Residential Water Purifier Market Size and Forecast 2025 to 2034

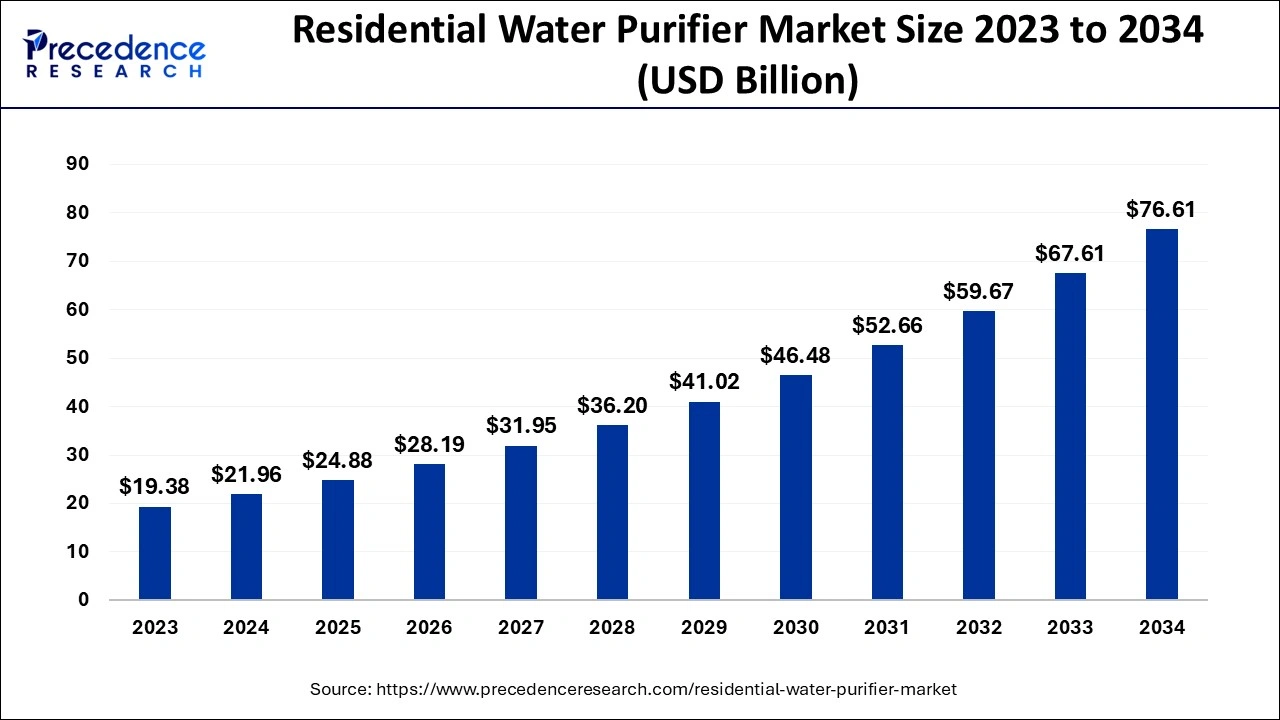

The global residential water purifier market size was calculated at USD 21.96 billion in 2024 and is predicted to reach around USD 76.61 billion by 2034, expanding at a CAGR of 13.31% from 2025 to 2034. The demand for affordable and efficient water purifiers is boosting the residential water purifier market's success. Rising awareness of water quality and purification is driving the expansion of the market. Increasing urbanization demands clean and drinkable water, leading to market growth.

Residential Water Purifier Market Key Takeaways

- In terms of revenue, the residential water purifier market is valued at $24.88 billion in 2025.

- It is projected to reach $76.61 billion by 2034.

- The residential water purifier market is expected to grow at a CAGR of 13.31% from 2025 to 2034.

- Asia Pacific dominated the residential water purifier market with the largest market share in 2024.

- North America will host the fastest-growing market during the forecast period.

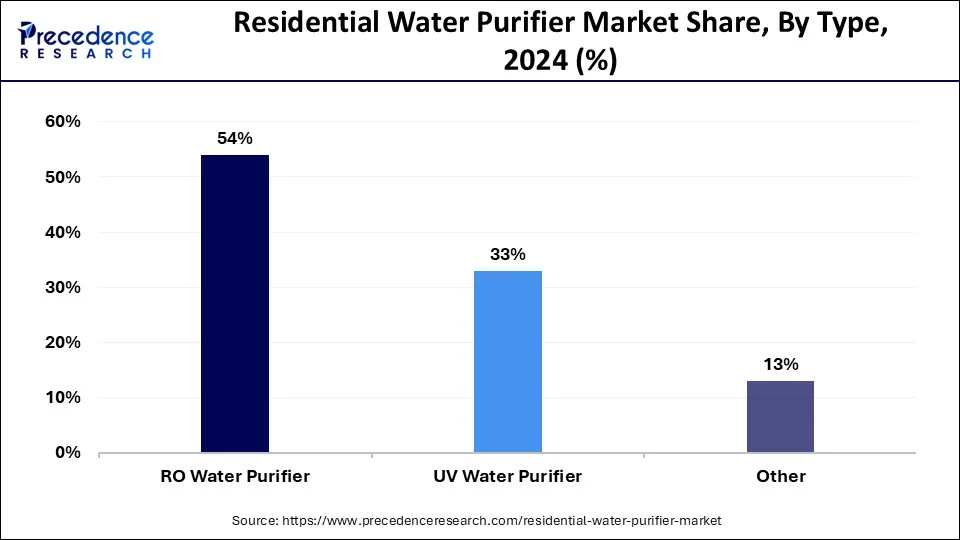

- By type, the RO water purifiers segment held the major market share of 54% in 2024.

- By type, the UV water purifier segment will grow rapidly in the market in the coming years.

- By application, the housing segment dominated the global market in 2024.

- By application, the apartment segment will grow rapidly in the market over the forecast period.

Integration of AI in the Residential Water Purifier Market

AI is now wrapped in each sector; water purification is no exception. AI-enable water Purifiers are becoming more popular in urban areas due to the growing economy and education. AI is providing transformation solutions in water purifiers. It is helping the residential water purifier market to boost in various ways by providing AI-enabled features, including data analysis, prediction, real-time water quality monitoring, optimization of the water treatment process, automated filter cleaning, a smart alert system, a decision support system, energy optimizers, personalized suggestions, a voice assistant, remote monitoring, quick contaminant detection, smart filtration, and sensors, rapid response to emerging contaminants, and many more.

AI-enabled features of water purifiers help to improve the consumer experience by improving water quality and safety and reducing energy assumptions. Real-time optimization helps to reduce maintenance costs and possible contamination of water. Additionally, the adoption of AI-enabled water purifiers has increased due to their premiumization and brand popularity. Smart homes are becoming large adopters of AI-enabled water purifiers due to the properties of AI-enabled water purifiers, such as ease of climate change, algorithms, and improved water security.

Market Overview

Growing awareness of health and hygiene is driving the growth of the residential water purifier market. The importance of clean water has gained popularity worldwide. Increasing awareness of water-based disease is driving focus toward water purification. Rising urbanization and industrialization require more clean drinking water; as urban areas have limited access to water, the demand for water purifiers has reached success.

Government initiatives like water quality regulations and campaigns for public awareness are contributing an additional share of the market. Moreover, advancements in technologies like reverse osmosis (RO), ultraviolet (UV), nanofiltration (NF), ultrafiltration, distillation, and activated carbon have yielded great dividends. The adoption of LOT technologies in home-based water purifiers has increased rapidly in recent years. Demand for customized systems and AI-enabled purifiers is seeking expansion.

Residential Water Purifier Market Growth Factors

- Urbanization: Rising urbanization and population increase the requirement for clean and quality drinking water. Urban people prioritize health, and limited clean water access in urban areas leads them to adopt water purifiers.

- Middle-class population: The growing middle-class population is the key factor driving the growth of residential water purifiers. Increasing disposable income is driving middle-class preference for residential water purifiers.

- Sustainability awareness: Growing sustainability concerns and awareness of water waste and climate change are driving the shift to sustainable water purifiers.

- Growth of the healthcare sector: People worldwide are becoming more health conscious. Consumer awareness of the impact of unclean water on health and the rising importance of water purification are enhancing market success.

- Aging population: Health concerns have been of significant importance among the elderly population. The requirement for clean drinking water among older people is helping the residential water purifier market to drive toward growth.

- Government initiatives: The government is promoting various policies to promote the importance of clean water and increase eco-friendly water purification procedures to maintain environmental sustainability.

- Technology advances: Innovations in cutting-edge water purification technologies are boosting the demand for residential water purifiers. The development of smart technologies for reducing energy consumption and real-time monitoring and tracking of water quality is helping to make purifiers more affordable and efficient, which is attracting more consumers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 76.61 Billion |

| Market Size in 2024 | USD 21.96 Billion |

| Market Size in 2025 | USD 24.88 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.31% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Growing demand for sustainable solutions

Expanding urbanization and industrialization are impacting the environment. Additionally, population growth is contributing to increased environmental pollution. The increased population has increased the demand for water purifiers; however, with a growing shift toward sustainability, consumer demand for sustainable solutions for water purifiers has increased.

Increasing awareness of water security and plastic waste is driving demand for recyclable and sustainable water purifiers. People are becoming aware of water waste, which is increasing the importance of its optimized use and natural water purification methods. The government is promoting different policies and initiatives to enhance sustainable water purifier solutions. Environmentally friendly concerns encourage manufacturers to develop sustainable filters and modify traditional filters to meet demands.

Systems like ultrapurification and ultraviolent are gaining popularity among water waste consumers. Manufacturers are developing water purifiers using recyclable and biodegradable materials. Technology advancement is helping to reduce the requirement of energy consumption in filters as well as disposable income, increasing consumers' preference for such water purifiers. Growing eco-friendly concerns and strict government regulations are driving the demand for sustainable water purifiers.

- In November 2024, Livpure, one of India's leading and most trusted customer-centric brands dedicated to consumer well-being, launched the Sereno SS, equipped with cutting-edge HR Technology with a 60% water recovery rate, saves up to 20 liters of water daily, which helps reduce water wastage

Restraint

High maintenance costs

Expensive maintenance of water filters can hamper the growth of the residential water purifier market. Water purifiers need to be replaced from time to time to maintain water quality. Additionally, regular replacements of other components can be expensive for customers. Different filters required different changes according to their product types and technologies. RO filters require the most membrane replacements. Additionally, the RO systems need the highest power consumption, which can affect users' economies. Filters require regular cleaning and sanitizing to maintain water quality, which can be costly. The cost of components and parts of filters for regular change and handling is quite expensive to maintain.

Opportunity

Intergradation of smart technology

Manufacturers have increased the adoption of smart technologies in water purifiers to offer clean and affordable waters in the world. The development of smart water purifiers is attracting consumers due to their monitoring capabilities and the installation of smart sensors. This filter provides information to the user about real-time water quality, which helps users make better decisions. Additionally, manufacturers' ongoing shift toward the development of sustainable filters with the use of sustainable and eco-friendly materials is driving filter popularity among consumers.

The adoption of smart technology in water purifiers is helping to reduce costs and enhance efficiency. Emerging technologies in water purifiers like nanofiltration (NF) block all contaminants except ions and molecules to maintain water purification and reduce energy consumption. Additionally, the adoption of artificial intelligence in water purification offers smart sensors and optimized performance.

Integration of Internet of Things (IoT) technologies provides real-time monitoring and water quality tracking. The future of water purification is likely to be highlighted by the adoption of cutting-edge technologies like advanced oxidation processes (AOPs), electrocoagulation, graphene-based filters, forward osmosis (FO), biological nutrient removal (BNR), solar desalination, microbial fuel cells (MFCs), nanomaterials, and carbon nanotube filters.

Type Insights

The RO water purifiers segment held the largest share of the residential water purifier market in 2024 with ongoing advancement in the technology. Reverse Osmosis (RO) allows 99% removal of bacteria, viruses, and other contaminants from water. Additionally, with technological advancements and innovations, manufacturers have featured RO to reduce energy consumption, making it the first priority for consumers. RO is able to reduce water usage and requires less maintenance; affordability has enhanced the demand rate for RO purifiers. Additionally, the introduction of LOT, voice assistants, and AI is helping to advance the features of RO purifiers. Due to growing demands for sustainable solutions, manufacturers are focusing on the development of sustainable RO purifiers.

The UV water purifier segment will grow rapidly in the residential water purifier market in the coming years due to simple and easy mechanisms. UV water purifiers are designed with no chemicals or additives, which drives their popularity among sustainability-conscious users. UV water filters require low energy consumption compared to RO purifiers. UV water purifiers are convenient for under-sinks and countertops, which increases their adoption for house installations. Additionally, advanced UV LED technology is showing new light on segment expansion.

Application Insights

The housing segment dominated the global residential water purifier market in 2024. Growth in consumer awareness of waterborne diseases and the importance of clean water has improved the water purifier installations in houses. Growing need for comprehensive water solutions enhancing segment growth. Additionally, increased home appeals and centralized installations of water purifiers make them convenient for house uses. Adoption of water purifiers is high in smart homes.

The apartment segment will grow rapidly in the residential water purifier market over the forecast period with increasing urbanization and apartments in cities. Apartments usually contain a small space and don't have individual water sources. The demand for convenient, easy installation and small-space installable purifiers is in a high range. Additionally, demand for water purifiers in apartments has increased due to skin and hair concerns, as unclean water damages hair and skin health. Consumer desire for low-maintenance and convenient solutions is driving segment growth.

Regional Insights

Asia Pacific dominated the residential water purifier market in 2024. The increasing health and hygiene consciousness and urbanization are driving the growth of the market in Asia. Countries like China and India are holding a larger market share due to their vast population and increased demand for clean water.

China continues to dominate the residential water purifier market due to its increased awareness of water-based diseases. Increased adoption of smart water purifiers is boosting the Chinese residential water purifier market. Additionally, COVID-19's impact has boosted health awareness and hygiene preferences in China. With government-strength regulations and an expanding healthcare sector, China is projected to continue its dominant market in the forecast period.

India's increased urbanization and industrialization are causing issues of water contamination, leading to the development of efficient water purification solutions. The adoption of smart technologies like reverse osmosis (RO) and ultrafiltration (UF) is the latest trending purifier technology in the country. Additionally, the increasing middle-class population increased disposable income, helping the residential water purifier market in India. Government initiatives for providing clean drinking water and rising disposable income are driving consumers toward the adoption of residential water purifiers.

- In October 2023, the smart RO water purifiers under the sub-brand Native called ‘Native M1 and M2 models powered with superior filters and 'rapid reverse rinse' technology was launched by smart RO water purifiers under the sub-brand Native called ‘Native M1 and M2 models' powered with superior filters and 'rapid reverse rinse' technology. This purifier features superior filters and ‘rapid reverse rinse' technology, requiring no change or service for 2 years.

North America will host the fastest-growing residential water purifier market during the forecast period due to its advanced infrastructure and growing awareness of health and hygiene. North America is well-known for its innovations in AI, automation, and machine learning technologies. Such technologies are influencing regions' healthcare, automotive, and industrial infrastructures. This advancement enhances the availability of smart water purifiers, making them convenient for consumers.

The healthcare industry in North America is a key adopter of AI-enabled residential water purifiers, as the whole industry has been leveraged by AI and digitalization. The growing demand for smart, connected, loT technology-featured water purifiers is contributing a great share to the growth of the North American residential water purifier market. Expanding e-commerce and smart houses are playing a crucial role in the market. Additionally, increasing innovations in research and development are expected to advance water treatments.

The residential water purifier market in the United States is a robust and vital industry that addresses the pressing need for safe and clean drinking water in households and businesses across the country. This market encompasses a range of technologies and products designed to remove contaminants, pollutants, and health risks from water sources, ensuring that consumers have access to clean water for various uses. An increasing number of customers are becoming increasingly concerned about the environmental impact of single-use plastic bottles and the carbon emissions associated with the manufacturing and distribution of bottled water. Additionally, changing lifestyles and consumer preferences further boost the growth of the residential water purifier market in the United States. Moreover, the introduction of water purifiers that feature eco-friendly characteristics, such as recyclable filter cartridges, energy-efficient technologies, and reduced wastewater generation, is promoting a positive market outlook.

Europe is expected to grow significantly in the residential water purifier market during the forecast period. Due to growing awareness about health in Europe, the demand for the use of residential water purifiers is increasing. At the same time, due to growing contamination and pollution, the population is shifting towards the use of residential water purifiers. This, in turn, is increasing their development, as well as innovations to enhance their purity, which in turn is leading to new collaborations among the companies. Thus, all these factors are promoting the market growth.

UK

The population in the UK is adopting various residential water purifiers for the use of safe and purified water. This, in turn, is leading to new developments in the purifiers with the use of RO or UV systems to improve the water quality, as well as the use of advanced technologies is also contributing to the same.

Germany

Due to growing water contamination, various health issues are rising in Germany, which is increasing the demand for residential water purifiers. Moreover, the growing urbanization is also contributing to the same.

Residential Water Purifier Market Companies

- 3M Purification

- AQUAPHOR International OU

- Hanston

- BWT Holding GmbH

- Honeywell

- Haier

- Royalstar

- Best Water Technology

- Whirlpool

- GREE

- LG Electronics

- A. O. Smith

Company revenue

- In March 2025, the financial report for 2024, Haier Smart Home Co., Ltd., was announced. As per the report published a gross profit margin of 27.8% for 2024 was observed, which represented a sustained growth of Haier Smart Home. Moreover, the revenue reflected a YoY growth of 4.29% achieving RMB 285.98 billion. RMB 18.74 billion was noted as the net profit of the parent company, reflecting a YoY growth of 12.9%. Additionally, RMB 26.54 billion was recorded from operating activities as the net cash flow. Furthermore, a cash dividend of RMB 9.65 per 10 shares, that is tax inclusive, along with a payout ratio of 48.01% was proposed by the company.

(Source: https://finance.yahoo.com/)

Latest Announcements Made by Market Leaders

- In September 2024, Livpure launched its water-as-a-service model. Rakesh Kaul, Managing Director at Livpure, said, ‘The company launched the water-as-a-service model four years ago; right now, the company has more than 2,50,000 consumers in three and a half years. The company is aiming to gain more than 655 market shares. The company is looking at the water market not with the mindset of water purifiers as products, but as a service.'

- In November 2024, A.O. Smith Corporation, a global water technology company, announced its acquisition of FMCG major HUL's water purification business, Pureit. CEO K. J. Wheeler, Chairman and CEO at A. O. Smith, committed, ‘The completion of this purchase bolsters the company premium water treatment product portfolio and distribution footprint, aligned with the company strategy of adding scales.'

Recent Developments

- In May 2025, Viomi Technology Co., Ltd, a leading technology company specializing in home water solutions in China, announced the official launch of its cutting-edge Kunlun 4 Pro Alkaline Mineral Water Purifier. Unveiled during a distinctive product launch on May 16th, this state-of-the-art water purifier employs AI technology to replicate the process of natural mineral water formation, aiming to shift household drinking water from the pure water stage to the groundbreaking pure mineral water stage, offering a solution for families seeking mineral-rich drinking water at home.

- In April 2025, Xiaomi has expanded its smart home ecosystem, this time emphasizing the vital domain of clean water. Today, the company officially launched two new models in its Dual-Effect Water Purifier Pro range: the Mijia Water Purifier Pro Dual-Outlet 1200G and 1600G. Pre-sales have begun, and deliveries are scheduled to start on May 8. The initial cost is 2599 yuan, roughly $360 for the 1200G variant, and 2999 yuan, around $415 for the stronger 1600G model.

- In November 2024, ANGEL Company introduced its U10 Ultrafiltration Water Purification Solution at FHA HoReCa 2024. This purifier solution is efficient at removing bacteria and viruses from water. This development was done to meet high demand for food safety standards, ensuring smooth and efficient kitchen operations.

- In February 2024, DrinkPrime, a water purifier provider on a subscription model, launched its copper filtration system for clean and safe drinking water across India. And upgraded RO+UV+Copper filtration system that integrates reverse osmosis (RO) and ultraviolet (UV) purification.

Segments Covered in the Report

By Type

- RO Water Purifier

- UV Water Purifier

- Other

By Application

- Apartment

- House

- Other

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting