December 2024

The global E-waste management market size is estimated at USD 73.28 billion in 2024, grew to USD 85.08 billion in 2025 and is predicted to surpass around USD 326.08 billion by 2034, expanding at a CAGR of 16.10% between 2024 and 2034.

The global E-waste management market size is estimated at USD 73.28 billion in 2024 and is anticipated to reach around USD 326.08 billion by 2034, growing at a CAGR of 16.10% between 2024 and 2034.

The Europe e-waste management market size is estimated at USD 27.85 billion in 2024 and is expected to be worth aropund USD 123.91 billion by 2034, growing at a CAGR of 16.10% from 2024 to 2034.

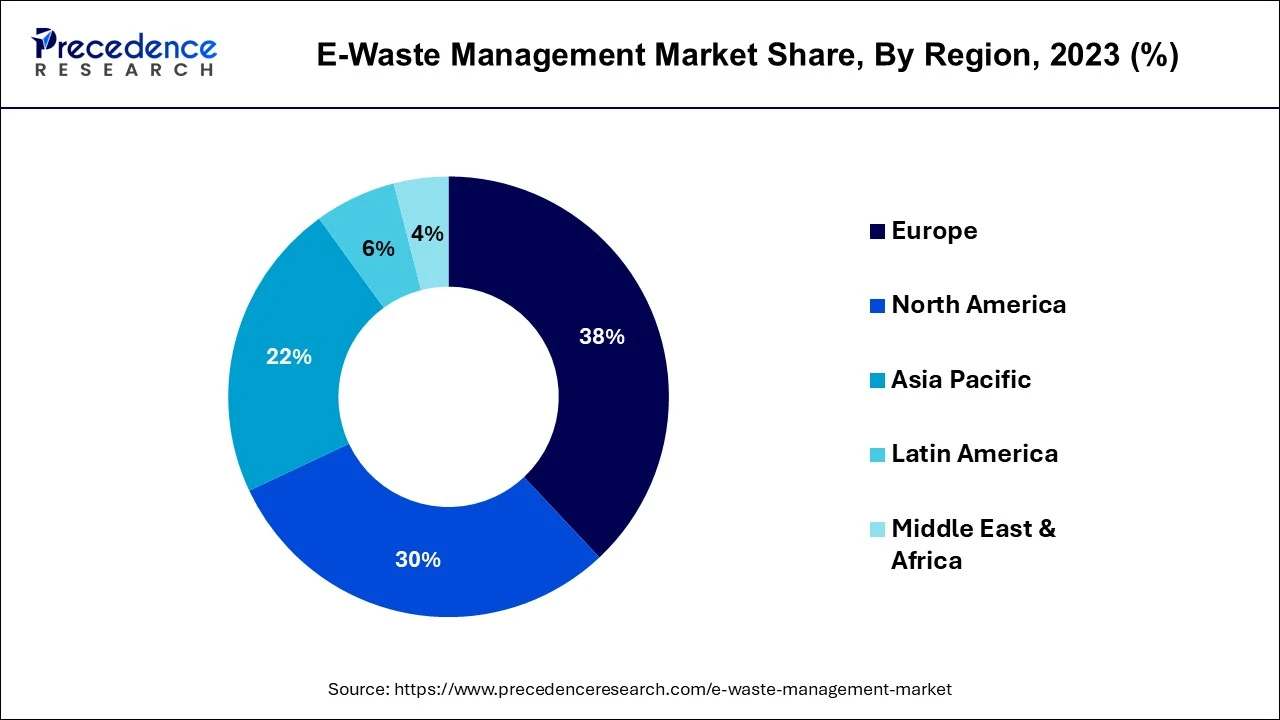

Europe has held the largest revenue share of 38% in 2023. In Europe, the E-waste management market is experiencing significant growth driven by stringent regulations and environmental awareness. The European Union's stringent e-waste directives have prompted responsible disposal practices and increased recycling efforts. Circular economy initiatives encourage the refurbishment and reutilization of electronic devices, reducing electronic waste. The region also witnesses a surge in e-waste collection and recycling facilities, promoting a sustainable approach to e-waste management.

Asia-Pacific is estimated to observe the fastest expansion. The region grapples with mounting e-waste challenges due to increasing electronic consumption. However, it's also witnessing remarkable developments in e-waste management. Several countries have introduced e-waste legislation to regulate disposal. China is adopting extended producer responsibility (EPR) mechanisms, encouraging manufacturers to take responsibility for their products' entire life cycle. India's e-waste management and handling rules are steering the region toward better e-waste management. Asia-Pacific experiences growth in recycling plants and informal sector involvement in e-waste recycling, contributing to sustainable practices.

The E-waste management market pertains to the structured management and disposal of electronic waste, encompassing discarded electrical and electronic devices. This market addresses the burgeoning issue of electronic waste, ensuring its environmentally responsible disposal, recycling, or refurbishment. With the rapid obsolescence of electronic devices and the global surge in electronic consumption, the demand for effective e-waste management is rising.

This market addresses ecological concerns, promotes recycling, and ensures the safe handling of hazardous materials found in electronic waste. It aligns with the global shift toward sustainable practices, environmental regulations, and the efficient use of resources.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 16.10% |

| Market Size in 2024 | USD 73.28 Billion |

| Market Size by 2034 | USD 326.08 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Application, By Material Type, By Source Type, and By Recycler Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rapid technological advancements and circular economy initiatives

The E-waste management market is significantly driven by rapid technological advancements and the widespread proliferation of electronic devices. Consequently, there is a substantial increase in electronic waste generation, compelling the need for efficient e-waste management solutions. Consumers and organizations alike are constantly in pursuit of the latest electronic innovations, perpetuating a cycle of device replacement and disposal. This ever-growing stream of discarded electronics underscores the importance of comprehensive e-waste management practices.

Simultaneously, the adoption of circular economy initiatives plays a pivotal role in driving market demand. The global shift towards a circular economy encourages responsible e-waste management practices such as recycling, refurbishment, and materials recovery. Rather than discarding electronic devices as waste, this approach aims to extend their life cycle and extract valuable materials from old gadgets, reducing the environmental impact. With the increasing focus on sustainability and resource conservation, circular economy principles align perfectly with the goals of eco-conscious individuals and businesses, further boosting the demand for professional e-waste management services.

Lack of awareness and resource-intensive recycling

Lack of awareness among consumers and businesses about the significance of proper e-waste management acts as a major constraint on the market. Many individuals and organizations lack awareness regarding the environmental and health risks linked to improper electronic waste disposal. The improper disposal of e-waste, including careless dumping in landfills or incineration, has severe consequences, leading to increased pollution and the squandering of valuable resources. To tackle this challenge, extensive awareness campaigns and educational initiatives are essential in promoting responsible e-waste disposal practices and fostering environmental stewardship.

Resource-intensive recycling processes can also deter market demand. E-waste recycling often involves labor-intensive disassembly and the extraction of valuable materials, such as precious metals and rare earth elements, from electronic devices. To address this restraint, innovations in automated and efficient e-waste recycling technologies and increased awareness campaigns are essential to promote responsible e-waste management practices.

Consumer electronics upgrade cycles and global E-waste trade

The market demand for E-waste management is significantly surged by consumer electronics upgrade cycles. As consumers continuously seek the latest technological advancements, electronic devices become obsolete at an accelerated pace. This phenomenon, known as planned obsolescence, fuels the generation of electronic waste. Manufacturers intentionally design products with a limited lifespan to encourage frequent upgrades. As consumers replace their old devices with new ones, the volume of e-waste increases.

Global E-waste trade is another crucial factor propelling market demand. With the globalization of electronics manufacturing, there's a thriving global trade of electronic components and devices. The global trade of e-waste can lead to environmental and health hazards in the countries that receive these materials. Growing awareness of the negative consequences of unregulated e-waste disposal is leading to increased demand for international e-waste management practices.

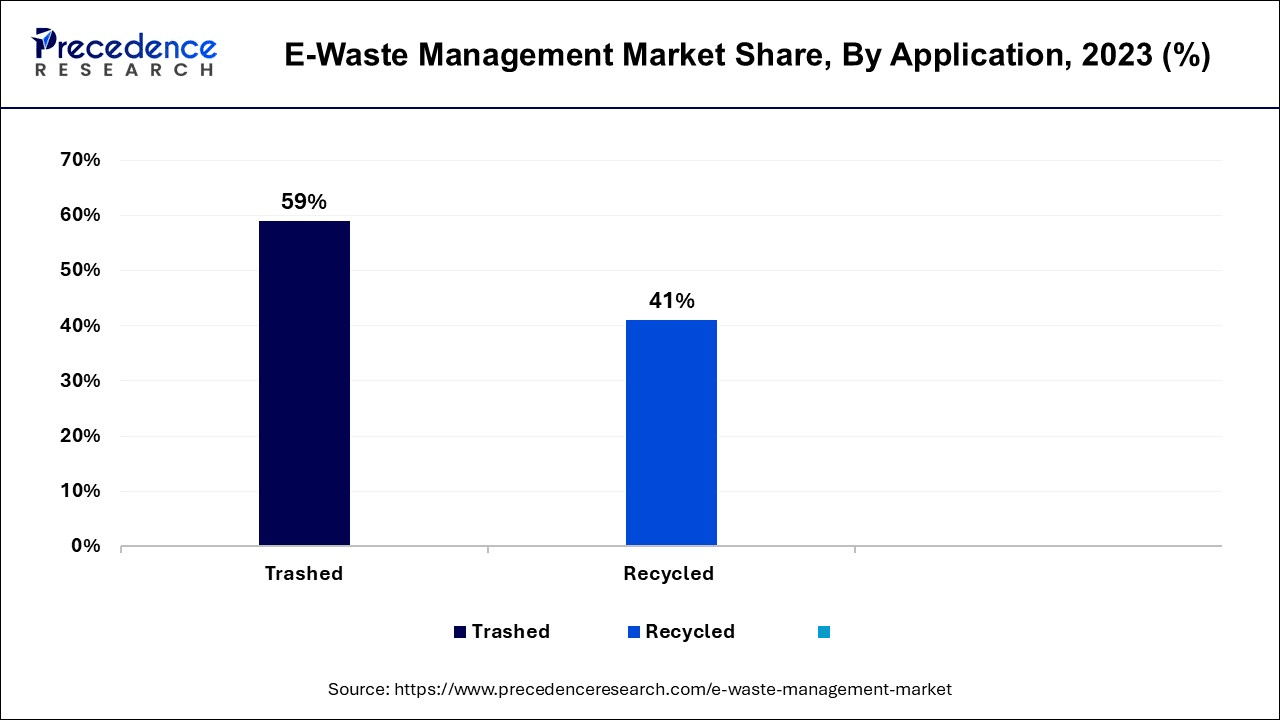

According to the application, the trashed segment has held 59% revenue share in 2023. In the E-waste management market, the segment signifies electronic waste that is improperly discarded, leading to potential environmental and health hazards. This often includes electronic items that end up in landfills or are incinerated, highlighting the urgent need for proper disposal methods and responsible recycling.

The recycled segment is anticipated to expand at a significant CAGR of 18.1% during the projected period. Recycled e-waste refers to electronic devices and components collected and processed through recycling methods, contributing to resource conservation and reduced environmental impacts. A growing trend in this market is the emphasis on sustainable e-waste management practices, fostering responsible disposal, and recycling efforts to minimize the environmental footprint.

Based on the material type, the metal segment held largest market share of 47% in 2023. In the E-waste management market, metal refers to the category of electronic waste materials composed primarily of various metals, including aluminum, copper, and gold, which can be extracted and recycled. Trends in metal e-waste management involve increasing recycling efforts to recover valuable metals. Additionally, the rising use of eco-friendly and energy-efficient electronic products reduces the need for mining new metals, making metal recycling a more sustainable practice.

On the other hand, the plastic segment is projected to grow at the fastest rate over the projected period. The plastic category pertains to electronic waste materials that consist mainly of plastic components. A prevalent trend in plastic e-waste management is the development of efficient methods for recycling plastics found in electronic devices, contributing to reduced plastic waste and environmental conservation. The market is witnessing innovations in plastic recycling technologies, enabling the responsible handling of electronic products containing plastic elements.

In 2023, the consumer electronics segment had the highest market share of 42% on the basis of the source type. Consumer electronics cover a wide range of personal devices like smartphones, laptops, and tablets. E-waste management in this category focuses on increasing recycling rates, promoting eco-friendly design and materials, and creating collection programs for obsolete devices. A trend includes extended producer responsibility (EPR) programs that shift the burden of e-waste management from consumers to manufacturers, ensuring proper disposal and recycling practices for consumer electronics.

Additionally, initiatives for promoting trade-in and buy-back schemes encourage consumers to return old electronics for recycling and upgrade to newer, more sustainable models. These trends aim to reduce the electronic waste footprint and create a more circular economy for consumer electronics.

The household appliances segment is anticipated to expand at the fastest rate over the projected period. Household appliances encompass electronic devices used in homes, such as refrigerators, washing machines, and microwaves. In the E-waste management market, the recycling and responsible disposal of these appliances are becoming more prevalent. Sustainable trends include refurbishing and reusing appliances, extracting valuable metals and components for recycling, and complying with stricter regulations for handling hazardous materials within appliances. These trends aim to minimize the environmental impact of discarded household appliances.

In 2023, the metal recyclers segment had the highest market share of 49% on the basis of the recycler type. Metal recyclers in the E-waste management market specialize in processing discarded electronic devices to recover valuable metals such as copper, gold, and aluminum. These recyclers use advanced techniques like shredding and smelting to extract metals from electronic waste. The trend in this sector is a rising demand for efficient and environmentally responsible metal recycling to reduce the environmental impact of e-waste.

The plastic recyclers segment is anticipated to expand at the fastest rate over the projected period. Plastic recyclers in the E-waste management market focus on the reclamation and recycling of plastics from discarded electronic products. They employ methods like mechanical recycling, which involves sorting, shredding, and reusing plastics. The trend in plastic recycling centers on the increased emphasis on reusing plastic components from electronic waste to minimize waste and promote sustainability.

Segments Covered in the Report

By Application

By Material Type

By Source Type

By Recycler Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

September 2024

March 2025