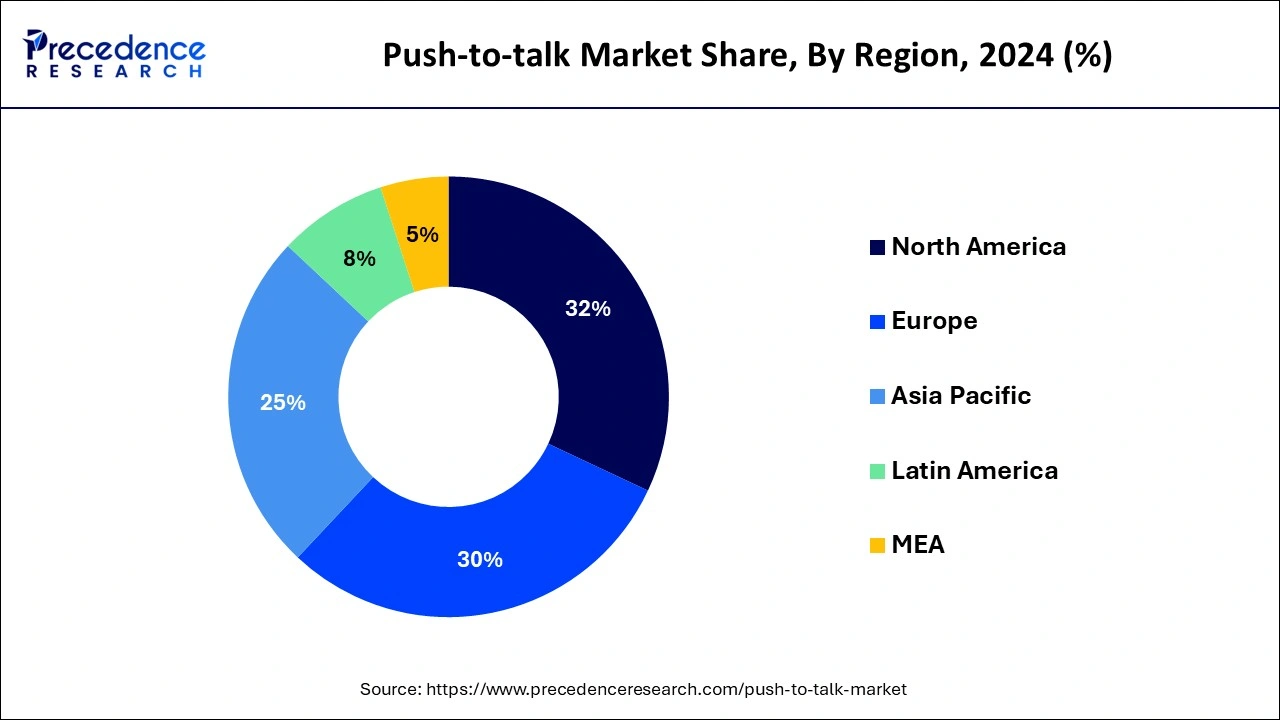

North America held the largest revenue share of 32% in 2024 due to robust demand from public safety, emergency response, and defense sectors. The region's advanced telecommunications infrastructure, early adoption of PTT technology, and the presence of key market players contribute to its dominance. The continuous development of LTE networks, technological innovations, and a strong focus on enhancing communication capabilities further solidify North America's leading position in the push-to-talk market, meeting the evolving needs of industries requiring instant and reliable communication solutions.

The Asia-Pacific region is poised for rapid growth in the push-to-talk (PTT) market due to increasing industrialization, infrastructure development, and a surge in demand for efficient communication solutions. The growing emphasis on public safety and the adoption of advanced technologies in countries like China and India are driving the expansion. Additionally, the region's increasing smartphone penetration and the rollout of advanced mobile networks contribute to the rising demand for instant and reliable communication, positioning Asia-Pacific as a key market for PTT growth.

Meanwhile, Europe is experiencing notable growth in the push-to-talk market due to increased demand for instant and reliable communication solutions across various sectors. The region's focus on public safety, transportation, and industrial applications is driving the adoption of push-to-talk technology. Additionally, advancements in mobile networks, including the rollout of 5G, contribute to the expansion of push-to-talk services. The need for efficient communication in diverse industries and the ongoing technological developments position push-to-talk as a vital tool, fostering substantial growth in the European market.

Push-to-Talk (PTT) is a communication technology that enables instant voice communication with a simple push of a button. Similar to a walkie-talkie, PTT allows users to talk to individuals or groups in real-time over a network. It's a quick and efficient way to relay messages without the need for dialing numbers or waiting for calls to connect. In PTT systems, users have the convenience of immediate communication, making it especially valuable in situations where swift response is crucial. It is commonly used in industries such as public safety, construction, and logistics, where clear and rapid communication is essential. PTT functionality is integrated into both traditional radio devices and modern smartphones, fostering seamless communication and coordination among team members, and enhancing efficiency in various professional settings.

Push-to-talk Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.33% |

| Market Size in 2025 | USD 37.43 Billion |

| Market Size by 2034 | USD 98.55 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Network, and Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Integration with broadband and LTE networks

The integration of push-to-talk (PTT) services with broadband and LTE networks has significantly boosted market demand by enhancing the efficiency and reach of communication solutions. By linking PTT technology with these high-speed networks, users experience improved coverage and reliability, ensuring seamless communication across various settings. This integration addresses the limitations of traditional radio systems, providing a more versatile and widely accessible solution.

Moreover, as broadband and LTE networks continue to expand globally, the adoption of PTT over these platforms becomes increasingly attractive. This surge in demand is driven by the need for instant and reliable communication in diverse industries, ranging from public safety and transportation to logistics. The broader coverage, faster data speeds, and improved connectivity offered by these networks position integrated PTT solutions as essential tools for businesses and organizations seeking efficient communication solutions in today's fast-paced and interconnected world.

Limited spectrum capacity

Limited spectrum capacity poses a significant restraint on the push-to-talk (PTT) market by constraining the available channels for communication. As the demand for PTT services increases, the finite spectrum resources become prone to congestion, resulting in potential communication bottlenecks. This limitation is particularly evident in densely populated urban areas or during emergencies when numerous users attempt to access PTT networks simultaneously. The consequence is a potential degradation in the performance and reliability of PTT communication.

Moreover, the constrained spectrum capacity can hinder the scalability of PTT services, limiting the expansion of coverage and availability. In situations where multiple organizations or industries rely on PTT for mission-critical communication, spectrum limitations may impede interoperability and hinder the seamless collaboration between different user groups. Addressing these challenges requires careful spectrum management and coordination, along with technological innovations to optimize spectrum use and ensure efficient PTT communication in the face of growing demand.

5G Implementation

The implementation of 5G technology is ushering in a new era of opportunities for the push-to-talk (PTT) market. The high-speed and low-latency capabilities of 5G networks significantly enhance the performance of PTT communication. With faster data speeds, users can experience almost instantaneous voice transmission, improving the overall responsiveness and reliability of PTT services. This creates opportunities for more seamless communication in critical situations, especially in industries like public safety and emergency response where quick and efficient information exchange is paramount.

Moreover, the expanded capacity of 5G networks allows for a broader user base and increased scalability for PTT solutions. The enhanced network capabilities open doors for the integration of PTT in diverse sectors, ranging from healthcare to manufacturing, as businesses can leverage the robust and efficient communication provided by 5G-enabled PTT services. As 5G infrastructure continues to roll out globally, the push-to-talk market stands poised to capitalize on these opportunities, offering advanced communication solutions to industries seeking faster, more reliable, and more responsive connectivity.

The hardware segment held the highest market share of 46% in 2024. In the push-to-talk (PTT) market, the hardware segment refers to the physical devices that enable instant communication. This includes ruggedized smartphones, two-way radios, and specialized PTT accessories. The trend in PTT hardware is towards more durable and versatile devices, capable of withstanding harsh conditions. Additionally, there's an integration trend, where PTT functionalities are incorporated into existing devices, such as smartphones, expanding the reach of instant communication solutions to a broader user base across various industries.

The solution segment is anticipated to witness rapid growth at a significant CAGR of 13.8% during the projected period. In the push-to-talk market, the solution segment refers to the various offerings and packages provided by service providers to meet communication needs. This encompasses the software, hardware, and associated services that enable instant voice communication. Recent trends indicate a shift towards cloud-based push-to-talk solutions, allowing for scalable and flexible deployments. Additionally, advancements in interoperability standards are influencing solution development, promoting seamless communication across different networks and devices, thereby enhancing the overall effectiveness of push-to-talk services.

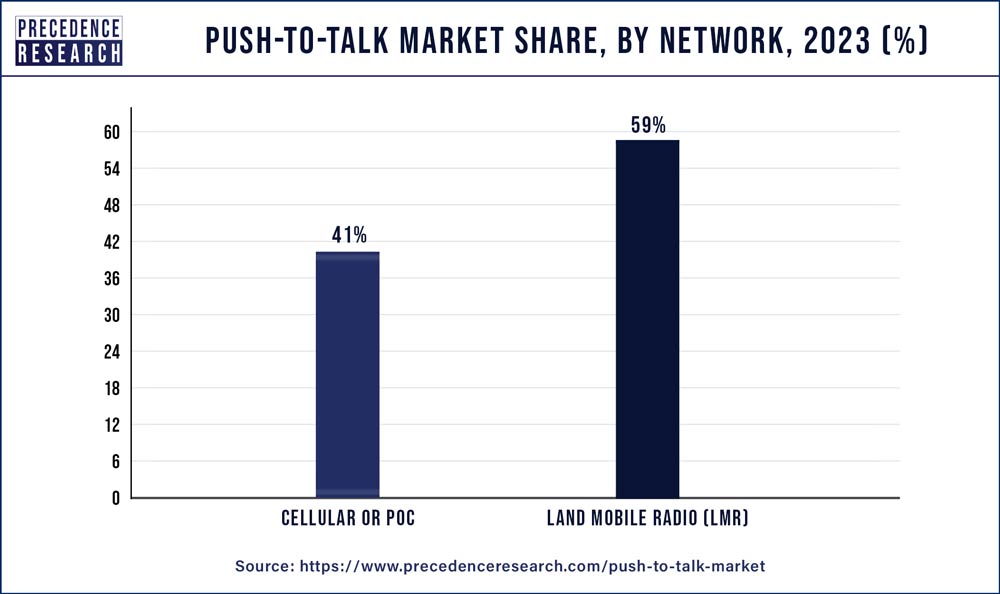

The land mobile radio (LMR) segment has held 59% market share in 2024. In the push-to-talk market, the land mobile radio (LMR) segment refers to a network infrastructure that supports traditional two-way radio communication. LMR systems are widely used in sectors like public safety and transportation for reliable instant communication. A trend in this segment involves the gradual transition to digital LMR technologies, offering enhanced features, better audio quality, and increased capacity. This shift reflects a broader industry movement towards modernizing communication networks, ensuring more efficient and secure push-to-talk services in various professional settings.

The cellular or PoC segment is anticipated to witness rapid growth over the projected period. In the push-to-talk (PTT) market, the cellular or Push-to-Talk over Cellular (PoC) segment refers to communication solutions that leverage cellular networks for instant voice communication. This segment is witnessing a trend towards increased adoption due to the ubiquity and advancements in cellular technology. PoC services over cellular networks offer enhanced coverage, scalability, and interoperability, making them a preferred choice in industries like public safety and transportation. The trend indicates a shift towards more versatile and accessible PTT solutions, aligning with the widespread use of mobile devices and the expansion of cellular infrastructure.

The public safety & security segment has held a 28% market share in 2024. In the push-to-talk (PTT) market, the public safety and security segment focuses on providing instant and reliable communication solutions for law enforcement, emergency responders, and security personnel. Trends in this segment include the integration of PTT with advanced technologies like body-worn cameras and IoT devices for enhanced situational awareness. The adoption of PTT over LTE networks is also growing, ensuring seamless communication during critical incidents. These trends underscore the commitment to leveraging PTT technology to improve coordination and response times in public safety.

The government & defense segment is anticipated to witness rapid growth over the projected period. In the push-to-talk (PTT) market, the government and defense segment pertains to the deployment of instant communication solutions for military and public safety agencies. This vertical demands secure and reliable PTT services for swift and coordinated responses in critical situations. Recent trends in this segment include the integration of advanced encryption and security features to safeguard sensitive communications. Additionally, the adoption of ruggedized PTT devices, interoperability standards, and the incorporation of IoT technologies contribute to the evolving landscape of PTT solutions in government and defense applications.

By Offering

By Network

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client