July 2024

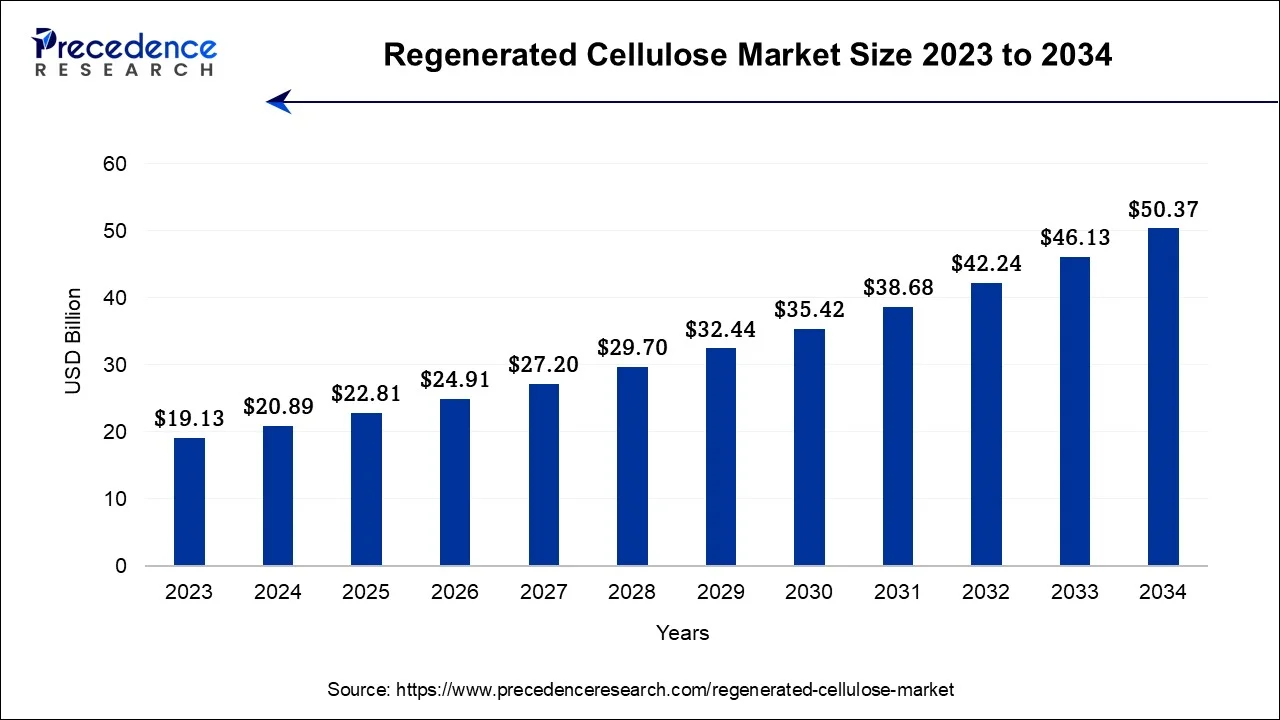

The global regenerated cellulose market size accounted for USD 20.89 billion in 2024, grew to USD 22.81 billion in 2025 and is projected to surpass around USD 50.37 billion by 2034, representing a healthy CAGR of 9.20% between 2024 and 2034.

The global regenerated cellulose market size is estimated at USD 20.89 billion in 2024 and is anticipated to reach around USD 50.37 billion by 2034, representing a noteble CAGR of 9.20% between 2024 and 2034.

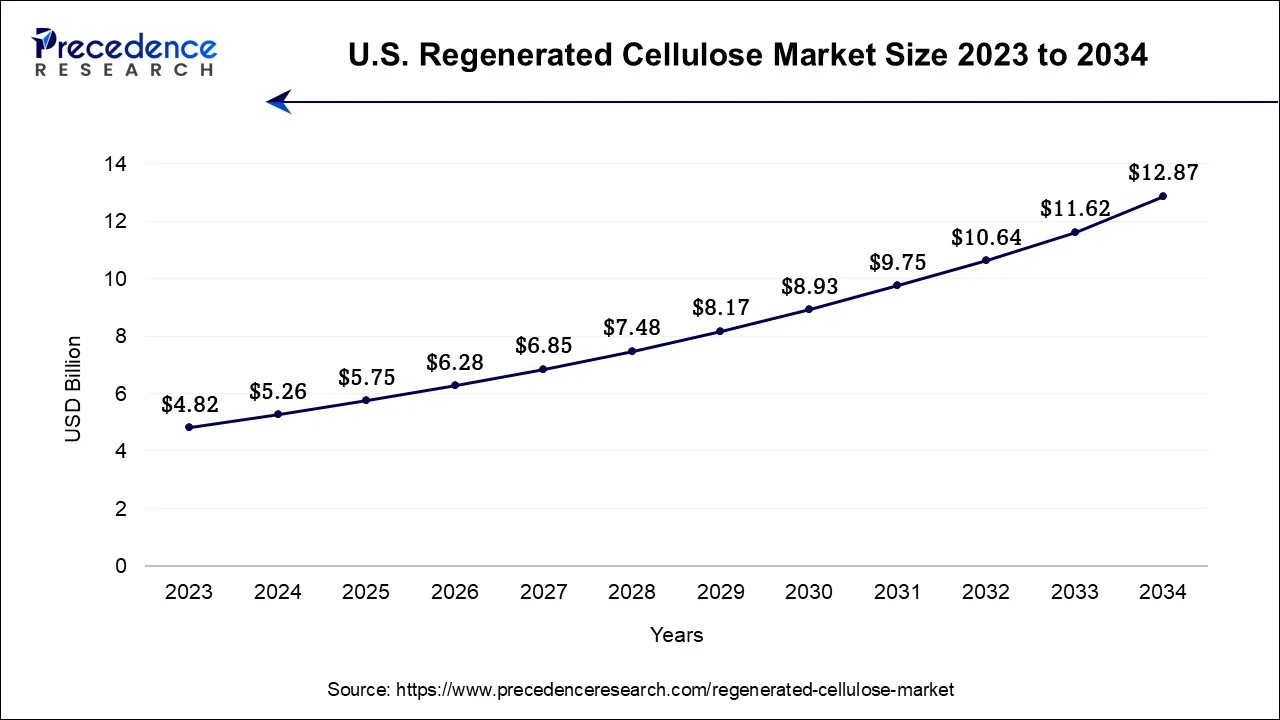

The U.S. regenerated cellulose market size accounted for USD 5.26 billion in 2024 and is expected to be worth around USD 12.87 billion by 2034, growing at a CAGR of 9.36% from 2024 to 2034.

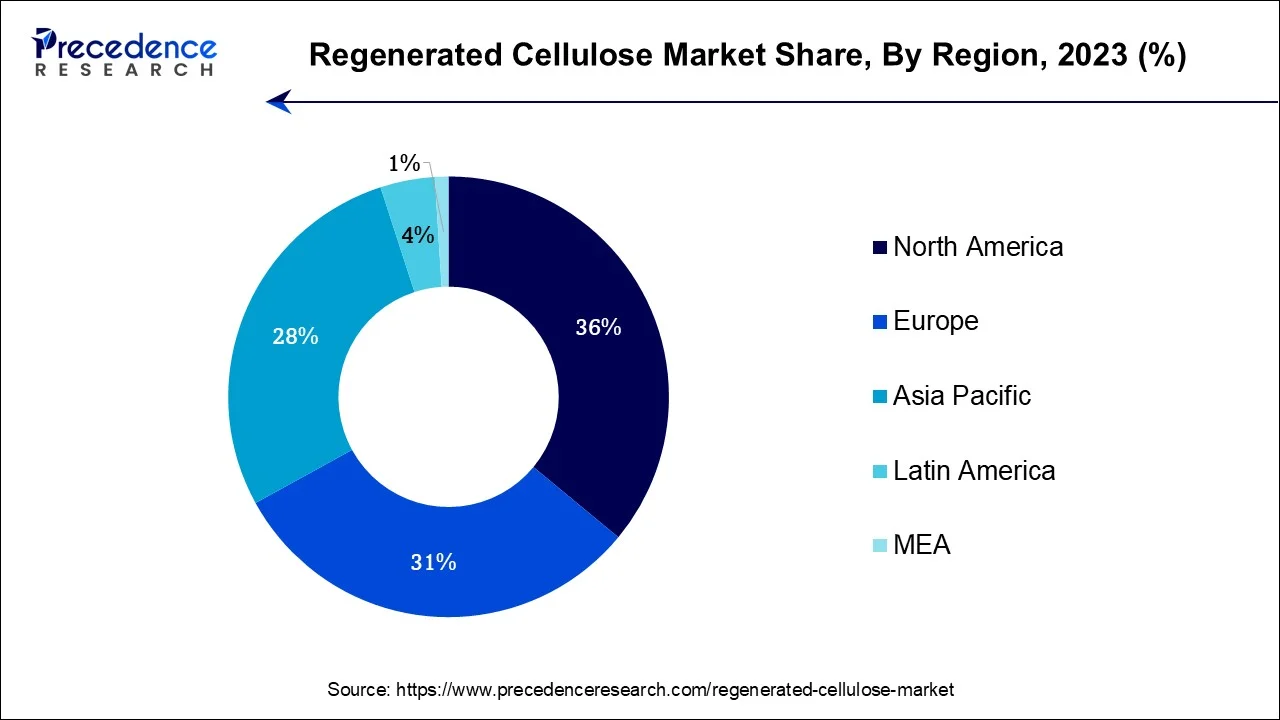

North America held the largest revenue share 36% in 2023. In North America, the regenerated cellulose market is witnessing notable trends. A growing emphasis on sustainability is driving demand for eco-friendly materials in various industries, including textiles, packaging, and automotive applications. This region is also experiencing increased research and development efforts to create innovative cellulose-based products, enhancing market growth. Additionally, collaborations between businesses and academia are fostering technological advancements, further propelling the adoption of regenerated cellulose materials. As environmental consciousness continues to rise, North America remains a key hub for sustainable material innovations and market expansion.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the regenerated cellulose market is witnessing significant growth driven by sustainability trends. The growing interest in sustainable textiles, especially in nations like China and India, is driving the acceptance of cellulose-derived fabrics like viscose and lyocell in the market. Moreover, the region's expanding middle-class population and rising environmental awareness are driving demand for sustainable products. The Asia-Pacific region is also a manufacturing hub for regenerated cellulose, further propelling market growth as the supply chain becomes more efficient, meeting both domestic and international demands.

The regenerated cellulose market revolves around the production and utilization of cellulose-based materials obtained from renewable sources, primarily wood pulp and cotton linters. This sustainable alternative to synthetic materials has gained traction across industries due to its biodegradability and versatility. Its applications range from textiles like viscose and lyocell to packaging films and non-woven materials, making it a valuable component of the circular economy.

The regenerated cellulose market is experiencing significant growth and transformation due to various industry trends, growth drivers, and challenges. As a sustainable and versatile material, regenerated cellulose is gaining prominence in various applications, from textiles to packaging. However, the industry also faces hurdles related to sustainability and competition. Amidst these challenges, there are promising business opportunities for companies that can innovate and align with the growing demand for eco-friendly materials.

Several trends and growth drivers propel the regenerated cellulose market forward. Firstly, increasing environmental awareness and the shift towards sustainable materials have boosted the demand for regenerated cellulose products. Moreover, technological advancements in processing methods and the development of new cellulose derivatives have expanded the range of applications, driving market growth. Despite its promise, the industry faces challenges related to sustainability.

The production of regenerated cellulose materials often involves chemical processes that can have environmental impacts. Balancing the demand for sustainable products with eco-friendly manufacturing practices remains a challenge. Moreover, competition from other eco-friendly materials like hemp and bamboo poses a threat to the market. Additionally, ensuring a transparent and ethical supply chain, especially in regions with lax regulations, is a persistent concern.

Within these challenges lie numerous business opportunities including companies that invest in research and development to create more sustainable production processes can gain a competitive edge. Meeting the increasing demand for cellulose-based textiles in the fashion industry through innovative designs and marketing strategies is another avenue for growth.

Additionally, emphasizing transparency and ethical sourcing can enhance brand value and attract eco-conscious consumers. Furthermore, exploring emerging applications in sectors such as healthcare and electronics can diversify revenue streams and expand the market's reach.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 9.2% |

| Market Size in 2024 | USD 20.89 Billion |

| Market Size by 2034 | USD 50.37 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Source, By Manufacturing Process, and By End Use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The biodegradability of regenerated cellulose is a significant driver of market demand. As environmental concerns rise, consumers and industries seek sustainable alternatives to reduce their ecological impact. Regenerated cellulose materials, being biodegradable, align with this preference. They break down naturally, reducing landfill waste and pollution. This eco-friendliness makes them a favored choice in applications like packaging, textiles, and disposable products.

The assurance that products made from regenerated cellulose can be disposed of without harming the environment drives a surge in demand for this environmentally responsible material. Moreover, fashion industry trends play a pivotal role in surging demand for the regenerated cellulose market.

As sustainability gains prominence in the fashion world, there is a growing inclination towards sustainable and biodegradable textiles. Regenerated cellulose fabrics, such as lyocell and viscose, align perfectly with these trends. Their eco-friendly properties, soft texture, and versatility make them sought-after materials for clothing brands looking to meet consumer demand for environmentally conscious and stylish garments. This fashion-driven demand significantly contributes to the growth of the regenerated cellulose market.

Competition from other sustainable materials constrains market demand for regenerated cellulose. Alternative eco-friendly materials like bamboo, hemp, and organic cotton offer similar environmental benefits and can divert demand. Consumers and industries exploring sustainability are presented with a variety of options, making it imperative for regenerated cellulose producers to differentiate their offerings. This competition highlights the need for continuous innovation, cost-effectiveness, and a strong value proposition to maintain and expand market share within the context of sustainability-driven consumer choices. Moreover, the cost of production is a significant restraint on the market demand for regenerated cellulose.

The manufacturing processes, which often involve chemical treatments and advanced technology, can be expensive. This results in higher production costs, which may lead to elevated prices for regenerated cellulose products. In a competitive market, where price sensitivity is a factor, this can limit the affordability and accessibility of such products for consumers and businesses. Consequently, the higher production costs can hinder the broader adoption and demand for regenerated cellulose materials in various applications.

Advanced manufacturing processes play a pivotal role in boosting market demand for regenerated cellulose. By streamlining production, reducing waste, and enhancing efficiency, these processes can lower the cost of manufacturing regenerated cellulose materials. The cost-effectiveness of regenerated cellulose materials enhances their competitiveness in the market, resulting in more affordable and accessible eco-friendly products.

Moreover, Innovative textiles play a pivotal role in boosting market demand for regenerated cellulose. These textiles, often made from materials like lyocell or viscose, combine eco-friendliness with cutting-edge technology. They cater to the evolving consumer preferences for sustainable, breathable, and comfortable fabrics in applications ranging from activewear to high-performance technical textiles. As fashion brands and industries seek unique, environmentally conscious solutions, the adoption of innovative regenerated cellulose textiles surges, driving up demand and solidifying the material's position as a sought-after choice in various textile markets.

Impact of COVID-19

The COVID-19 pandemic had multifaceted effects on the regenerated cellulose industry. Initially, lockdowns and disruptions in supply chains impeded production and distribution, causing supply shortages and delays. Reduced consumer spending, particularly in fashion, affected demand for cellulose-based textiles. However, the pandemic also heightened awareness of sustainability, driving interest in eco-friendly materials. As industries gradually adapted to pandemic conditions, demand for regenerated cellulose, especially in face masks and medical textiles, surged.

The crisis underlined the importance of biodegradable and renewable materials, reinvigorating the market. While challenges remain, the regenerated cellulose industry is expected to recover and expand as sustainability becomes a central focus for various applications, including fashion, healthcare, and packaging.

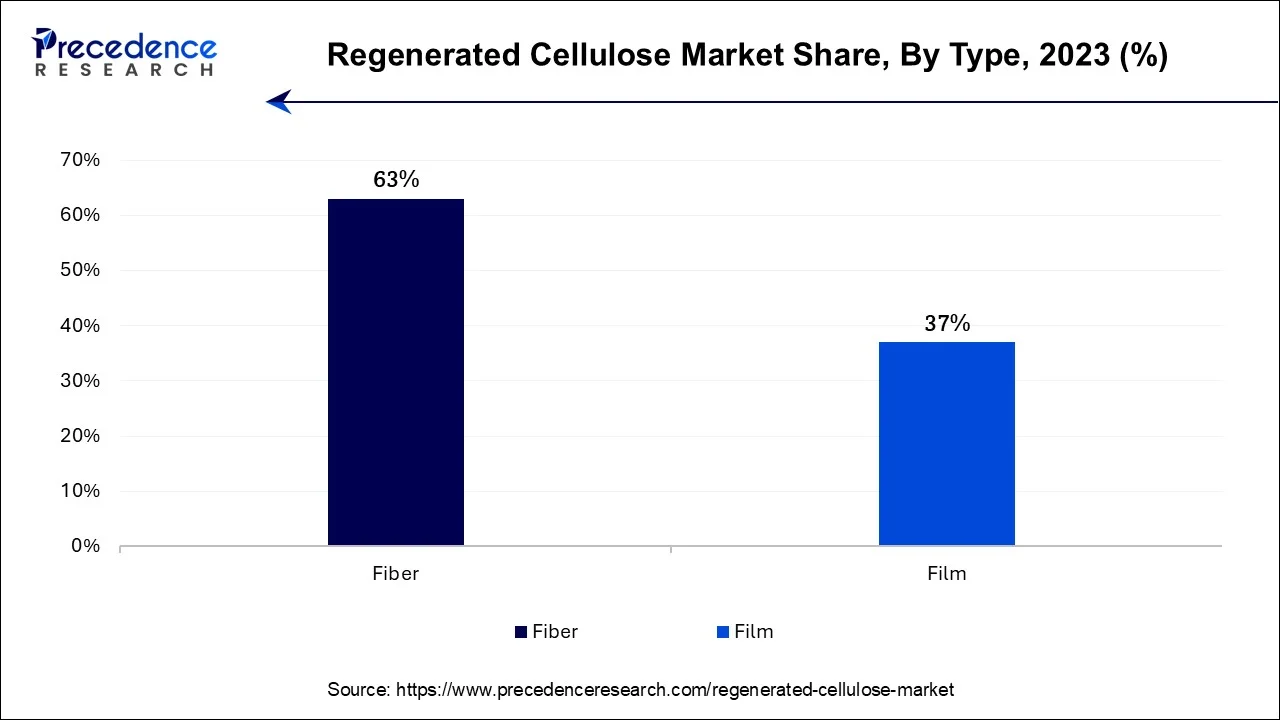

According to the type, the fiber sector has held a 63% revenue share in 2023. Regenerated cellulose fibers are a category of cellulose-based materials produced from renewable sources like wood pulp or cotton linters. These fibers exhibit excellent moisture management, biodegradability, and versatility, making them suitable for textiles, non-woven products, and packaging materials. Trends in the regenerated cellulose fiber market include a growing preference for eco-friendly textiles in the fashion industry, innovations in processing methods for enhanced fiber properties, and increased demand for sustainable packaging solutions.

The Film segment is anticipated to expand at a significantly CAGR of 9.8% during the projected period. Regenerated cellulose film refers to thin, flexible sheets or rolls made from cellulose-based materials. These films offer various advantages, such as biodegradability and versatility, making them suitable for packaging, labeling, and various industrial applications. In the regenerated cellulose market, there's a growing trend towards using cellulose films as sustainable alternatives to plastic packaging. This shift is propelled by heightened environmental consciousness, stricter regulations targeting single-use plastics, and a growing consumer preference for eco-friendly materials. As a result, the demand for regenerated cellulose films in packaging and labeling applications is on the rise, contributing to the market's growth.

Based on the source, Wood pulp held the largest market share of 32% in 2023. Wood pulp, a key source for regenerated cellulose production, is derived from wood fibers through a chemical process. It serves as a sustainable and renewable raw material for various cellulose-based products, including textiles, films, and packaging materials. In the regenerated cellulose market, there is a growing trend towards sourcing wood pulp from sustainably managed forests, ensuring a more eco-friendly and responsible supply chain. Additionally, research into more efficient wood pulp extraction and processing methods is enhancing the cost-effectiveness and sustainability of regenerated cellulose production.

On the other hand, the recycled pulp segment is projected to grow at the fastest rate over the projected period. Recycled pulp, in the context of the regenerated cellulose market, refers to the raw material obtained from the recycling of post-consumer waste textiles, such as discarded clothing and textiles. This sustainable source aligns with the market's focus on eco-friendly materials. Trends in the regenerated cellulose market show a growing interest in utilizing recycled pulp as a source material. As sustainability gains importance, recycled pulp offers a closed-loop solution, reducing waste and conserving resources. It also reflects consumer preferences for environmentally conscious products, further promoting its adoption in the industry.

In 2023, the Viscose sector had the highest market share of 36.8% on the basis of the manufacturing process. Viscose, a key product in the regenerated cellulose market, is manufactured through the viscose process. This process involves dissolving wood pulp or cotton cellulose in a chemical solution to create a viscous liquid. It's then extruded through spinnerets to form fibers, which are subsequently processed into textiles, films, and more. In recent trends, the regenerated cellulose market has seen a growing demand for eco-friendly viscose textiles due to their softness, breathability, and biodegradability. Sustainable production methods reduced chemical usage, and certifications for responsible sourcing are gaining prominence in response to environmental concerns and consumer preferences.

The cuprammonium is anticipated to expand at the fastest rate over the projected period. Cuprammonium, a manufacturing process in the regenerated cellulose market, involves dissolving cellulose in a copper and ammonia solution. It yields soft and lustrous fibers, commonly used in textiles. Recent trends in this process emphasize sustainability and eco-friendliness. Manufacturers are exploring ways to reduce the environmental impact by optimizing chemical use and disposal. Additionally, they are incorporating innovative techniques to ensure efficient cellulose dissolution, enhancing the quality of cuprammonium-based regenerated cellulose materials while aligning with the growing demand for sustainable and responsible production practices.

The Fabric segment held the largest revenue share of 44.9% in 2023. Fabric in the regenerated cellulose market refers to textiles and materials produced from cellulose-based fibers like lyocell and viscose. Cellulose-based fabrics, celebrated for their sustainability, soft texture, and breathability, are experiencing a surge in demand. This uptick is notably pronounced in the fashion industry, where environmentally conscious consumers are driving the shift towards eco-friendly textiles.

The combination of these favorable characteristics and the fashion sector's focus on sustainability aligns perfectly, making cellulose-based fabrics a sought-after choice for clothing brands and consumers alike. Additionally, technical textiles and biodegradable packaging materials made from regenerated cellulose are gaining prominence due to their environmental benefits. The market continues to evolve as industries increasingly prioritize sustainable alternatives to traditional textiles and packaging materials.

The packaging sector is expected to grow at a significantly faster rate, registering a CAGR of 8.6% over the projected period. In the regenerated cellulose market, packaging involves the utilization of cellulose-based materials for diverse packaging purposes, encompassing food, cosmetics, and pharmaceutical industries. Recent trends include a growing demand for sustainable and biodegradable packaging solutions, where regenerated cellulose stands out as an eco-friendly option.

The rise of eco-conscious consumers has prompted brands to shift towards cellulose-based packaging to reduce their environmental footprint. Additionally, technological advancements in cellulose processing have improved the barrier properties and durability of these materials, making them more suitable for diverse packaging needs.

Segments Covered in the Report

By Type

By Source

By Manufacturing Process

By End Use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

September 2024

October 2024