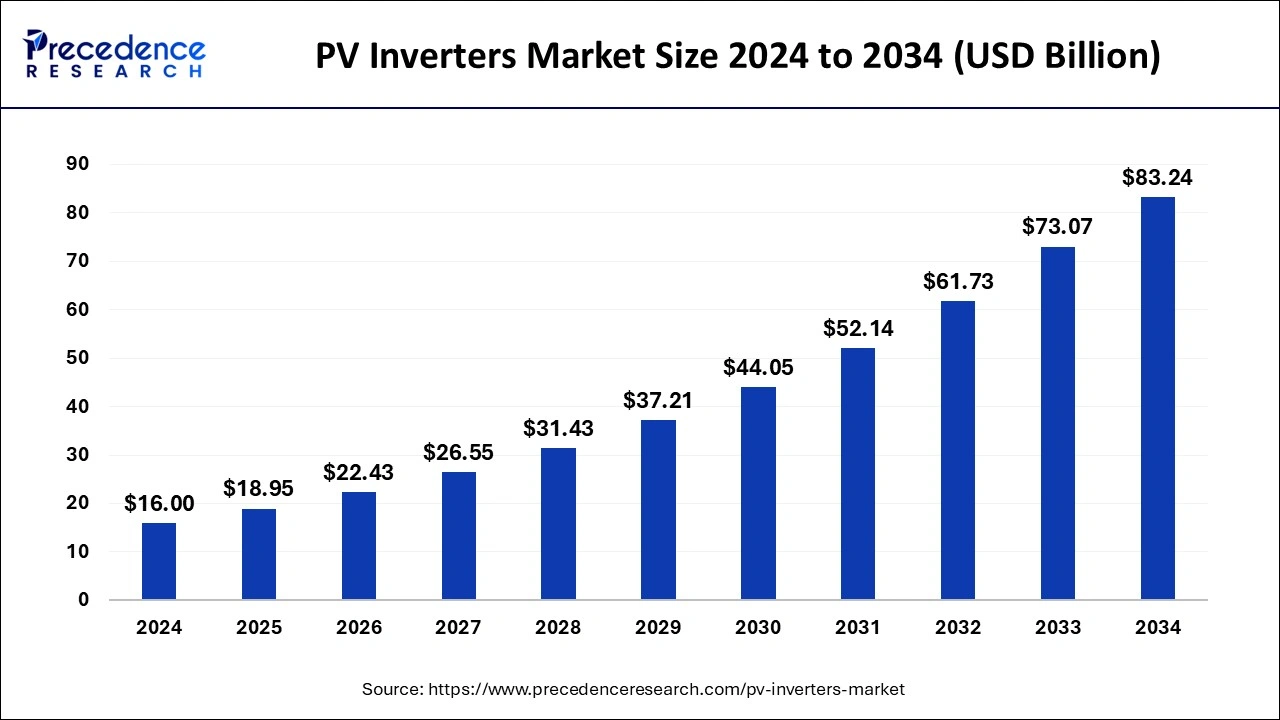

The global PV inverters market size is calculated at USD 18.95 billion in 2025 and is forecasted to reach around USD 83.24 billion by 2034, accelerating at a CAGR of 17.93% from 2025 to 2034. The Asia Pacific PV inverters market size surpassed USD 8.53 billion in 2025 and is expanding at a CAGR of 18.06% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global PV inverters market sizewas estimated at USD 16 billion in 2024 and is predicted to increase from USD 18.95 billion in 2025 to approximately USD 83.24 billion by 2034, expanding at a CAGR of 17.93% from 2025 to 2034. The increased awareness about environmental issues and the need to reduce carbon emissions is driving demand for clean energy solutions, which is anticipated to drive demand for various energy equipment, including PV inverters.

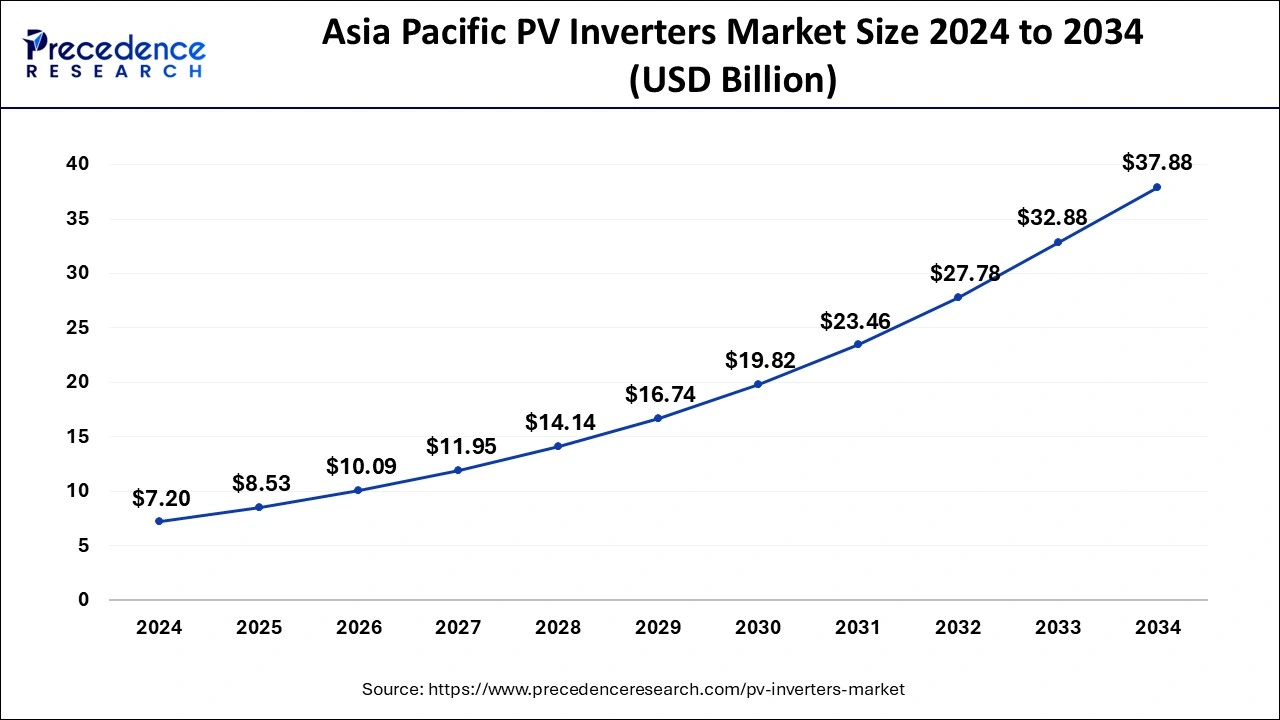

The Asia Pacific PV inverters market size was estimated at USD 7.20 billion in 2024 and is predicted to be worth around USD 37.88 billion by 2034 at a CAGR of 18.06% from 2025 to 2034.

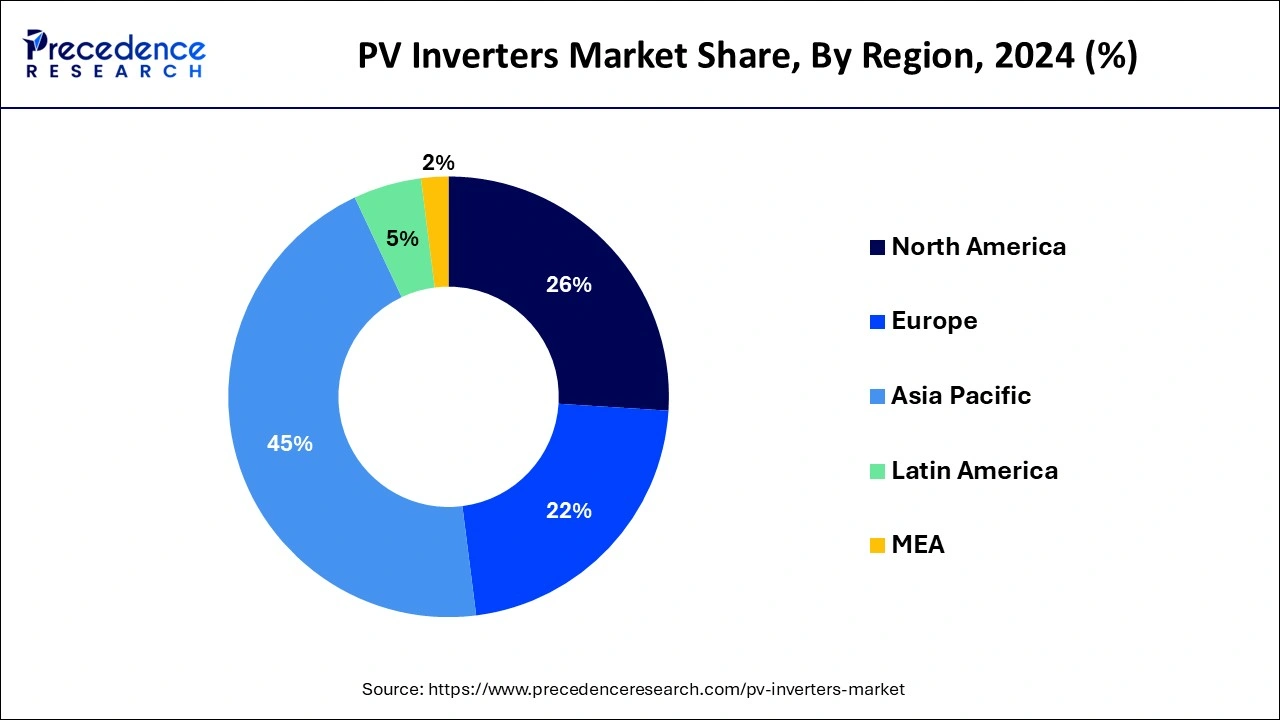

Asia Pacific dominated the PV inverters market share 45% in 2024. More solar installations in developing nations have substantially contributed to the growth of the region's market. China held the largest market share over the projected period. The government of China largely invests in power generation from renewable sources. They have also opened various channels for foreign investment in the country. This is anticipated to boost the market growth further.

As part of the Paris Agreement the Government of India set an ambitious target of achieving 175 GW of renewable energy capacity by 2022. Out of the 175 GW, 100 GW was earmarked for solar capacity with 40 GW (40%), which was anticipated to be achieved through decentralized and rooftop-scale solar projects.

The North American PV inverters market, mainly dominated by the US and Canada, holds the largest share in the region. Favorable policies and government initiatives promoting renewable energy generation in both countries have been key drivers of market growth. The efforts by the Mexican government to encourage the use of clean energy technologies have further fueled market expansion in the country.

Moreover, the presence of major PV inverter vendors in the region, along with support for research and development activities by research organizations and manufacturers, has contributed to the increased adoption of solar energy generation. These factors are expected to continue driving market growth in the forecast period.

PV inverters, also known as photovoltaic inverters, are crucial components of solar energy systems. They convert the direct current (DC) electricity produced by solar panels into alternating current (AC) electricity, which can be used in homes, businesses, and the power grid. Solar PV inverters ensure that the electricity generated by solar panels meets the requirements of standard electrical appliances and can be seamlessly integrated into existing power systems.

The PV inverters market plays a vital role in optimizing the efficiency and reliability of solar energy systems. They adjust power output and voltage levels to match variations in sunlight and electrical demand, maximizing the system's performance. In addition to converting DC to AC power, modern solar PV inverters offer advanced features such as maximum power point tracking (MPPT) to maximize power extraction from solar panels, grid-tie capabilities for exporting surplus energy to the grid, and performance monitoring systems.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 17.93% |

| Market Size in 2025 | USD 18.95 Billion |

| Market Size by 2034 | USD 83.24 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for renewable energy solutions

The world's growing demand for renewable energy, driven by concerns over environmental pollution and fossil fuel depletion, has made solar energy an attractive option. Despite its abundance and cleanliness, solar energy faces challenges due to the intermittent nature of sunlight. Photovoltaic inverters play a crucial role in addressing this issue by converting solar PV modules' direct current into usable alternative current for electrical grids or buildings.

With increasing global installations of solar power, supported by government policies, falling module prices, and rising initiatives, the demand for PV inverters is expected to rise significantly. Countries worldwide are setting ambitious targets and offering incentives to increase the share of solar and renewables in their energy mix. This helps drive the growth of the PV inverters market.

Rise in global electricity demand

Global electricity demand is expected to rise significantly over the forecast period, reaching nearly two-thirds of current demand. The increasing emphasis on distributed power and utility projects is projected to drive market growth in the coming years. While coal remains a prominent source of electricity generation worldwide, concerns over dwindling coal reserves and environmental impacts have led to a shift towards natural gas and renewable energy sources like wind power for electricity production. This helps drive the growth of the PV inverters market.

Lack of proper regulatory policies

The lack of proper regulatory policies is substantially restraining the growth of PV inverters market. Without guidelines and regulations, the installation and utilization of PV inverters are not efficient. This also creates uncertainty among market players and consumers. Furthermore, where regulations still exist but a lack of law enforcement and supervision impedes the evolution of quality standards, semi-standard or non-compliant inverters can result in grid instabilities and safety concerns over time. This lessens customers' confidence in the technology.

Emerging residential PV industry

The PV inverters market has significant potential for expansion, especially with the emerging residential photovoltaic (PV) sector. As concerns about climate change escalate and renewable energy options become more accessible, homeowners worldwide are increasingly turning to rooftop solar panels to reduce their carbon footprint and electricity costs. This previously untapped sector presents an important segment of the power generation in the PV inverters market.

Residential PV installations allow households to convert their roofs into energy generators. The PV inverter market plays a crucial role in this process by converting the direct current (DC) electricity produced by solar panels into the alternating current (AC) required for appliances and grid integration. Their contribution to maximizing the efficiency and return on investment of residential solar systems drives the growing demand as more homeowners invest in independent renewable energy production.

Increased global PV demand

The growing global demand for PV systems presents a big opportunity for the PV inverters market to expand substantially in the coming years. More countries and communities are installing rooftops and large-scale power installations as the world switches towards reducing its carbon footprint and dependence on fossil fuels. Also, market players are launching new products, which will help expand the market further.

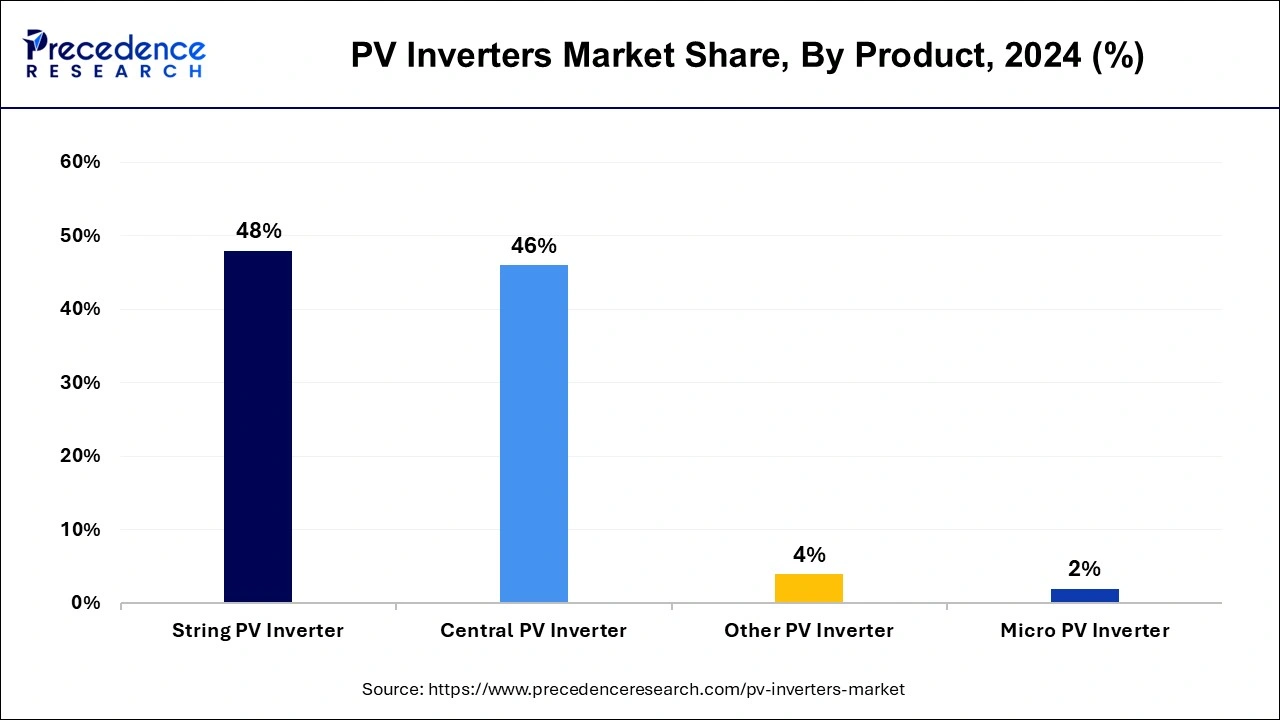

The string PV inverter segment dominated the PV inverters market share of 48% in 2024. These inverters are highly reliable and flexible enough to be placed in a protected location for their installation. Lower cost and easy installation are two major factors responsible for the growth of the segment. Moreover, these inverters offer high efficiency, high design flexibility and are well-supported.

The micro-PV inverters segment is anticipated to grow at a significant rate over the forecast period. These inverters are module-level electronics and become popular choices for industrial and commercial sectors. These inverters also have the benefit of high performance, increased efficiency, and high reliability with ease of installation, no space constraints, and are cost-effective.

The utilities segment of the PV inverters market held the largest market share in 2024. Utility-scale solar projects require reliable, robust, and scalable infrastructure. The central and string inverters are the most used PV inverters in this sector. The growth of the utility segment is driven by increased demand for renewable energy, declining costs of solar power and equipment, and government subsidies. Many key players offer industry-leading utility-scale solutions aimed at achieving higher efficiency and reducing balance-of-system costs through pre-integrated power stations.

The residential segment has grown due to rising consumer demand for solar energy for electricity needs. Governments worldwide are encouraging captive power generation in residential buildings by implementing policies and offering financial incentives to promote renewable energy sources.

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client