January 2025

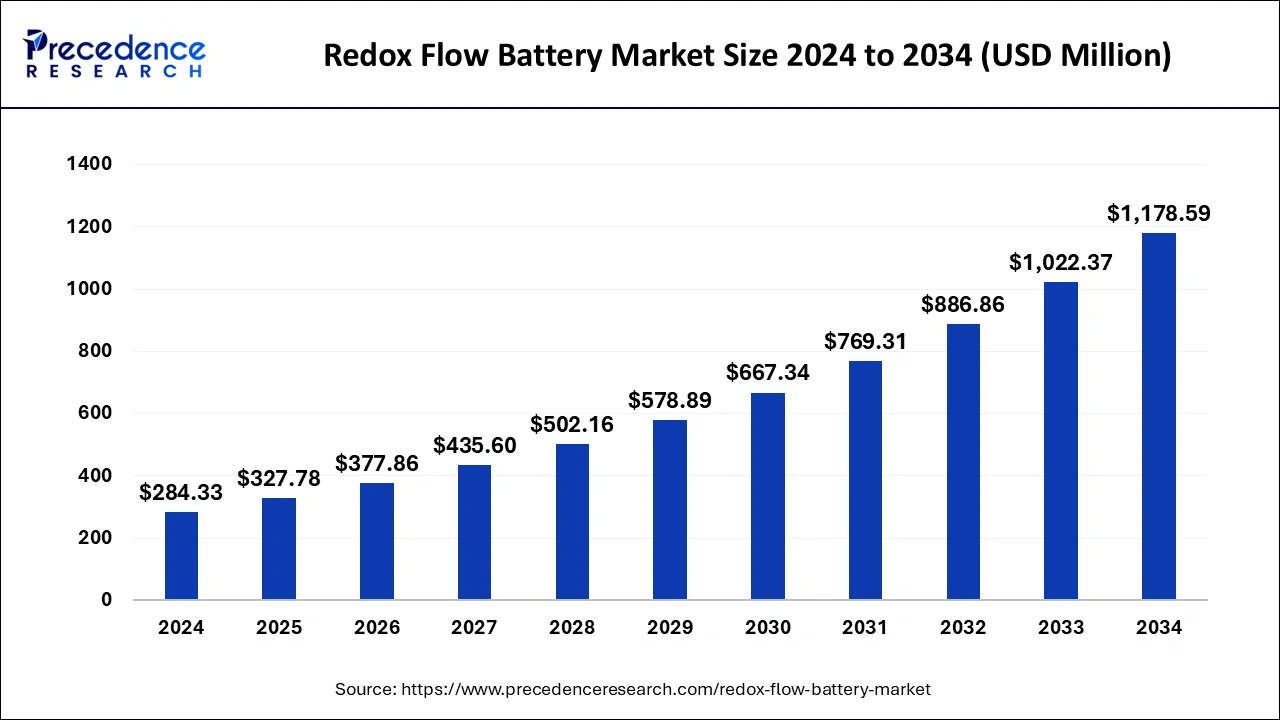

The global redox flow battery market size is calculated at USD 327.78 million in 2025 and is forecasted to reach around USD 1,178.59 million by 2034, accelerating at a CAGR of 15.28% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global redox flow battery market size was estimated at USD 284.33 million in 2024 and is predicted to increase from USD 327.78 million in 2025 to approximately USD 1,178.59 million by 2034, expanding at a CAGR of 15.28% from 2025 to 2034. The market is primarily influenced by policies supporting greener alternatives stemming from environmental concerns globally.

The redox flow battery market offers materials that are rechargeable electrochemical devices that use reversible oxidation and working fluid reduction to transform chemical energy into electrical energy. In comparison to other battery types like lead-acid and lithium-ion, it is economical, sustainable, reliable, clean, and efficient. It is capable of storing energy from sporadic electrical sources like solar and wind power due to its adaptable system architecture. These days, several end-use sectors are seeing a surge in demand for redox flow batteries due to the substantial growth in the usage of renewable energy sources.

| Report Coverage | Details |

| Market Size in 2025 | USD 327.78 Million |

| Market Size by 2034 | USD 1,178.59 Million |

| Growth Rate from 2025 to 2034 | CAGR of 15.28% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing expenditure on renewable energy

Redox flow batteries are widely used for storing renewable energy. Revisions to energy regulations have been made by nations including the U.S., India, China, and Japan to incorporate a significant share of energy generation from renewable resources like solar and wind. Government financial assistance and related global returns are driving higher renewable energy investments. Globally, renewable energy sources are now the go-to option for developing, updating, and extending power networks. Growing investments in renewable energy are therefore projected to propel the redox flow battery market throughout the forecast period.

Privacy concerns and lack of standardization

Even though redox flow batteries have shown promise as a technology for energy storage, there are a few technical issues with them that are impeding their commercial expansion. The two main disadvantages of these batteries are their complicated construction and inferior power density. Compared to normal batteries, redox flow batteries are more complex because they need additional containment containers, pumps, sensors, flow and power control, and other components to work.

Redox flow batteries are comparatively heavier and bulkier due to these components and their practical design, which limits their use in large-scale locations. The energy density of several flow battery types varies significantly from one another. Additionally, the overall efficiency of the system is negatively impacted by the pumping losses and chemical reaction losses that these flow batteries experience. Furthermore, the corrosive and poisonous electrolyte requires cautious handling during maintenance, storage, and transportation, which limits the expansion of the redox flow battery market.

Rising demand for battery energy storage

The introduction of novel resources, including renewable energy, has increased the grid's complexity and multifacetedness, directly affecting the redox flow battery market dynamics. Utilities use control systems like automated generation control (AGC) and energy storage systems (ESS) to manage these resources and maintain grid stability. Redox flow batteries can be utilized for grid energy storage and renewable energy grid integration applications due to their compact size, extended lifespan, and ability to function at a variety of temperatures.

The quantity of electricity that utilities must manage grows as renewable energy sources become more widely used, and with it comes the uncertainty that comes with intermittent energy. Utility firms are now compelled to use advanced ESSs to regulate and reduce grid stress. During the projected period, the worldwide redox flow battery market is anticipated to rise due to significant growth in the integration of renewable energy.

The vanadium redox flow battery segment held the largest share of the redox flow battery market in 2024. Vanadium redox flow batteries offer several advantages, including high energy efficiency, scalability, and the ability to decouple power and energy. Vanadium redox flow batteries can be charged and discharged simultaneously, allowing for flexible operation and longer cycle life. Moreover, ongoing research and development efforts are focused on improving the performance and reducing the cost of vanadium redox flow batteries. Innovations in materials, membranes, and system design are aimed at addressing challenges such as cost-effectiveness and energy density. Furthermore, the increasing expansion by the market players also propels the segment growth.

The hybrid redox flow battery segment is expected to grow at a rapid rate over the forecast period. Hybrid redox flow batteries are designed to offer versatility and flexibility in terms of energy storage applications. By combining the benefits of different chemistries, these systems may be better suited for specific use cases or environments. Thereby, driving the segment growth and that of the redox flow battery market.

The renewable energy integration segment held the dominating share of the market in 2024. RFBs, including variants like vanadium redox flow batteries (VRFBs), are being explored for grid stabilization by balancing intermittent renewable energy sources such as solar and wind. They can store excess energy during periods of high renewable energy production and release it during periods of low production or high demand.

Additionally, the adoption of redox flow batteries for renewable energy integration is influenced by government policies, incentives, and support for energy storage technologies. Countries and regions with ambitious renewable energy targets often seek efficient energy storage solutions to facilitate the integration of renewables into the grid.

Besides the renewable energy integration segment, the UPS segment is expected to grow at the highest CAGR during the forecast period. Redox flow batteries are suitable for providing backup power in UPS systems due to their ability to store large amounts of energy. UPS applications aim to ensure a continuous and reliable power supply, especially in critical facilities such as data centres, hospitals, and industrial plants.

Moreover, redox flow batteries can be integrated into grid-connected UPS systems, allowing them to store energy when needed during times of low demand and discharge. This helps in reducing the reliance on traditional backup power sources and can contribute to grid stabilization during peak demand periods. Thus, driving the segment expansion as well as the redox flow battery market.

Asia Pacific held the dominating share of the redox flow battery market because the area is a major battery manufacturing hub. This region produces the largest amounts of batteries produced anywhere in the globe. The region's battery development has benefited greatly from the contributions of nations like China and Japan. The increasing funding for energy storage projects, which are presently progressing at the quickest rate in the region, is another significant factor propelling the market in the area.

As a result, it is anticipated that numerous energy storage and renewable energy projects will be announced in the upcoming years. The benefits of flow batteries are their high efficiency, modular design, and ease of transportation. Large-scale deployment of the batteries is feasible, and they can readily cover the kW to MW range. Consequently, the development of power systems or grid energy storage systems in conjunction with renewable energy generation is the main focus of stakeholders in Asia-Pacific.

Under its most recent five-year plan (2021–25), China required energy storage technologies for its wind and solar projects. During the study period, this might potentially facilitate the expansion of the redox flow battery market in the area. Rogkepower declared in August 2022 that a redox flow battery storage technology will be utilized in a Dalian power project. Up to 400 megawatt-hours of energy from wind turbines and other sources may be stored in the battery system. The project is expected to need an expenditure of around USD 281 million. Rongke supplied around 560 MWh of redox flow batteries as of August 2021. The Dalian project will get an extra 400 MWh of storage. Thus, this is expected to drive the growth of the redox flow battery market in the region.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

November 2024

February 2025