February 2025

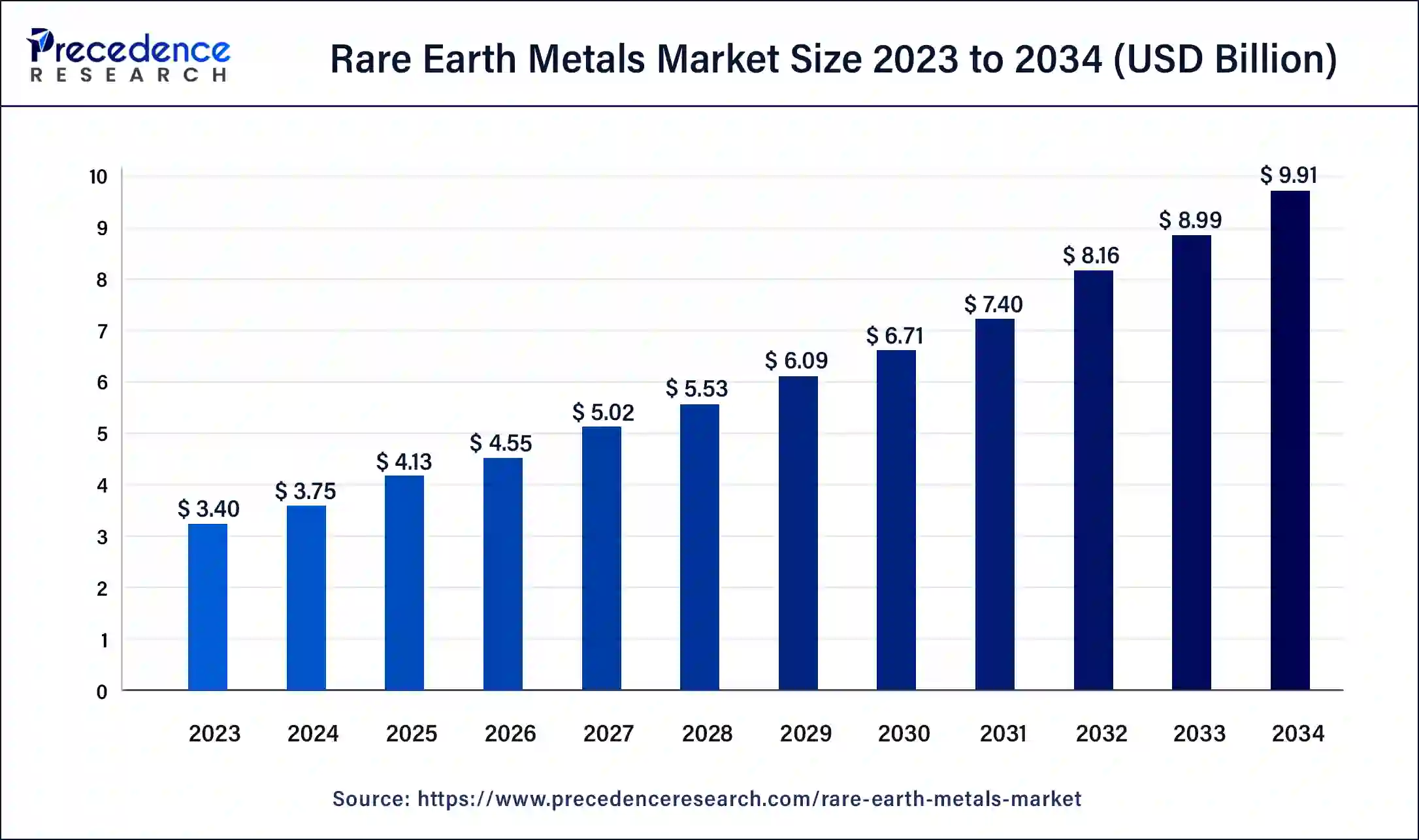

The global rare earth metals market size was USD 3.40 billion in 2023, calculated at USD 3.75 billion in 2024 and is expected to be worth around USD 9.91 billion by 2034. The market is slated to expand at 10.21% CAGR from 2024 to 2034.

The global rare earth metals market size is expected to be worth USD 3.75 billion in 2024 and is anticipated to reach around USD 9.91 billion by 2034, growing at a solid CAGR of 10.21% over the forecast period 2024 to 2034. The adoption of electronic vehicles globally and the rising demand for smart technologies, which require permanent magnets that can be obtained from rare earth metals, are the major driving factors of the rare earth metals market.

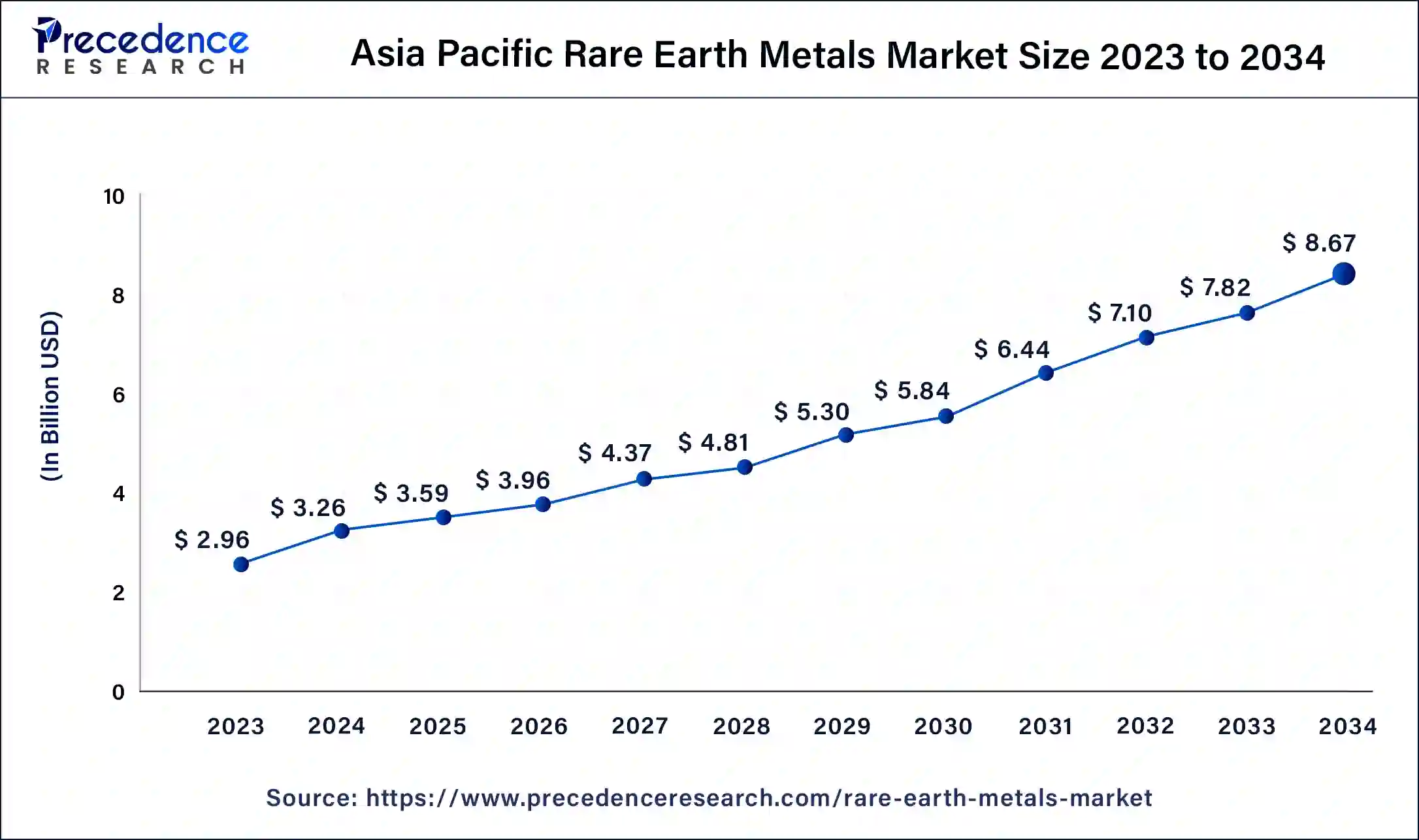

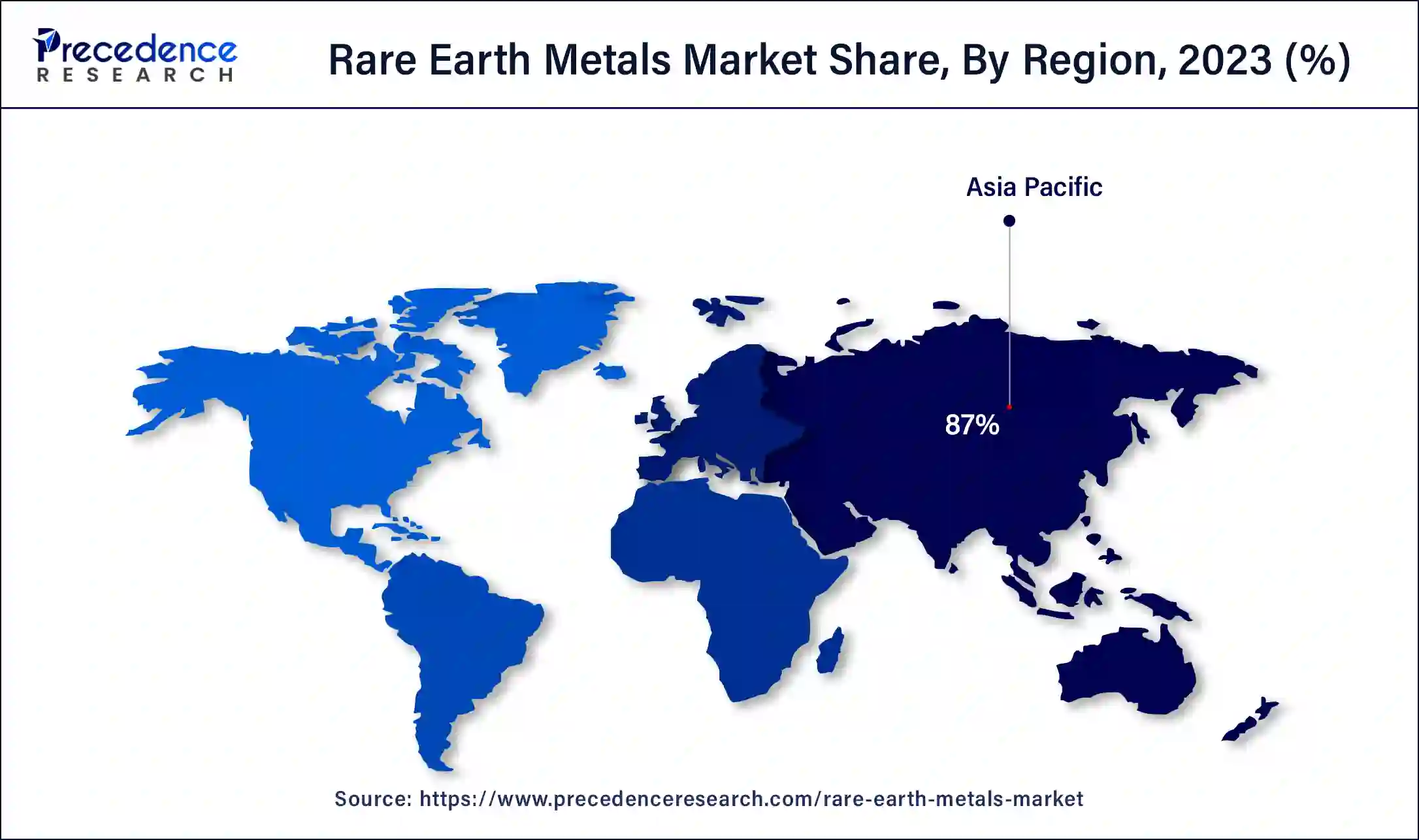

The Asia Pacific rare earth metals market size was exhibited at USD 2.96 billion in 2023 and is projected to be worth around USD 8.67 billion by 2034, poised to grow at a CAGR of 10.26% from 2024 to 2034.

Asia Pacific accounted for the largest share of the rare earth metals market in 2023. Asia, particularly China, dominates the rare earth metals market due to its vast reserves and established mining infrastructure. China's government has heavily invested in the industry, ensuring a robust supply chain from extraction to processing. The region's advanced technological capabilities and cost-effective production also contribute to its dominance.

Additionally, China's strategic stockpiling and export controls influence global prices and availability, reinforcing its pivotal role in the rare earth metals market. Asia, particularly China, dominates the market due to its vast reserves and established mining infrastructure. China's government has heavily invested in the industry, ensuring a robust supply chain from extraction to processing. The region's advanced technological capabilities and cost-effective production also contribute to its dominance. India and Japan are also making significant strides.

The rare earth metals market is witnessing significant growth, driven by rising demand across high-tech industries such as electronics, renewable energy, and electric vehicles. These metals, which include neodymium, dysprosium, and terbium, are crucial for manufacturing permanent magnets, batteries, and advanced alloys. The market is dominated by China, which controls over 80% of global production and refining capacity, creating supply chain vulnerabilities. Efforts to diversify sources and increase recycling are gaining momentum. Technological advancements and governmental policies promoting green energy are key growth drivers. However, environmental concerns associated with mining and processing rare earth metals pose challenges.

The AI Impact on the Rare Earth Metals Market

In the rising era of AI, the rare earth metals market could not be the exception, and it isn't affected by the waves created by AI in the global market. AI is revolutionizing the rare earth metals market in an unprecedented manner by enhancing the efficiency of earth exploration and mining processes and searching for new metals or rare earth elements using predictive analytics. AI-driven technologies are enabling a more precise and cost-effective identification process for rare earth deposits. AI is also helpful in improving the refinement process by predicting equipment failures and their causes, which optimizes resource allocation, enhances overall productivity, and reduces adverse environmental impact.

| Report Coverage | Details |

| Market Size by 2034 | USD 9.91 Billion |

| Market Size in 2024 | USD 3.75 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 10.21% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Applications, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand from different industries

The significant driving factor for the growth of the rare earth metals market is the increasing demand for metals and earth elements from various industries to manufacture the products efficiently. These earth metals are mandatory and crucial, too, in the production of various electronic devices such as smartphones, gadgets, laptops, desktops, and highly advanced medical machinery/equipment. They are essential for manufacturing the permanent magnets used in wind turbines and electric vehicle motors.

The global shift towards smart technologies and digitalization continues to accelerate the demand for metals, thus driving the global market. With the increasing adoption of renewable energy sources and electric vehicles on a large scale, the need for metals is further amplified and boosts the rare earth metals market growth globally.

Environmental initiatives supported by governments worldwide

Another driving factor of the rare earth metals market is increasing support from authorities worldwide to reduce their carbon footprint and embrace renewable energy sources instead of traditional ones, which cause harm to the climate. Governments worldwide are implementing policies to promote green energy, which helps reduce carbon emissions and further fuels the growth of the market. These rare earth metals are crucial for the development of cleaner energy technologies such as wind and solar power systems and electric vehicles.

Moreover, the strategic initiatives, subsidies provided by the government, and notable investments to develop sustainable energy infrastructure are encouraging increased production and proper utilization of rare earth metals. Again, the efforts made to develop and refine recycling processes for these metals are gaining traction, further contributing to a more stable and environmentally friendly supply. Such regulatory support from authorities, keeping the clean climate as a primary focus, is fuelling the rare earth metals market globally.

Adverse impact on the ecosystem due to the mining process

A major restraint that hinders the rare earth metals market is the harmful impact on the overall ecosystem associated with mining and processing for the purification of these raw metals obtained from the earth's crust/core. Extracting rare earth metals often involves environmentally damaging practices such as extensive landfalls, disruptions in lands, water contamination, air pollution, and noise pollution with tons of hazardous waste. These climatic impacts have led to stringent regulations and created a backlash from local communities as they disrupt their way of living. Such opposition further complicates the establishment and expansion of mining operations.

Moreover, the complex processes that are energy intensive, which are required to separate and refine the raw metals from the earth, further lead to high operational costs and create delays, which eventually affect the profitability and supply chain stability in the global market, which hinders the rare earth metals market expansion significantly.

Recycling and sustainable practices

As environmental concerns around mining intensify, the rare earth metals market has significant opportunities in recycling and sustainable practices. Developing efficient recycling technologies can recover valuable metals from electronic waste, reducing dependency on primary mining. This not only helps in addressing environmental issues but also stabilizes supply chains. Companies investing in sustainable extraction methods and eco-friendly processing technologies can gain a competitive edge, meeting regulatory requirements and consumer demand for greener products. This focus on sustainability opens up new avenues for growth and innovation in the market.

Geographical diversification of supply

Diversifying the geographical sources of rare earth metals presents a major opportunity for the rare earth metals market. Currently, China dominates production, leading to supply chain vulnerabilities. Investing in the exploration and development of rare earth deposits in other regions, such as the United States, Australia, and Africa, can mitigate risks associated with over-reliance on a single source. This diversification not only enhances global supply security but also fosters competitive pricing. Companies and governments collaborating on these initiatives can unlock new reserves, ensuring a more resilient and stable supply for high-tech and green energy industries.

The rare earth metals market is further segmented into lanthanum, cerium, neodymium, praseodymium, samarium, europium, and others. In 2023, the neodymium segment held the largest share of the market. The growth of this segment is attributed to increasing demand for electric and hybrid vehicle manufacturing on a wider scale. Batteries used in electric vehicles are made of neodymium-based magnets. Since batteries are the primary part of the functioning of EVs, the rising production and adoption of EVs in various regions is directly proportional to the growth of the neodymium segment, which, in turn, increases the market and its growth globally. Similarly, the cerium element is a vital part of automotive manufacturing. Thus, its growth is associated with the proliferation of the automotive industry. To minimize carbon emissions, cerium is generally used in the exhaust system and catalytic converters in the automobile.

The lanthanum segment is expected to grow at the fastest rate in the global rare earth metals market during the forecast period. The proliferation of this segment on a global scale is due to the increasing expansion of battery manufacturers. Nickel metal batteries are primarily used in consumer electronics devices, where lanthanum is used as an intermetallic component of nickel metal hybrid batteries. Hence, the rising adoption of electronic devices by the masses on a routine basis is the major contributor to this segment's growth in the market.

The magnets segment dominated the global rare earth metals market in 2023. The market is further segmented into metallurgy, batteries, polishing, glass and ceramics, catalysts, phosphorous, and others. There are continuous demands from various manufacturers, such as handheld consumer electronics, hard drives, servo motors, sensors, speakers, and headphones.

The battery segment is expected to showcase substantial growth in the rare earth metals market over the forecasted years. Technological development at a rapid pace, combined with the rising adoption of EVs, where batteries are an essential part of EV components, is the prominent factor driving battery segment growth in this market. Also, the substantial growth rate for energy storage applications with increasing reliance on electronic gadgets further fuels the battery segment and its expansion on a wider scale. Region-wise, China, the U.S., and European countries are the largest producers of EVs and will eventually become major contributors to this segment’s growth globally.

Segments Covered in the Report

By Type

By Applications

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

July 2024

August 2024

July 2024