January 2025

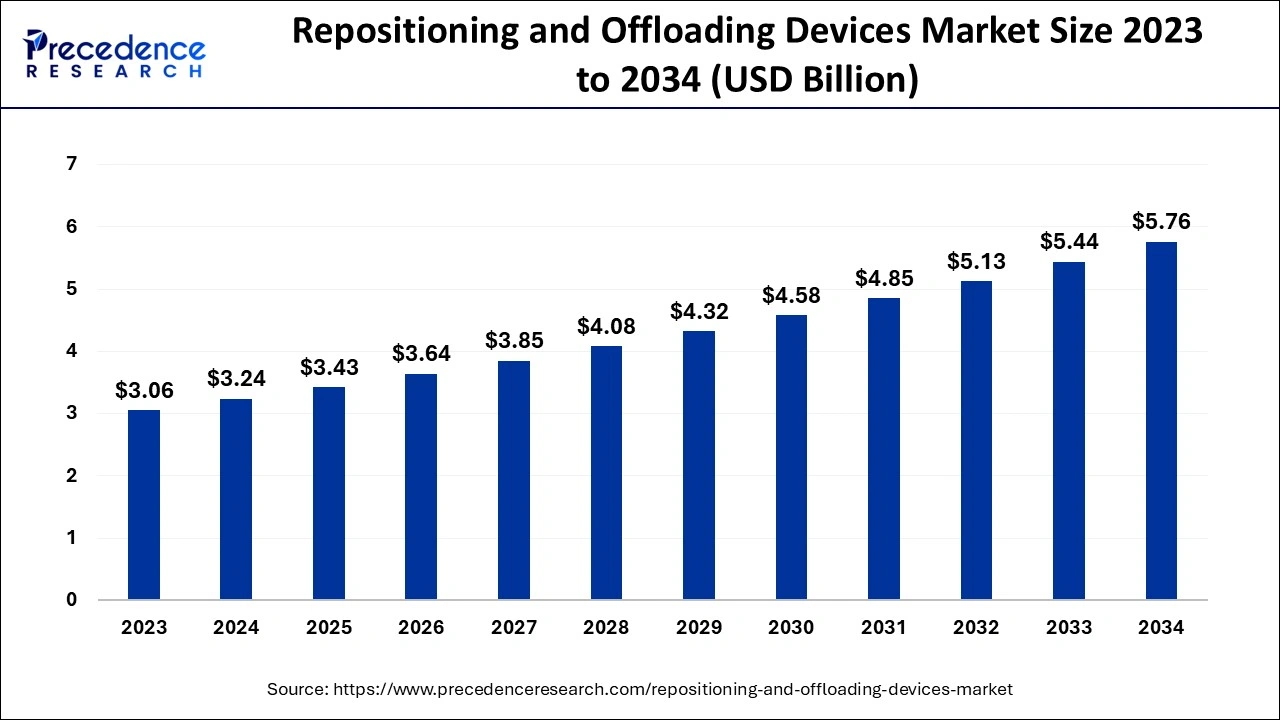

The global repositioning and offloading devices market size is calculated at USD 3.24 billion in 2024, grew to USD 3.43 billion in 2025 and is projected to surpass around USD 5.76 billion by 2034. The market is expanding at a CAGR of 5.92% between 2024 and 2034. The North America repositioning and offloading devices market size is evaluated at USD 1.17 billion in 2024 and is expected to grow at a CAGR of 6.05% during the forecast year.

The global repositioning and offloading devices market size accounted for USD 3.24 billion in 2024 and is predicted to reach around USD 5.76 billion by 2034, growing at a CAGR of 5.92% from 2024 to 2034. The repositioning and offloading devices market is driven by the amount of data produced by IoT devices and is expanding quickly.

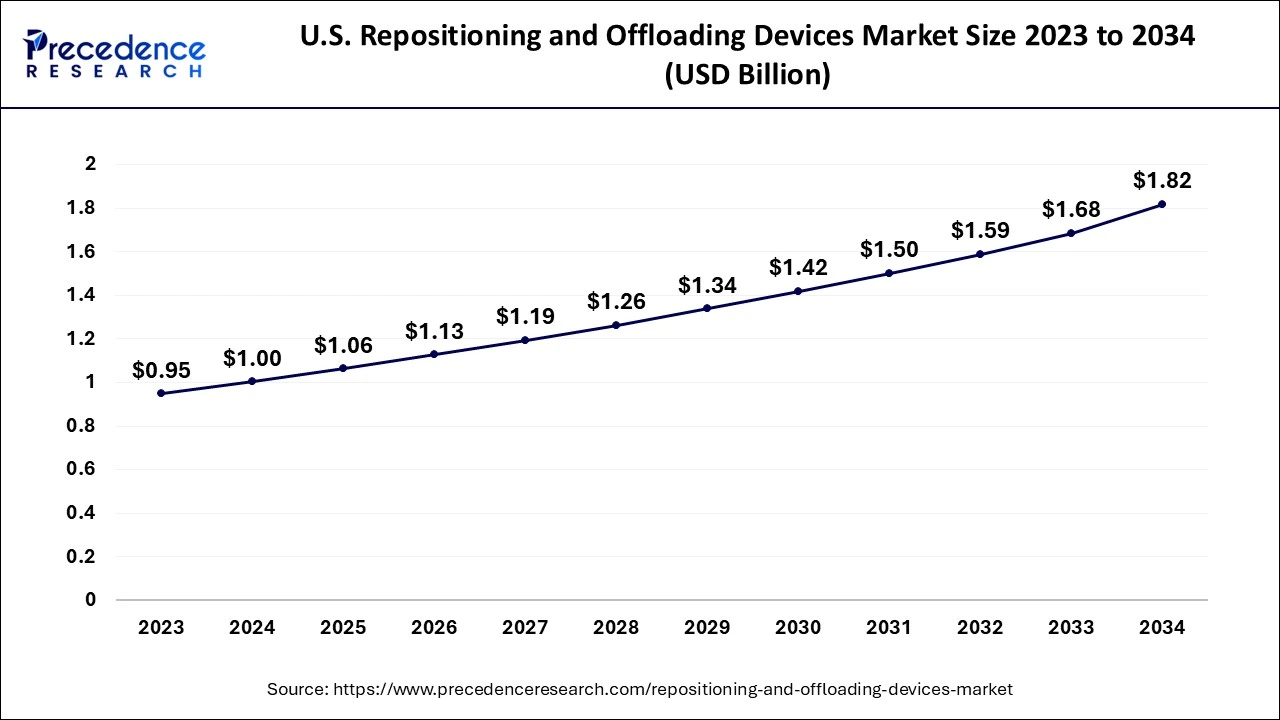

The U.S. repositioning and offloading devices market size is evaluated at USD 1.00 billion in 2024 and is projected to be worth around USD 1.82 billion by 2034, growing at a CAGR of 6.08% from 2024 to 2034.

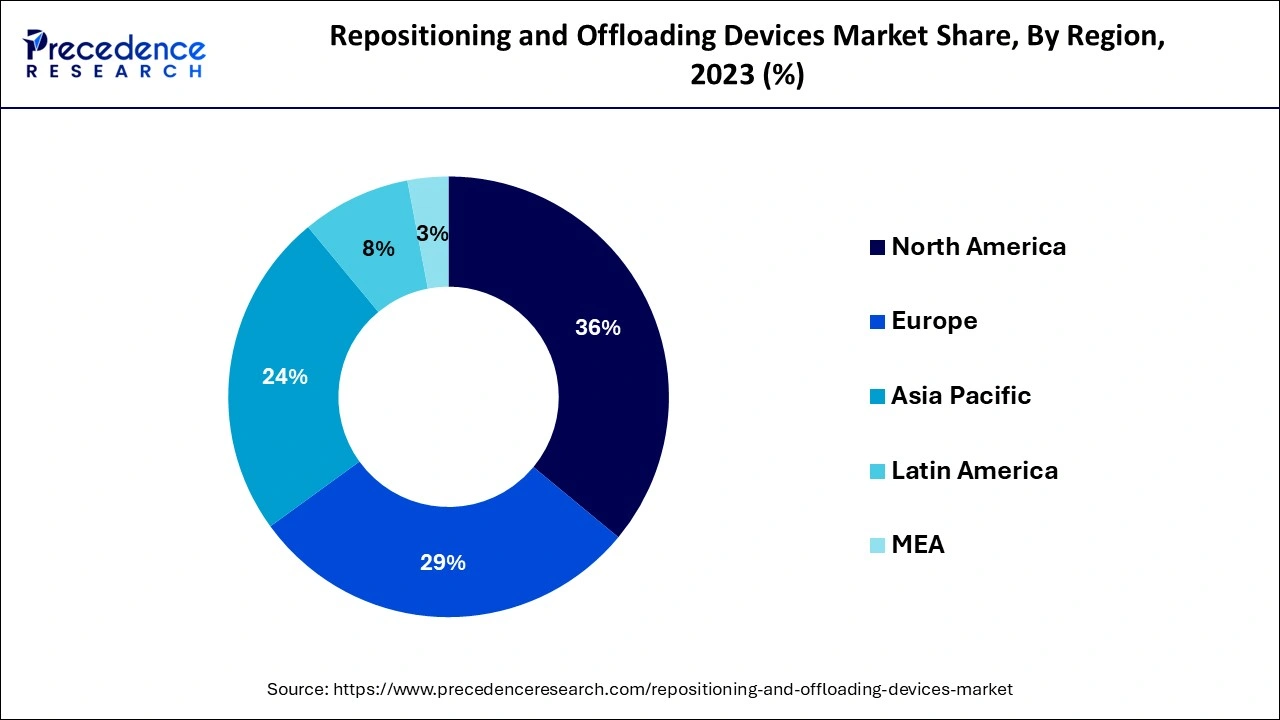

North America dominated repositioning and offloading devices market in 2023. Many top, constantly innovating medical device firms are based in North America. These businesses are leading the way in developing cutting-edge repositioning and offloading equipment. Air-fluidized therapeutic beds, adjustable mattresses, sensor-based pressure point monitoring systems, and diabetic patient-specific footwear are examples of innovations.

The prevalence of diabetes in the U.S. has increased significantly, with the CDC estimating that over 37 million Americans had diabetes in 2022. Diabetic foot ulcers are a common complication, which has fueled the demand for offloading devices like therapeutic shoes and total contact casts.

Medicare and Medicaid cover a variety of repositioning and offloading devices such as therapeutic shoes, wheelchairs with pressure-relief cushions, and advanced mattresses. This reimbursement structure encourages both patients and providers to adopt these devices for prevention and treatment.

Asia-Pacific is observed to be the fastest growing in the repositioning and offloading devices market during the forecast period. In Asia-Pacific, people are far more aware of the significance of wound care and pressure ulcer prevention. Advanced wound care product use is increasing due to expanding healthcare infrastructure and educational initiatives. Countries, including Japan and Singapore, have instituted training programs and workshops on preventing pressure ulcers in hospitals and healthcare settings. Healthcare workers receive training in identifying high-risk patients and using the proper unloading and repositioning equipment.

Treatment for pressure ulcers is expensive, and some more severe ulcers necessitate long-term care and surgery. Healthcare providers can lower the prevalence of pressure ulcers and save a lot of money by investing in preventive interventions like repositioning and unloading devices. Preventing these ulcers reduces hospital visits, possible legal risks, and problems from untreated wounds for healthcare facilities. Repositioning and unloading solutions are necessary for conditions including diabetes, spinal cord injuries, and other disorders that impede mobility.

How is AI is Integrated in Repositioning and Offloading Devices Market?

Artificial Intelligence (AI) is making it possible to create "smart" offloading products that adapt to the patient's demands in real-time, like wearable technology, beds, and cushions. These gadgets use AI-powered sensors to track variations in temperature and pressure. To redistribute pressure automatically and minimize the need for human interaction, the AI algorithms modify the device's settings, such as inflating or deflating specific mattress areas. AI and robotics are combined in certain cutting-edge systems to help move immobilized patients.

Artificial intelligence enabled robotic systems can move patients into positions that minimize physical strain on caregivers while ensuring that patients are moved in a way that best avoids pressure ulcers. This is especially helpful in hospital and long-term care settings with low staffing levels.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.76 Billion |

| Market Size in 2024 | USD 3.24 Billion |

| Market Size in 2025 | USD 3.43 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.92% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rising incidence of pressure ulcers

The importance of preventing pressure ulcers is becoming more widely recognized among healthcare professionals. To reduce the risk of skin breakdown, stricter procedures and standards for patient unloading and repositioning have been implemented. It is expensive for patients and healthcare professionals to treat pressure ulcers. To lower the frequency of these injuries and the related expenses of treating them, healthcare facilities must engage in preventative measures, such as repositioning and unloading equipment.

Regulatory challenges

Regulatory agencies frequently need continuous post-market monitoring after a gadget is authorized and put on the market to monitor its functionality and safety. This can involve providing regular safety reports, performing post-marketing research, and gathering information on adverse events. These demands may strain available resources and increase the operational load on businesses. For all phases of product development, design, testing, manufacturing, and distribution, regulatory agencies want copious documentation. It can be challenging for startups or small enterprises with limited resources to maintain thorough documentation.

Innovations in materials and technology

Smart fabrics that can track the temperature, moisture content, and pressure levels of the skin have been created due to textile innovations. These textiles can improve patient outcomes by warning caretakers of possible problems before they become more serious. Repositioning device data can be analyzed by AI to forecast the risk of pressure ulcer development. By enabling prompt interventions, this predictive capability enhances patient care and resource allocation. Comfort and efficacy can be enhanced by devices that adjust to a patient's changing condition or level of movement. Dynamic pressure redistribution devices, for instance, can adapt automatically to changes in patient posture.

The nonremovable knee-high offloading devices segment dominated the repositioning and offloading devices market in 2023. The standard for treating diabetic foot ulcers, one of the leading causes of lower limb amputations, is non-removable knee-high offloading devices such as complete contact casts (TCC) and prefabricated offloading walkers. These tools efficiently transfer pressure to the rest of the leg from the ulcerated area, which is usually on the sole.

The healing process is sped up and problems are decreased when the affected foot's weight-bearing burden is reduced. Diabetic foot ulcers, a significant indication for offloading devices, have increased because of the expanding global prevalence of diabetes, especially type 2 diabetes. The rising prevalence of pressure ulcers and associated disorders that call for the use of offloading devices is also a result of the aging population and the high obesity rates.

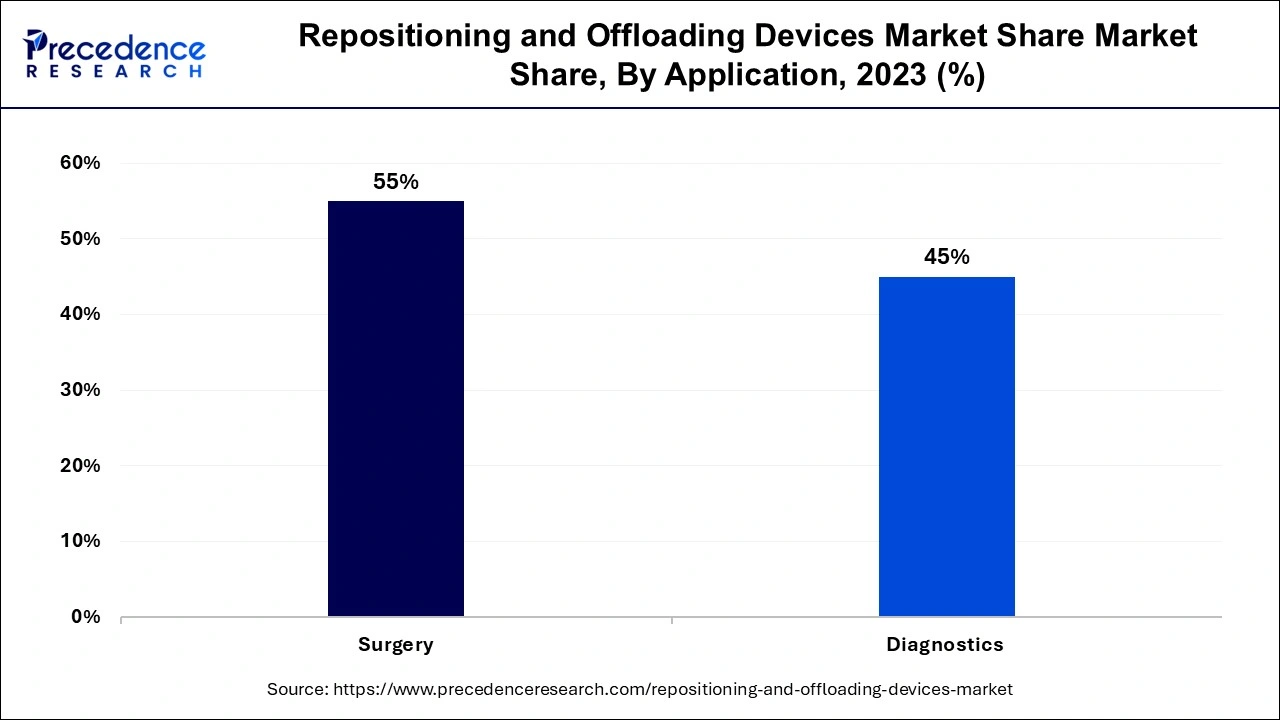

The surgery segment dominated the repositioning and offloading devices market in 2023. Patients with diabetes run the risk of getting foot ulcers, which, if left untreated, can develop into serious infections. Early on, offloading devices may be helpful, but once ulcers are too bad, surgery, including reconstructive or amputation surgeries, is frequently required. The number of foot ulcers that need surgical treatment has increased due to the rise in diabetes prevalence worldwide, which has helped the surgery segment dominate the market for repositioning and offloading devices.

The diagnostics segment shows a notable growth in the repositioning and offloading devices market during the forecast period. The aging population is one of the main causes of the diagnostics segment's growth in the market for repositioning and offloading devices. Pressure ulcers are more common in older people, especially those with chronic conditions or limited mobility. As the population ages, thorough diagnostics to determine which patients need relocation and unloading devices will become more necessary.

Moreover, the need for portable, user-friendly diagnostic tools that may be used in non-hospital settings has increased due to the demand for outpatient services and home healthcare. This promotes expansion in the segment by extending the reach of diagnostic instruments to a larger patient base.

The hospitals segment held the largest share in the repositioning and offloading devices market in 2023. Hospitals treat a wide range of patients in many specialties, including those who are more likely to get pressure ulcers, such as the elderly, people with limited mobility, and people recuperating from significant surgeries or accidents. Repositioning and unloading devices are constantly needed to prevent or treat pressure injuries because of the high patient turnover. Many patients need extended hospital stays, particularly in long-term care wards or critical care units (ICUs).

Long-term bed rest-induced immobility raises the likelihood of pressure ulcer development; hence, hospitals must implement prophylactic measures. Hospitals employ healthcare professionals in repositioning and offloading devices, including nurses, physical therapists, and wound care specialists. Therefore, hospitals are the perfect setting for these gadgets.

Segments Covered in the Report

By Product Type

By Application

By End user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025