January 2025

Remote Health Monitoring Market (By Devices: Respiratory monitoring, Blood Glucose Monitoring, Cardiac Monitoring, Multi-Parameter Monitoring; By Application: Oncology, Cardiovascular Diseases, Diabetes, Others; By End-Users: Hospitals, Home Health Care, Diagnostic Centers) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

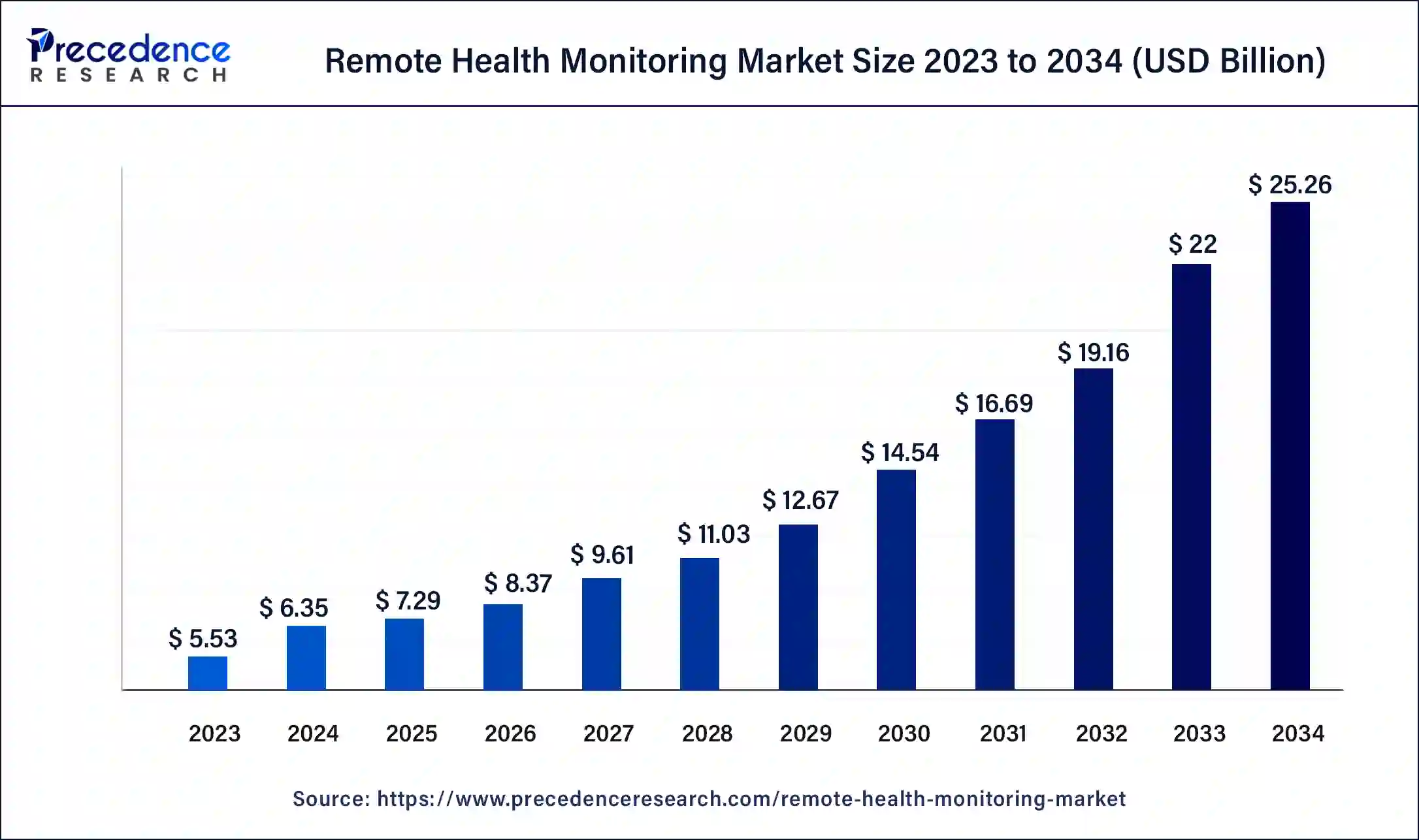

The global remote health monitoring market size accounted for USD 6.35 billion in 2024 and is expected to reach around USD 25.26 billion by 2034, expanding at a CAGR of 14.8% from 2024 to 2034. The North America wind energy market size reached USD 2.32 billion in 2023.

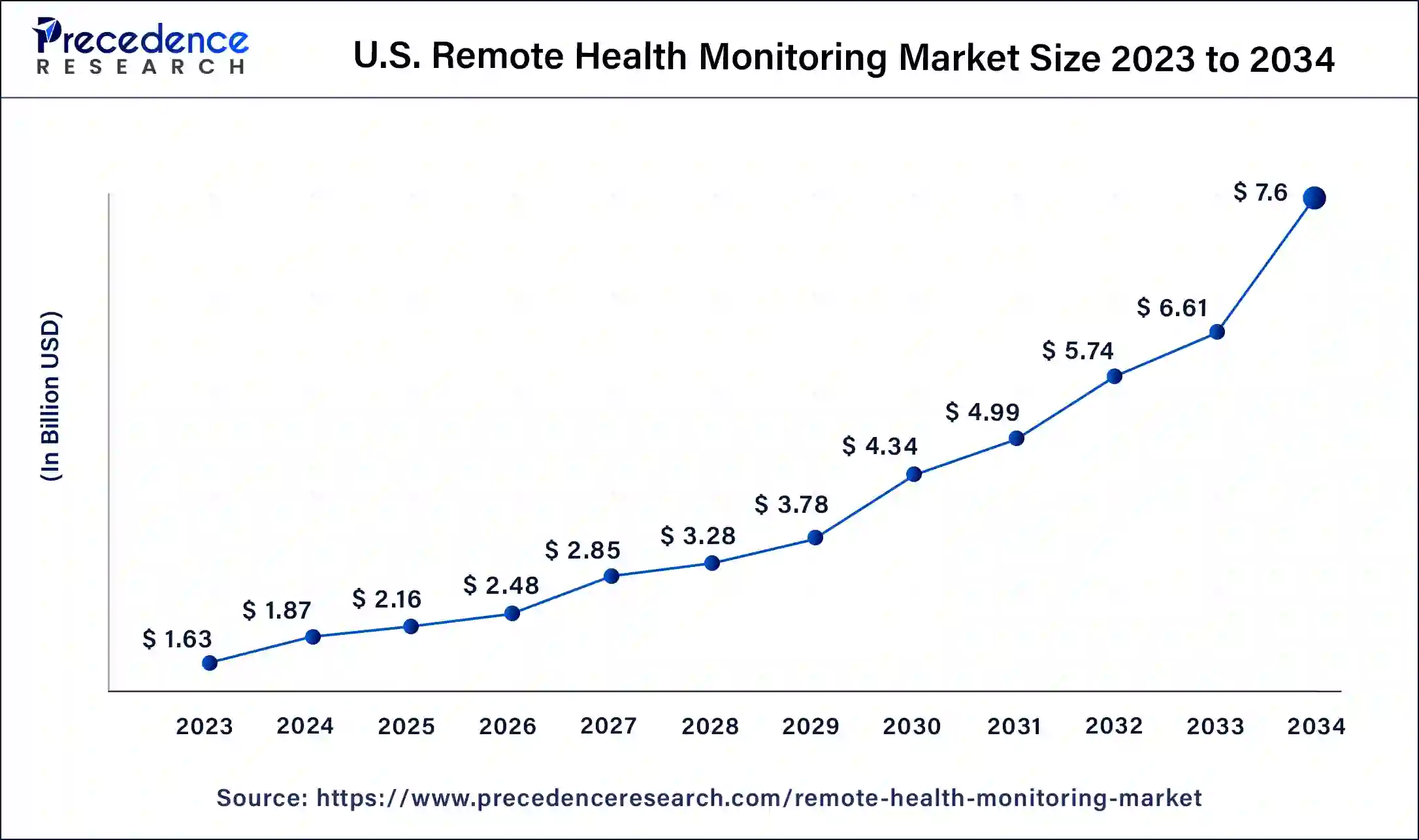

The U.S. remote health monitoring market size was estimated at USD 1.63 billion in 2023 and is predicted to be worth around USD 7.60 billion by 2034, at a CAGR of 15% from 2024 to 2034.

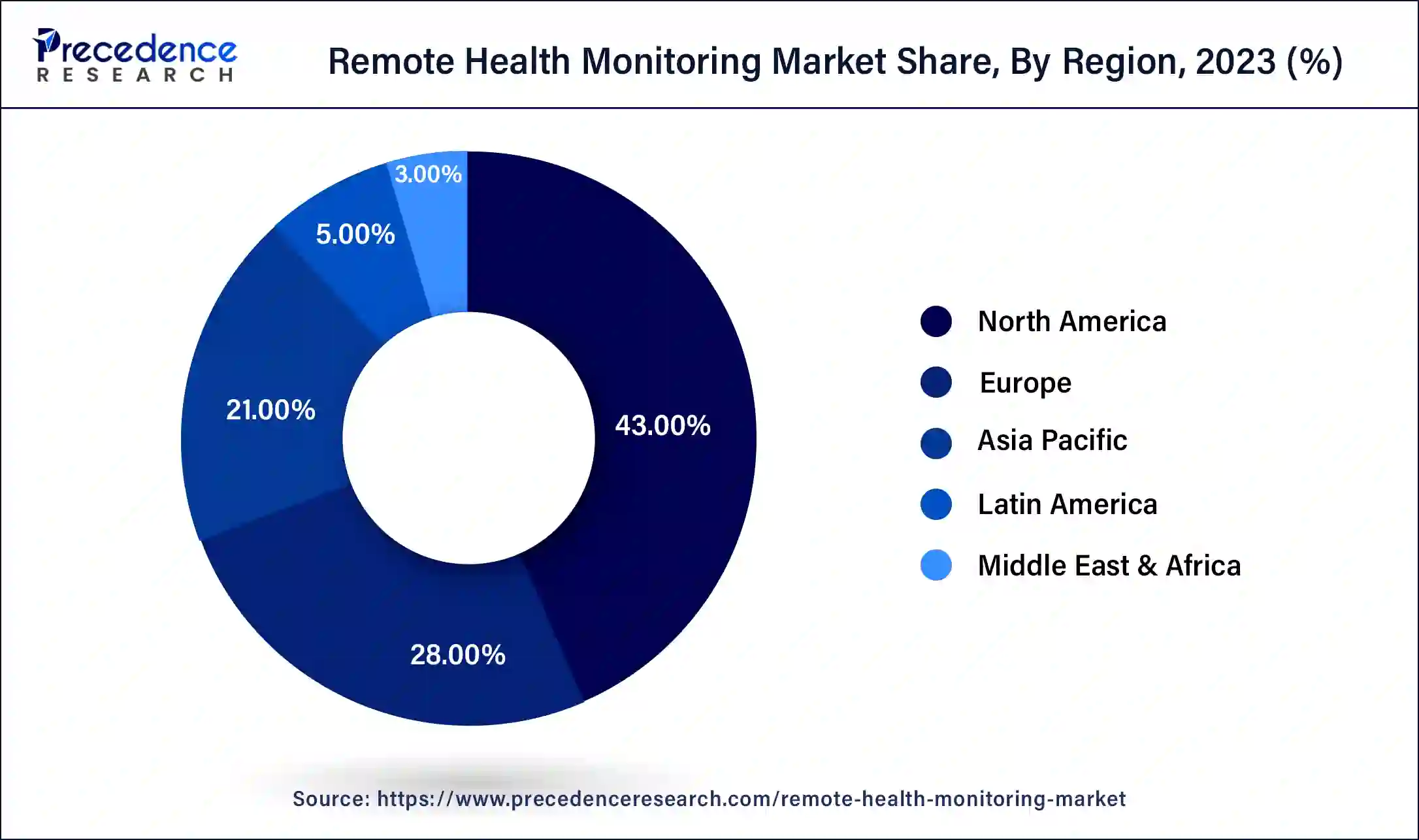

The remote health monitoring market is segmented by region into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Geographically, North America is leading the remote health monitoring market and accounted for more than 43% of revenue share in 2023 due to rapid adaptation to the advance remote health monitoring systems in U.S. and Canada. Multiple investors have contributed to the market with considerable investments in the invention of technologically advanced remote health monitoring devices/systems. Additionally, companies such as Boston Scientific Corporation, Johnso & Johnson, General Electric Company, and many others have contributed to the growth of the remote health monitoring market in the North American region.

Europe holds the second-largest revenue share in the remote health monitoring market, and the region is expected to generate noticeable growth in 2024-2034. The rising demand for digital healthcare is increasing in the UK, France, and Italy, which is considered a driving factor for the remote health monitoring market growth. A growing number of investments for research and development (R&D) in the industry is seen as another driver for the remote health monitoring market growth. The Asia Pacific region is expected to show a significant change in the remote health monitoring market owing to the rising healthcare infrastructure in the developing countries in the Asia Pacific region. Rapidly increasing heart, cancer, and diabetes patients and patients with sleep disorders in the area have forced hospitals and diagnostic centers to adopt advanced remote health monitoring systems. The remote health monitoring market in Latin America, the Middle East, and Africa is growing and is anticipated to grow during the forecast period of 2024-2034 as the healthcare infrastructure is still developing.

Remote health monitoring is used to manage a patient's health from a distance to get proper and real-time data. Remote health monitoring devices can collect patients' health information, transfer it to the hospital-based system and help doctors/administration get timely updates. Remote health monitoring devices are generally used to monitor patients with chronic diseases. Moreover, it also assists in monitoring heart rhythms, stress levels, blood glucose levels, temperature, and other parameters. With the growing advent of technology in remote health monitoring devices, getting prior alarms in case of severe health issues has become possible for doctors or health providers. Thus, the utilization of remote health monitoring devices has resulted in a reduction in morbidity.

The remote health monitoring technique covers multiple medical solutions and allows the medical sector to provide excellent health care to patients not present on the hospital premises. Along with this, the technology has allowed the direct involvement of patients in their health management by providing time-to-time health-related data while sitting in the comfort of their homes. A few other benefits of remote health monitoring include the reduction of patients' visits to the hospital and convenience for hospital administration with a reduced workload.

Remote health monitoring devices have helped the health sector immensely by preventing unnecessary admissions and appointments in hospitals or clinics. The COVID-19 pandemic accelerated the utilization of remote health monitoring devices in the healthcare sector with the rapid adaptation of technology due to imposed regulations to constrain the spread of the virus. The pandemic increased investments in the invention and research & development sectors for the remote health monitoring market.

| Report Coverage | Details |

| Market Size in 2023 | USD 5.53 Billion |

| Market Size in 2024 | USD 6.35 Billion |

| Market Size by 2034 | USD 25.26 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 14.8% |

| Base Year | 2023 |

| Forecast Period | 2024to 2034 |

| Segments Covered | By Devices, By Application, By End-Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

The remote health monitoring market is likely to grow in the upcoming years with increasing demand from developing countries where the healthcare infrastructure is still growing. Hospitals are adapting to remote health monitoring technology due to improved patient outcomes and cost savings. Wearable ECG monitors, Fitness tracker watches, Patch-biosensor, Smart health watches, and wearable blood pressure monitors are a few remote health monitoring devices that have gained immense importance in the remote health monitoring market.

The remote health monitoring market carries multiple drivers. Increasing cases of chronic diseases are seen as a significant driver for the growth of the remote health monitoring market. Chronic conditions include diabetes, cardiovascular diseases, cancer, and other diseases that need continuous medical attention. The utilization of remote health monitoring techniques for managing chronic illness has benefited both patients and doctors. The remote health monitoring marker is surging with the increasing awareness of self-health care. In recent years, people have started focusing on early diagnosis and remote health monitoring devices to help them get proper health care, as these devices provide early signs of uncertain health issues before minor issues turn into major ones. Another remote health monitoring market driver is raising investment in the research and development sector. Prominent companies have started investing in the remote health monitoring market, which will help in developing advanced devices. The invention of technologically advanced remote monitoring devices is seen as another driving factor for the remote health monitoring market. Prominent players in the market are focused on developing their product portfolio while launching new remote health monitoring devices. For instance, the Stasis Lab launched a new multi-parameter remote health monitoring device in the U.S. market in August 2020. Rapidly increasing adaptation of artificial intelligence is likely to fuel the growth of the remote health monitoring market.

The remote health monitoring market also carries considerable restraints along with multiple driving factors. Privacy concerns and data safety issues are seen as major restraining factors for the remote health monitoring market. The remote health monitoring device carries health-related data. At the same time, the remote health monitoring systems imposed in hospitals have patients' confidential health information along with payment-related data. The threat of cyber-attack is continuously growing for every firm in the market and losing any patient data can result in a significant loss for the hospital administration. Thus, the privacy concern associated with remote health monitoring technology hampers the market. The lack of adoption of remote health monitoring devices in low or middle-income countries is another restraining factor for the growth of the remote health monitoring market. Implementing remote health monitoring technology in the healthcare sector requires skilled professionals, significant investments, a sufficient budget, and quality maintenance. Limited availability of quality healthcare infrastructure, along with a lack of awareness, has hampered the growth of the remote health monitoring market in low- or middle-income countries.

Covid-19 Impacts:

In 2020, the World Health Organization (WHO) declared Covid-19 as a pandemic, and a health emergency was imposed across the globe. The prolonged imposed lockdown negatively impacted every industry and sector. However, the healthcare sector showed significant growth during the pandemic. To contain the spread of the virus, people prefer not to visit hospitals or clinics unless there is an important reason. The remote health monitoring market boosted during this period. The remote health monitoring devices helped patients get health reports without visiting hospitals.

In contrast, remote health monitoring systems helped hospital administration to keep an eye on patients' real-time health without checking them physically. Due to the increased demand for remote health monitoring devices, the manufacturers saw opportunities in the remote health monitoring market, leading to the invention of technologically advanced remote health monitoring devices during the pandemic. Also, during the Covid-19 pandemic, when researchers focused on developing a novel drug to fight against Covid, fast-track approvals for research and development of remote health monitoring devices were given by governments and administrative bodies. For instance, In April 2020, the U.S. Food and Drug Administration (FDA) approved Dexcom and Abbott to continuously provide remote glucose monitoring systems to hospitals to minimize contact with patients and reduce the risk of infection.

Patients with chronic diseases such as diabetes, cardiovascular or cancer require ongoing treatment for one or more years. Remote health monitoring technology became a boon for such patients, as they could receive excellent healthcare service with the help of remote health monitoring devices. Critically ill Covid patients were admitted to the hospitals. On the other hand, Covid patients with less or no symptoms (asymptomatic) were advised to be quarantined at home. Doctors and hospital administration used remote health monitoring devices to keep regular checks on patients. The utilization of remote health monitoring devices boosted during the pandemic, which showed significant impacts on the remote health monitoring market. Along with this, the increased awareness among the population of self-health monitoring enabled the market for wearable remote health monitoring devices.

By device, the remote health monitoring market is segmented into Respiratory monitoring, Blood glucose monitoring, Cardiac monitoring, and Multi-parameter monitoring. The cardiac monitoring device is the largest remote health monitoring market segment. The rise in heart disease has boosted the demand for cardiac monitoring devices. Blood pressure cuffs, Pulse oximeters, and wearable activity trackers are a few examples of cardiac remote health monitoring devices available in the market. Unpredictable risks caused due to chronic diseases have forced hospitals and cardiology departments to adopt remote health monitoring devices to track the real-time health conditions of patients. The rapid increase in demand for advanced healthcare technologies in intensive care units has boosted multi-parameter monitoring devices. The multi-parameter monitoring segment is predicted to propel the remote health monitoring market growth during 2024-2034, owing to its multi-beneficiary factor. Multi-parameter monitoring devices can monitor oxygen levels, blood glucose levels, cardiac activities, and temperature on one screen. Remote multi-parameter monitoring devices allow hospitals to simultaneously manage multiple patients and their real-time health data. Considering the benefits of the multi-parameter monitoring device, the demand for such devices will likely increase in the upcoming years.

The remote health monitoring market is segmented by application into Oncology, Cardiovascular diseases, Diabetes, and Others. Among these, the cardiovascular segment holds the largest revenue share in the market. Increasing heart attacks, heart failures, arrhythmia, and hypertension patients are considered to boost the demand for remote health monitoring devices. Cardiac remote health monitoring devices such as insertable, external monitoring devices, and wearables can monitor heart rate, heart health, pulse rate, and stress level. Cardiac remote health monitoring devices can track improper heartbeats, dizziness, fainting, dropped blood pressure, and hypertension to send alarming early warnings to the system imposed in the hospital. Cardiovascular diseases fall under the segment of chronic illnesses that require continuous medical attention. The remote health monitoring devices developed for cardiovascular detail provide reliable health care to all such requirements. Thus, the cardiovascular segment is likely to grow in the forecast period of 2024-2034.

The increasing number of diabetes patients across the globe has increased the demand for remote blood glucose monitoring devices. In contrast, increased awareness related to diabetes has forced the population to check blood glucose levels daily. This is another factor considered for the growth of the diabetes sector in the remote health monitoring market.

By end-users, the remote health monitoring market is segmented into Hospitals, Home health care, and Diagnostic centers. The hospital segment holds the largest share of the remote health monitoring market. The increase in the number of hospital visits has forced hospitals to adopt remote health monitoring technology. Also, during the Covid-19 pandemic, multiple healthcare providers, hospitals, and clinics adopted remote health monitoring systems to provide better and more reliable healthcare to patients remotely by reducing the risk of virus spread.

The home healthcare segment will likely experience growth in the forecast period owing to the rising importance of self-healthcare among people. People have started preferring real-time monitoring of their health. In contrast, remote health monitoring devices allow the direct involvement of patients in managing their health. These factors will grow the home healthcare segment in the remote health monitoring market.

Segments Covered in the Report

By Devices

By Application

By End-Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

February 2025