January 2025

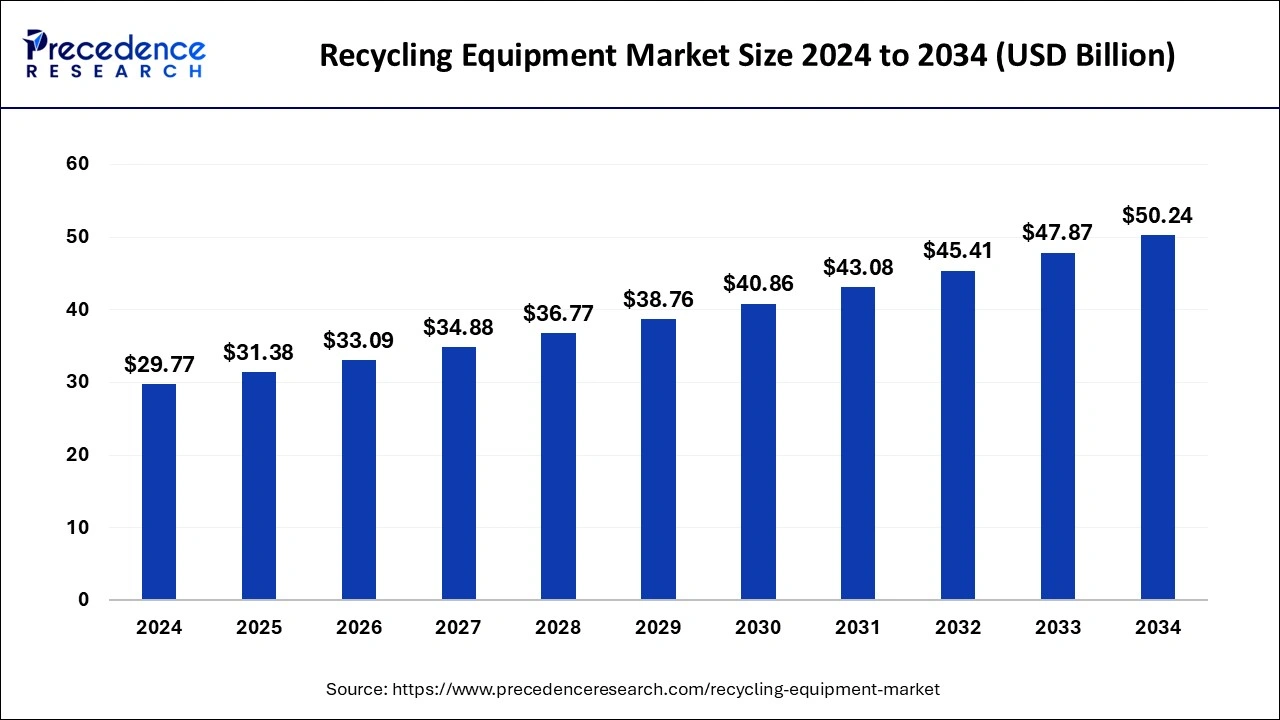

The global recycling equipment market size is calculated at USD 31.38 billion in 2025 and is forecasted to reach around USD 50.24 billion by 2034, accelerating at a CAGR of ccc% from 2025 to 2034. The Asia Pacific recycling equipment market size surpassed USD 12.87 billion in 2025 and is expanding at a CAGR of 5.50% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global recycling equipment market size was estimated at USD 29.77 billion in 2024 and is predicted to increase from USD 31.38 billion in 2025 to approximately USD 50.24 billion by 2034, expanding at a CAGR of 5.37% from 2025 to 2034. The collaboration of a technical company with a waste material management company can be the opportunity to boost the recycling equipment market.

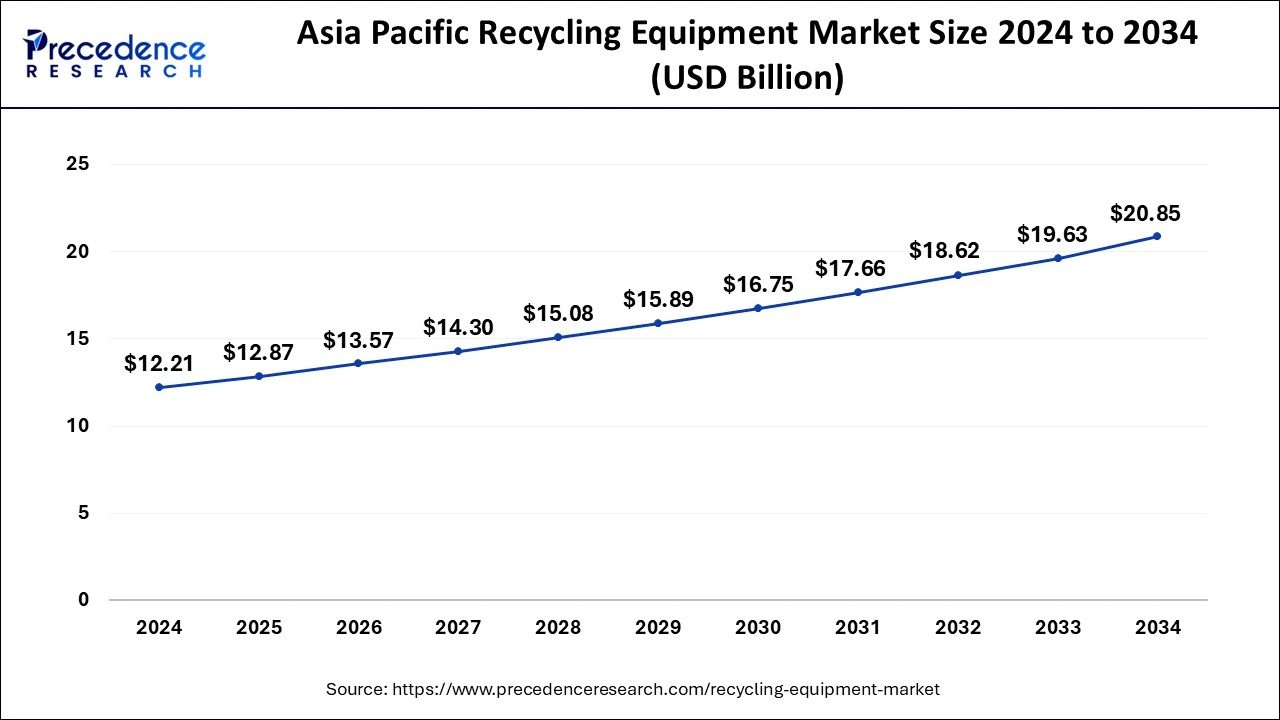

The Asia Pacific recycling equipment market size reached USD 12.21 billion in 2024 and is predicted to be worth around USD 20.85 billion by 2034, at a CAGR of 5.50% from 2025 to 2034.

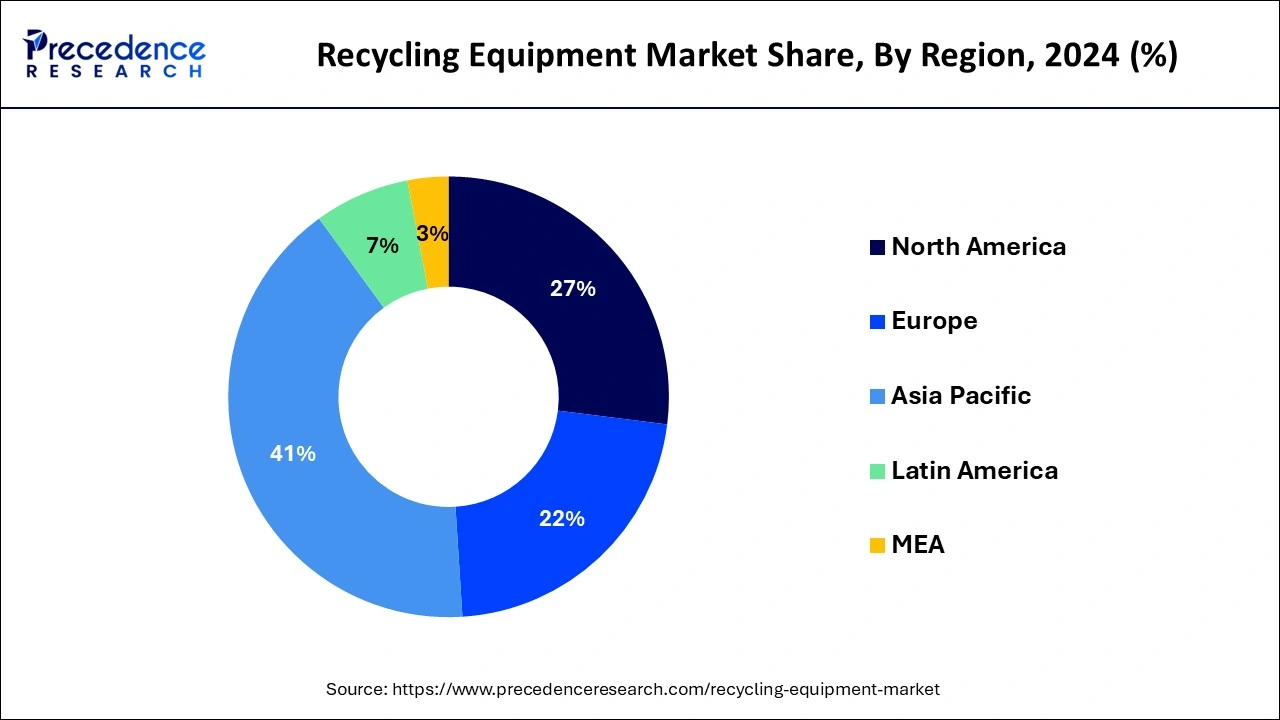

Asia Pacific has held the largest market share in 2024. Due to a number of factors, including expanding urbanization, environmental awareness, stricter government regulations, and growing investment in suitable development efforts, the market is likely to rise in the Asia Pacific region. In order to manage waste efficiently and sustainably, the region’s fast industrialization and growing manufacturing sector also increase the need for recycling technology.

India’s environment ministry has proposed a new draft under which the government will be focusing on recycling in the automobile sector. The newly draft policy seeks establishment of 20 official vehicle dismantlers across the country.

North America is observed to grow at a significant rate in the recycling equipment market by region, during the forecast period. The recycling equipment is in high demand due to the strict management and recycling requirements in North America. The area has a competitive advantage in the worldwide market thanks to the numerous creative businesses that are creating cutting-edge machinery there. The business has been further stimulated by significant investments made by North American nations in recycling infrastructure, including structures and machinery.

The recycling equipment market refers to the industry that offers equipment that is used to recycle waste materials into useful products. The recycling equipment includes devices that help in the separation and arrangement of recyclable materials such as paper, plastic, rubber, glass, and metal for additional processing and reuse. The recycling equipment includes baler presses, shredders, granulators, agglomerators, shears, separators, extruders, etc.

The recycling equipment market is driven by the rise in the usage of recycled materials, rising concern about waste management, and the collaboration of technical companies with waste material management companies can be the opportunity to boost the market.

The recycling equipment market is fragmented with multiple small-scale and large-scale players such as Recycling Equipment Manufacturing, The CP Group, American Baler, Kiverco, General Kinematics, MHM Recycling Equipment, Marathon Equipment, Ceco Equipment Ltd., Danieli Centro Recycling, ELDAN Recycling, Metso, Suny Group, Forrec Srl Recycling, BHS Sonthofen, LEFORT GROUP.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.37% |

| Market Size in 2025 | USD 31.38 Billion |

| Market Size by 2034 | USD 50.24 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Equipment, and By Processed Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising the usage of recycled material

The rise in the usage of recycled materials boosts the recycling equipment market. The demand for recycling equipment in the electric and electronics sector will soar due to the growing use of recycled materials in a variety of end-user industries, such as packaging, building and construction, electrical and electronics, automotive and pharmaceuticals, etc. Recycled materials are widely used in the production of wire and cable insulation, refrigerators, TV cabinets, laptops, bodies, and cell phones.

Rising concern about waste management

The rising concern about waste management can boost the recycling equipment market. Governments, industries, and consumers are placing a higher priority on recycling and appropriate waste management techniques as environmental awareness rises. In order to handle recycling equipments efficiently, this trend has raised demand for recycling equipments including shredders, crushers, and sorting machines.

Environmental impact

The environmental impact may slow down the recycling equipment market. Recycling e-waste has an impact on the environment even though it lessens the requirement for landfill space and the extraction of new raw materials. Energy is needed for the recycling process itself, which might produce pollutants. For example, the process of shredding e-waste might result in dust particles that aggravate air pollution. In a similar vein, wastewater that needs to be cleaned before being discharged into the environment can result from using water during the recycling process.

Collaborative activities between companies

The collaboration of a technical company with a waste material management company can be the opportunity to boost the recycling equipment market. This collaboration combines technical expertise with waste management knowledge, which results in more effective and innovative solutions for sorting e-waste to recycling with a rising demand for advanced waste management technology.

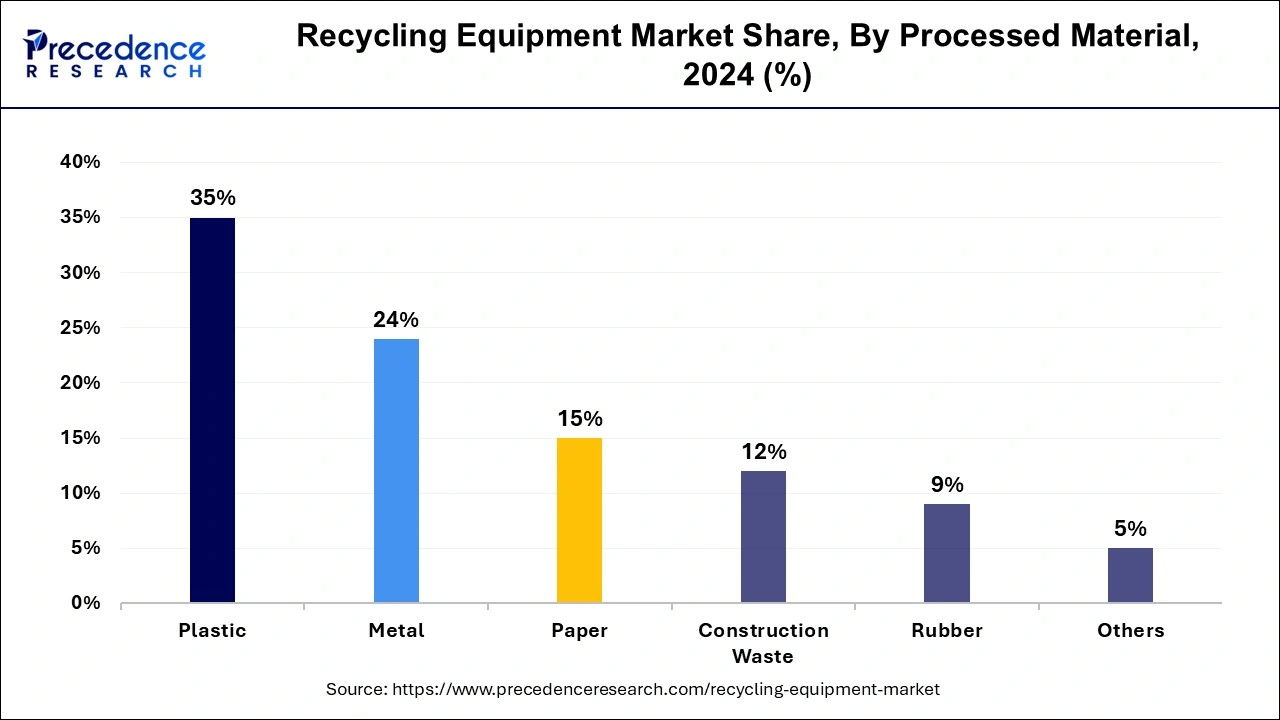

The baler press segment dominated the recycling equipment market by equipment in 2024. The baler press device is used to compress and bind materials into small, controllable bundles. The baler press is widely utilized for cleaning products, including plastic, paper, rubber, and construction waste, as well as for simpler recycling storage and transportation in industries, manufacturing facilities, and recycling centers. Additionally, the baler press reduces the volume of simpler handling, storage, and transportation by effectively compressing materials into compact bundles. The baler presses simplify the recycling process and cut down on the amount of material effort required, which helps industries save labor costs.

The separator segment is expected to grow at a significant rate in the recycling equipment market by equipment, during the forecast period. The separator is a part of equipment used in recycling that divides materials according to their characteristics, such as size, density, or magnetic susceptibility. The separator helps in the separation of items like paper, plastic, rubber, and metals, improving safe recycling procedures. Industries and governments are investing more in recycling infrastructure as environmental concerns grow and the rules harden. By automating the sorting process and enhancing material purity, separators are essential for increasing the efficacy and efficiency of recycling equipment.

The plastic segment dominated the recycling equipment market by processed material, in 2024. Last week, it was the industry leader in recycling equipment for a number of reasons. The recycling efforts heavily target plastic waste due to its vast global generation. Additionally, recycling plastic materials is now more practical and effective because of technological improvements. Also, there is a growing need for recycling equipment designed specially to manage plastic waste due to increased awareness of the adverse environmental impact of plastic pollution.

The rubber segment is expected to expand rapidly in the market by processed material during the forecast period. There is a growing need across a range of industries, including consumer goods, construction, and automotive, for recycled rubber materials. Additionally, manufacturing and recycling rubber products is now more financially feasible because of advancements in recycling technologies. Rubber waste recycling is becoming more popular as sustainability and minimizing environmental effects become more important. All these factors support the expected growth of rubber in the recycling equipment market.

By Equipment

By Processed Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

February 2025