Reinsurance Market (By Type: Facultative Reinsurance, Treaty Reinsurance; By Application: Property & Casualty Reinsurance, Life & Health Reinsurance; By Distribution Channel: Direct Writing, Broker; By Mode: Online, Offline) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

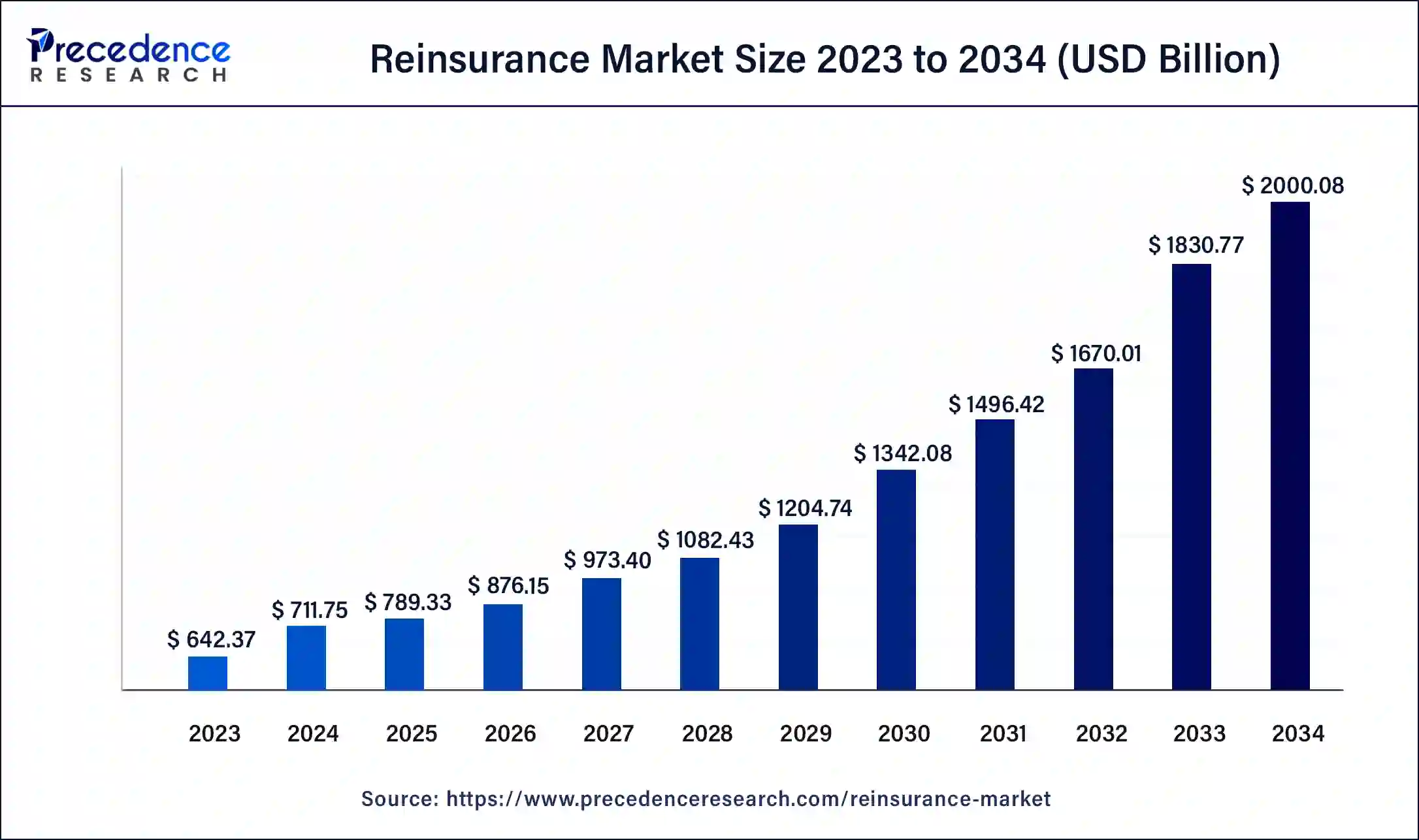

The global reinsurance market size was USD 642.37 billion in 2023, calculated at USD 711.75 billion in 2024 and is expected to reach around USD 2000.08 billion by 2034, expanding at a CAGR of 11% from 2024 to 2034. The North America reinsurance market size reached USD 255.32 billion in 2023.

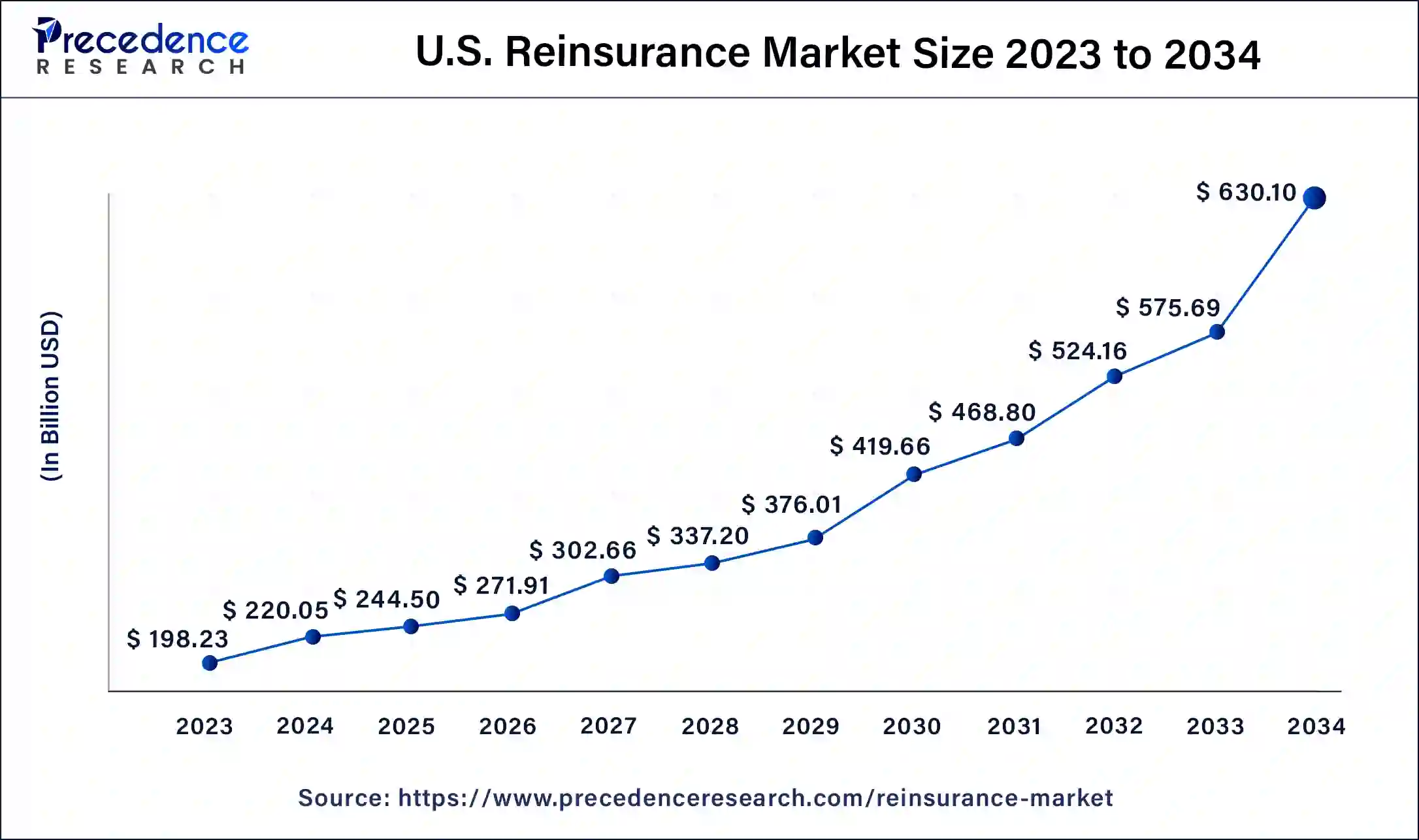

The U.S. reinsurance market size was valued at USD 198.23 billion in 2023 and is expected to reach USD 630.10 billion by 2034, growing at a CAGR of 11.09% from 2024 to 2034.

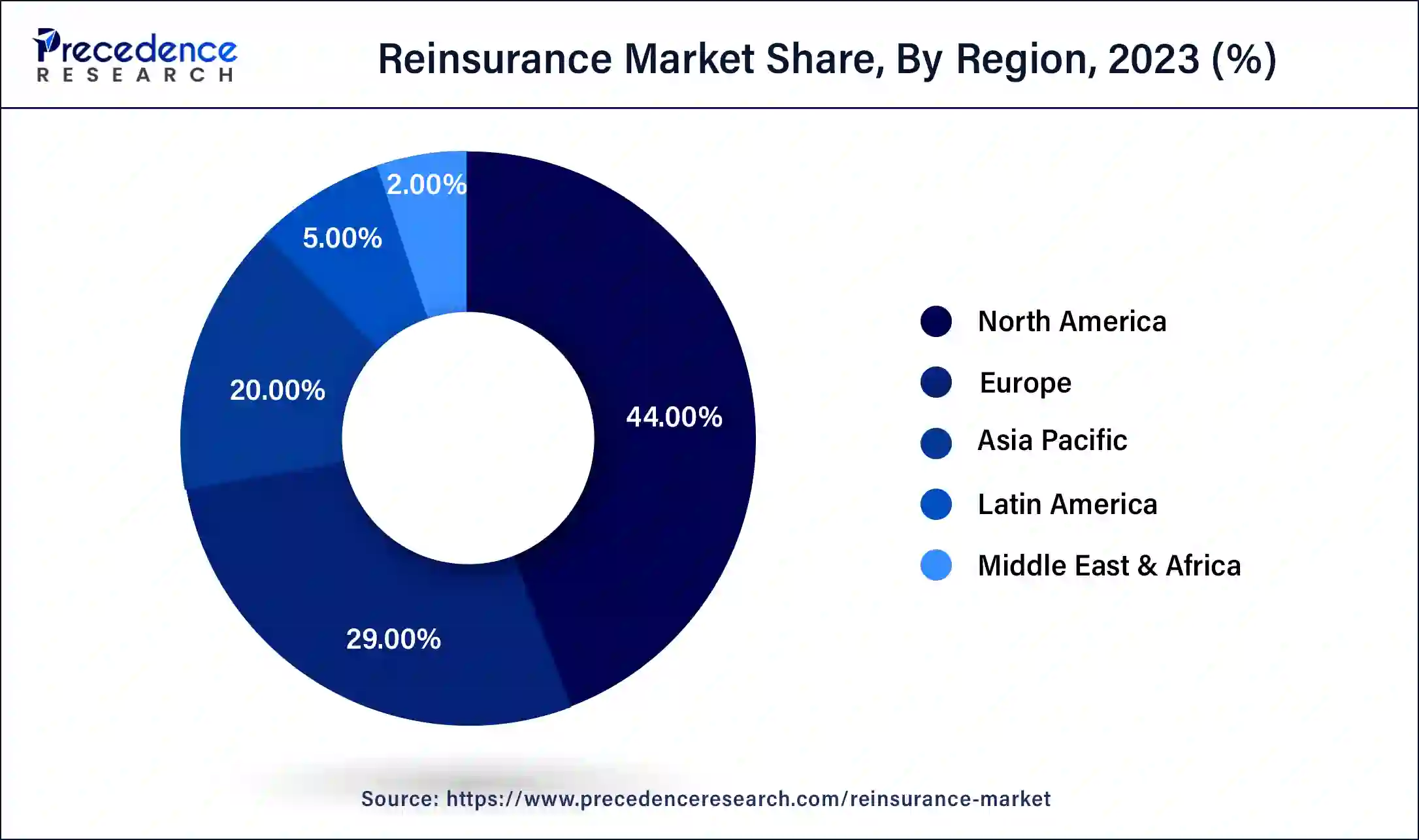

North America has held largest revenue share 44% in 2023. In North America, a notable trend in the reinsurance market involves an increased focus on innovative risk solutions, driven by a rise in natural catastrophes. Insurers are actively seeking reinsurance coverage for climate-related risks, such as hurricanes and wildfires. Additionally, advancements in insurtech and data analytics are shaping product development, enhancing risk modeling capabilities.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific reinsurance market is experiencing robust growth, driven by the region's expanding economies and heightened awareness of insurance. Insurers are increasingly turning to reinsurers for risk management, particularly in emerging markets. Regulatory developments and a surge in insurtech adoption are influencing market dynamics, fostering a more sophisticated and responsive reinsurance landscape in the Asia-Pacific region.

In Europe, the reinsurance market is marked by a growing emphasis on sustainability and environmental, social, and governance (ESG) considerations. Reinsurers are actively developing products to address climate-related risks. Regulatory frameworks are evolving to align with changing market dynamics. Additionally, technology integration and collaborations with insurtech firms are enhancing operational efficiency and risk assessment capabilities in the European reinsurance sector.

The reinsurance market involves insurers transferring a portion of their risk to other insurers to mitigate potential losses. Reinsurers assume a share of the original insurer's liability in exchange for premiums. This market plays a crucial role in stabilizing the insurance industry by spreading risk and preventing catastrophic financial impacts on individual insurers. Reinsurance can be purchased for various risks, including natural disasters and large-scale events. Reinsurers operate globally and provide a layer of financial protection, enhancing the overall resilience of the insurance sector and promoting the ability to handle substantial claims without compromising stability.

Reinsurance allows insurers to manage their exposure to large and unexpected losses, ensuring financial solvency. The market fosters innovation by encouraging insurers to take on diverse risks. It also promotes global risk-sharing and collaboration, creating a robust financial ecosystem that benefits both insurers and policyholders.

| Report Coverage | Details |

| Market Size by 2034 | USD 2000.08 Billion |

| Market Size in 2023 | USD 642.37 Billion |

| Market Size in 2024 | USD 711.75 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, Distribution Channel, Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing frequency of catastrophic events, alternative capital sources and Insurance-Linked Securities (ILS)

The escalating frequency of catastrophic events, including natural disasters and climate-related incidents, has become a major catalyst driving demand for the reinsurance market. As these events become more prevalent and severe, primary insurers are faced with heightened financial risks. To mitigate potential losses and maintain financial stability, insurers increasingly turn to reinsurers to share the burden of these large-scale risks. Reinsurance provides a crucial layer of protection, allowing insurers to manage their exposure and ensure they can fulfill their financial obligations even in the face of unprecedented events.

Simultaneously, the surge in alternative capital sources, particularly through the emergence of insurance-linked securities (ILS), has injected additional liquidity and capacity into the reinsurance market. Investors, seeking non-traditional opportunities, participate directly in assuming insurance risks through ILS instruments such as catastrophe bonds. This influx of alternative capital enhances the overall resilience of the reinsurance market, providing insurers with additional options for risk transfer and influencing the dynamics of risk pricing and management. Together, the increasing frequency of catastrophic events and the rise of alternative capital sources contribute to a heightened demand for reinsurance as an essential tool for managing and distributing risk in an evolving and unpredictable environment.

Financial market volatility, low interest rates and investment returns

Financial market volatility, low interest rates, and diminished investment returns collectively exert significant constraints on the demand for the reinsurance market. Firstly, heightened financial market volatility complicates investment strategies for reinsurers, as they face increased uncertainties in managing their portfolios. Fluctuations in asset values can result in reduced investment income, impacting the overall profitability of reinsurers and limiting their capacity to underwrite risks.

Moreover, the persistently low-interest rates prevalent in many economies undermine the traditional investment income streams for reinsurers. With fixed-income securities offering lower yields, reinsurers find it challenging to generate satisfactory returns on their investment portfolios. This low-interest-rate environment compounds the pressure on profitability, as the returns from investment activities play a crucial role in supporting underwriting activities. As a result, the combined effect of financial market volatility and low-interest rates contributes to a challenging landscape for reinsurers, influencing their ability to meet the increasing demands for risk coverage while maintaining financial stability.

Innovation in product development and diversification of capital sources

Innovation in product development plays a pivotal role in surging demand for the reinsurance market. As insurers face evolving and complex risks, innovative reinsurance products offer tailored solutions to address emerging challenges. Advanced risk modeling, data analytics, and artificial intelligence enable reinsurers to develop sophisticated products that accurately assess and price risks, meeting the dynamic needs of the insurance industry. These innovations not only enhance risk management capabilities but also position reinsurance as a strategic partner for insurers seeking comprehensive and customized coverage, thereby driving increased demand.

Furthermore, the diversification of capital sources has injected resilience and capacity into the reinsurance market. The emergence of alternative capital, including insurance-linked securities (ILS) and catastrophe bonds, has expanded the pool of funds available for risk assumption. This diversification not only provides reinsurers with additional financial resources but also influences market dynamics, fostering competition and improving overall efficiency. As the market adapts to these alternative capital structures, it experiences increased demand, further solidifying reinsurance as a critical component in the global risk management ecosystem.

The facultative reinsurance segment has held 62% revenue share in 2023. Facultative reinsurance involves the acceptance or rejection of individual insurance risks on a case-by-case basis. Reinsurers assess each risk independently, providing flexibility for insurers. Recent trends in facultative reinsurance include increased demand for specialized coverage, particularly in areas such as cyber risks and emerging technologies. Insurers seek tailored solutions for unique and complex risks, driving growth in the facultative reinsurance segment.

The treaty reinsurance segment is anticipated to expand at a significant CAGR of 13.1% during the projected period. Treaty reinsurance involves a broader, pre-established agreement between the insurer and reinsurer to cover specified types of risks. Trends in treaty reinsurance indicate a shift towards more collaborative and transparent partnerships. Insurers and reinsurers are increasingly exploring innovative structures within treaty agreements, such as proportional and non-proportional treaties, to optimize risk-sharing and ensure effective capital management in a changing market landscape.

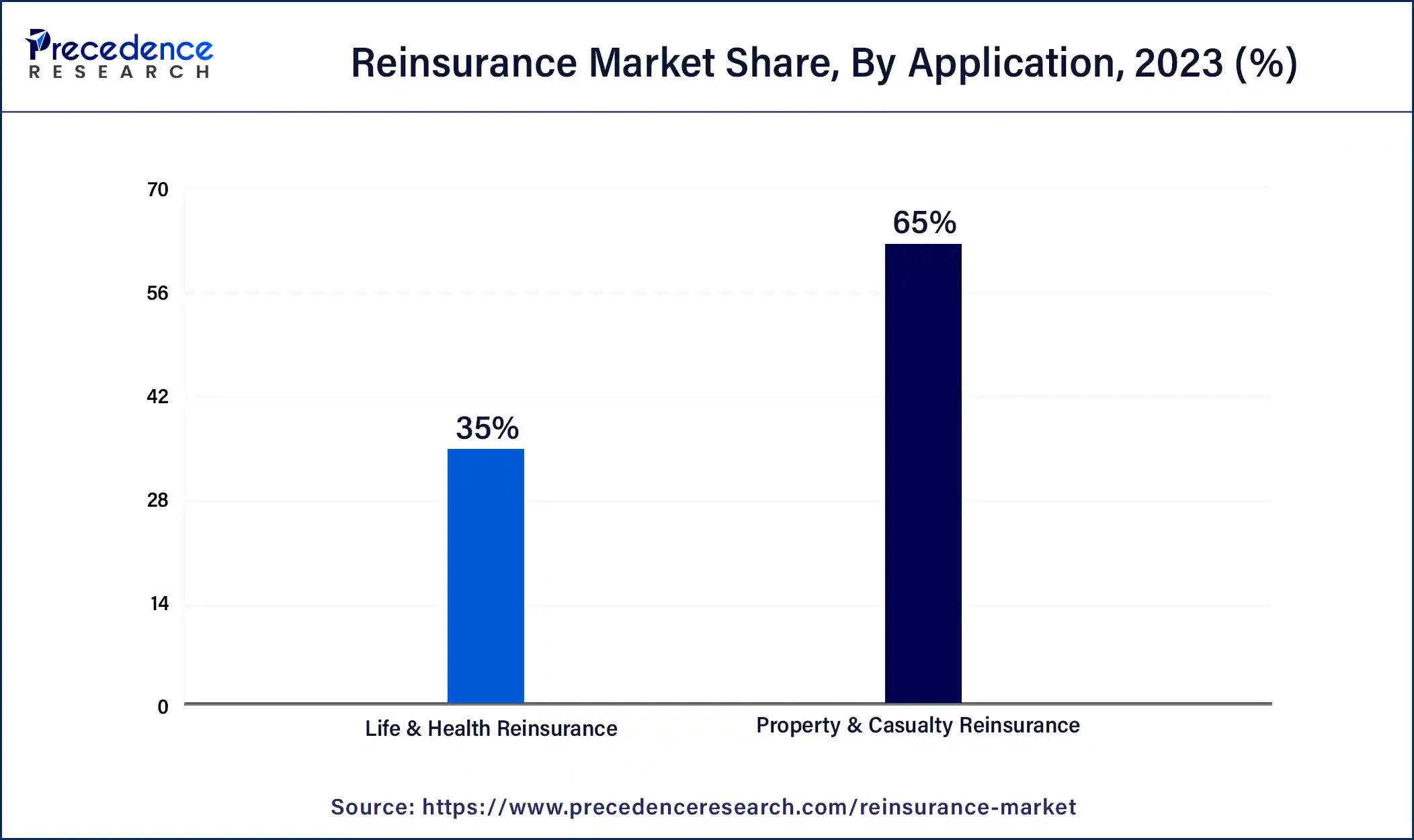

The life & health reinsurance segment held the largest market share of 65% in 2023. Life & health reinsurance pertains to the transfer of risk associated with life insurance and health-related events. This segment encompasses mortality, morbidity, and longevity risks. Current trends in life & health reinsurance highlight a shift towards personalized and data-driven solutions. Insurers and reinsurers are leveraging advancements in medical technology and data analytics to develop products that cater to individual health profiles, creating a more dynamic and responsive market to the evolving needs of policyholders in the life and health insurance space.

The property & casualty reinsurance segment is projected to grow at the fastest rate over the projected period. Property & casualty reinsurance involves the transfer of risk related to property damage and liability. In this segment, reinsurers provide coverage for events like natural disasters, accidents, and third-party liability. Recent trends indicate a growing demand for innovative products in response to the increasing frequency and severity of natural disasters, emphasizing the need for comprehensive coverage. Technological advancements in risk modeling and a focus on developing tailored solutions contribute to the evolving landscape of property & casualty reinsurance.

The broker segment held the largest market share of 58% in 2022. Direct writing in the reinsurance market involves insurers dealing directly with reinsurers without intermediaries. This approach streamlines communication and facilitates a more direct relationship between the primary insurer and the reinsurer. The trend in direct writing is driven by advancements in technology, enabling seamless transactions and enhanced collaboration. Insurers opt for direct channels to gain more control, efficiency, and cost-effectiveness in managing their reinsurance needs.

The direct writing segment is projected to grow at the fastest rate over the projected period. Reinsurance brokers act as intermediaries, connecting insurers with reinsurers to facilitate risk transfer. They play a crucial role in negotiating terms, securing the best deals, and providing market insights. The trend in reinsurance brokerage involves increased specialization, with brokers offering expertise in specific risk areas. Technology adoption, such as digital platforms, is also reshaping the broker segment, streamlining processes and improving access to a broader range of reinsurers. This trend enhances efficiency and transparency in reinsurance transactions.

The offline segment held the highest market share of 73%in 2023 based on the Mode. Offline reinsurance refers to traditional, non-digital channels for risk transfer. This mode typically involves face-to-face interactions, manual processes, and physical documentation. Despite the rise of online platforms, offline reinsurance remains prevalent, especially for complex and large-scale transactions. Trends in offline reinsurance include a focus on relationship-building, personalized service offerings, and the integration of technology to enhance underwriting processes while maintaining the human touch in negotiations and relationship management.

The online segment is anticipated to expand at the fastest rate over the projected period. Online reinsurance involves digital platforms and technology-driven solutions for risk transfer. This mode leverages advanced data analytics and communication tools to streamline transactions, enhance efficiency, and facilitate quick decision-making. Trends in online reinsurance include the adoption of blockchain for secure and transparent transactions, insurtech partnerships to integrate innovative technologies, and the development of digital platforms that offer real-time access to reinsurance products, fostering a more agile and interconnected reinsurance ecosystem.

Segments Covered in the Report

By Type

By Application

By Distribution Channel

By Mode

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client