November 2024

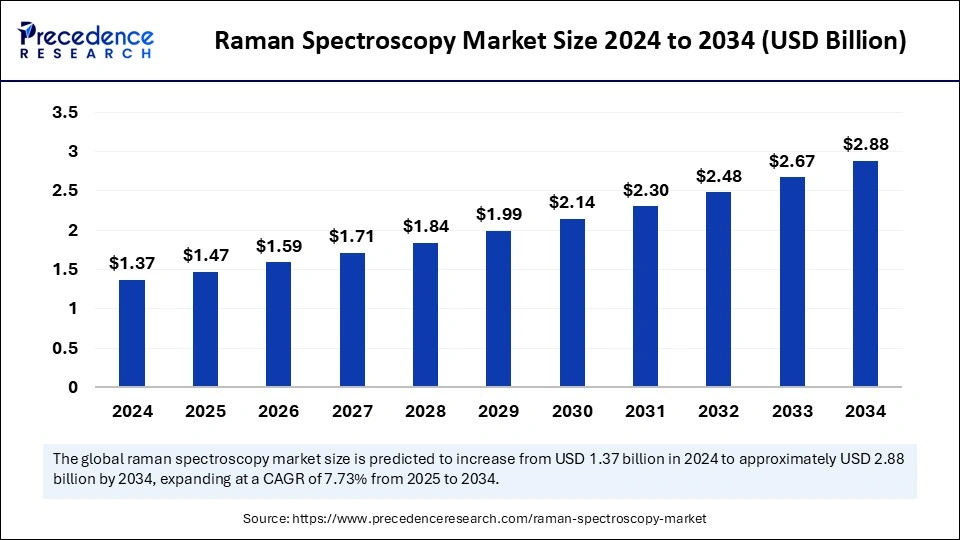

The global raman spectroscopy market size is calculated at USD 1.47 billion in 2025 and is forecasted to reach around USD 2.88 billion by 2034, accelerating at a CAGR of 7.73% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global raman spectroscopy market size accounted for USD 1.37 billion in 2024 and is predicted to increase from USD 1.47 billion in 2025 to approximately USD 2.88 billion by 2034, expanding at a CAGR of 7.73% from 2025 to 2034. The growth of the Raman spectroscopy market is driven by the rising adoption in various industries. Furthermore, the increasing focus on drug development, in which Raman spectroscopy plays a crucial role, and rising R&D activities drive market growth.

Artificial Intelligence significantly impacts the Raman spectroscopy method by analyzing complex data. It overcomes several limitations in conventional chemometrics techniques by enhancing the ability to handle huge datasets and heterogeneous structures and minimizing the need for manual processing or human intervention, marking a prominent advancement in the field.

The integration of AI in Raman spectroscopy gained traction due to the availability of open-source machine learning libraries, like PyTorch and Keras, and several application programming interfaces for data analysis. In addition, leading players in the market are making efforts to develop innovative solutions by integrating AI, further driving the market's growth.

Raman spectroscopy refers to the analytical technique generally used for the observation of vibrational, rotational, and other low-frequency modes in a system. It depends on the inelastic scattering of monochromatic light derived from a LASER source. Due to the interaction of laser light with molecular vibrations, there are changes in the energy levels of the molecule. This shift in energy throws light on the detailed vibrational modes in the system. Raman spectroscopy is named after renowned Indian physicist and highly prestigious Nobel Prize winner Mr. C.V. Raman. In chemistry, Raman spectroscopy is majorly used to provide a structural fingerprint, which is helpful in determining new compounds.

The key driving factors for the market’s expansion include the need for spectroscopy at different stages of drug discovery, including chemical identification, molecular biology research, bioanalysis, solid form screening, formulation analytics, raw material certification, quality control process, and counterfeit identification. The strategic collaborations and acquisitions by leading players to strengthen their product portfolio further contribute to market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.88 Billion |

| Market Size in 2025 | USD 1.47 Billion |

| Market Size in 2024 | USD 1.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.73% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Instrument, Sampling Technique, Application and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Use in Disease Diagnostics

The increasing use of Raman spectroscopy in disease diagnostics and food safety is a major factor driving the growth of the Raman spectroscopy market. Raman spectroscopy offers non-invasive methods and enables real-time analysis, making it an ideal option for diagnostics applications. It is heavily used in cancer diagnosis, arterial blockage detection, and bone disease diagnostics. In addition, Raman spectroscopy finds extensive applications in industries like pharmaceuticals and biotechnology, especially for new drug discovery, along with product development and quality control methods to comply with safety regulations set by authorities. Protein characterization and stability studies are an integral part of the biopharmaceutical sector, in which Raman spectroscopy plays a crucial role.

Availability of Alternative Technologies

The easy availability of alternative technologies, which offer similar results to Raman spectroscopy, is a key factor restraining the growth of the Raman spectroscopy market. Technologies like infrared spectroscopy and ray diffraction create barriers to the adoption of the Raman spectroscopy method. Skilled personnel can efficiently derive complementary data from a combination of substitute technologies, limiting the use of Raman spectroscopy. Moreover, in Raman spectroscopy, a powerful monochromatic light source is used, which holds the potential to cause thermal damage to the samples. Hence, there are limitations of Raman spectroscopy to using it for thermally unstable materials and biological samples, which may limit the market's growth.

Emergence of CMOS-based Raman Spectroscopy

A significant opportunity that the Raman spectroscopy market holds is the emergence of complementary metal-oxide semiconductor (CMOS) cameras and sensors for Raman spectroscopy. These sensors are well known to provide many benefits, like high quantum efficiency, lower noise, low-cost production, and minimized readout time. They further increase the sensitivity and system’s speed. Due to such advantages, leading players in the market are focusing on developing CMOS-based Raman spectrometers. Moreover, researchers are innovating, like integrating CMOS sensors with different microsystems like microfluidics, supporting the trend for CMOS-based Raman spectroscopy.

The microscopy Raman segment dominated the Raman spectroscopy market with the largest share in 2024. This is mainly due to its advanced capabilities, which offer high spatial resolution. It is crucial for analyzing microstructures in biology, material science, and pharmaceuticals. By using microscopy Raman, detailed imaging and chemical analysis is possible even at the microscopic level, which is crucial for accuracy in research and diagnostics.

Microscopy Raman plays a crucial role in drug development and quality control due to its improved sensitivity and specificity. Moreover, the increase in demand for non-destructive analysis in several industries, like healthcare, material science, and environmental monitoring, bolstered the segment growth.

The FT Raman segment is expected to witness notable growth in the coming years. FT Raman is beneficial in the analytical laboratory. Its easy sample preparation method, enhanced speed, and precise spectral data presentation make it suitable for spectroscopy.

The surface-enhanced Raman scattering (SERS) segment is anticipated to grow at a rapid pace in the foreseeable future. The segment growth is attributed to ongoing technological advancements and increased research activities have prominently broadened the scope of surface-enhanced Raman scattering. This technique finds applications in life science, material science, and pharmaceutical domains. As compared to other techniques, surface-enhanced Raman scattering is beneficial owing to its enhanced signal intensity and large concentration range.

The pharmaceutical segment dominated the Raman spectroscopy market in 2024. The increased use of solid-state pharmaceutical products in academic and industrial applications bolstered the segment. Raman spectroscopy enables the visualization of drugs and excipient distribution in formulations like tablets, ointments, and creams used for medical purposes. Some other advantages have been provided by Raman spectroscopy, like the selection and optimization of active medicinal components. The Raman spectroscopy offers higher lateral spatial and depth resolution, contributing to segmental growth.

The life science segment is projected to witness notable growth in the market during the forecast period. The segment growth is attributed to the higher potential of Raman spectroscopy in accurate diagnosis, which is crucial in medical and biochemical research for the observation of cells. It is also used for process control and quality checking in the manufacturing of drugs. Additionally, Raman spectroscopy is used on aqueous substances, which is beneficial for the life science domain. It can also integrate with several measurement configurations, like microscopy and endoscopy.

Asia Pacific Raman Spectroscopy Market Trends

Asia Pacific registered dominance in the market by capturing the largest share in 2024. The region is expected to sustain its market dominance owing to the rapid expansion of the pharmaceutical and food & beverage industry. Stringent regulations regarding the safety of pharmaceuticals and food & beverages support market growth. Raman spectroscopy plays a crucial role in quality control processes. The rising focus on advancing analytical tools and the growing demand for portable spectrometers for environmental monitoring and industrial applications further strengthen the market in Asia Pacific.

India plays a crucial role in the Asia Pacific Raman spectroscopy market. The growing demand for high-quality pharmaceuticals and increasing investments in material science and life science research are driving the market growth. The presence of several leading pharmaceutical companies and research institutes that focus on life science research and expanding contract manufacturing organizations are further driving the market in India.

North American Raman Spectroscopy Market Trends

North America is expected to witness significant growth in the upcoming period. The presence of well-established pharmaceutical and biotechnology sectors supports regional market expansion. The U.S. is expected to lead the market in North America. This is mainly due to the increasing acceptance of Raman spectroscopy in manufacturing facilities for quality assurance. Moreover, increasing usage of spectroscopy for diagnostics and research purposes supports market expansion.

By Instrument

By Sampling Technique

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

April 2025

June 2024

April 2025